How Investors Are Reacting To Oversea-Chinese Banking (SGX:O39) Strengthening Tier 2 Capital With $1 Billion Notes

Reviewed by Simply Wall St

- Oversea-Chinese Banking Corporation Limited recently completed the issuance of US$1 billion in fixed rate subordinated notes under its US$30 billion Global Medium Term Note Programme, with the proceeds earmarked for general corporate purposes and to strengthen Tier 2 capital under MAS rules.

- This move highlights OCBC's ongoing focus on capital management and regulatory compliance, potentially enhancing the bank’s financial flexibility to support future growth and resilience initiatives.

- Now, we'll examine how the bolstered Tier 2 capital base impacts OCBC’s investment narrative and supports its capital strength story.

Find companies with promising cash flow potential yet trading below their fair value.

Oversea-Chinese Banking Investment Narrative Recap

To be a shareholder in Oversea-Chinese Banking Corporation (OCBC), you need to believe in the strength of its regional banking model, its foothold in Southeast Asia wealth management, and its prudent capital management. The recent US$1 billion Tier 2 note issuance underscores OCBC’s regulatory capital discipline, but does not materially alter the most immediate catalysts, such as digital expansion and wealth platform growth, nor does it reduce exposure to key risks like interest margin pressure from lower rates.

Among the latest announcements, OCBC’s recent half-year earnings report stands out: it showed a continued decline in net interest income, reflecting the ongoing effects of tighter margins. This trend is directly linked to the core risk for OCBC, persistent downward pressure on net interest margins, even as the bank seeks to diversify with moves like this latest subordinated note issuance, which supports its capital strength amid market headwinds.

Yet, while capital buffers have improved, investors should be aware that short-term profitability remains highly sensitive to interest rate movements, especially if...

Read the full narrative on Oversea-Chinese Banking (it's free!)

Oversea-Chinese Banking is projected to reach SGD 15.7 billion in revenue and SGD 7.9 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.7% and a rise in earnings of about SGD 0.6 billion from the current SGD 7.3 billion.

Uncover how Oversea-Chinese Banking's forecasts yield a SGD17.58 fair value, a 4% upside to its current price.

Exploring Other Perspectives

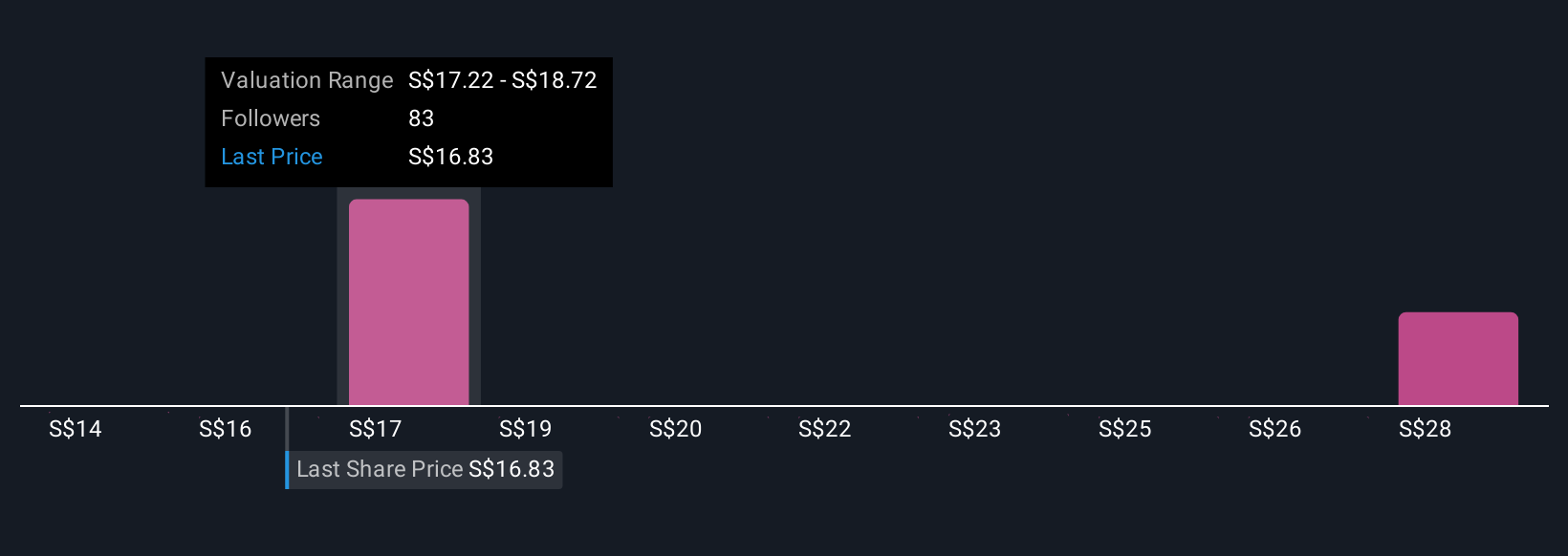

Four members of the Simply Wall St Community have published OCBC fair value estimates, spanning from S$14.21 to S$28.93. With net interest margin pressure still a focal challenge, you can find a range of views that reflect just how differently market participants assess the company’s outlook.

Explore 4 other fair value estimates on Oversea-Chinese Banking - why the stock might be worth 16% less than the current price!

Build Your Own Oversea-Chinese Banking Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oversea-Chinese Banking research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Oversea-Chinese Banking research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oversea-Chinese Banking's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O39

Oversea-Chinese Banking

Provides financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives