Swedish Growth Companies With High Insider Ownership In July 2024

Reviewed by Simply Wall St

As global markets exhibit mixed signals with ongoing rotations and adjustments, Sweden's market remains a point of interest for those looking at growth companies with high insider ownership. Understanding the implications of such ownership structures can be particularly relevant in today's economic climate, where strategic alignments within companies are crucial for navigating uncertainties.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Biovica International (OM:BIOVIC B) | 18.7% | 73.8% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

We'll examine a selection from our screener results.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB operates globally, providing products that facilitate communication and information sharing between industrial equipment, with a market capitalization of approximately SEK 20.34 billion.

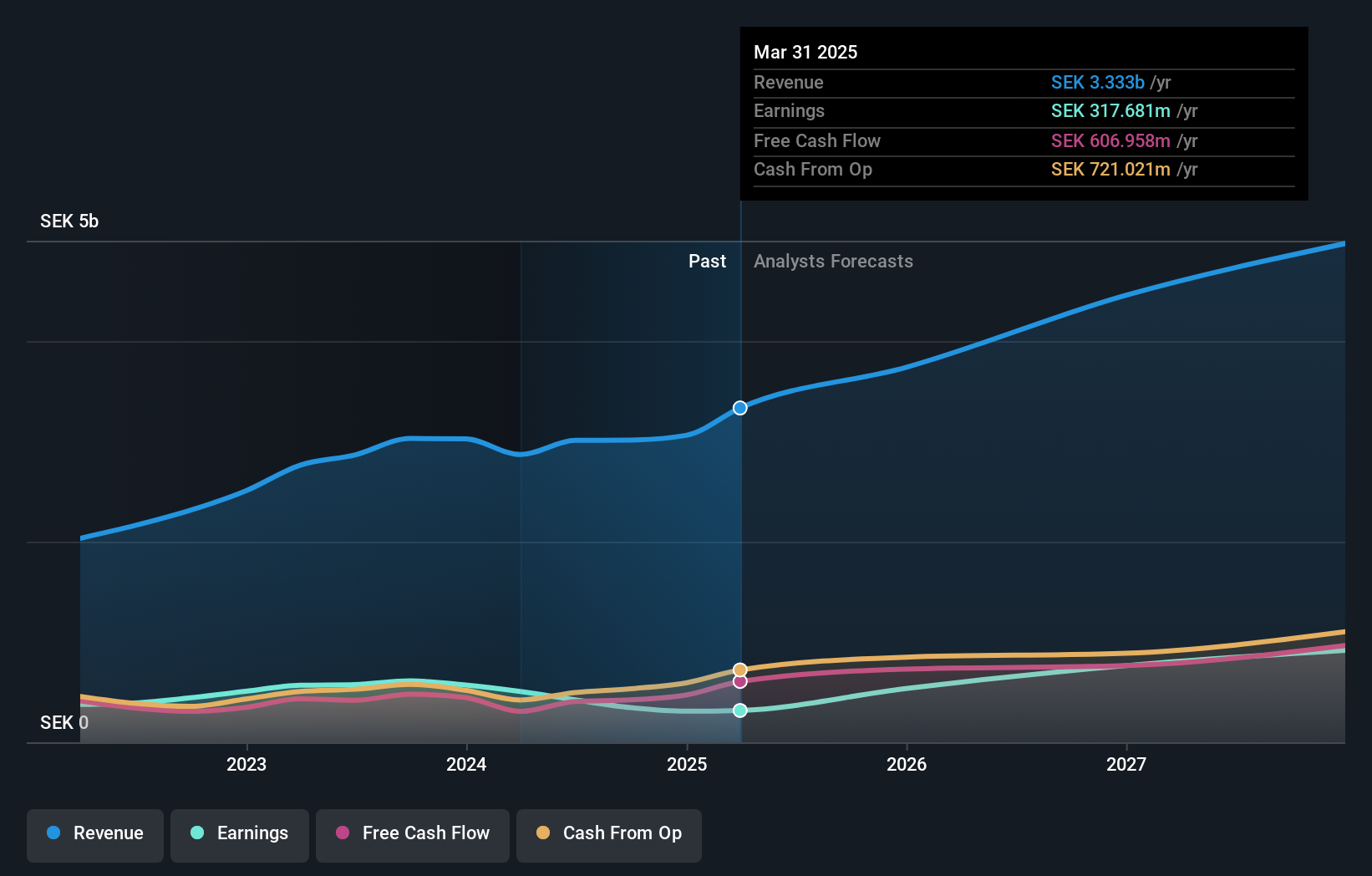

Operations: The company generates SEK 3.01 billion from its wireless communications equipment segment.

Insider Ownership: 12.6%

Revenue Growth Forecast: 12.2% p.a.

HMS Networks, a Swedish company with high insider ownership, shows mixed financial health. Despite a recent decrease in net profit margin from 20.1% to 14% and a drop in earnings per share over the past year, HMS's revenue growth (12.2% per year) is projected to outpace the Swedish market significantly. Insider activity has been balanced with more purchases than sales, though not in large volumes. The company's debt level is high, which may raise concerns about its financial stability amidst its growth trajectory.

- Get an in-depth perspective on HMS Networks' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that HMS Networks is priced higher than what may be justified by its financials.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★☆

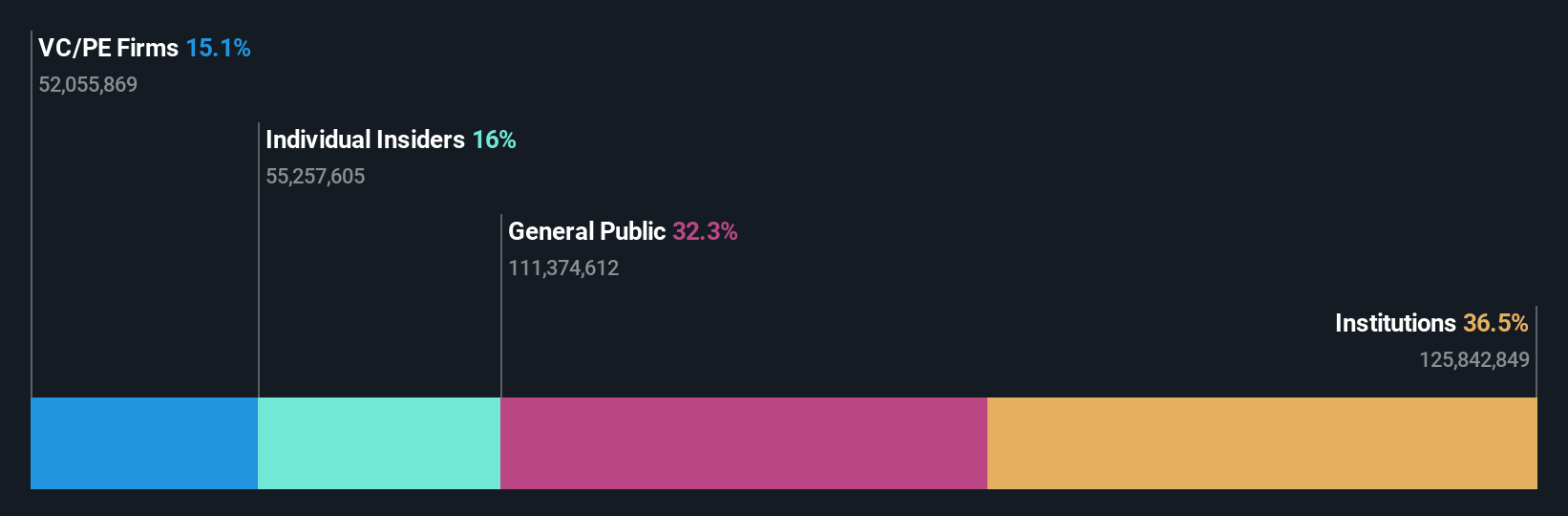

Overview: Truecaller AB (publ) specializes in developing and publishing mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and other global markets, with a market capitalization of SEK 11.68 billion.

Operations: The company generates its revenue primarily from communications software, totaling SEK 1.72 billion.

Insider Ownership: 29.4%

Revenue Growth Forecast: 19.8% p.a.

Truecaller, a Swedish growth company with high insider ownership, has shown mixed financial results recently. In the second quarter of 2024, sales and net income decreased compared to the previous year. However, Truecaller is expected to see significant earnings growth over the next three years, outpacing the Swedish market. Insider activity includes more purchases than sales in recent months but not in substantial volumes. The company's Return on Equity is forecasted to be very high in three years' time.

- Unlock comprehensive insights into our analysis of Truecaller stock in this growth report.

- According our valuation report, there's an indication that Truecaller's share price might be on the cheaper side.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

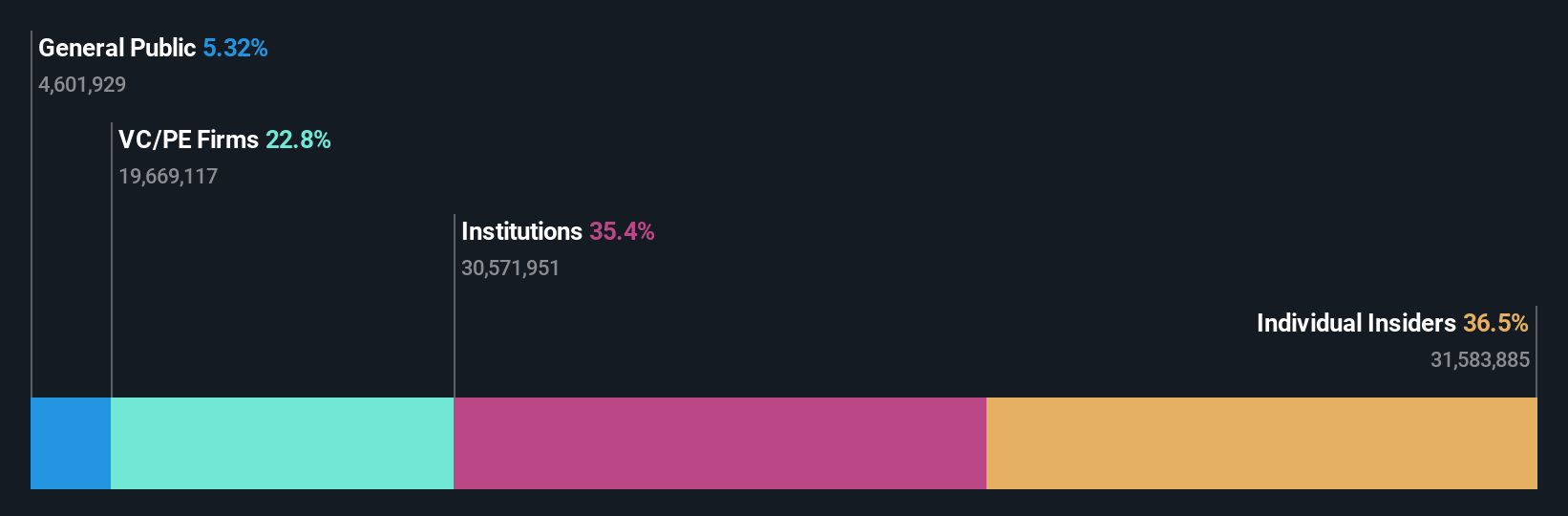

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 23.29 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Revenue Growth Forecast: 22.9% p.a.

Yubico, a Swedish growth company with high insider ownership, has seen its revenue grow by 19.9% over the past year and is expected to continue this trend with forecasts showing a 22.9% annual increase. While profit margins have decreased from 16.9% to 8.6%, earnings are projected to rise significantly at a rate of 43.79% annually over the next three years, outperforming the Swedish market's expectations of 15.4%. Recent product launches and strategic partnerships aim to enhance secure web browsing for military and government applications, further supporting growth prospects despite some shareholder dilution in the past year.

- Dive into the specifics of Yubico here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Yubico is trading beyond its estimated value.

Taking Advantage

- Click here to access our complete index of 90 Fast Growing Swedish Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.