- Singapore

- /

- Capital Markets

- /

- SGX:S68

3 SGX Dividend Stocks Yielding 3.1% To 5.8%

Reviewed by Simply Wall St

The Singapore market has shown resilience amid global economic uncertainties, with indices reflecting a stable yet cautious investor sentiment. In this environment, dividend stocks can offer a reliable income stream and potentially mitigate risks associated with market volatility. When evaluating dividend stocks, it's essential to consider factors such as yield consistency, payout ratio, and the company's financial health. Here are three SGX-listed dividend stocks yielding between 3.1% to 5.8%, which may provide steady returns in the current market landscape.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.93% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.24% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.22% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.19% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.10% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.80% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.82% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.47% | ★★★★☆☆ |

| Tai Sin Electric (SGX:500) | 5.88% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

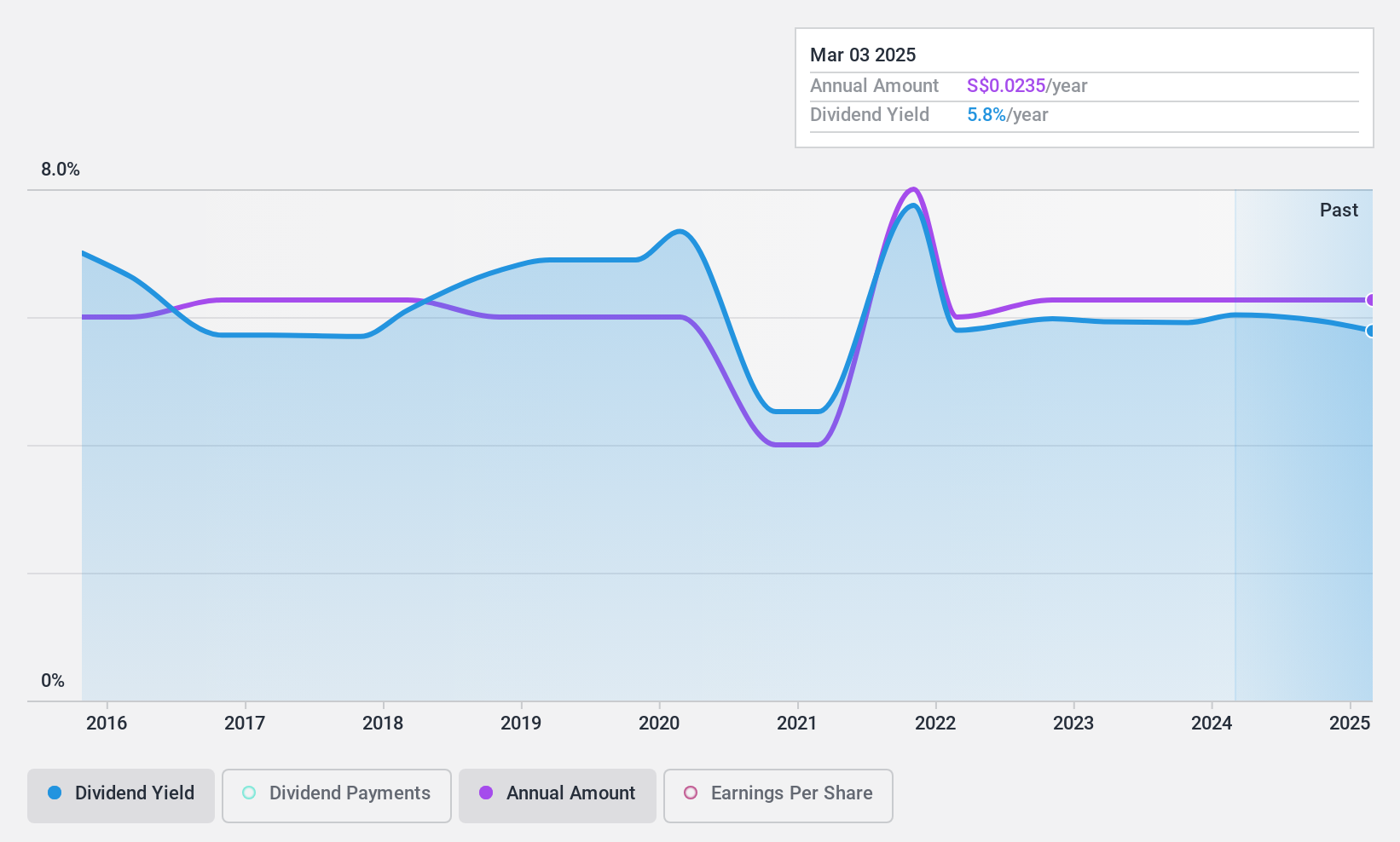

Tai Sin Electric (SGX:500)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tai Sin Electric Limited, with a market cap of SGD184.10 million, manufactures and deals in cable and wire products through its subsidiaries.

Operations: Tai Sin Electric Limited generates revenue from four main segments: Cable & Wire (SGD272.15 million), Electrical Material Distribution (SGD95.10 million), Test & Inspection (SGD29.72 million), and Switchboard (SGD4.55 million).

Dividend Yield: 5.9%

Tai Sin Electric's dividend yield of 5.88% places it in the top 25% of dividend payers in Singapore, but its sustainability is questionable as dividends are not covered by free cash flows and have been volatile over the past decade. Recent earnings showed a decline with net income at S$14.6 million compared to S$16.67 million last year, impacting the company's ability to maintain consistent dividend payments despite a reasonable payout ratio of 74.1%.

- Click here to discover the nuances of Tai Sin Electric with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Tai Sin Electric's share price might be too pessimistic.

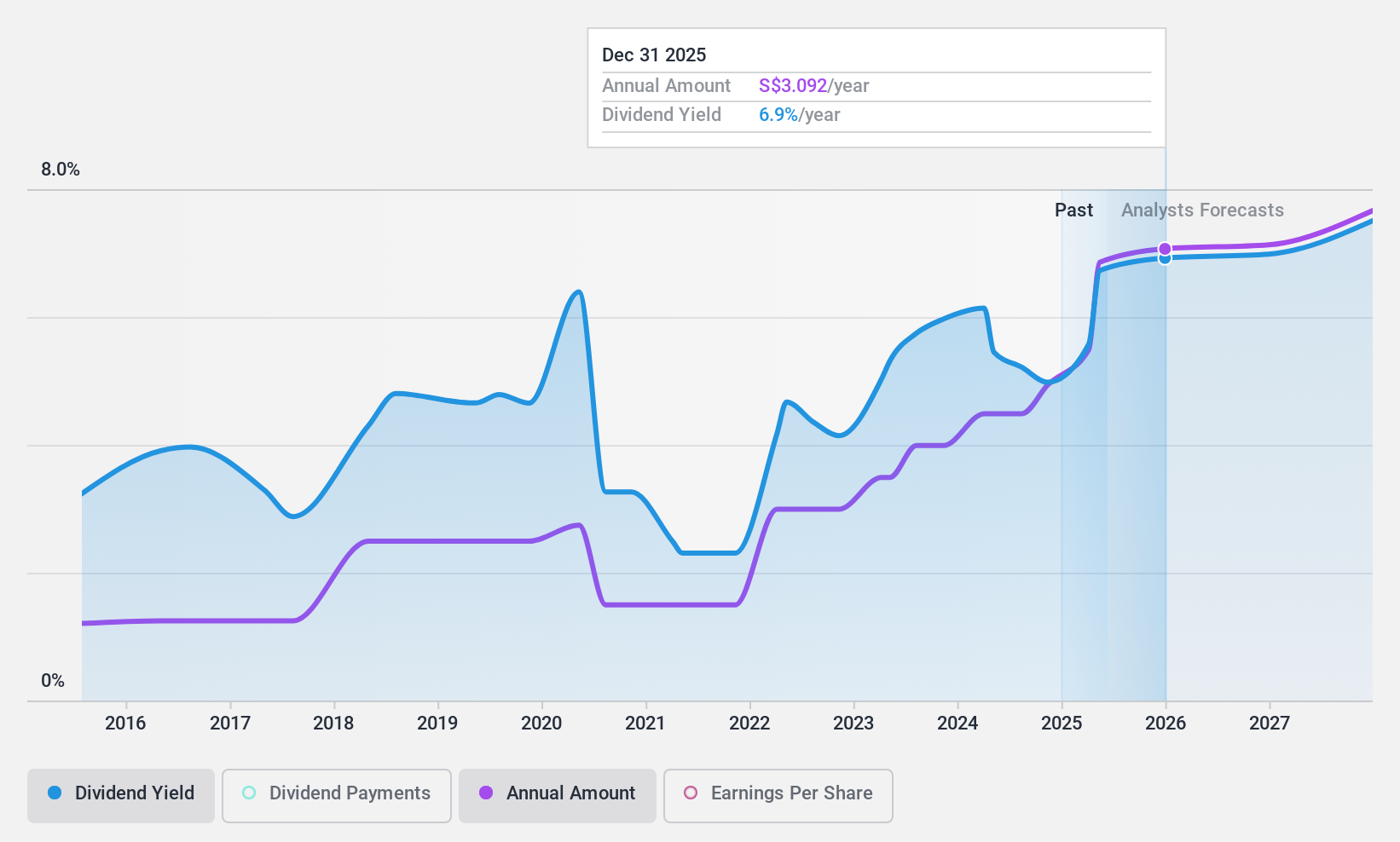

DBS Group Holdings (SGX:D05)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd is a commercial banking and financial services provider operating in Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market cap of SGD106.94 billion.

Operations: DBS Group Holdings Ltd generates revenue primarily from Consumer Banking/Wealth Management (SGD9.34 billion), Institutional Banking (SGD9.18 billion), and Treasury Markets (SGD695 million).

Dividend Yield: 5.7%

DBS Group Holdings' dividend payments have increased over the past decade, although they have been volatile with occasional drops over 20%. The current payout ratio of 54.1% ensures dividends are covered by earnings, and this is expected to remain sustainable in the next three years. Recent earnings report showed net income rising to S$5.74 billion for H1 2024 from S$5.2 billion a year ago, supporting its ability to continue paying dividends.

- Take a closer look at DBS Group Holdings' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that DBS Group Holdings is trading behind its estimated value.

