- Germany

- /

- Medical Equipment

- /

- XTRA:SBS

Top Growth Companies With Insider Ownership In November 2024

Reviewed by Simply Wall St

As global markets navigate through a period of broad-based gains and geopolitical uncertainties, major U.S. indexes are approaching record highs, buoyed by strong labor market data and positive sentiment around economic growth. In this context, identifying growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

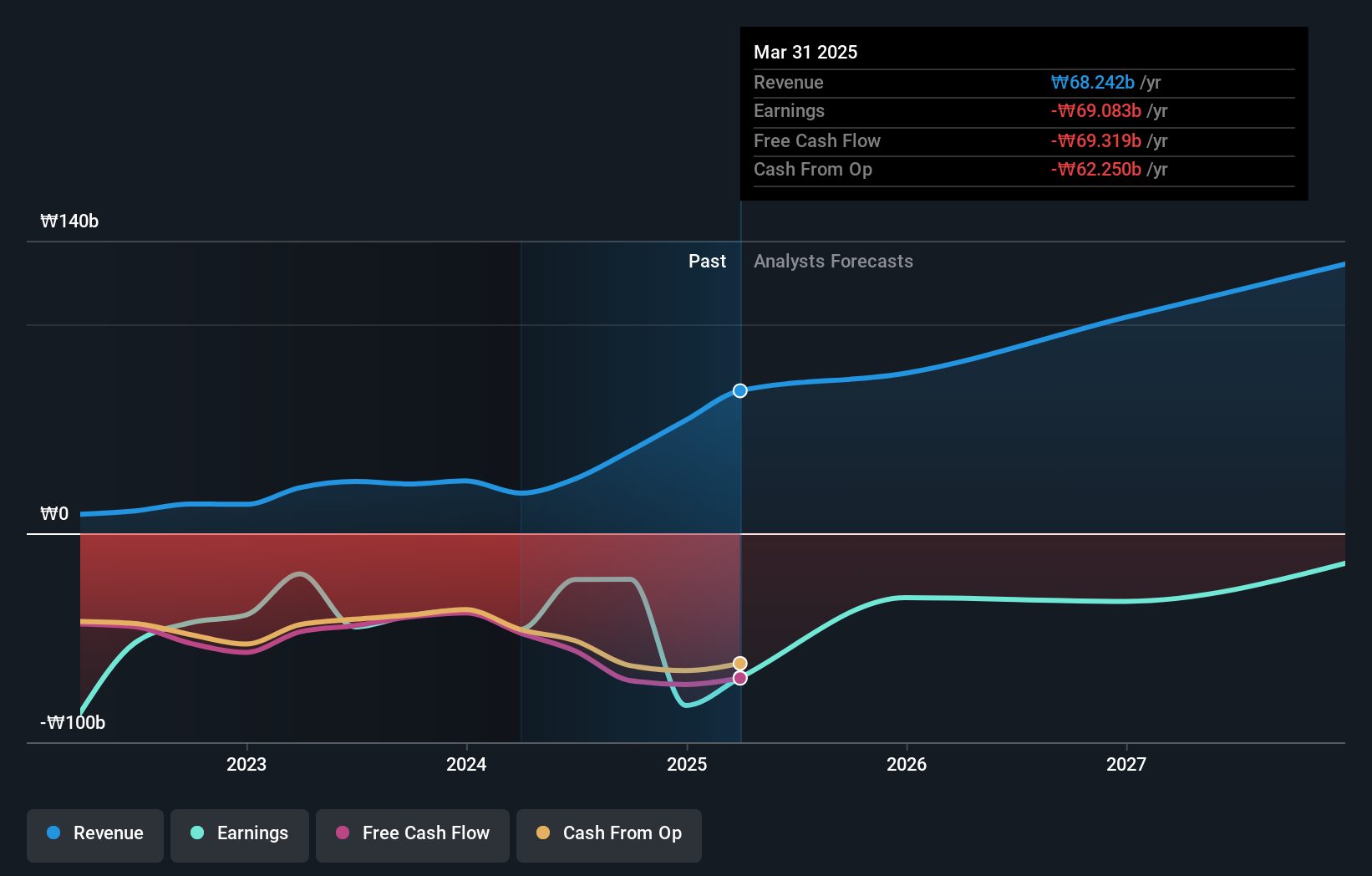

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lunit Inc. develops AI-based software solutions for cancer screening, diagnosis, and treatment, with a market cap of ₩2.03 trillion.

Operations: Lunit Inc.'s revenue segments are not specified in the provided text.

Insider Ownership: 21%

Earnings Growth Forecast: 78.2% p.a.

Lunit's strategic partnerships, such as with Salud Digna and AstraZeneca, highlight its growth potential in AI-powered medical imaging. These collaborations enhance Lunit's product reach and data access, crucial for refining AI algorithms. Despite a volatile share price and past shareholder dilution, Lunit is trading below its estimated fair value. With projected revenue growth of 49.9% annually and expected profitability within three years, the company shows promise in expanding its market presence while addressing healthcare challenges globally.

- Delve into the full analysis future growth report here for a deeper understanding of Lunit.

- The valuation report we've compiled suggests that Lunit's current price could be inflated.

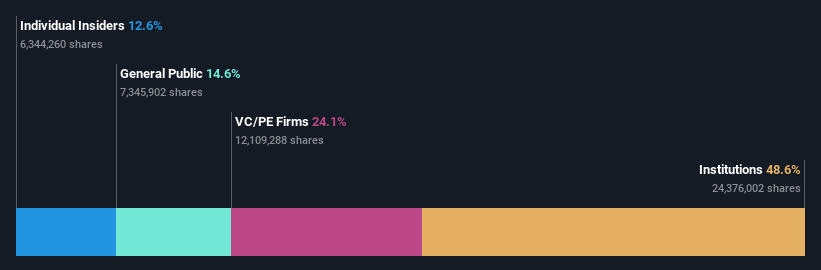

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK19.34 billion.

Operations: The company's revenue is primarily derived from its Wireless Communications Equipment segment, which generated SEK3.01 billion.

Insider Ownership: 12.6%

Earnings Growth Forecast: 42.5% p.a.

HMS Networks is undergoing significant restructuring to enhance growth, organizing into three divisions to leverage technology synergies. Despite a drop in profit margins from 20.2% to 11.5%, earnings are forecasted to grow at 42.5% annually, outpacing the Swedish market's growth rate of 15.1%. Although trading below fair value and carrying high debt, HMS shows potential with revenue expected to rise by 19% annually and no substantial insider selling recently observed.

- Take a closer look at HMS Networks' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, HMS Networks' share price might be too optimistic.

