Smart Eye AB (publ) (STO:SEYE) Stocks Shoot Up 32% But Its P/S Still Looks Reasonable

Smart Eye AB (publ) (STO:SEYE) shares have continued their recent momentum with a 32% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 78%.

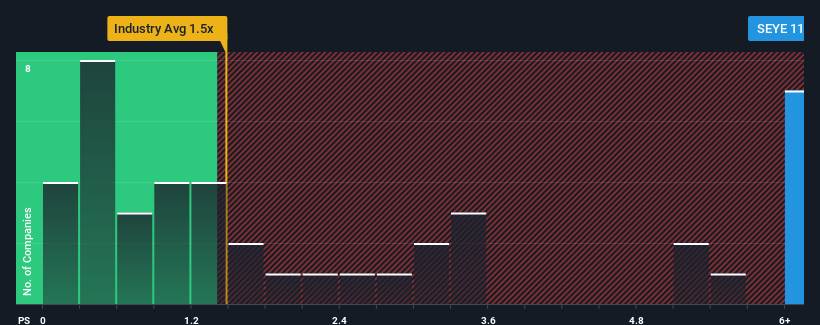

Since its price has surged higher, you could be forgiven for thinking Smart Eye is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 11.3x, considering almost half the companies in Sweden's Electronic industry have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Smart Eye

How Smart Eye Has Been Performing

Recent times have been advantageous for Smart Eye as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Smart Eye's future stacks up against the industry? In that case, our free report is a great place to start.How Is Smart Eye's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Smart Eye's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. The strong recent performance means it was also able to grow revenue by 272% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 59% each year during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 8.5% per annum growth forecast for the broader industry.

In light of this, it's understandable that Smart Eye's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Smart Eye's P/S?

The strong share price surge has lead to Smart Eye's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Smart Eye's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Smart Eye has 4 warning signs (and 1 which is concerning) we think you should know about.

If you're unsure about the strength of Smart Eye's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SEYE

Smart Eye

Develops human insight artificial intelligence (AI) technology solutions that understand, support, and predict human behavior in the Nordics countries, the rest of Europe, North America, Asia, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rare Disease Monopoly" – Commercial Execution Play

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026