One Smart Eye AB (publ) (STO:SEYE) Analyst Just Made A Major Cut To Next Year's Estimates

One thing we could say about the covering analyst on Smart Eye AB (publ) (STO:SEYE) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analyst seeing grey clouds on the horizon. Surprisingly the share price has been buoyant, rising 13% to kr42.58 in the past 7 days. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

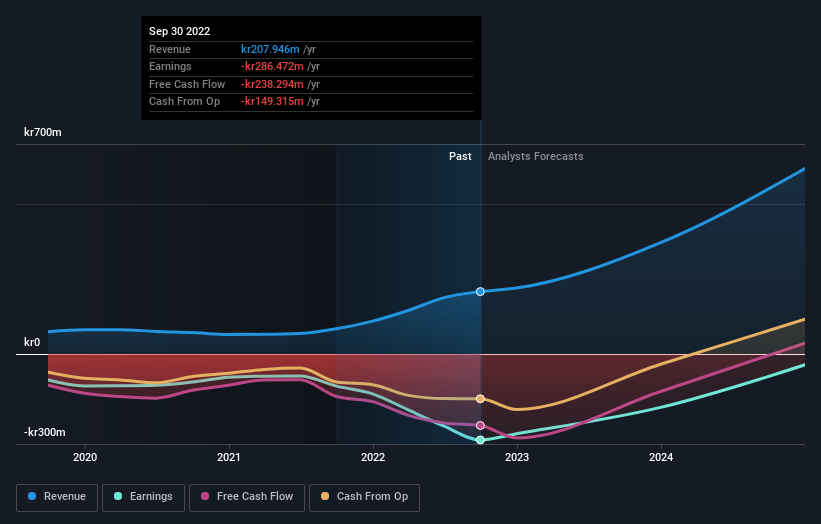

Following the downgrade, the latest consensus from Smart Eye's solo analyst is for revenues of kr371m in 2023, which would reflect a huge 78% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 58% to kr5.40. Yet prior to the latest estimates, the analyst had been forecasting revenues of kr451m and losses of kr4.90 per share in 2023. Ergo, there's been a clear change in sentiment, with the analyst administering a notable cut to next year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for Smart Eye

The consensus price target fell 30% to kr155, with the analyst clearly concerned about the company following the weaker revenue and earnings outlook.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analyst is definitely expecting Smart Eye's growth to accelerate, with the forecast 59% annualised growth to the end of 2023 ranking favourably alongside historical growth of 22% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 6.3% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect Smart Eye to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analyst increased their loss per share estimates for next year. While the analyst did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. After such a stark change in sentiment from the analyst, we'd understand if readers now felt a bit wary of Smart Eye.

As you can see, the analyst clearly isn't bullish, and there might be good reason for that. We've identified some potential issues with Smart Eye's financials, such as a short cash runway. Learn more, and discover the 2 other concerns we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SEYE

Smart Eye

Develops human insight artificial intelligence (AI) technology solutions that understand, support, and predict human behavior in the Nordics countries, the rest of Europe, North America, Asia, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026