- Sweden

- /

- Communications

- /

- OM:HMS

HMS Networks' (STO:HMS) earnings growth rate lags the 23% CAGR delivered to shareholders

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is HMS Networks AB (publ) (STO:HMS) which saw its share price drive 178% higher over five years. In the last week shares have slid back 3.4%.

Although HMS Networks has shed kr756m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for HMS Networks

SWOT Analysis for HMS Networks

- Earnings growth over the past year exceeded the industry.

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Dividend is low compared to the top 25% of dividend payers in the Communications market.

- Expensive based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow for the next 3 years.

- Annual earnings are forecast to grow slower than the Swedish market.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

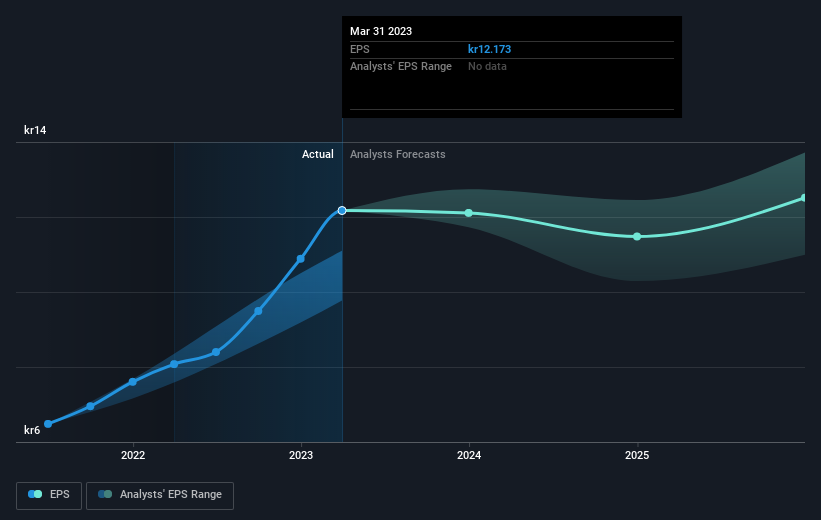

Over half a decade, HMS Networks managed to grow its earnings per share at 32% a year. This EPS growth is higher than the 23% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that HMS Networks has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of HMS Networks, it has a TSR of 186% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that HMS Networks has rewarded shareholders with a total shareholder return of 11% in the last twelve months. And that does include the dividend. However, that falls short of the 23% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HMS Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HMS

HMS Networks

Engages in the provision of products that enable industrial equipment to communicate and share information worldwide.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives