As the European markets experience a mix of gains and losses, with the pan-European STOXX Europe 600 Index rising slightly amid trade tensions and economic uncertainty, investors are keeping a close eye on opportunities that may arise. Penny stocks, though often considered relics of earlier trading days, continue to represent smaller or newer companies that can offer intriguing investment prospects. By focusing on those with robust financials and potential for growth, investors might uncover valuable opportunities within these lesser-known entities.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.035 | SEK1.95B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.39 | SEK226.26M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.74 | SEK280.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.92 | SEK238.49M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.65 | PLN123.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.50 | €52.64M | ✅ 4 ⚠️ 2 View Analysis > |

| I.M.D. International Medical Devices (BIT:IMD) | €1.49 | €25.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.99 | €33.15M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.20 | €62.85M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.22 | €306.5M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 435 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

InCoax Networks (OM:INCOAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: InCoax Networks AB (publ) offers networking products and solutions to fiber/LAN and fixed wireless access operators, internet service providers, and hospitality customers across the European Union, North America, and internationally with a market cap of SEK183.33 million.

Operations: InCoax Networks generates revenue primarily from its Computer Networks segment, totaling SEK99.8 million.

Market Cap: SEK183.33M

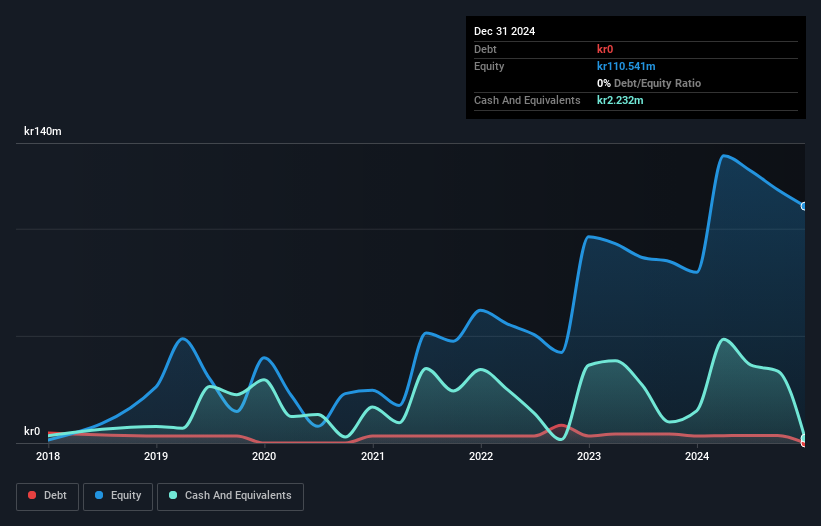

InCoax Networks AB, with a market cap of SEK183.33 million, is navigating the penny stock landscape by leveraging its MoCA Access technology to secure significant orders and partnerships. Despite being unprofitable, the company has reduced losses over five years and remains debt-free. Recent developments include a strategic partnership with CTIconnect to expand in North America and a notable USD1 million order from a global fiber network supplier. InCoax's recent follow-on equity offering raised SEK33.51 million, bolstering its financial position as it aims for broader adoption of its networking solutions amidst volatile share price movements.

- Get an in-depth perspective on InCoax Networks' performance by reading our balance sheet health report here.

- Evaluate InCoax Networks' prospects by accessing our earnings growth report.

Lukardi (WSE:LUK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lukardi S.A. offers a range of professional IT services in Poland and has a market capitalization of PLN29.54 million.

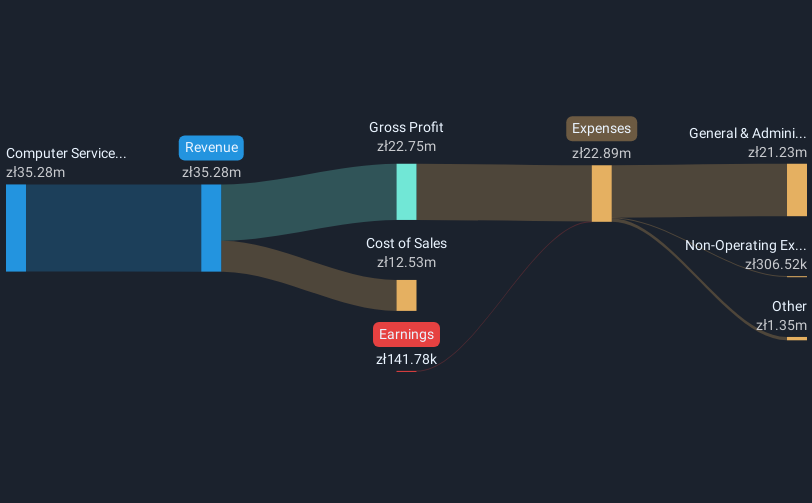

Operations: The company's revenue segment is comprised of Computer Services, generating PLN35.28 million.

Market Cap: PLN29.54M

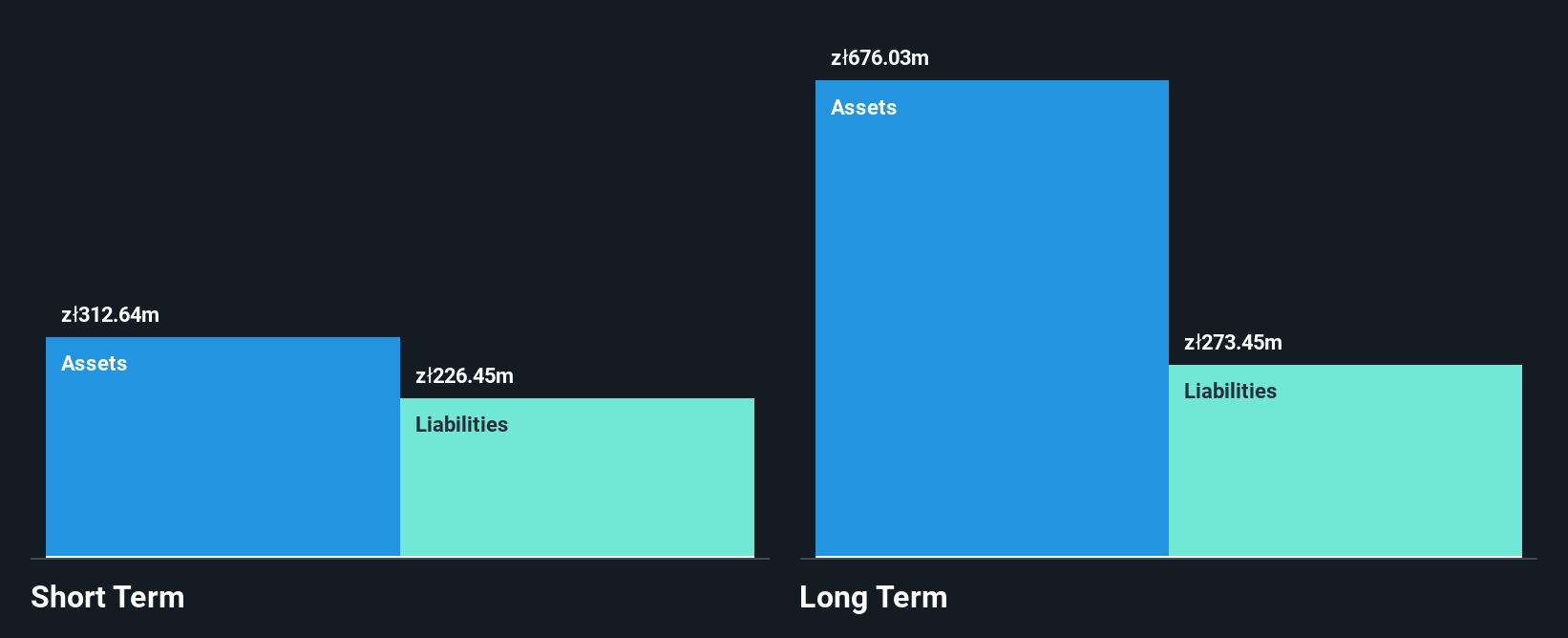

Lukardi S.A., with a market cap of PLN29.54 million, operates within the IT services sector in Poland. Despite being unprofitable and experiencing increasing losses over the past five years, the company has maintained a satisfactory net debt to equity ratio of 25.9% and has not significantly diluted shareholders recently. Lukardi's short-term assets exceed both its short-term and long-term liabilities, indicating financial stability in covering obligations. Recent earnings announcements show a decrease in annual revenue to PLN35.28 million from PLN43.07 million last year, while net loss narrowed substantially from PLN0.463992 million to PLN0.141781 million.

- Navigate through the intricacies of Lukardi with our comprehensive balance sheet health report here.

- Evaluate Lukardi's historical performance by accessing our past performance report.

PCC Exol (WSE:PCX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PCC Exol S.A. manufactures and distributes surfactants both in Poland and internationally, with a market cap of PLN419.67 million.

Operations: The company's revenue primarily comes from its Specialty Chemicals segment, which generated PLN915.71 million.

Market Cap: PLN419.67M

PCC Exol S.A., with a market cap of PLN419.67 million, operates in the specialty chemicals sector and generated PLN915.71 million in revenue. Despite negative earnings growth of -52.3% over the past year, it has maintained stable weekly volatility at 3%. The company's net debt to equity ratio is high at 50.2%, but its short-term assets cover both short- and long-term liabilities effectively. While profit margins have decreased to 3% from last year's 5.7%, operating cash flow covers debt well, and interest payments are adequately managed with an EBIT coverage of 3.7 times interest expenses.

- Click to explore a detailed breakdown of our findings in PCC Exol's financial health report.

- Examine PCC Exol's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Unlock our comprehensive list of 435 European Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:LUK

Flawless balance sheet and good value.

Market Insights

Community Narratives