- Sweden

- /

- Professional Services

- /

- OM:HIFA B

Discover May 2025's European Penny Stock Opportunities

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the easing of U.S.-China trade tensions, investors are keenly observing opportunities across various sectors. The term 'penny stocks' may seem like a nod to bygone market eras, but these lower-priced equities continue to offer intriguing potential for those seeking affordable entry points and growth possibilities. In this article, we explore three penny stocks that stand out for their financial robustness and promise within the evolving European landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.29 | SEK2.19B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.59 | SEK237.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.58 | SEK268.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.69 | PLN125.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.59 | €54.63M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €33.02M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.75 | €17.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.16 | €298.22M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 440 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Alumil Rom Industry (BVB:ALU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alumil Rom Industry S.A. is engaged in the production and sale of aluminum profiles and accessories both in Romania and internationally, with a market cap of RON80.63 million.

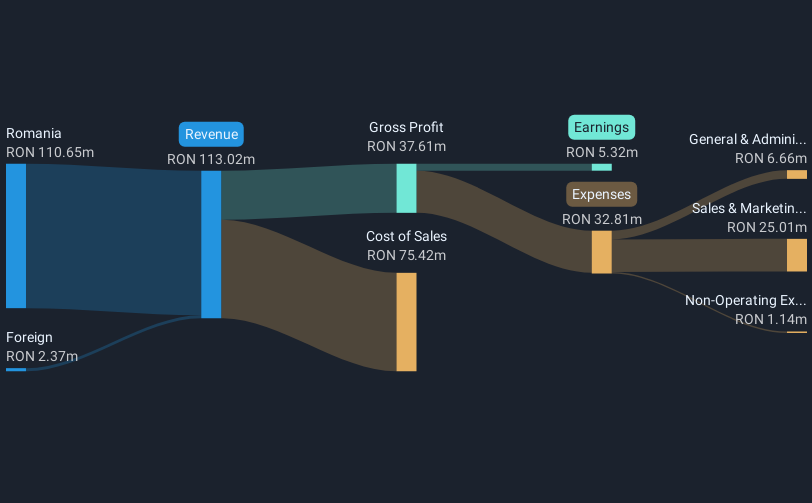

Operations: The company's revenue is primarily derived from its aluminum profiles and accessories and tools segment, amounting to RON113.02 million.

Market Cap: RON80.62M

Alumil Rom Industry, a company with a market cap of RON80.63 million, generates significant revenue from its aluminum profiles and accessories segment, totaling RON113.02 million in 2024. Despite experiencing negative earnings growth of 18.3% over the past year, the company has seen profits grow by an average of 12.8% annually over five years. Its financial stability is supported by well-covered debt through operating cash flow and interest payments covered by EBIT at 18.3 times coverage. However, recent dividend decreases may indicate caution in financial management despite stable weekly volatility and satisfactory net debt levels at 10.2%.

- Click to explore a detailed breakdown of our findings in Alumil Rom Industry's financial health report.

- Examine Alumil Rom Industry's past performance report to understand how it has performed in prior years.

Hifab Group (OM:HIFA B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hifab Group AB (publ) offers project management and consulting services across Sweden, Europe, Asia, and Africa with a market cap of SEK225.10 million.

Operations: The company's revenue is primarily derived from its project management segment, amounting to SEK323.09 million.

Market Cap: SEK225.1M

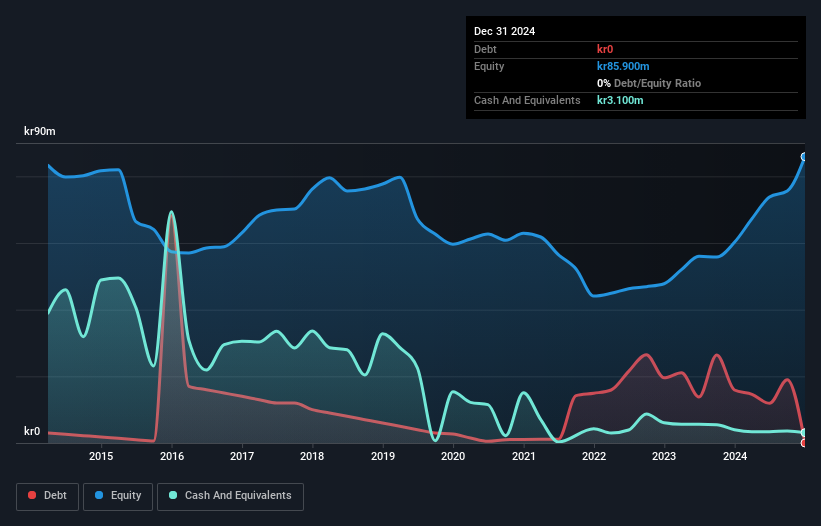

Hifab Group AB, with a market cap of SEK225.10 million, has demonstrated robust financial health and growth potential. The company reported Q1 2025 revenue of SEK80.1 million, slightly down from the previous year but maintains strong profitability with net income at SEK6 million. Earnings have grown significantly by 71% over the past year, surpassing industry averages and accelerating beyond its five-year growth rate of 61.3%. Short-term assets comfortably cover liabilities, while debt levels are low and well-managed with ample cash flow coverage. Despite an unstable dividend history, Hifab's valuation appears attractive at 84.5% below estimated fair value.

- Click here and access our complete financial health analysis report to understand the dynamics of Hifab Group.

- Learn about Hifab Group's historical performance here.

Thunderful Group (OM:THUNDR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Thunderful Group AB is a Swedish company that invests in, develops, and publishes digital games primarily for PC and console platforms, with a market cap of SEK54.55 million.

Operations: No revenue segments are reported for this company.

Market Cap: SEK54.55M

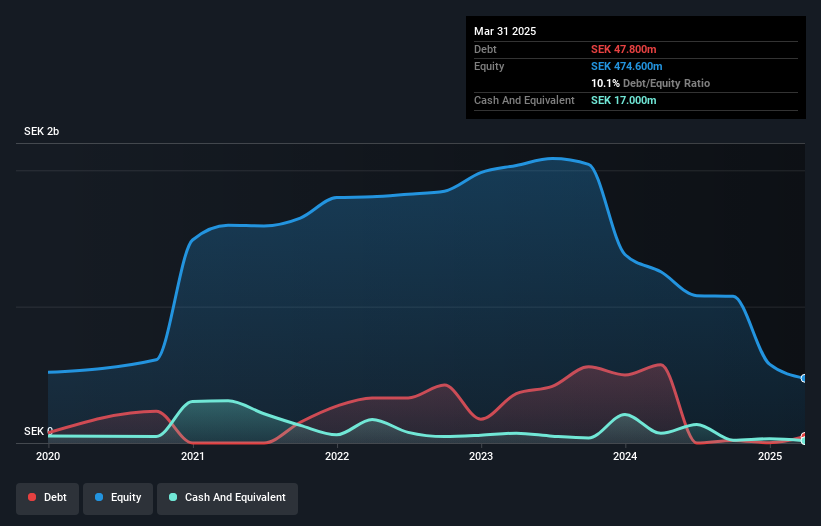

Thunderful Group AB, with a market cap of SEK54.55 million, recently reported Q1 2025 revenue growth to SEK62.9 million from SEK59 million the previous year, though it remains unprofitable with a net loss of SEK38.4 million. The company's stock was delisted from OTC Equity due to inactivity, highlighting potential liquidity concerns for investors. Despite its challenges, Thunderful has maintained a satisfactory net debt to equity ratio and possesses a cash runway exceeding three years due to positive free cash flow growth. However, short-term liabilities exceed assets and volatility remains high compared to peers in Sweden's stock market.

- Get an in-depth perspective on Thunderful Group's performance by reading our balance sheet health report here.

- Gain insights into Thunderful Group's future direction by reviewing our growth report.

Taking Advantage

- Jump into our full catalog of 440 European Penny Stocks here.

- Contemplating Other Strategies? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hifab Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HIFA B

Hifab Group

Provides project management and consulting services in Sweden, rest of Europe, Asia, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives