- Sweden

- /

- Real Estate

- /

- OM:HUFV A

Steer Clear Of Hufvudstaden And Explore This One Appealing Dividend Stock

Reviewed by Sasha Jovanovic

In the realm of Swedish dividend stocks, investors often seek stability and growth in their passive income streams. While many companies have successfully increased their dividends, contributing to an average growth rate of 6.7% over the past year, others have not fared as well. A declining dividend, such as that seen with Hufvudstaden, can signal potential issues for investors looking for reliable and growing returns from their investments.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.38% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.78% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.51% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.34% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.02% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.97% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.39% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.42% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.06% | ★★★★★☆ |

| Husqvarna (OM:HUSQ B) | 3.48% | ★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Let's review one of the notable picks from our screened stocks and one not so great.

Top Pick

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

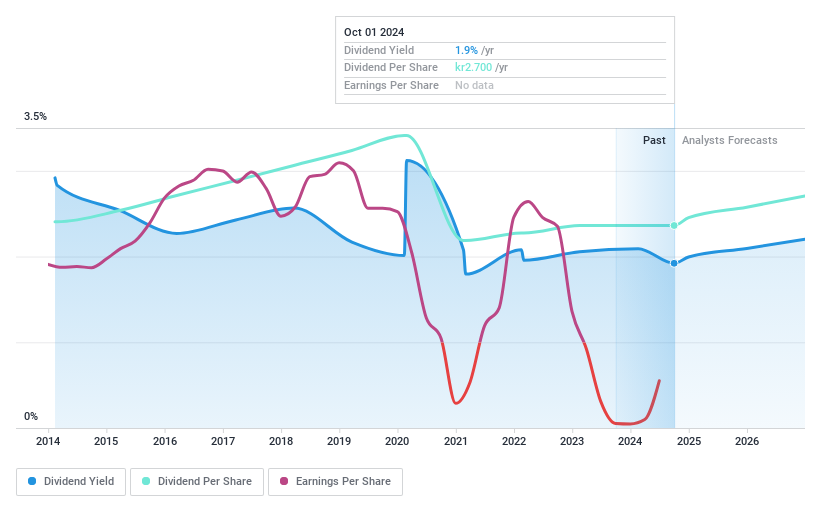

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector primarily in Sweden and other parts of Europe, with a market capitalization of approximately SEK 5.52 billion.

Operations: The company generates revenue through its Retail Market and Corporate Market segments, with SEK 1.30 billion and SEK 606.24 million respectively.

Dividend Yield: 3.9%

Bahnhof AB has demonstrated a consistent increase in dividend payments over the past decade, reflecting a stable return to shareholders despite its dividend yield of 3.9% being slightly below the top quartile of Swedish dividend stocks. Recent financials show a 17.7% earnings growth year-over-year with Q1 sales rising to SEK 491.38 million from SEK 451.4 million, underpinning this reliability. However, the sustainability is questionable as dividends are not well-covered by earnings, with a high payout ratio of 97.5%.

- Unlock comprehensive insights into our analysis of Bahnhof stock in this dividend report.

- The valuation report we've compiled suggests that Bahnhof's current price could be inflated.

One To Reconsider

Hufvudstaden (OM:HUFV A)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Hufvudstaden AB (publ) is a company focused on owning, developing, and managing commercial properties in Stockholm and Gothenburg, Sweden, with a market capitalization of approximately SEK 25.61 billion.

Operations: Hufvudstaden generates revenue primarily through property management in Stockholm and Gothenburg, contributing SEK 1.42 billion and SEK 326.60 million respectively, along with retail operations in the NK Business Area generating SEK 824 million.

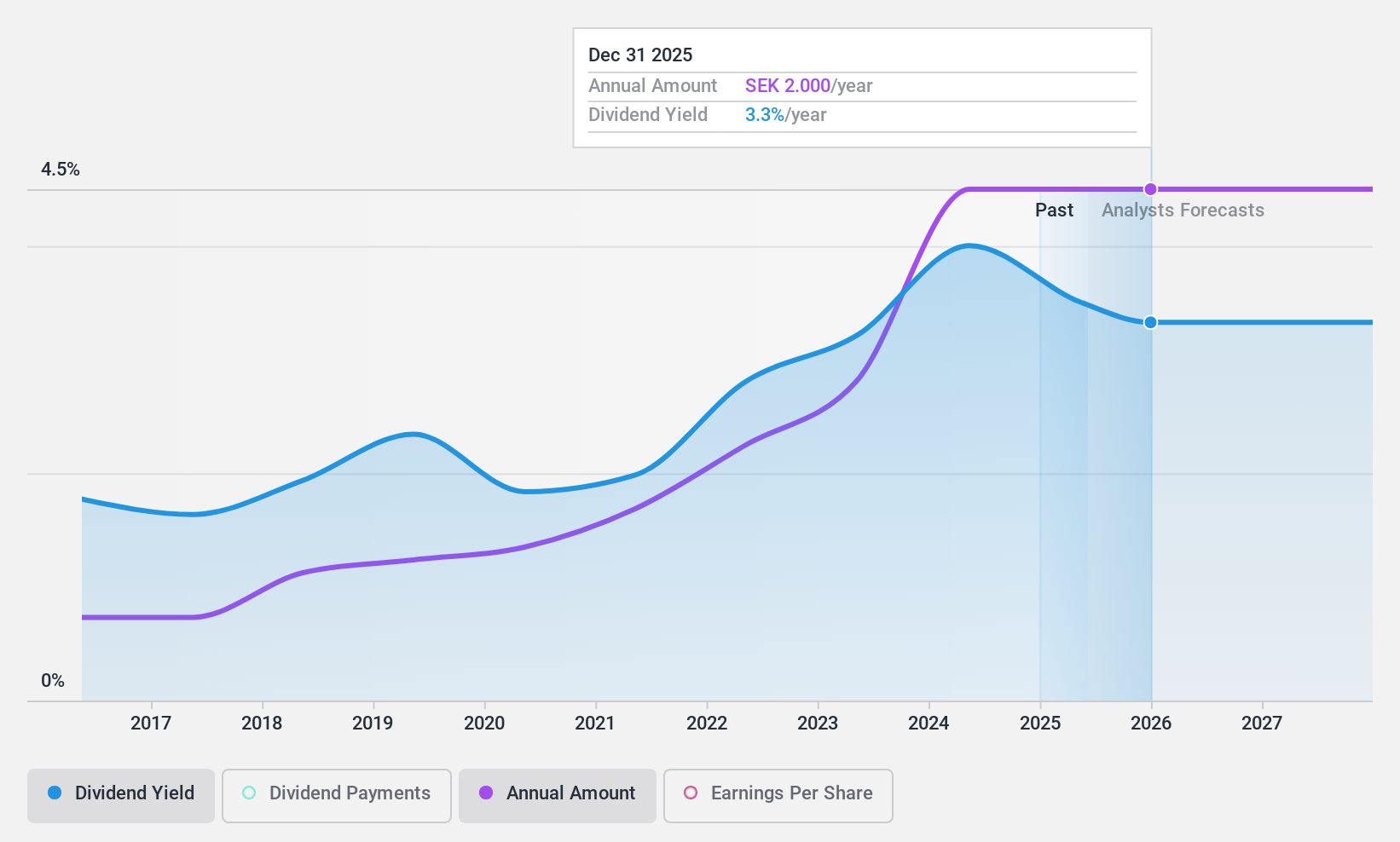

Dividend Yield: 2.1%

Hufvudstaden's dividend, currently at 2.13%, is lower than the top quartile of Swedish dividend stocks at 4.17%. Despite a cash payout ratio of 46%, suggesting dividends are covered by cash flows, the company's profitability is in question as it remains unprofitable with recent net losses. Over the past decade, its dividend payments have been both unreliable and volatile, with a trend of declining payouts. This instability makes Hufvudstaden a less attractive option for dividend-seeking investors.

Summing It All Up

- Navigate through the entire inventory of 24 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hufvudstaden, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hufvudstaden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUFV A

Hufvudstaden

Engages in the ownership, development, and management of commercial properties in Stockholm and Gothenburg, Sweden.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives