- Spain

- /

- Real Estate

- /

- BME:AEDAS

3 Top Dividend Stocks Yielding Between 4% And 9%

Reviewed by Simply Wall St

Amidst geopolitical tensions and consumer spending concerns, global markets have experienced volatility with major indexes showing declines. As investors navigate these uncertain times, dividend stocks yielding between 4% and 9% offer a potential avenue for income generation, providing stability through regular payouts in the face of fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.73% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.92% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.67% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

Click here to see the full list of 2009 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

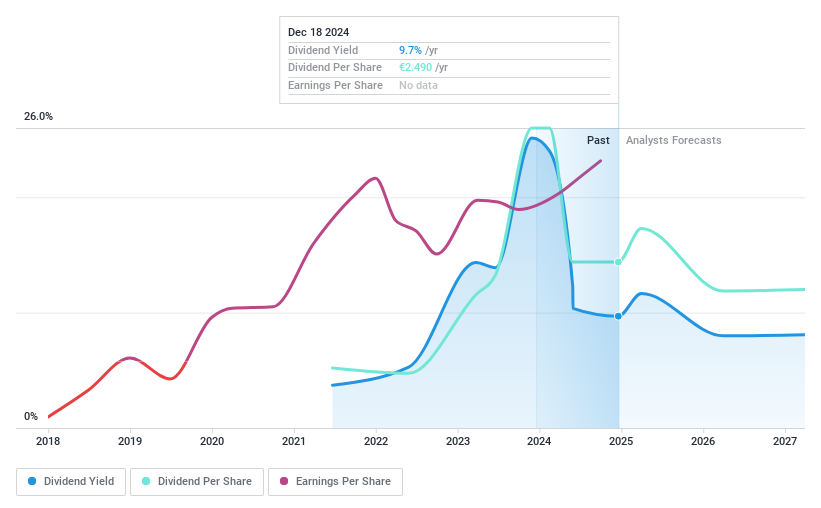

Aedas Homes (BME:AEDAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aedas Homes, S.A. is a company that focuses on the development of residential properties in Spain and has a market capitalization of approximately €1.18 billion.

Operations: Aedas Homes, S.A. generates its revenue primarily through property development, with this segment contributing €1.22 billion.

Dividend Yield: 9.1%

Aedas Homes offers an appealing dividend yield of 9.09%, ranking in the top 25% among Spanish stocks, yet its track record is unstable with only four years of payments and volatility over time. Despite earnings forecasted to decline by 7.1% annually for the next three years, dividends are well-covered by a low payout ratio (8%) and cash flow coverage (37.2%). The stock trades at a significant discount to estimated fair value, enhancing its attractiveness despite high debt levels.

- Navigate through the intricacies of Aedas Homes with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Aedas Homes' share price might be too pessimistic.

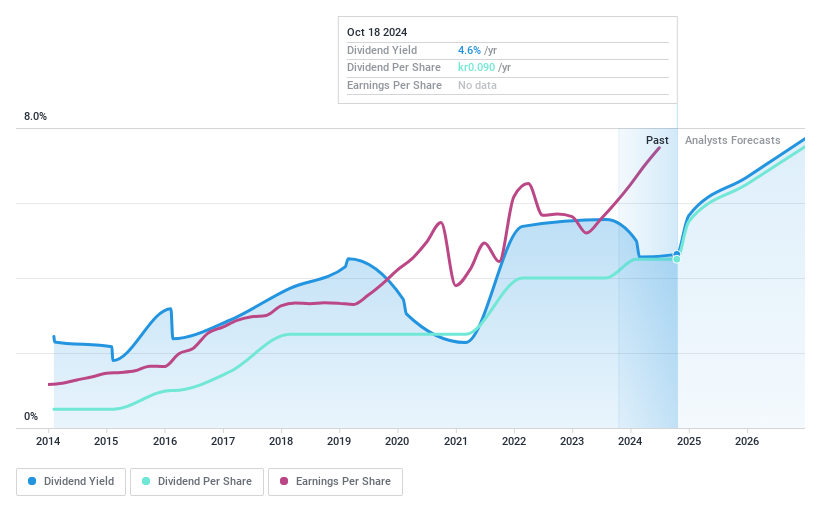

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and businesses in Sweden, with a market cap of SEK1.91 billion.

Operations: Bredband2 i Skandinavien AB (publ) generates revenue primarily from its National Broadband Service, amounting to SEK1.73 billion.

Dividend Yield: 4.8%

Bredband2 i Skandinavien offers a compelling dividend yield of 5.01%, placing it in the top 25% among Swedish stocks. Its dividends have been stable and growing over the past decade, supported by earnings coverage with an 87.6% payout ratio and a cash payout ratio of 43.8%. Recent Q4 earnings showed increased sales (SEK 444.74 million) and net income (SEK 29.61 million), reflecting strong financial performance that underpins its reliable dividend payments.

- Dive into the specifics of Bredband2 i Skandinavien here with our thorough dividend report.

- The analysis detailed in our Bredband2 i Skandinavien valuation report hints at an deflated share price compared to its estimated value.

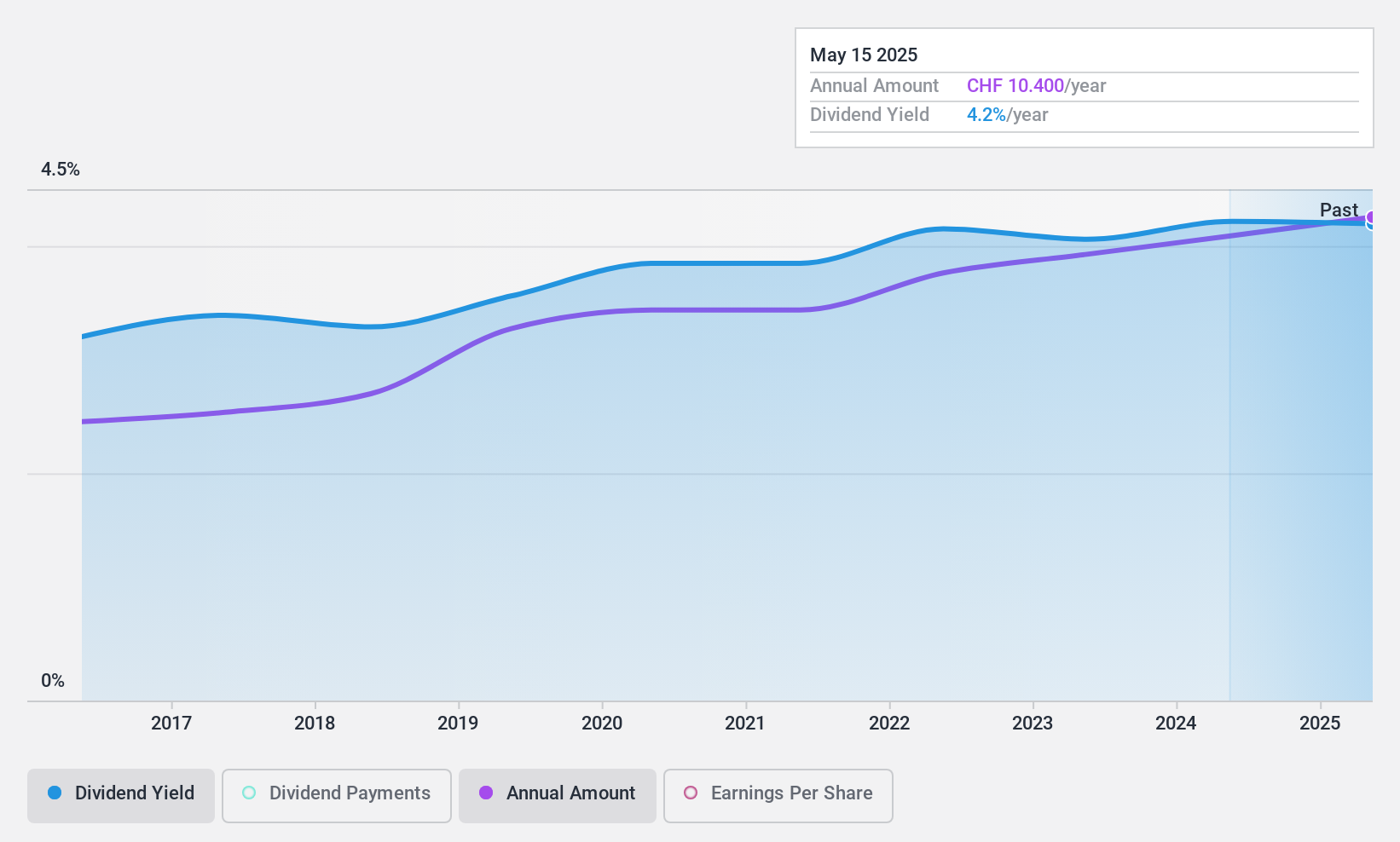

Berner Kantonalbank (SWX:BEKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Berner Kantonalbank AG provides banking products and services to private individuals and corporate customers in Switzerland, with a market cap of CHF 2.26 billion.

Operations: Berner Kantonalbank AG generates CHF 539.60 million from its banking segment, serving both private and corporate clients in Switzerland.

Dividend Yield: 4%

Berner Kantonalbank offers a reliable dividend yield of 4.08%, ranking in the top 25% of Swiss dividend payers. Over the past decade, its dividends have grown steadily with minimal volatility, supported by a reasonable payout ratio of 52.8%. The bank's price-to-earnings ratio is favorable at 13x compared to the Swiss market average of 21.1x, although insufficient data exists to assess future dividend coverage by earnings or cash flows.

- Delve into the full analysis dividend report here for a deeper understanding of Berner Kantonalbank.

- Our valuation report here indicates Berner Kantonalbank may be overvalued.

Seize The Opportunity

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 2006 more companies for you to explore.Click here to unveil our expertly curated list of 2009 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AEDAS

Aedas Homes

Engages in the development of residential properties in Spain.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives