As global markets navigate a landscape of rate cuts and mixed index performances, the Nasdaq Composite stands out by reaching a record high. In this climate, penny stocks—though an outdated term—remain relevant as they can offer unique opportunities for growth, particularly when backed by strong financials. We'll explore three promising penny stocks that demonstrate financial strength and potential for long-term success, providing investors with the chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.08 | £785.55M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$45.04B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £149.86M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.56M | ★★★★☆☆ |

Click here to see the full list of 5,766 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Nurminen Logistics Oyj (HLSE:NLG1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nurminen Logistics Oyj offers logistics services in Finland, Russia, and the Baltic countries, with a market cap of €76.49 million.

Operations: The company generates revenue from its Transportation - Trucking segment, which amounts to €118.19 million.

Market Cap: €76.49M

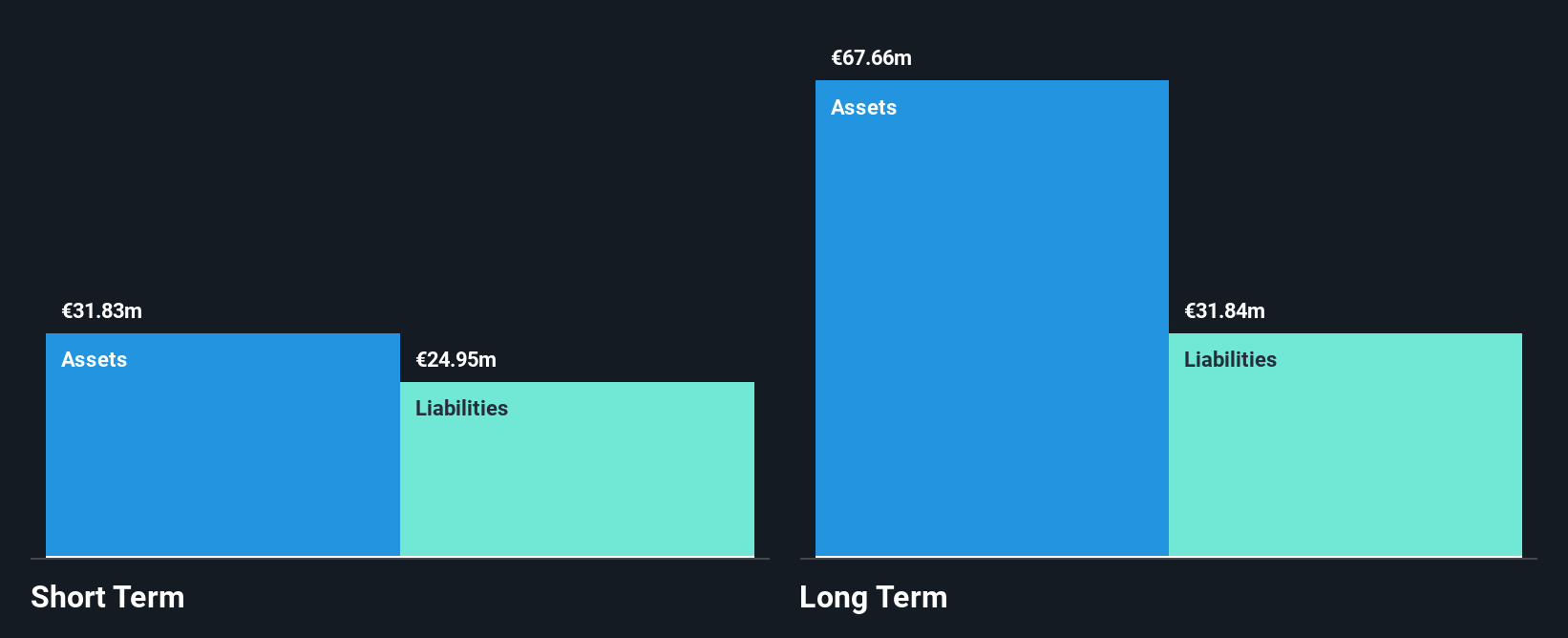

Nurminen Logistics Oyj, with a market cap of €76.49 million, has shown significant earnings growth over the past year at 150.4%, although recent financial results were impacted by a €12.3 million one-off gain. The company's debt management is strong, with a net debt to equity ratio of 8.5% and interest payments well covered by EBIT at 6.7 times coverage. Despite these strengths, short-term liabilities exceed assets (€17.6M vs €16.1M), and sales have declined due to reduced Baltic volumes amid geopolitical tensions, impacting full-year net sales and operating profit outlook negatively for 2024.

- Unlock comprehensive insights into our analysis of Nurminen Logistics Oyj stock in this financial health report.

- Understand Nurminen Logistics Oyj's earnings outlook by examining our growth report.

KebNi (OM:KEBNI B)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: KebNi AB (publ) specializes in the development, manufacturing, marketing, and sales of 4-axes stabilizing VSAT antennas for maritime applications under the KebNi Maritime brand, with a market cap of SEK261.66 million.

Operations: The company generates revenue from its Unclassified Services segment, amounting to SEK134.37 million.

Market Cap: SEK261.66M

KebNi AB, with a market cap of SEK261.66 million, has shown substantial revenue growth recently, reporting SEK100.11 million for the first nine months of 2024 compared to SEK34.16 million the previous year. Despite this progress, KebNi remains unprofitable with a negative return on equity and increased losses over five years at 10.5% annually. The company is debt-free and trades below its estimated fair value by 48.1%. However, it faces challenges such as limited cash runway and recent strategic downsizing by closing Satmission AB due to low utilization in a declining market segment.

- Take a closer look at KebNi's potential here in our financial health report.

- Evaluate KebNi's prospects by accessing our earnings growth report.

New Focus Auto Tech Holdings (SEHK:360)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New Focus Auto Tech Holdings Limited is an investment holding company that manufactures and sells electronic and power-related automotive parts and accessories across the People’s Republic of China, the Americas, Europe, and the Asia Pacific, with a market cap of HK$946.93 million.

Operations: The company generates revenue from two primary segments: CN¥410.94 million from its Manufacturing and Trading Business, and CN¥125.92 million from its Automobile Dealership and Service Business.

Market Cap: HK$946.93M

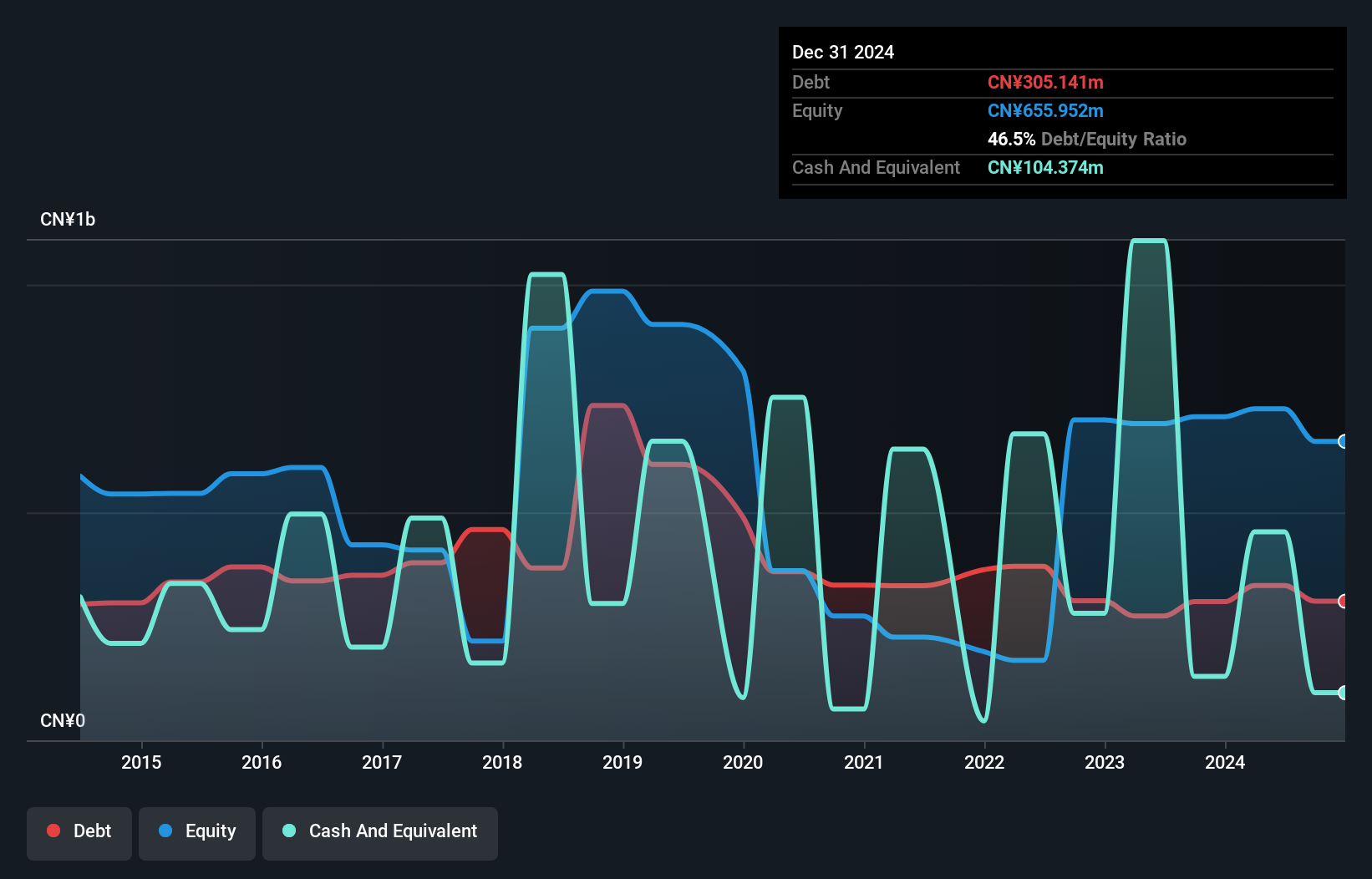

New Focus Auto Tech Holdings, with a market cap of HK$946.93 million, reports significant revenues from its Manufacturing and Trading Business (CN¥410.94 million) and Automobile Dealership and Service Business (CN¥125.92 million). The company has a cash runway exceeding one year based on current free cash flow but faces challenges with short-term liabilities surpassing short-term assets by CN¥66.3 million. Despite reducing its debt-to-equity ratio over five years, it remains unprofitable with a negative return on equity of -13.65%. The board's average tenure is 1.7 years, indicating limited experience in leadership roles amidst high share price volatility.

- Dive into the specifics of New Focus Auto Tech Holdings here with our thorough balance sheet health report.

- Evaluate New Focus Auto Tech Holdings' historical performance by accessing our past performance report.

Where To Now?

- Jump into our full catalog of 5,766 Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nurminen Logistics Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NLG1V

Nurminen Logistics Oyj

Provides logistics services in Finland, Russia, and Baltic countries.

Solid track record with excellent balance sheet.