The European markets have been navigating a complex landscape, with major indices showing mixed performances as investors weigh the impacts of recent monetary policy decisions. In this context, investing in penny stocks—an older term that still holds relevance for those seeking growth opportunities—can offer unique value propositions. These smaller or newer companies, when supported by strong financial health, may present both stability and potential for long-term success.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.326 | €1.5B | ✅ 4 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €235.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €5.00 | €40.54M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.486 | RON16.37M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.00 | €9.52M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.505 | €398.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.894 | €30.15M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 328 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Binero Group (OM:BINERO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Binero Group AB (publ) develops and delivers cloud and platform services across Sweden, Norway, Denmark, and Finland with a market capitalization of SEK346.05 million.

Operations: The company generates revenue of SEK440.08 million from its Internet Software & Services segment.

Market Cap: SEK346.05M

Binero Group AB, with a market cap of SEK346.05 million, operates in the cloud and platform services sector across Scandinavia. Despite being unprofitable, it has shown revenue growth from SEK205.3 million to SEK228.9 million year-on-year for the first half of 2025 but reported a net loss of SEK14.2 million compared to a previous net income of SEK12.3 million. The company benefits from sufficient cash runway exceeding three years and reduced losses at an annual rate of 29.8% over five years, though its share price remains highly volatile with inexperienced management and board teams impacting stability.

- Dive into the specifics of Binero Group here with our thorough balance sheet health report.

- Gain insights into Binero Group's future direction by reviewing our growth report.

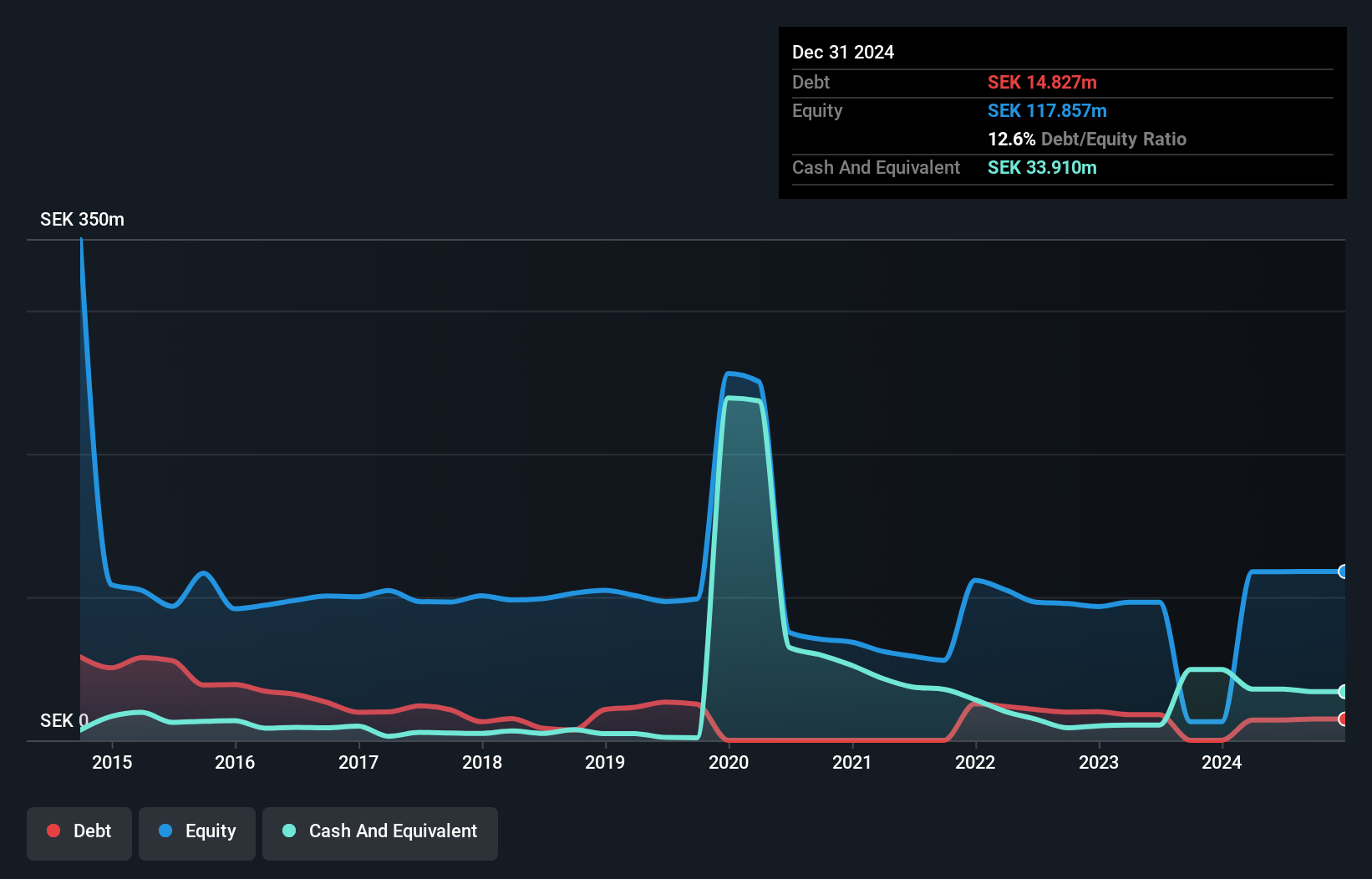

Net Insight (OM:NETI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Net Insight AB (publ) offers media network solutions globally, with a market cap of approximately SEK1.69 billion.

Operations: The company's revenue segment includes Media Networks, generating SEK546.59 million.

Market Cap: SEK1.69B

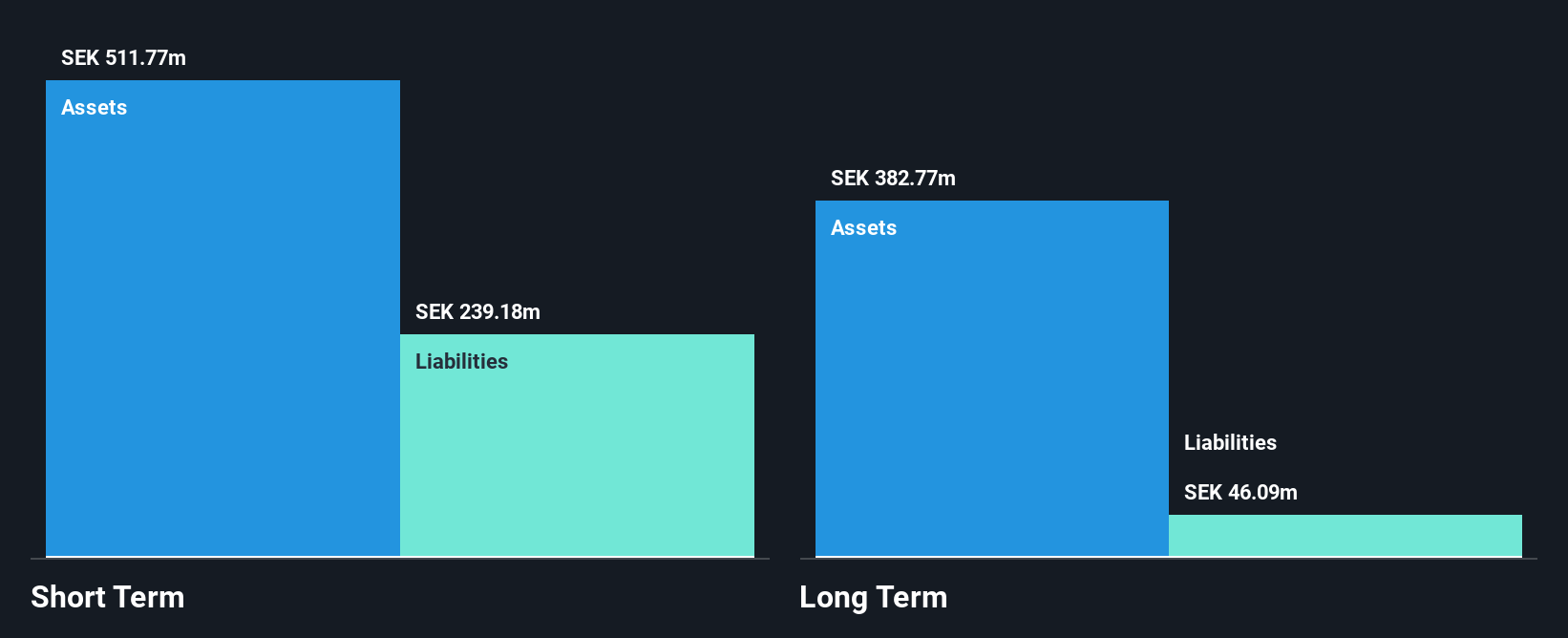

Net Insight AB, with a market cap of approximately SEK1.69 billion, is navigating the penny stock landscape with strategic product advancements and management changes. Recent upgrades to its Nimbra platform enhance IP adaptability and efficiency, aligning with industry trends towards IP-based media solutions. Despite a recent net loss of SEK10.68 million for Q2 2025 and declining profit margins from 13.3% to 0.3%, the company remains debt-free with short-term assets exceeding liabilities significantly. Management transitions aim to bolster technical leadership, ensuring Net Insight continues to adapt in a rapidly evolving media technology market while maintaining high-quality earnings amid revenue challenges.

- Click to explore a detailed breakdown of our findings in Net Insight's financial health report.

- Assess Net Insight's future earnings estimates with our detailed growth reports.

Pricer (OM:PRIC B)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pricer AB (publ) offers in-store digital solutions across various regions including Europe, the Middle East and Africa, the Americas, and Asia and Pacific, with a market cap of SEK819.95 million.

Operations: The company generates revenue from its Electronic Components & Parts segment, amounting to SEK2.22 billion.

Market Cap: SEK819.95M

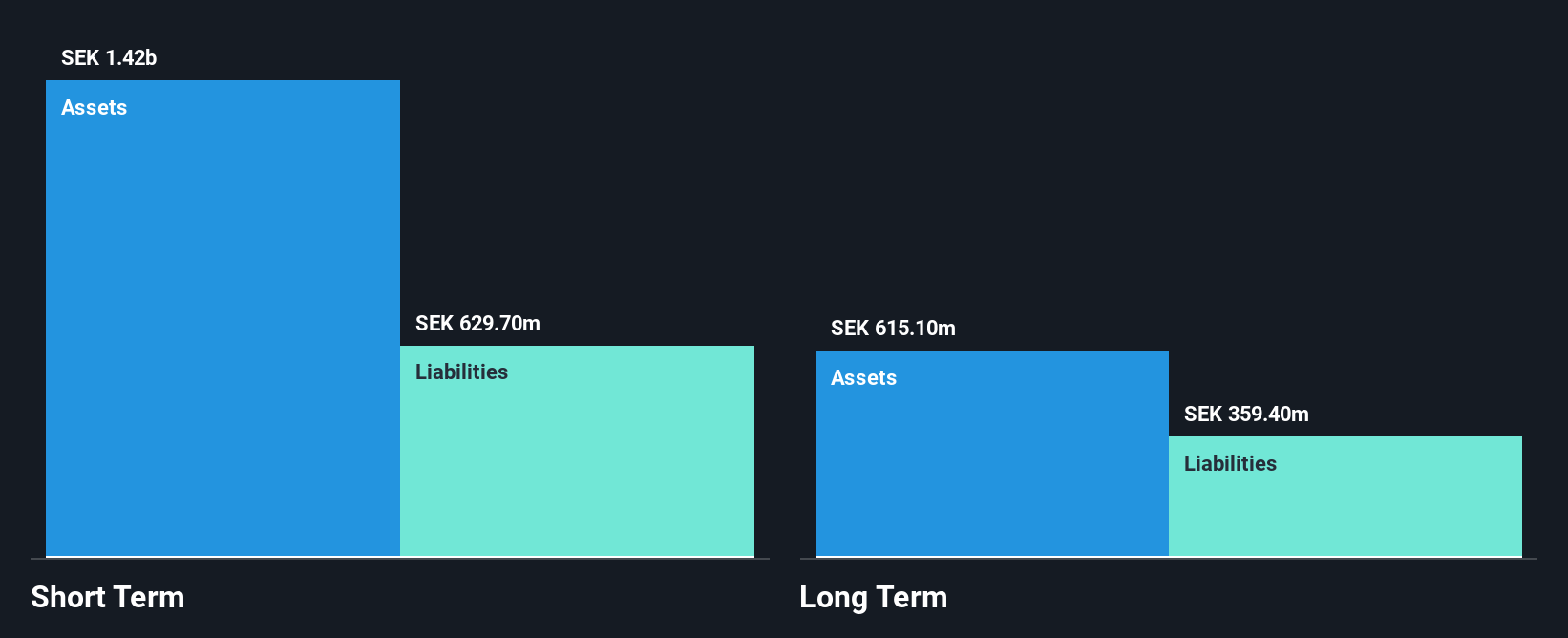

Pricer AB, with a market cap of SEK819.95 million, is navigating the European penny stock landscape amid recent management changes and financial challenges. The company reported a net loss of SEK35.7 million for Q2 2025, with sales declining to SEK448.7 million from SEK644 million the previous year. While short-term assets of SEK1.4 billion comfortably cover both short- and long-term liabilities, Pricer's return on equity remains low at 3.2%. Despite high-quality earnings, negative earnings growth persists alongside an increased debt-to-equity ratio over five years to 28.1%, highlighting ongoing financial pressures in a competitive electronic components sector.

- Get an in-depth perspective on Pricer's performance by reading our balance sheet health report here.

- Understand Pricer's track record by examining our performance history report.

Next Steps

- Navigate through the entire inventory of 328 European Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Binero Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BINERO

Binero Group

Develops and delivers cloud and platform services in Sweden, Norway, Denmark, and Finland.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success