As global markets experience a divergence in major indexes, with growth stocks leading the charge and value segments lagging, investors are keenly observing these shifts. Penny stocks, often associated with smaller or emerging companies, remain an intriguing area for those looking beyond traditional investments. Despite being an older term, penny stocks continue to offer potential opportunities by providing a blend of affordability and growth prospects when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Teo Seng Capital Berhad (KLSE:TEOSENG) | MYR2.33 | MYR346.54M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.105 | £793.09M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.435 | MYR1.21B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cairo Communication (BIT:CAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cairo Communication S.p.A. is a communication company operating mainly in Italy and Spain, with a market cap of €336.04 million.

Operations: The company's revenue is primarily derived from RCS (€861.7 million), advertising (€357.4 million), magazine publishing through Cairo Editore (€81.4 million), and TV publishing via La7 and network operations (€120 million).

Market Cap: €336.04M

Cairo Communication S.p.A. demonstrates several strengths as a potential investment in the penny stock arena. The company has shown robust earnings growth, with a 28% increase over the past year, surpassing its five-year average and outperforming industry peers. Despite its low return on equity of 7.7%, Cairo's financial health is underscored by more cash than total debt and well-covered interest payments. Recent earnings reports indicate improved net income from €10.8 million to €16.7 million year-over-year, although revenues slightly declined to €784.6 million for the nine months ending September 2024, reflecting challenges in revenue stability amidst operational improvements.

- Get an in-depth perspective on Cairo Communication's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Cairo Communication's future.

RCS MediaGroup (BIT:RCS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: RCS MediaGroup S.p.A. is a company that offers multimedia publishing services both in Italy and internationally, with a market cap of €389.27 million.

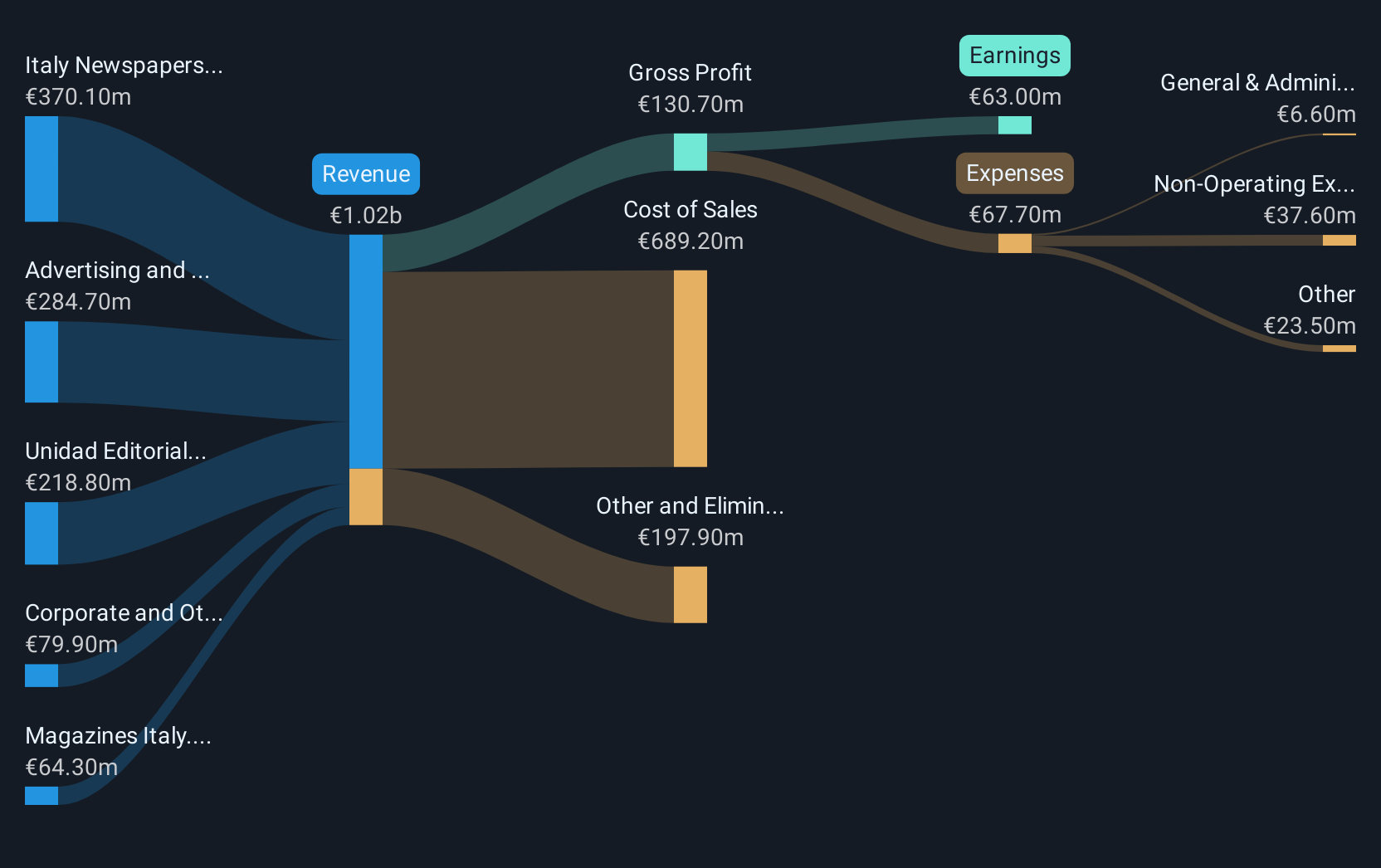

Operations: The company's revenue segments include €65.2 million from Magazines Italy, €371 million from Italy Newspapers, €220.6 million from Unidad Editorial, and €286.1 million from Advertising and Sport, with an additional contribution of €80.8 million from Corporate and Other Activities.

Market Cap: €389.27M

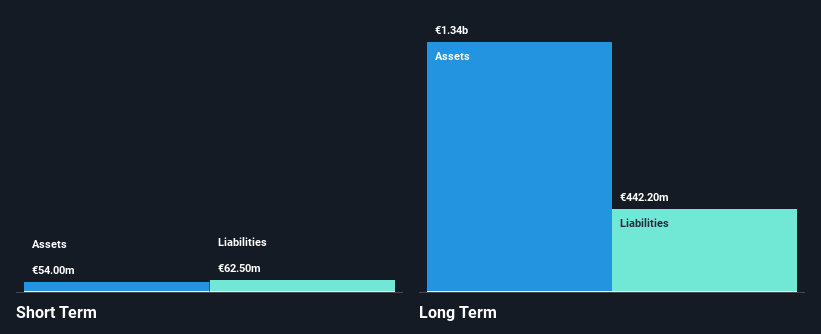

RCS MediaGroup S.p.A. presents a mixed picture within the penny stock landscape. The company reported stable revenues of €602.3 million for the nine months ending September 2024, with net income rising to €32.1 million, highlighting earnings growth despite slight revenue decline from the previous year. While RCS benefits from experienced leadership and high-quality earnings, its short-term assets fall short of covering both short- and long-term liabilities. The company's debt is well-managed with a satisfactory net debt to equity ratio and strong interest coverage by EBIT, but it faces challenges in dividend stability and achieving industry-leading growth rates.

- Click to explore a detailed breakdown of our findings in RCS MediaGroup's financial health report.

- Learn about RCS MediaGroup's historical performance here.

Koh Brothers Eco Engineering (Catalist:5HV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Koh Brothers Eco Engineering Limited is an investment holding company offering engineering, procurement, and construction services for infrastructure, water and wastewater treatment, building, bio-refinery, and renewable energy projects across Singapore, Malaysia, Indonesia, Africa, and internationally with a market cap of SGD101.45 million.

Operations: The company's revenue is derived from its Engineering and Construction segment, which generated SGD88.70 million, and its Bio-Refinery and Renewable Energy segment, which contributed SGD64.88 million.

Market Cap: SGD101.45M

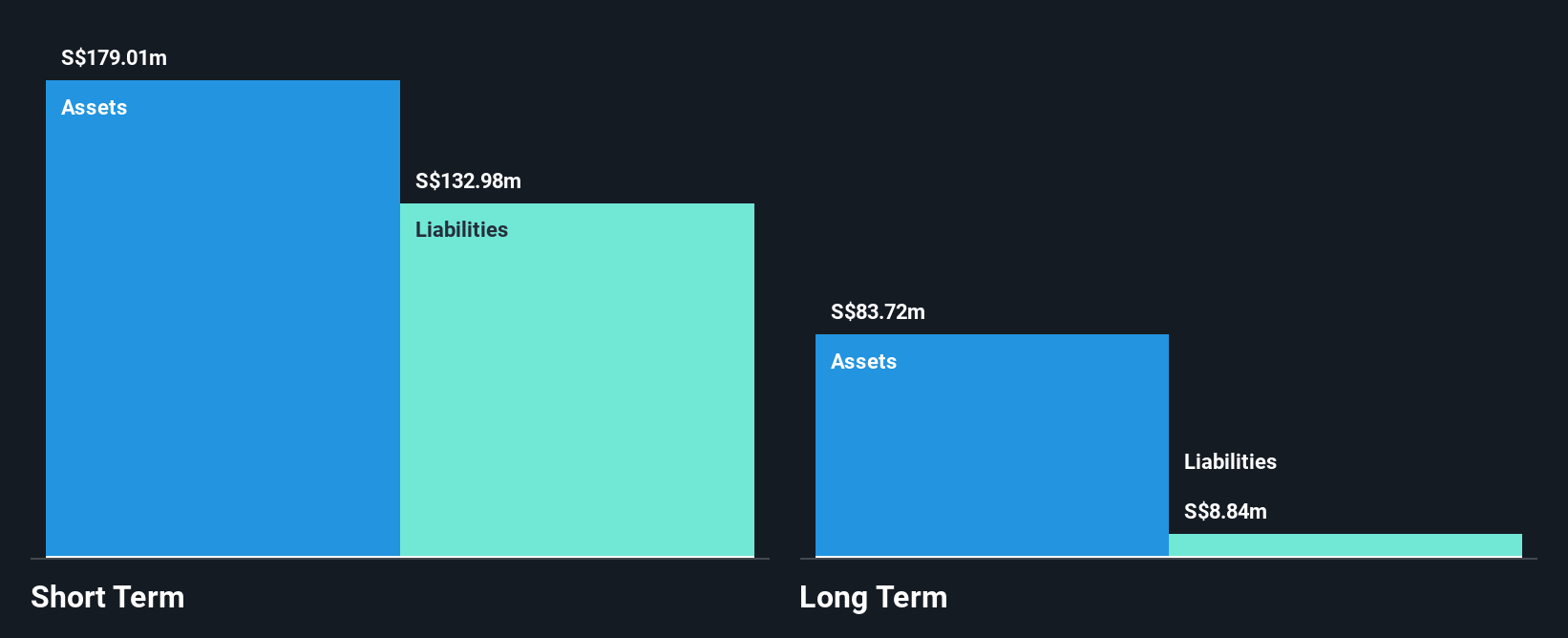

Koh Brothers Eco Engineering Limited faces challenges typical of penny stocks, with its unprofitability and declining earnings over the past five years at a rate of 39.8% annually. Despite this, the company has reduced its debt to equity ratio from 47.1% to 42.9%, and it holds more cash than total debt, indicating prudent financial management. However, high share price volatility and negative return on equity (-10.15%) underscore risk factors for investors. The company's short-term assets (SGD174.6M) comfortably cover both short- (SGD118.2M) and long-term liabilities (SGD13M), providing some financial stability amidst operational challenges.

- Click here to discover the nuances of Koh Brothers Eco Engineering with our detailed analytical financial health report.

- Gain insights into Koh Brothers Eco Engineering's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Take a closer look at our Penny Stocks list of 5,706 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RCS

RCS MediaGroup

Provides multimedia publishing services in Italy and internationally.

Good value with proven track record and pays a dividend.