- Switzerland

- /

- Consumer Finance

- /

- SWX:CMBN

Top European Dividend Stocks Offering Up To 4.5% Yield

Reviewed by Simply Wall St

As European markets rally, with the STOXX Europe 600 Index reaching record levels and major indices like Germany’s DAX and France’s CAC 40 showing strong gains, investors are increasingly focusing on dividend stocks as a way to capitalize on favorable market conditions. In this environment, a good dividend stock is often characterized by its ability to offer consistent yields while benefiting from positive economic sentiment and expectations for lower borrowing costs.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.35% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.52% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.66% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.02% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.22% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 11.91% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.60% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.34% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.00% | ★★★★★★ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

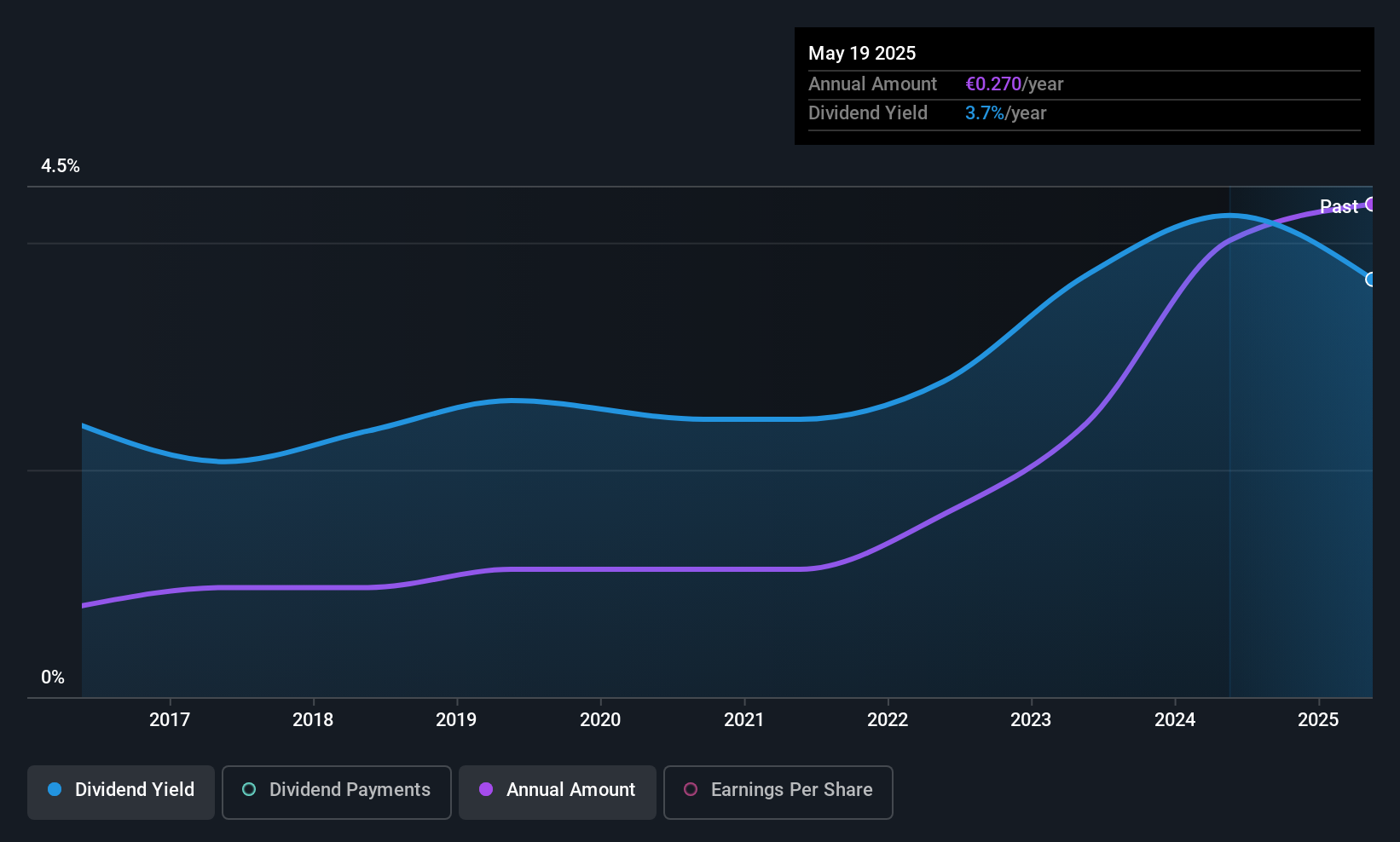

Caltagirone (BIT:CALT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caltagirone SpA operates through its subsidiaries in cement manufacturing, media, real estate, and publishing sectors with a market cap of €1.08 billion.

Operations: Caltagirone SpA's revenue is primarily derived from its Cement, Concrete and Inert segment (€1.65 billion), followed by Constructions (€422.86 million), Publishing (€111.40 million), and Management of Properties (€13.36 million).

Dividend Yield: 3%

Caltagirone SpA's dividend yield of 3% is below the Italian market's top tier, yet it offers stability with consistent growth over the past decade. Recent earnings show a healthy financial position, with sales at €1.08 billion and net income at €78.48 million for H1 2025. The company's dividends are well-covered by both earnings (payout ratio: 24.5%) and cash flows (cash payout ratio: 7.9%), suggesting sustainability despite a lower yield compared to peers.

- Unlock comprehensive insights into our analysis of Caltagirone stock in this dividend report.

- The analysis detailed in our Caltagirone valuation report hints at an deflated share price compared to its estimated value.

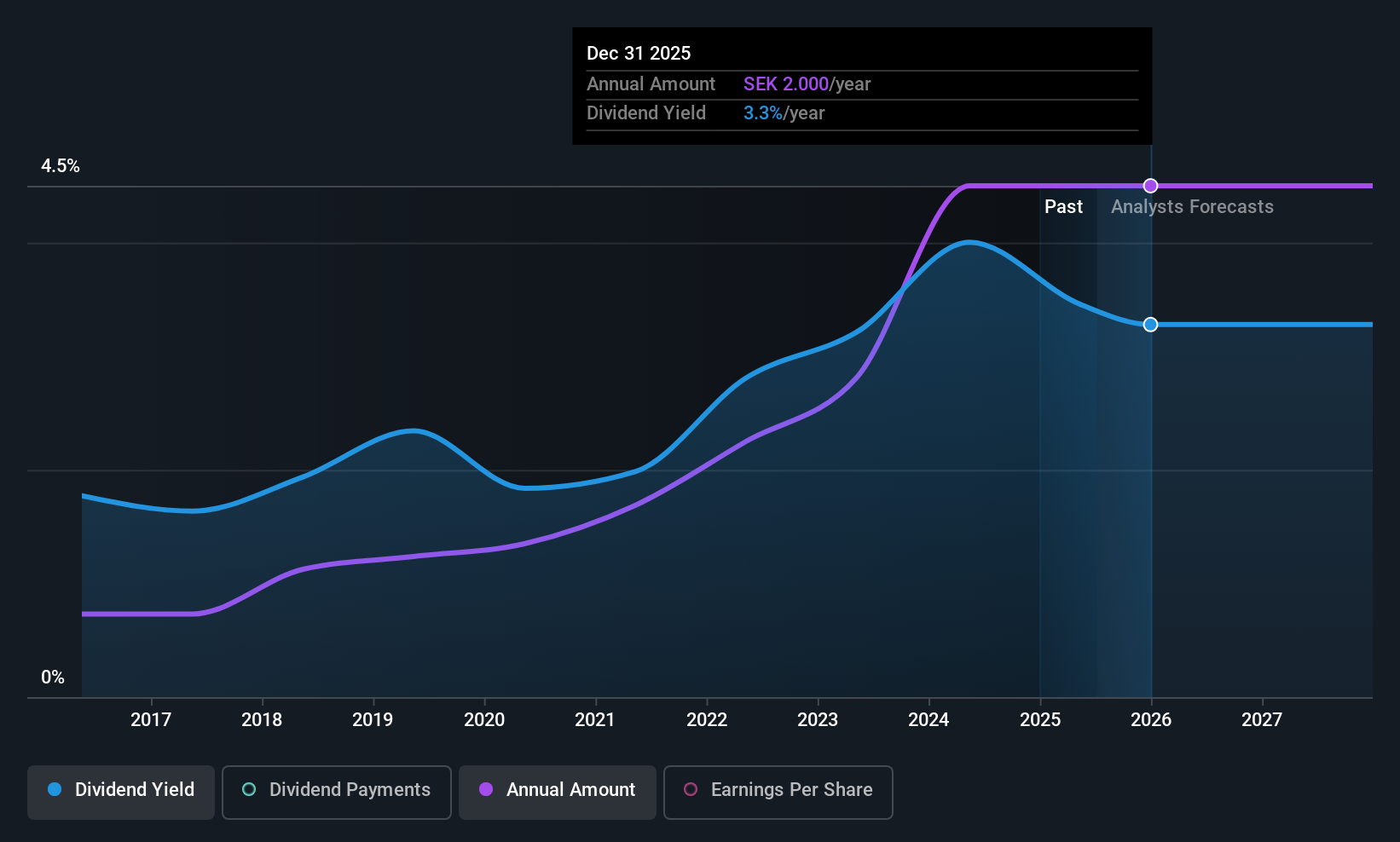

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK6.26 billion.

Operations: Bahnhof AB (publ) generates its revenue from its operations in the Internet and telecommunications sector across Sweden and Europe.

Dividend Yield: 3.4%

Bahnhof's dividend yield of 3.44% is below the Swedish market's top tier, though it has shown reliability and growth over the past decade. Despite stable dividends, a high payout ratio of 95.7% raises concerns about sustainability as earnings do not sufficiently cover payments. Recent earnings for Q2 2025 reported sales at SEK 548.47 million with net income at SEK 56.72 million, indicating moderate financial growth but highlighting potential risks for dividend investors due to coverage issues.

- Dive into the specifics of Bahnhof here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Bahnhof shares in the market.

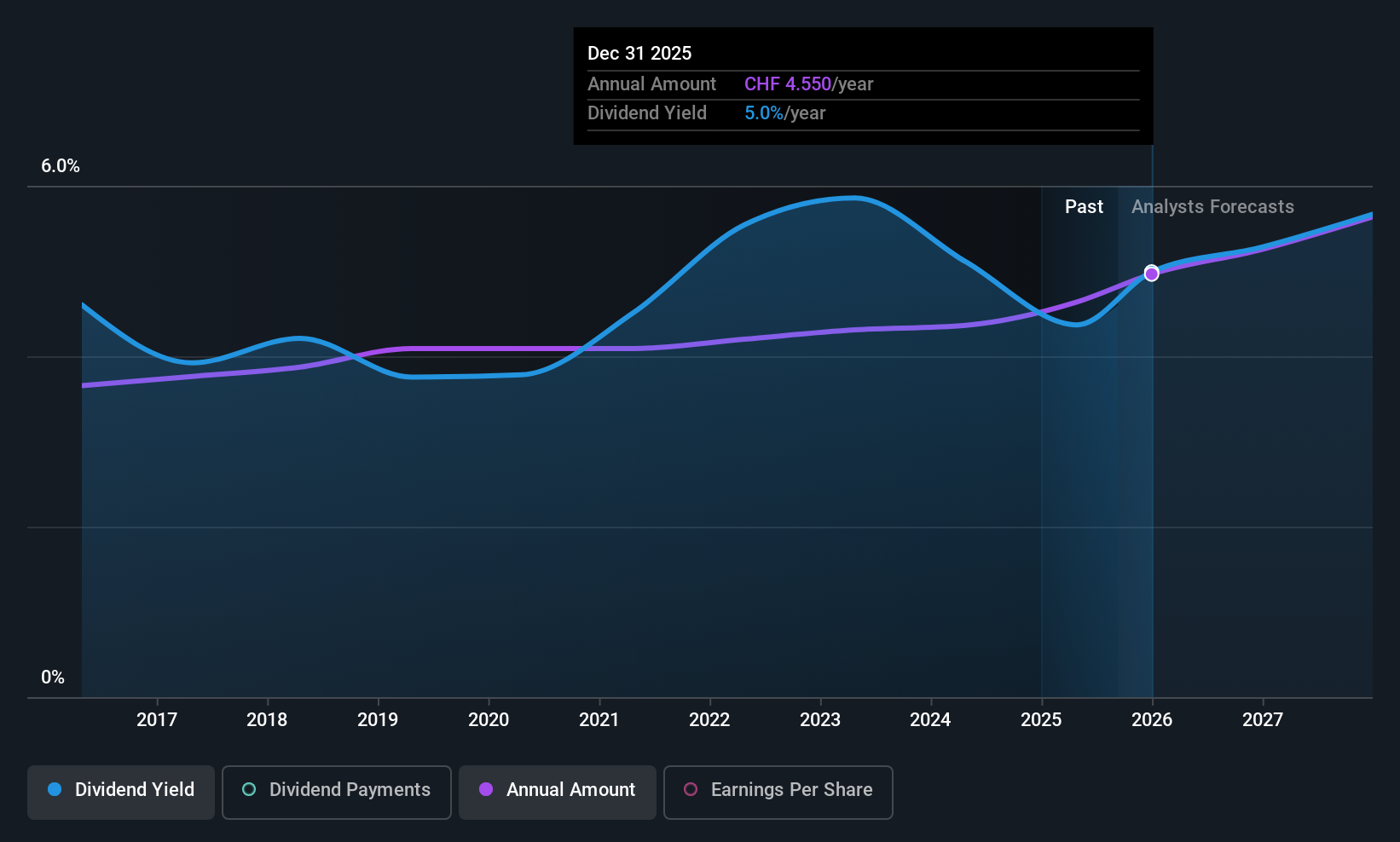

Cembra Money Bank (SWX:CMBN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cembra Money Bank AG is a Swiss company offering consumer finance products and services, with a market cap of CHF2.71 billion.

Operations: Cembra Money Bank AG generates revenue from two main segments: Lending, which contributes CHF279.26 million, and Payments, which adds CHF200.17 million.

Dividend Yield: 4.6%

Cembra Money Bank offers an attractive dividend yield of 4.6%, placing it in the top 25% of Swiss dividend payers. The bank's dividends have been stable and growing over the past decade, supported by a sustainable payout ratio currently at 69.5% and forecasted to remain manageable at 71.7%. Recent earnings results show net income increased to CHF 87.22 million for H1 2025, with guidance indicating continued growth and a projected ROE of 14–15%.

- Click here and access our complete dividend analysis report to understand the dynamics of Cembra Money Bank.

- In light of our recent valuation report, it seems possible that Cembra Money Bank is trading behind its estimated value.

Make It Happen

- Click this link to deep-dive into the 221 companies within our Top European Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CMBN

Cembra Money Bank

Provides consumer finance products and services in Switzerland.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026