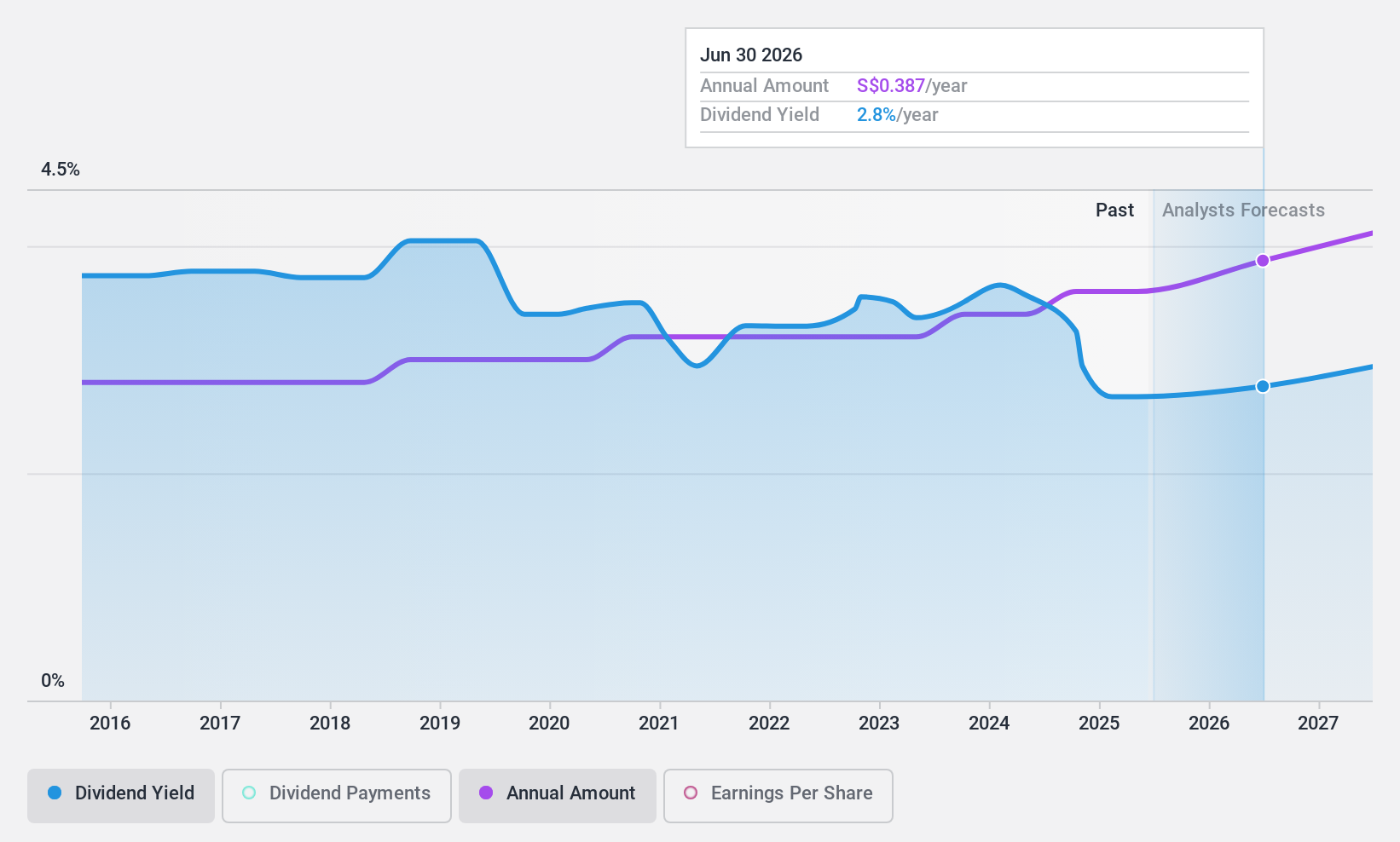

Singapore Exchange (SGX:S68)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates integrated securities and derivatives exchanges, related clearing houses, and an electricity market in Singapore with a market cap of SGD12.07 billion.

Operations: Singapore Exchange Limited generates revenue from four main segments: Equities - Cash (SGD334.94 million), Platform and Others (SGD240.20 million), Equities - Derivatives (SGD334.05 million), and Fixed Income, Currencies, and Commodities (SGD322.50 million).

Dividend Yield: 3.2%

Singapore Exchange's dividends are well-covered by earnings (payout ratio: 61.7%) and cash flows (cash payout ratio: 69.9%). The stock trades at a 12.2% discount to its estimated fair value, with stable and growing dividend payments over the past decade, currently yielding 3.19%. Recent earnings showed an increase in net income to S$597.91 million for FY2024 from S$570.9 million last year, indicating continued financial health despite executive changes including a new CFO starting December 2024.

- Dive into the specifics of Singapore Exchange here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Singapore Exchange shares in the market.

Next Steps

- Reveal the 22 hidden gems among our Top SGX Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S68

Singapore Exchange

An investment holding, engages in the operation of integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives