- Sweden

- /

- Telecom Services and Carriers

- /

- OM:OVZON

Why Investors Shouldn't Be Surprised By Ovzon AB (publ)'s (STO:OVZON) 29% Share Price Surge

Those holding Ovzon AB (publ) (STO:OVZON) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 63% share price drop in the last twelve months.

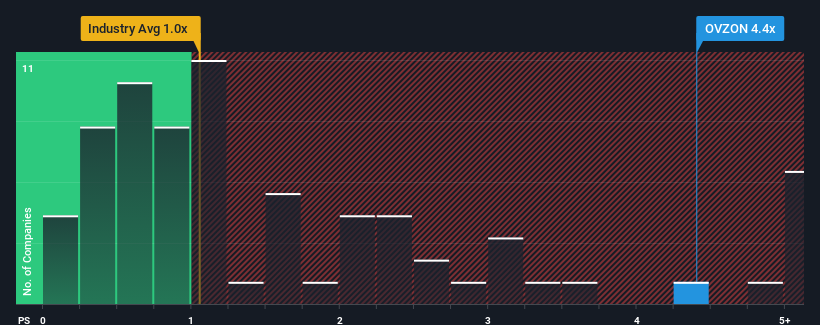

After such a large jump in price, given around half the companies in Sweden's Telecom industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Ovzon as a stock to avoid entirely with its 4.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Ovzon

What Does Ovzon's P/S Mean For Shareholders?

Ovzon could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Ovzon's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ovzon's Revenue Growth Trending?

Ovzon's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 7.6% decrease to the company's top line. Still, the latest three year period has seen an excellent 101% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 30% per year over the next three years. That's shaping up to be materially higher than the 3.6% per annum growth forecast for the broader industry.

In light of this, it's understandable that Ovzon's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Ovzon have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Ovzon maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Telecom industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Ovzon (2 are significant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OVZON

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives