The Singapore market remains active even as other major Asian markets like China, Japan, and South Korea are closed today. This presents a unique opportunity for investors to focus on dividend stocks that offer stability and attractive yields in the current economic landscape. A good dividend stock typically combines strong fundamentals with consistent payout history, making them appealing in times of market uncertainty. Here are three top SGX dividend stocks yielding up to 6.3%.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.05% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.69% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.21% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.36% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.17% | ★★★★★☆ |

| Genting Singapore (SGX:G13) | 4.79% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.34% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.76% | ★★★★☆☆ |

| Delfi (SGX:P34) | 7.10% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

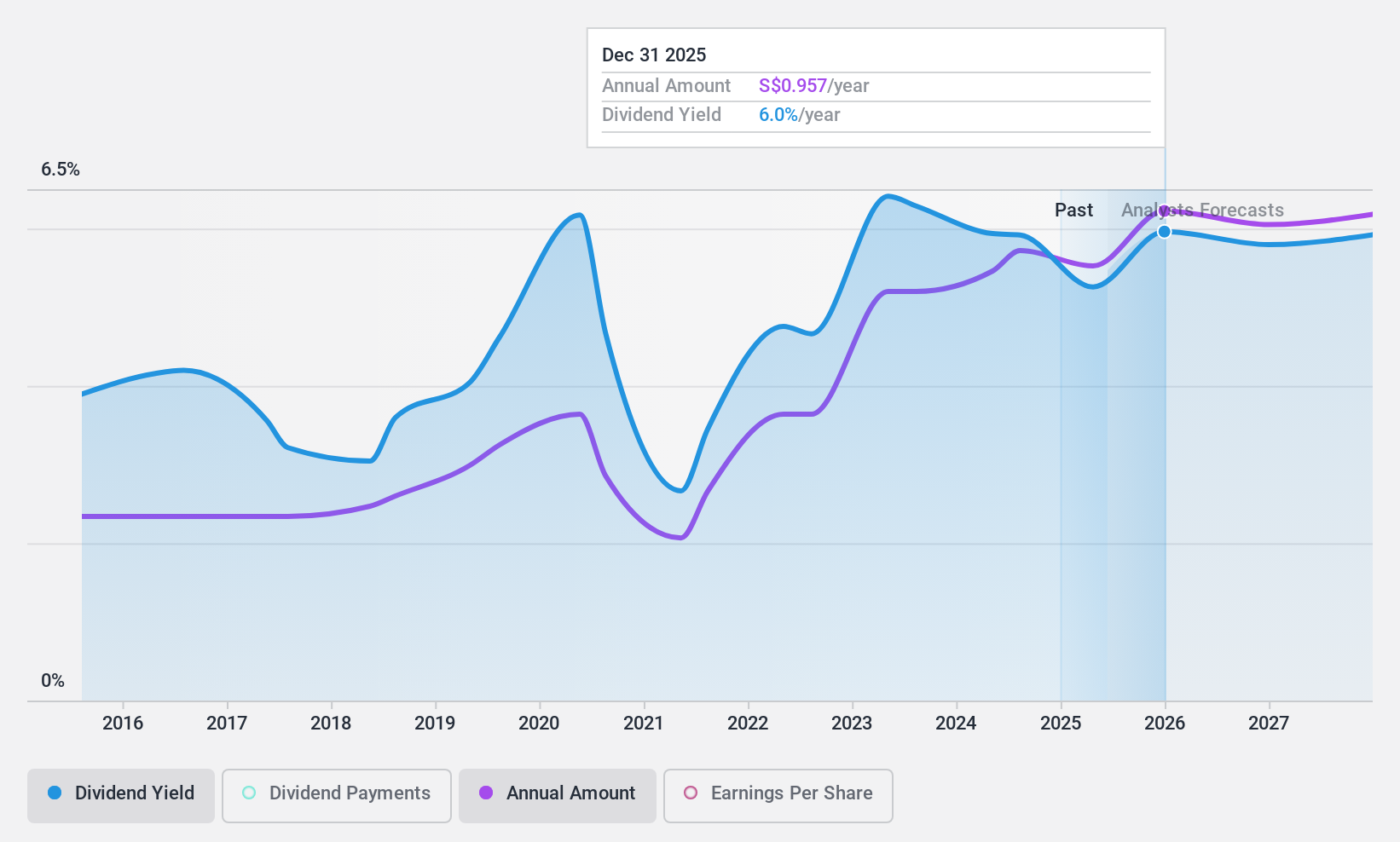

Oversea-Chinese Banking (SGX:O39)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited (SGX:O39) provides financial services across Singapore, Malaysia, Indonesia, Greater China, the rest of the Asia Pacific, and internationally, with a market cap of SGD68.77 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue from Global Wholesale Banking (SGD5.23 billion), Global Consumer/Private Banking (SGD5.19 billion), Insurance (SGD1.27 billion), and Global Markets (SGD512 million).

Dividend Yield: 5.8%

Oversea-Chinese Banking Corporation Limited (OCBC) recently announced a fiscal year 2024 interim dividend of S$0.44 per share, reflecting its stable payout ratio of 52.8%. Despite earnings growth to S$3.93 billion for H1 2024 and consistent dividend increases over the past decade, OCBC's dividends have been volatile and below the top tier in Singapore. The bank's dividends are expected to remain covered by earnings in the next three years, ensuring sustainability despite past instability.

- Navigate through the intricacies of Oversea-Chinese Banking with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Oversea-Chinese Banking is priced lower than what may be justified by its financials.

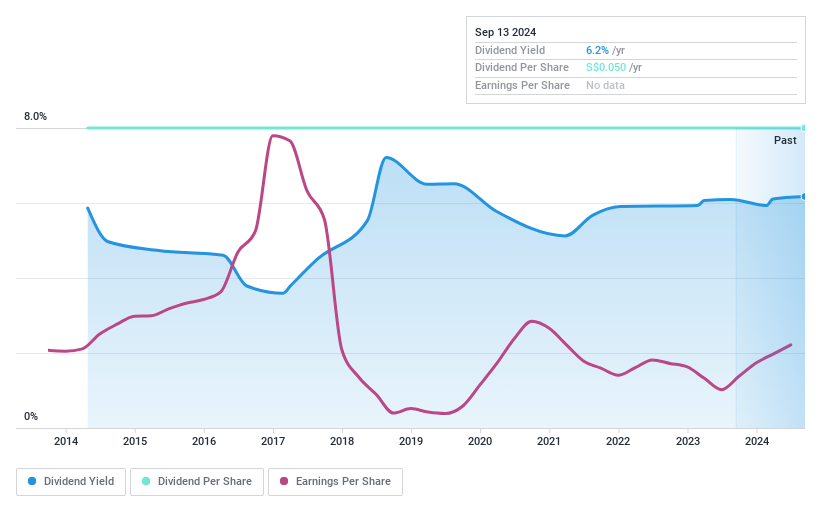

QAF (SGX:Q01)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: QAF Limited, with a market cap of SGD465.97 million, is an investment holding company involved in the manufacture and distribution of bread, bakery, and confectionery products across Singapore, Australia, the Philippines, Malaysia, and internationally.

Operations: QAF Limited generates revenue primarily from its Bakery segment (SGD460.50 million) and Distribution & Warehousing segment (SGD164.22 million).

Dividend Yield: 6.2%

QAF Limited announced an interim tax-exempt dividend of S$0.01 per share for FY2024, payable on 26 September 2024. Recent earnings showed significant improvement, with net income rising to S$12.48 million for H1 2024 from S$4.91 million a year ago. Despite stable dividends over the past decade, QAF's payout ratio stands at 82%, indicating coverage by earnings and cash flows but raising concerns about sustainability given historical volatility in dividend payments.

- Click to explore a detailed breakdown of our findings in QAF's dividend report.

- Our valuation report unveils the possibility QAF's shares may be trading at a premium.

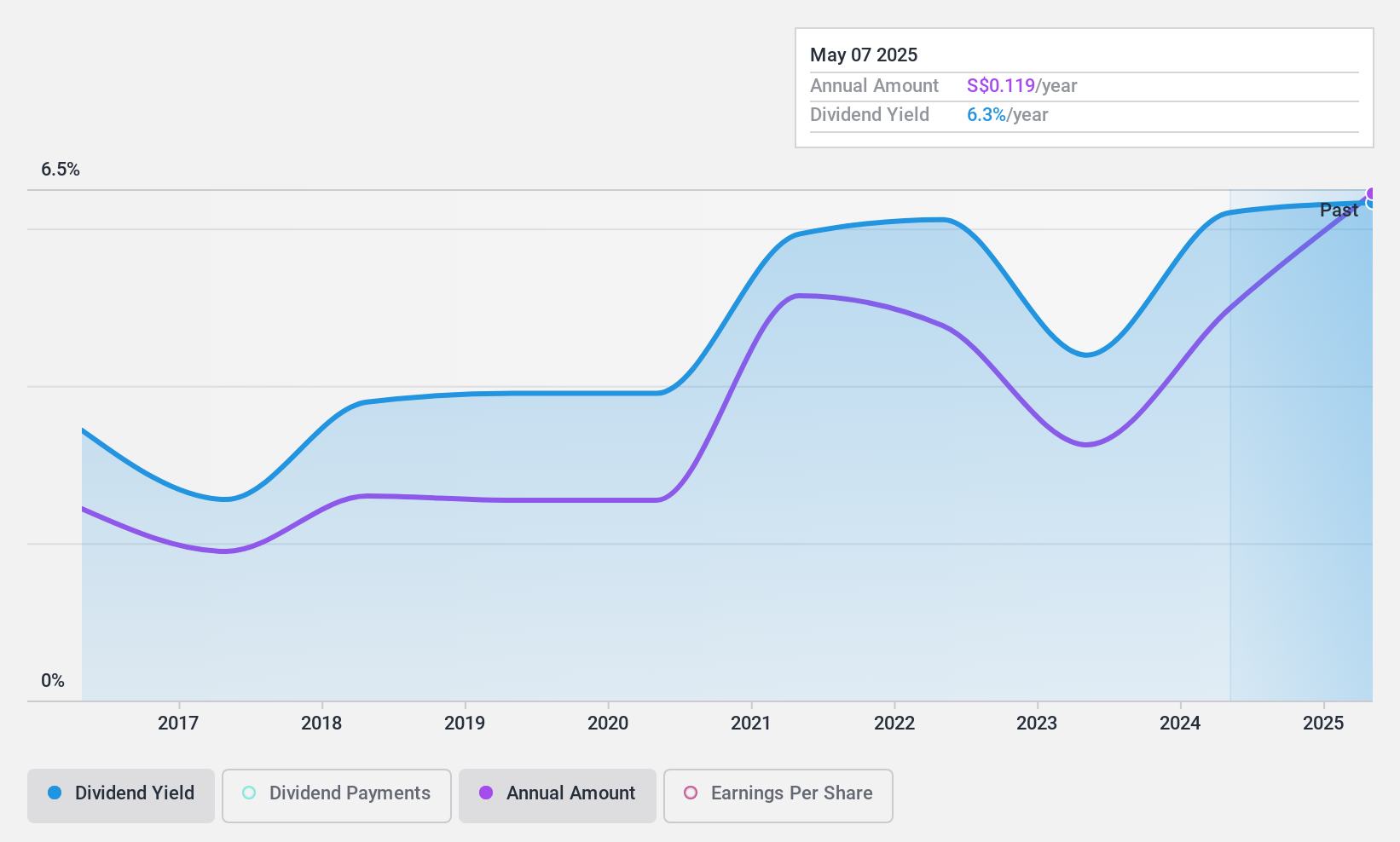

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited, an investment holding company with a market cap of SGD1.36 billion, provides stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services in Singapore, Hong Kong, Thailand, Malaysia and internationally.

Operations: UOB-Kay Hian Holdings Limited generated SGD581.07 million from its Securities and Futures Broking and Other Related Services segment.

Dividend Yield: 6.3%

UOB-Kay Hian Holdings' dividend yield of 6.34% places it among the top 25% in Singapore, but its sustainability is questionable. The high cash payout ratio (100.1%) indicates dividends are not well covered by free cash flows, despite a reasonable earnings payout ratio (38.6%). Recent earnings surged to S$113.91 million for H1 2024 from S$69.32 million a year ago, yet significant insider selling and past dividend volatility raise concerns about reliability and future stability.

- Unlock comprehensive insights into our analysis of UOB-Kay Hian Holdings stock in this dividend report.

- The analysis detailed in our UOB-Kay Hian Holdings valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Unlock more gems! Our Top SGX Dividend Stocks screener has unearthed 16 more companies for you to explore.Click here to unveil our expertly curated list of 19 Top SGX Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O39

Oversea-Chinese Banking

Engages in the provision of financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet with solid track record and pays a dividend.