- Japan

- /

- Trade Distributors

- /

- TSE:9699

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and climbing stock indexes, investors are paying close attention to dividend stocks as a potential source of steady income amidst economic uncertainties. In this environment, selecting strong dividend-paying stocks can be an effective strategy for those looking to balance growth with income, particularly when market volatility remains a key consideration.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.94% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.29% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1986 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

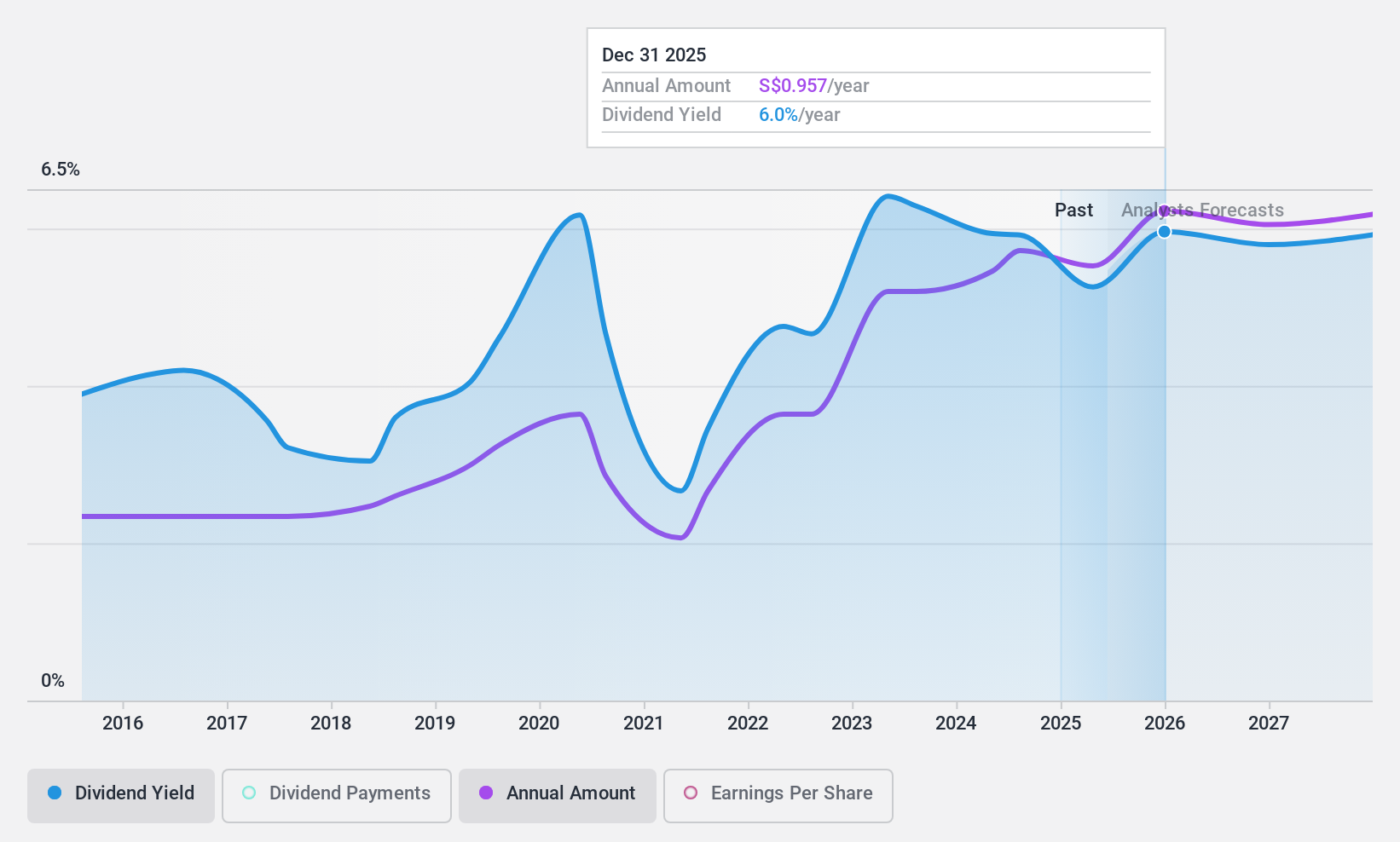

Oversea-Chinese Banking (SGX:O39)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited, with a market cap of SGD79.85 billion, provides financial services across Singapore, Malaysia, Indonesia, Greater China, the rest of the Asia Pacific region, and internationally through its subsidiaries.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue through its diverse financial services operations across multiple regions, including Singapore, Malaysia, Indonesia, Greater China, and the broader Asia Pacific area.

Dividend Yield: 4.9%

Oversea-Chinese Banking's dividend payments have been volatile over the past decade, though they have shown growth. The current payout ratio of 51.4% suggests dividends are covered by earnings, with future coverage expected to remain sustainable at 56.5%. However, the dividend yield of 4.93% is below Singapore's top quartile payers. Recent strategic moves include interest in acquiring a stake in PT Bank Pan Indonesia Tbk, potentially impacting future financial stability and growth prospects.

- Click to explore a detailed breakdown of our findings in Oversea-Chinese Banking's dividend report.

- Our comprehensive valuation report raises the possibility that Oversea-Chinese Banking is priced lower than what may be justified by its financials.

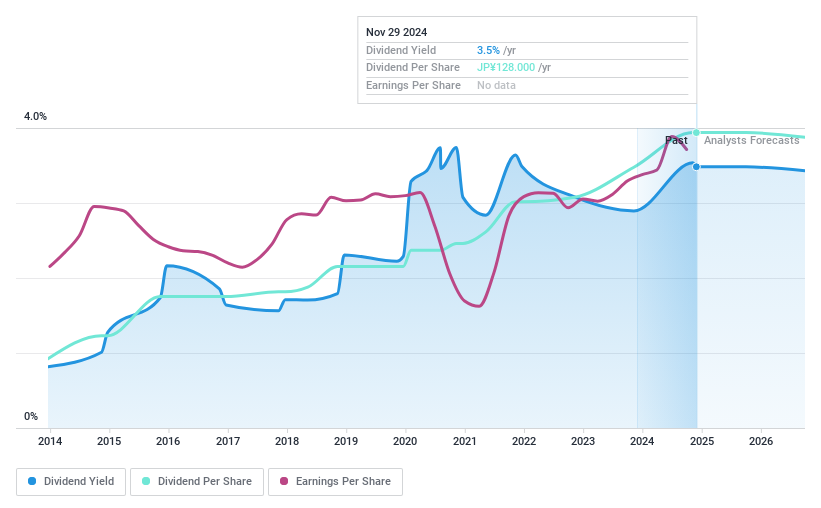

Nishio Holdings (TSE:9699)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nishio Holdings Co., Ltd. operates in the construction machinery rental industry both in Japan and internationally, with a market cap of ¥116.46 billion.

Operations: Nishio Holdings Co., Ltd. generates revenue primarily from its rental segment, which accounts for ¥196.27 billion.

Dividend Yield: 3%

Nishio Holdings' dividends are well-supported by both earnings and cash flows, with a payout ratio of 28.5% and a cash payout ratio of 16.8%. The company has consistently grown its dividend over the past decade without volatility, reflecting reliability. Despite offering a yield of 3.01%, which is lower than Japan's top quartile dividend payers, Nishio trades at an attractive valuation relative to its fair value and peers, underscoring potential for value-oriented investors.

- Take a closer look at Nishio Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility Nishio Holdings' shares may be trading at a discount.

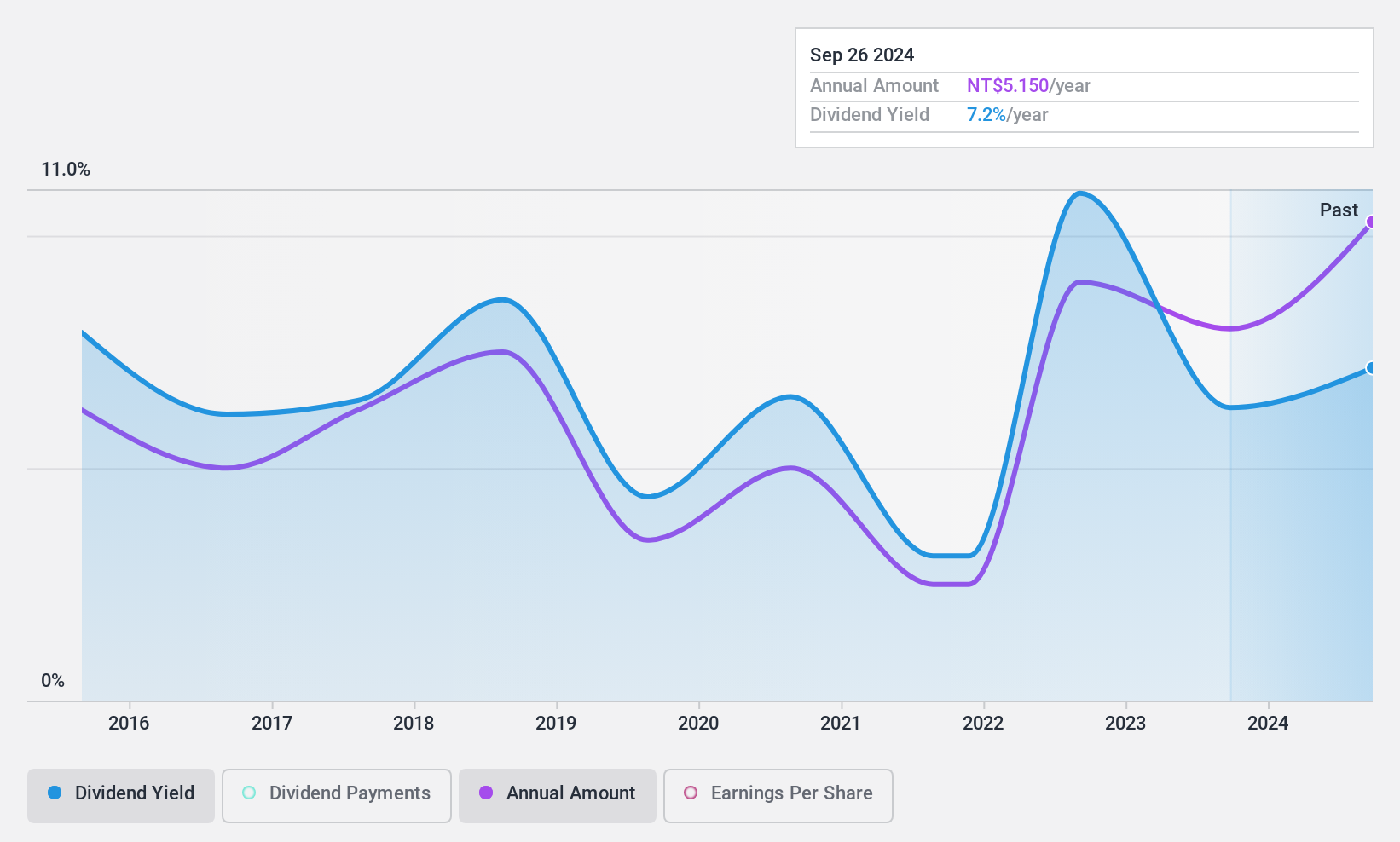

Thye Ming Industrial (TWSE:9927)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thye Ming Industrial Co., Ltd. operates in Asia, focusing on the manufacturing and sale of lead alloys and lead oxide, with a market cap of NT$11.51 billion.

Operations: Thye Ming Industrial Co., Ltd. generates revenue primarily from Taiming Co, which contributes NT$6.22 billion, and Thye Ming Industrial (Vietnam) Co., Ltd., contributing NT$2.71 billion.

Dividend Yield: 7.5%

Thye Ming Industrial's dividend yield of 7.49% ranks in the top quartile of the TW market but is not well-supported by cash flows, with a high cash payout ratio of 94.1%. While earnings growth has been robust at 21.1% annually over five years, dividend payments have been volatile, experiencing drops over 20% annually. The current payout ratio stands at 87%, suggesting coverage by earnings but raising concerns about sustainability given its unreliable payment history and special calls in November 2024.

- Get an in-depth perspective on Thye Ming Industrial's performance by reading our dividend report here.

- Our valuation report unveils the possibility Thye Ming Industrial's shares may be trading at a premium.

Key Takeaways

- Click here to access our complete index of 1986 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishio Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9699

Nishio Holdings

Engages in the construction machinery rental business in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives