- Austria

- /

- Electric Utilities

- /

- WBAG:VER

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results and economic policy shifts, investors have seen major indices like the S&P 500 and Nasdaq Composite reach record highs, driven by optimism surrounding potential growth and tax reforms. In this dynamic environment, dividend stocks can offer a compelling investment opportunity by providing steady income streams amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

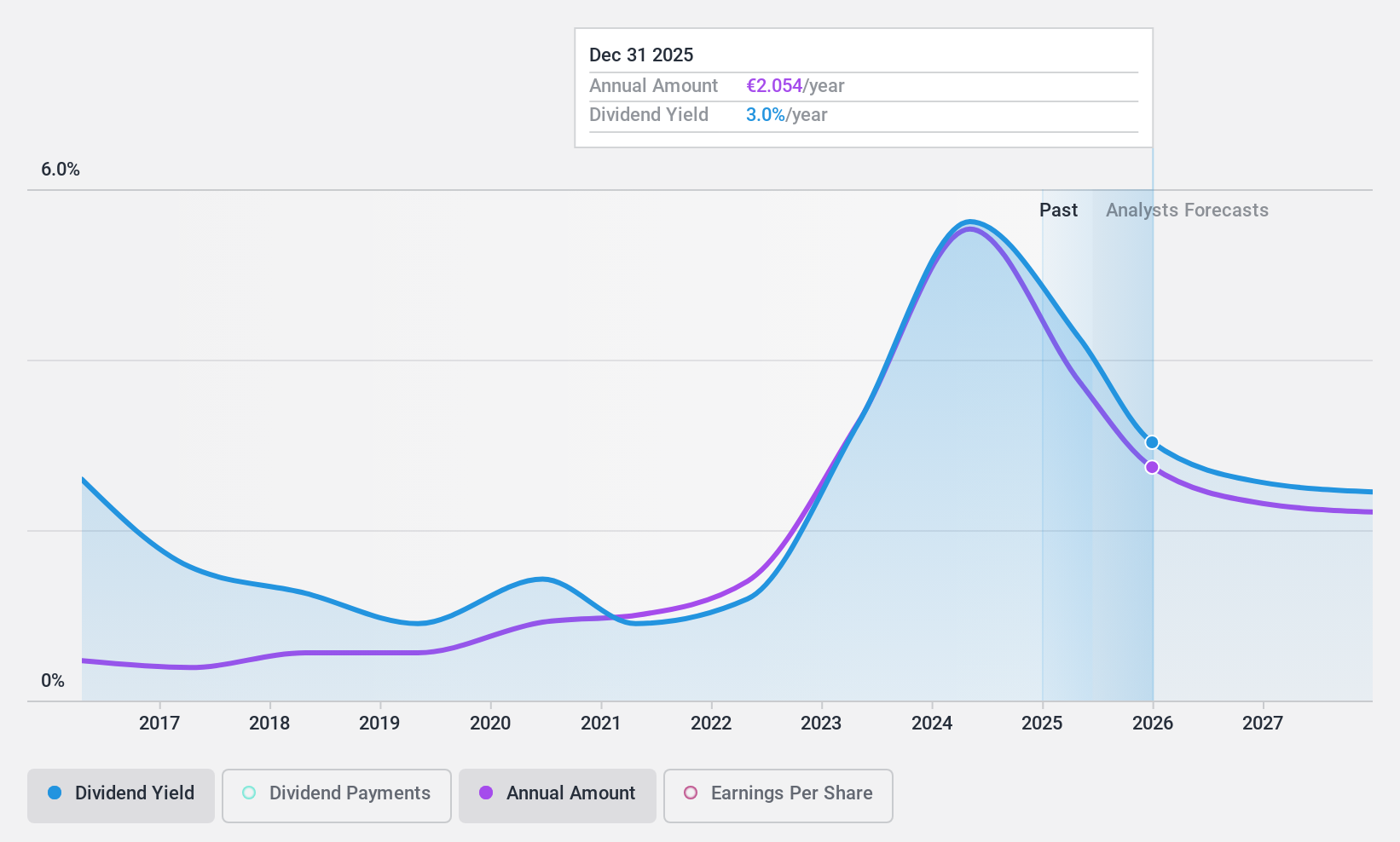

Banca Popolare di Sondrio (BIT:BPSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Popolare di Sondrio S.p.A., along with its subsidiaries, offers a range of banking products and services in Italy, with a market cap of €3.21 billion.

Operations: Banca Popolare di Sondrio S.p.A. operates through various revenue segments, focusing on providing a diverse array of banking products and services within the Italian market.

Dividend Yield: 7.5%

Banca Popolare di Sondrio's dividend yield is among the top 25% in Italy, offering a notable 7.49%. Despite past volatility with dividends dropping over 20% annually at times, recent earnings growth of 21.4% suggests improved stability. The payout ratio stands at a manageable 48.7%, indicating current dividends are well-covered by earnings and forecasted to remain sustainable at a 60.9% payout in three years, though high bad loans (3.2%) present risks.

- Get an in-depth perspective on Banca Popolare di Sondrio's performance by reading our dividend report here.

- According our valuation report, there's an indication that Banca Popolare di Sondrio's share price might be on the expensive side.

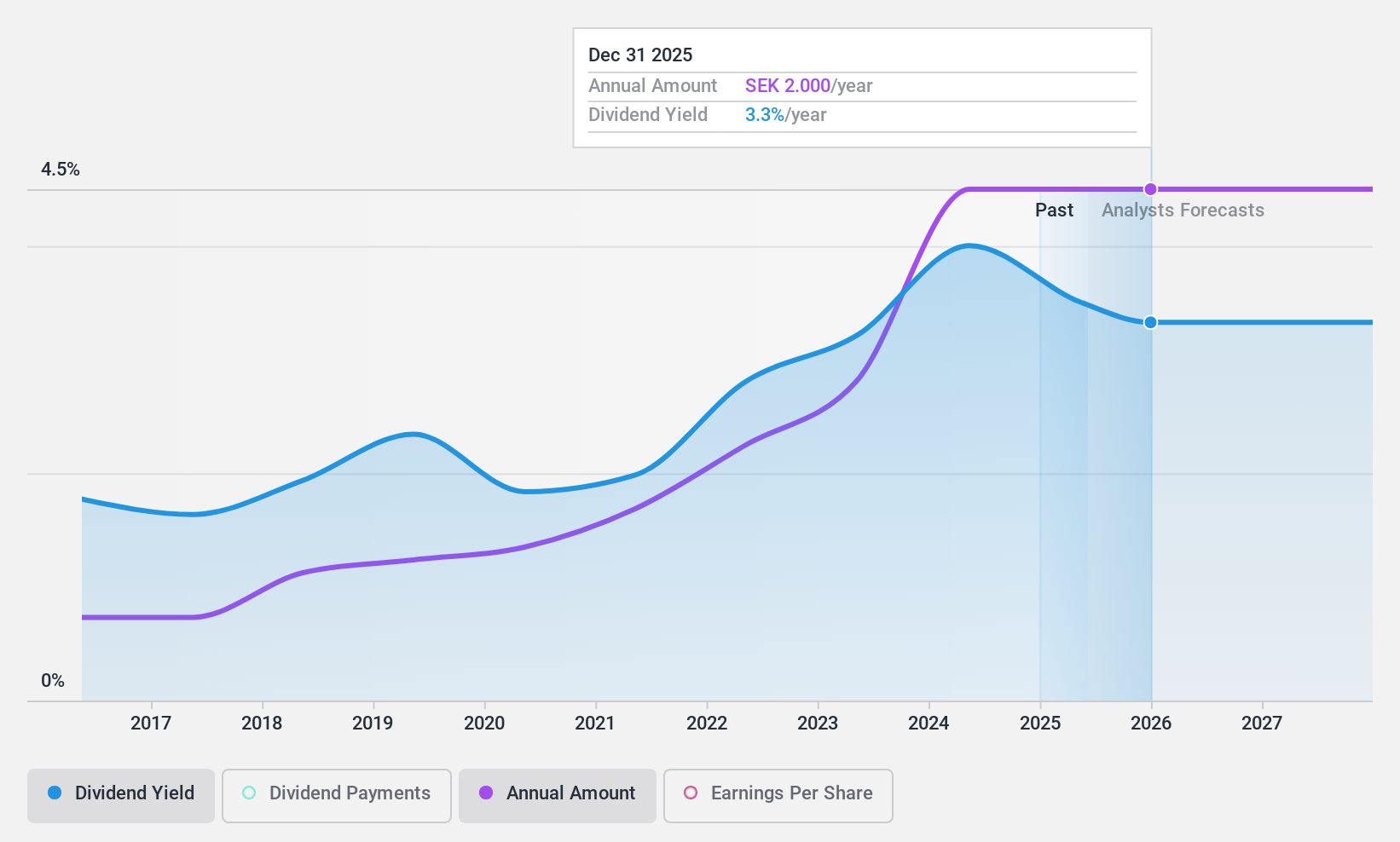

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK5.70 billion.

Operations: Bahnhof AB (publ) generates revenue from its operations in the Internet and telecommunications industry within Sweden and other parts of Europe.

Dividend Yield: 3.7%

Bahnhof's dividend yield of 3.7% is lower than the Swedish market's top 25%, and its high payout ratio of 93.8% suggests dividends are not well-covered by earnings, though cash flows cover them with a reasonable cash payout ratio of 72.8%. Earnings have grown by 14.6% over the past year, supporting dividend stability seen over the last decade. Recently added to the S&P Global BMI Index, Bahnhof reported Q3 revenue growth to SEK 511.57 million from SEK 477.88 million year-over-year.

- Unlock comprehensive insights into our analysis of Bahnhof stock in this dividend report.

- Our expertly prepared valuation report Bahnhof implies its share price may be lower than expected.

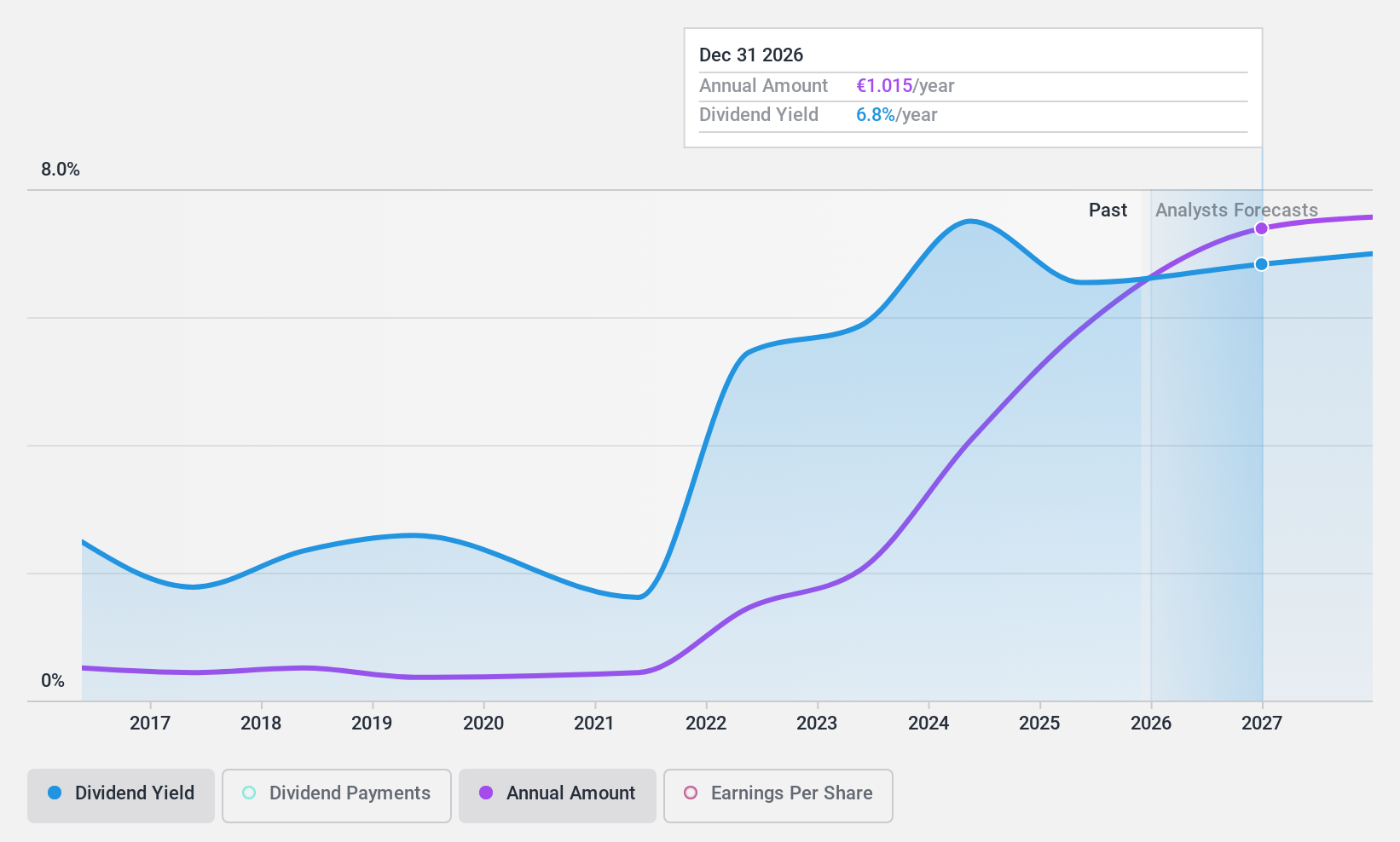

VERBUND (WBAG:VER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VERBUND AG, with a market cap of €24.68 billion, operates through its subsidiaries to generate, trade, and sell electricity to energy exchange markets, traders, electric utilities, industrial companies, households and commercial customers.

Operations: VERBUND AG's revenue is primarily derived from its Sales segment at €4.94 billion, followed by Hydro at €3.58 billion, Grid at €1.74 billion, and New Renewables contributing €328 million.

Dividend Yield: 5.5%

VERBUND's dividend payments have been volatile and unreliable over the past decade, despite a growth trend. The dividends are covered by both earnings and cash flows, with payout ratios of 70.6% and 65.6%, respectively, indicating sustainability. However, its dividend yield of 5.53% is below the top tier in Austria (6.26%). Recent financial results show declining sales and net income for Q3 2024 compared to the previous year, potentially impacting future dividend stability.

- Click here to discover the nuances of VERBUND with our detailed analytical dividend report.

- The analysis detailed in our VERBUND valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Access the full spectrum of 1939 Top Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:VER

VERBUND

Generates, trades, and sells electricity to energy exchange markets, traders, electric utilities and industrial companies, and households and commercial customers.

Excellent balance sheet average dividend payer.