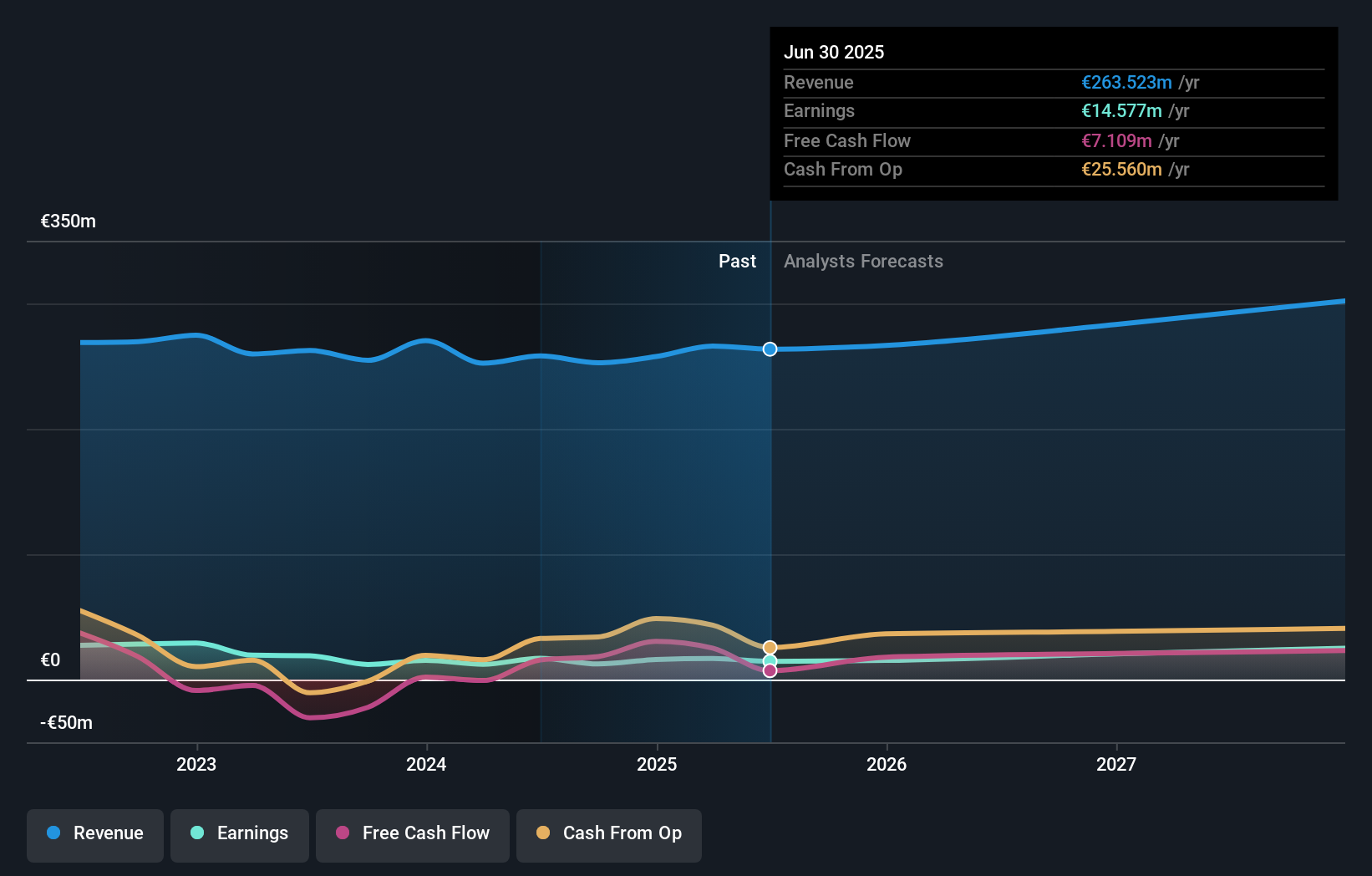

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE and its subsidiaries design and manufacture automation and instrumentation solutions for in-vitro diagnostics and life sciences, operating in Germany, the European Union, and internationally, with a market cap of approximately €382.30 million.

Operations: The company generates revenue primarily from its Automation Solutions for Highly Regulated Laboratory segment, amounting to €250.54 million.

Insider Ownership: 30.9%

Earnings Growth Forecast: 25.4% p.a.

Stratec faces challenges with declining sales and net income, as shown in its recent earnings report. Despite these setbacks, the company's earnings are projected to grow at 25.38% annually, surpassing the German market's growth rate of 20.9%. While trading below fair value and expected to rise by 30.4%, Stratec carries a high level of debt. Revenue growth is anticipated at 7.7% per year, faster than the market average but below significant levels for rapid expansion.

- Unlock comprehensive insights into our analysis of Stratec stock in this growth report.

- The valuation report we've compiled suggests that Stratec's current price could be quite moderate.

Taking Advantage

- Embark on your investment journey to our 1512 Fast Growing Companies With High Insider Ownership selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SBS

Stratec

Designs and manufactures automation and instrumentation solutions in the fields of in-vitro diagnostics and life sciences in Germany, European Union, and internationally.

Reasonable growth potential with adequate balance sheet.