As global markets show signs of recovery and investor sentiment improves, Sweden's tech sector stands out with promising growth potential. In this context, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation, robust financial health, and the ability to capitalize on emerging market trends.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fortnox | 20.18% | 22.60% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Xbrane Biopharma | 58.38% | 105.19% | ★★★★★★ |

| Hemnet Group | 20.13% | 25.41% | ★★★★★★ |

| Skolon | 31.76% | 121.72% | ★★★★★★ |

| Yubico | 22.52% | 43.69% | ★★★★★★ |

| Sileon | 40.13% | 109.34% | ★★★★★★ |

| BioArctic | 39.57% | 102.80% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| edyoutec | 26.51% | 63.05% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Acast (OM:ACAST)

Simply Wall St Growth Rating: ★★★★☆☆

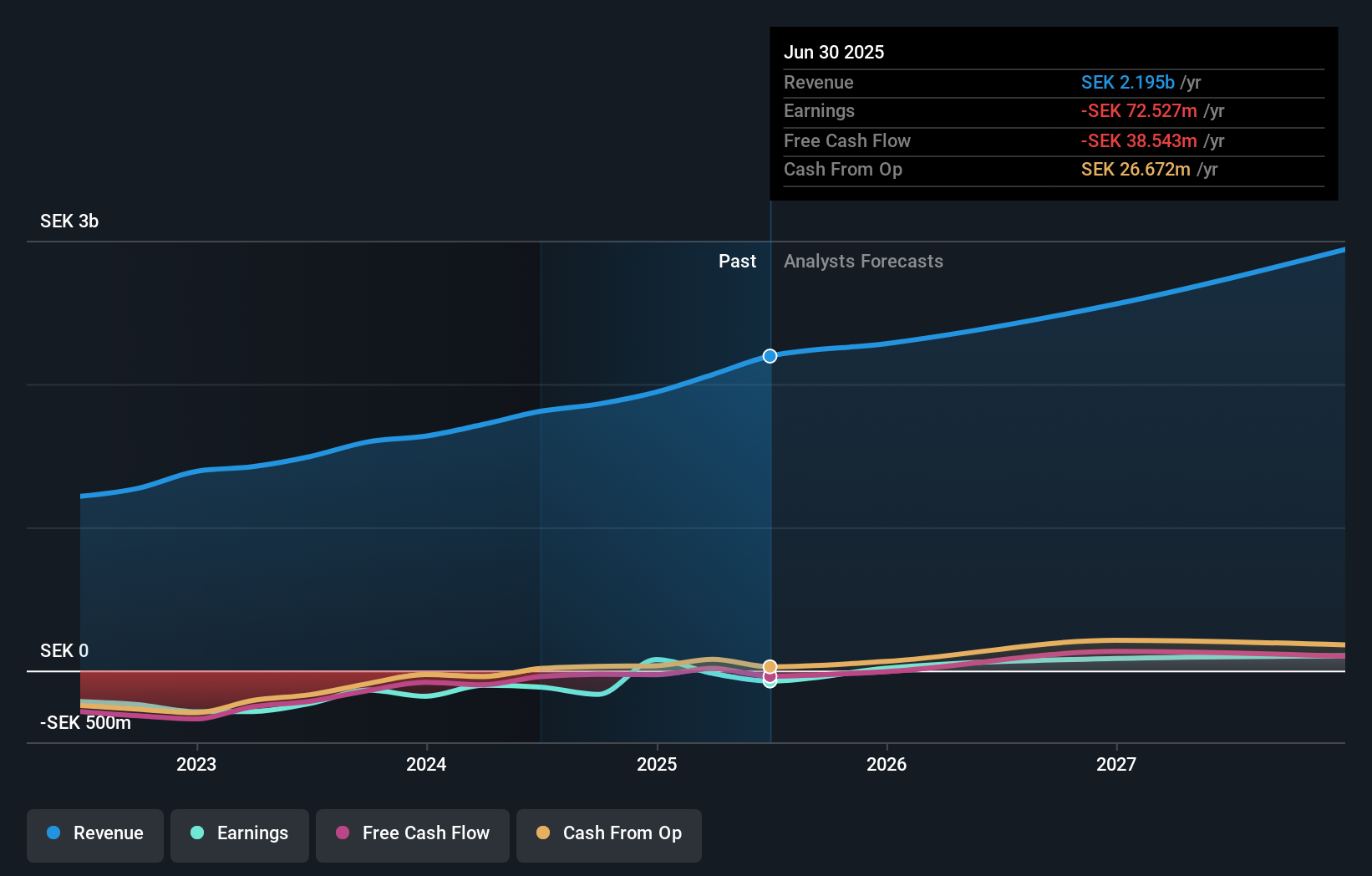

Overview: Acast AB (publ) is a podcasting company with operations in Europe, North America, and internationally, and has a market cap of SEK3.06 billion.

Operations: Acast AB (publ) generates revenue primarily through podcast advertising and content distribution services. The company operates across Europe, North America, and other international markets.

Acast, a Swedish tech company, is poised for notable growth with its revenue expected to increase by 17.2% annually, outpacing the broader market's 1.1%. Despite being unprofitable now, earnings are projected to surge by 160.3% per year over the next three years. The company's focus on podcasting and audio content positions it well in an expanding industry segment. With significant R&D investments aimed at enhancing its platform capabilities and user experience, Acast demonstrates strong potential for future profitability and market influence.

- Get an in-depth perspective on Acast's performance by reading our health report here.

Examine Acast's past performance report to understand how it has performed in the past.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that enable industrial equipment to communicate and share information worldwide, with a market cap of SEK20.74 billion.

Operations: HMS Networks AB (publ) generates revenue primarily from its Wireless Communications Equipment segment, which accounted for SEK3.01 billion. The company focuses on enabling industrial equipment to communicate and share information globally.

HMS Networks, a Swedish tech firm, is experiencing notable growth with its revenue forecasted to increase by 12.2% annually, surpassing the broader market's 1.1%. Despite a recent dip in net income from SEK 116 million to SEK 34 million for Q2 2024, the company's earnings are expected to grow at an impressive rate of 26.3% per year. Significant R&D investments have been made, amounting to SEK 112 million last year, focusing on enhancing industrial communication solutions which could drive future profitability and market positioning.

- Dive into the specifics of HMS Networks here with our thorough health report.

Explore historical data to track HMS Networks' performance over time in our Past section.

NCAB Group (OM:NCAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCAB Group AB (publ) manufactures and sells printed circuit boards (PCBs) across Sweden, the Nordic region, the rest of Europe, North America, and Asia with a market cap of SEK13.65 billion.

Operations: NCAB Group AB (publ) generates revenue primarily from the sale of printed circuit boards (PCBs) with significant contributions from Europe (SEK 2.02 billion), followed by the Nordic region (SEK 777 million), North America (SEK 767 million), and East Asia (SEK 206 million). The company operates across various regions, leveraging its market presence to drive sales.

NCAB Group, a Swedish tech company, is forecast to grow earnings by 18.4% annually, outpacing the broader market's 16.1%. Despite a recent 7.3% decline in net income for Q2 2024 to SEK 73.4 million and a revenue dip from SEK 1,066.2 million to SEK 936.3 million year-over-year, the company repurchased shares in the past year which may indicate confidence in future prospects. With its R&D expenses at SEK 112 million last year focusing on advanced PCB solutions, NCAB aims to enhance its competitive edge and drive future growth within the electronic components industry.

- Delve into the full analysis health report here for a deeper understanding of NCAB Group.

Assess NCAB Group's past performance with our detailed historical performance reports.

Make It Happen

- Unlock more gems! Our Swedish High Growth Tech and AI Stocks screener has unearthed 78 more companies for you to explore.Click here to unveil our expertly curated list of 81 Swedish High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCAB Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCAB

NCAB Group

Engages in the manufacture and sale of printed circuit boards (PCBs) in Sweden, Nordic region, rest of Europe, North America, and Asia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives