- Sweden

- /

- Telecom Services and Carriers

- /

- OM:OVZON

Investors Still Waiting For A Pull Back In Ovzon AB (publ) (STO:OVZON)

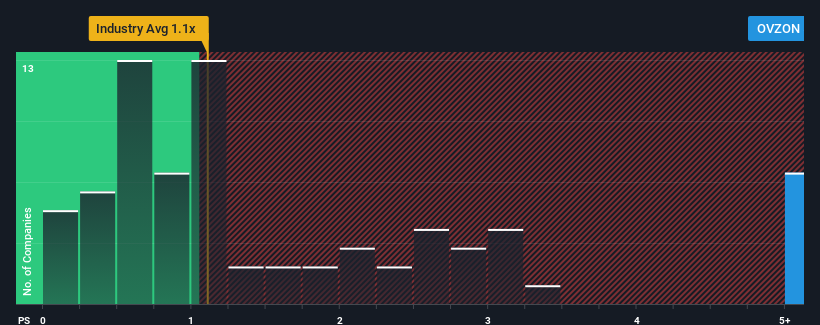

Ovzon AB (publ)'s (STO:OVZON) price-to-sales (or "P/S") ratio of 5.9x may look like a poor investment opportunity when you consider close to half the companies in the Telecom industry in Sweden have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Ovzon

How Has Ovzon Performed Recently?

While the industry has experienced revenue growth lately, Ovzon's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ovzon will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ovzon?

Ovzon's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 3.4% decrease to the company's top line. Even so, admirably revenue has lifted 101% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 47% over the next year. With the industry only predicted to deliver 2.2%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Ovzon's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Ovzon's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ovzon maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Telecom industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 3 warning signs we've spotted with Ovzon (including 1 which shouldn't be ignored).

If these risks are making you reconsider your opinion on Ovzon, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OVZON

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives