- Sweden

- /

- Communications

- /

- OM:NETI B

European Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

As European markets navigate the turbulence of escalating global trade tensions, the pan-European STOXX Europe 600 Index has experienced a slight decline, while central banks maintain heightened vigilance. In such uncertain times, investors often turn to penny stocks—an investment category that may be considered niche but still holds potential for growth. These stocks represent smaller or newer companies that can offer unique opportunities when backed by solid financials and a clear growth path. We'll explore three European penny stocks that stand out for their financial strength and potential to thrive in challenging market conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.998 | SEK1.91B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.47 | SEK230.27M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.58 | SEK268.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.92 | SEK238.49M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.38 | PLN114.56M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.51 | €52.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.96 | €32.15M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.10 | €23.74M | ✅ 3 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.83 | €18.05M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.095 | €289.24M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 428 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

illimity Bank (BIT:ILTY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: illimity Bank S.p.A. offers private banking, investment, and trading services in Italy with a market cap of €267.47 million.

Operations: illimity Bank S.p.A. has not reported any specific revenue segments.

Market Cap: €267.47M

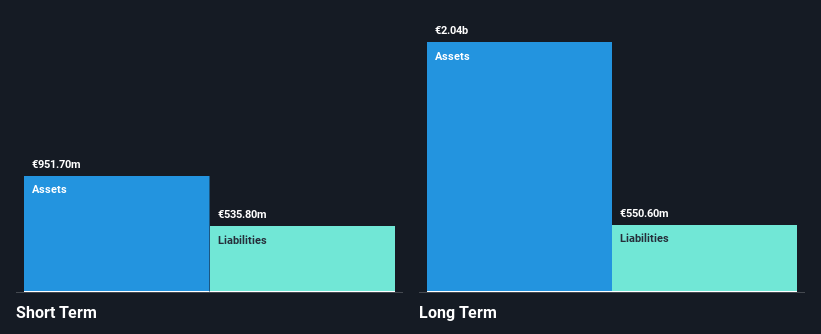

illimity Bank S.p.A., with a market cap of €267.47 million, recently presented at the Euronext Milan STAR Conference 2025. The bank reported a significant drop in net income to €0.37 million for 2024, down from €104.4 million the previous year, reflecting its current unprofitability despite reduced losses over five years. It maintains a stable asset base with an assets-to-equity ratio of 9.3x and an appropriate loans-to-deposits ratio of 123%. However, it faces challenges with high non-performing loans at 13.9% and low allowance for bad loans at 30%, indicating potential risk factors for investors in penny stocks.

- Get an in-depth perspective on illimity Bank's performance by reading our balance sheet health report here.

- Explore illimity Bank's analyst forecasts in our growth report.

Metsä Board Oyj (HLSE:METSB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market capitalization of approximately €1.19 billion.

Operations: The company generates revenue of €1.94 billion from its operations in folding boxboard, fresh fibre linerboard, and market pulp businesses.

Market Cap: €1.19B

Metsä Board Oyj, with a market cap of €1.19 billion, is navigating a challenging period marked by declining profits and significant operational changes. Recent earnings showed a net loss of €7.3 million in Q4 2024, contrasting with previous gains, while revenue remained stable at approximately €1.94 billion annually. The company is enhancing its product line with the upgraded MetsaBoard Classic FBB and modernizing its Simpele mill to improve sustainability and print quality by late 2025. Leadership changes are underway as Esa Kaikkonen takes over as CEO amidst ongoing strategic shifts including potential closures and efficiency improvements at key mills.

- Take a closer look at Metsä Board Oyj's potential here in our financial health report.

- Examine Metsä Board Oyj's earnings growth report to understand how analysts expect it to perform.

Net Insight (OM:NETI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Net Insight AB (publ) provides media network solutions globally and has a market capitalization of SEK 1.57 billion.

Operations: The company's revenue segment includes Media Networks, which generated SEK 608.01 million.

Market Cap: SEK1.57B

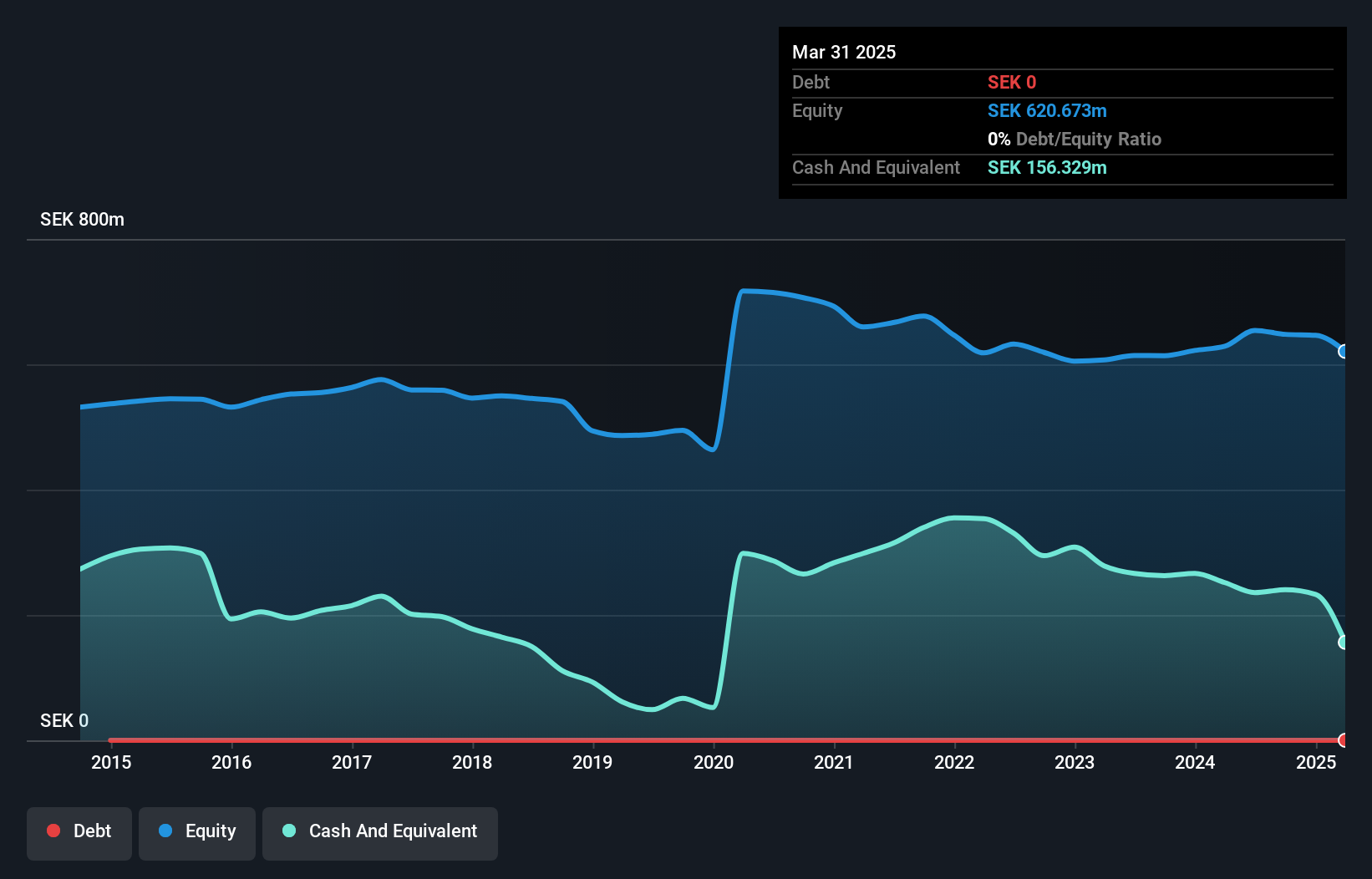

Net Insight AB, with a market capitalization of SEK 1.57 billion, is making strategic advances in media network solutions, particularly focusing on unmanaged networks. Recent collaborations with Globecast and Oranda highlight the company's commitment to expanding its Nimbra technology's reach in live sports and media transport sectors. Despite a decline in Q4 2024 sales to SEK 133.54 million from the previous year, full-year sales rose to SEK 608.01 million, indicating growth potential amid market fluctuations. The company remains debt-free and has not diluted shareholder value recently, supporting financial stability while navigating industry challenges with innovative IP-based solutions like Facility Connect.

- Click to explore a detailed breakdown of our findings in Net Insight's financial health report.

- Gain insights into Net Insight's future direction by reviewing our growth report.

Summing It All Up

- Explore the 428 names from our European Penny Stocks screener here.

- Contemplating Other Strategies? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Net Insight, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Net Insight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NETI B

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives