The European market has shown mixed results recently, with the pan-European STOXX Europe 600 Index remaining relatively flat as investors await developments in U.S. and European trade discussions. Amid these conditions, high growth tech stocks in Europe present intriguing opportunities for investors seeking exposure to sectors driven by innovation and resilience, especially given the backdrop of fluctuating economic indicators and regional trade dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Archos | 24.72% | 39.34% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

LINK Mobility Group Holding (OB:LINK)

Simply Wall St Growth Rating: ★★★★☆☆

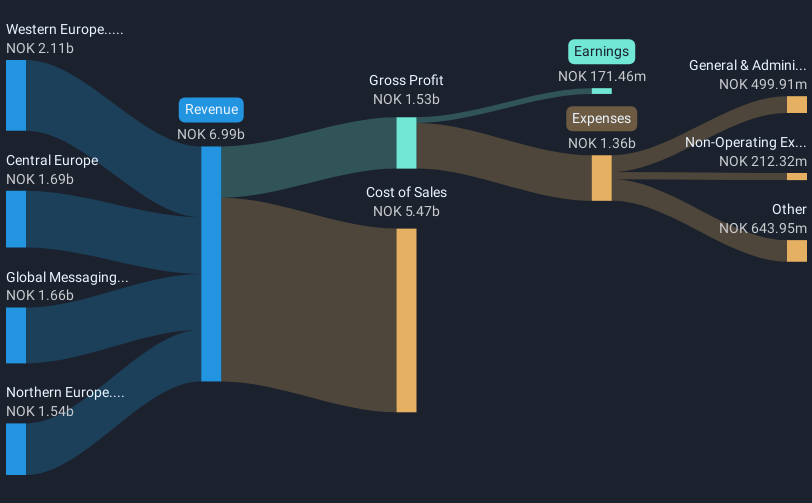

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions and has a market capitalization of NOK8.69 billion.

Operations: The company generates revenue primarily from four segments: Central Europe (NOK1.73 billion), Western Europe (NOK2.14 billion), Northern Europe (NOK1.55 billion), and Global Messaging (NOK1.55 billion).

LINK Mobility Group Holding ASA demonstrates robust growth dynamics within the European tech landscape, notably with its earnings surging by 61% over the past year, outpacing the software industry's average of 14.8%. This growth trajectory is bolstered by strategic financial activities including a recent senior unsecured bond placement of EUR 100 million aimed at refinancing existing debt, showcasing proactive capital management. Despite a challenging quarter with net income dropping to NOK 39.26 million from NOK 253.05 million year-over-year due to significant one-off losses, LINK continues to innovate and expand its market presence. The firm's commitment to leveraging advanced technology solutions for mobile communications positions it well for sustained growth, albeit mindful of fluctuating quarterly earnings impacted by non-recurring costs.

Hemnet Group (OM:HEM)

Simply Wall St Growth Rating: ★★★★★☆

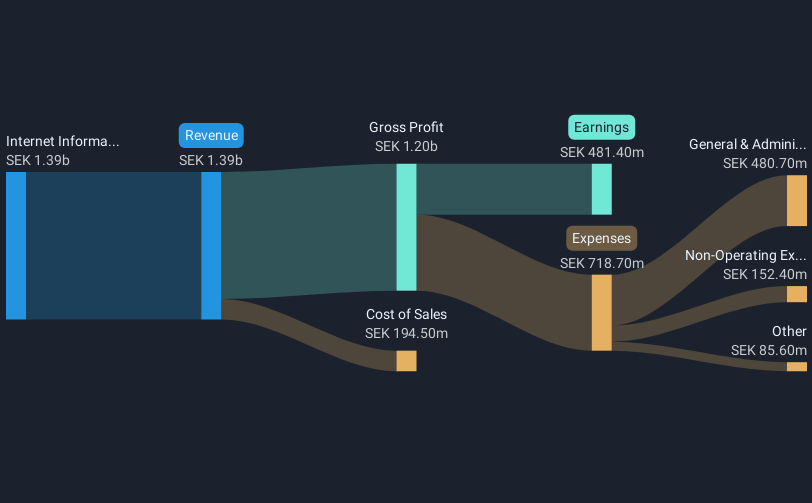

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden with a market cap of SEK28.21 billion.

Operations: The company generates revenue primarily through listing fees, value-added services, and advertising on its platform. It experiences a notable gross profit margin of 71.5%, indicating efficient cost management relative to its revenue streams.

Hemnet Group's recent performance underscores its robust position in the tech sector, with a notable increase in net income to SEK 185 million from SEK 148.7 million year-over-year for Q2 2025, reflecting a growth of 24.4%. This upward trajectory is supported by strategic share repurchases, with the company buying back over 1.3 million shares for SEK 449.8 million within the past year, signaling confidence in its financial health and commitment to shareholder value. Additionally, Hemnet's revenue surged by nearly 19% annually to SEK 813 million over six months, outpacing general market trends and highlighting its effective business model amid competitive digital marketplaces.

- Click to explore a detailed breakdown of our findings in Hemnet Group's health report.

Gain insights into Hemnet Group's past trends and performance with our Past report.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

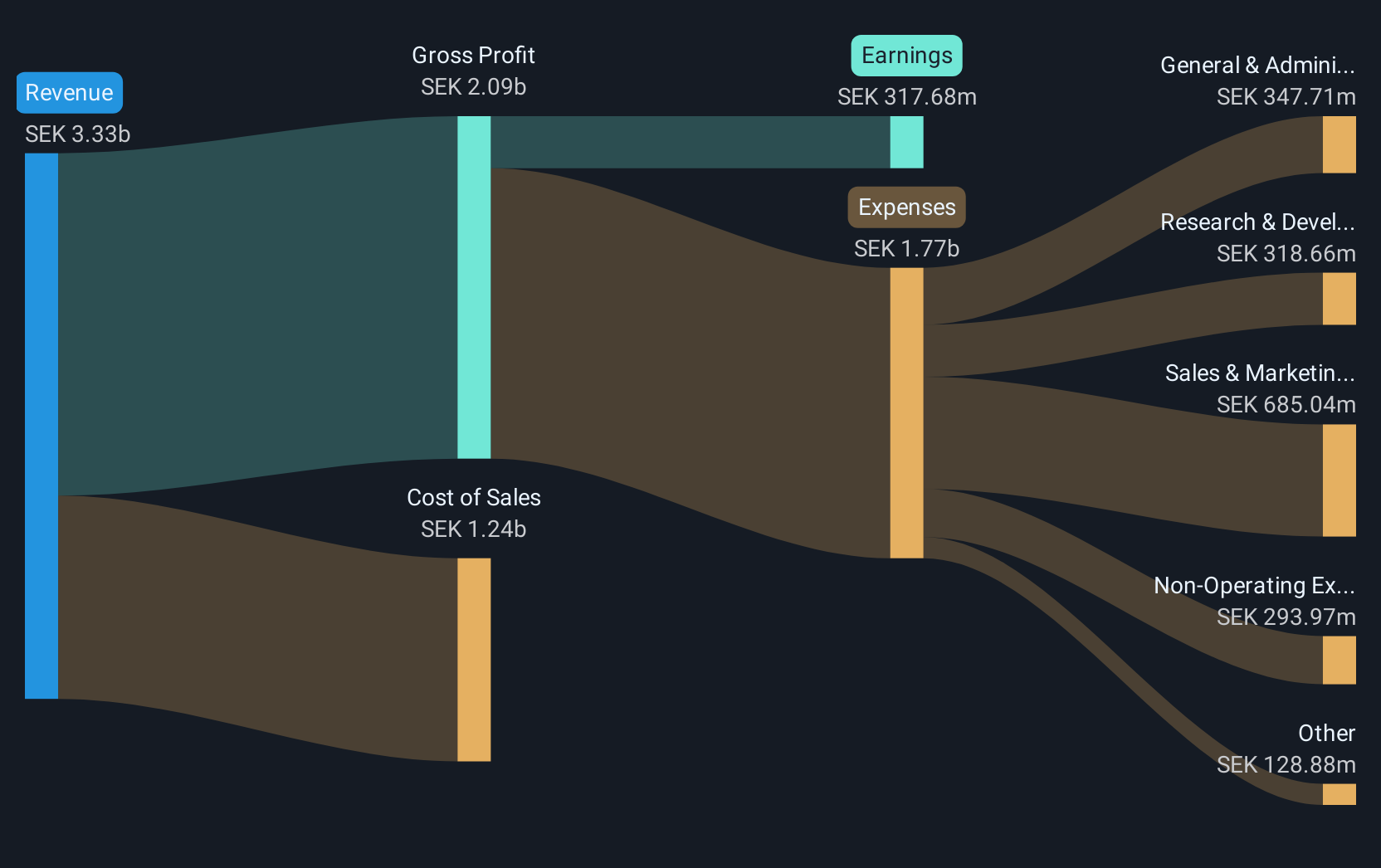

Overview: HMS Networks AB (publ) provides products facilitating communication and information sharing for industrial equipment globally, with a market cap of SEK20.94 billion.

Operations: HMS Networks AB (publ) focuses on developing and supplying communication solutions for industrial equipment, enabling seamless data exchange globally. The company operates with a market capitalization of SEK20.94 billion.

HMS Networks, a player in the European tech landscape, demonstrates robust growth with its revenue expected to rise by 14.2% annually. This outpaces the Swedish market's average of 5.1%, underscoring HMS's effective market strategies and innovation focus. The company also reported a significant jump in net income from SEK 34 million to SEK 84 million in Q2 2025 alone, reflecting an impressive annual earnings growth forecast of 33.5%. Despite opting not to pay dividends this year, HMS's commitment to R&D investments and operational enhancements suggest a strategic pivot towards long-term value creation and technological leadership within its sector.

- Unlock comprehensive insights into our analysis of HMS Networks stock in this health report.

Examine HMS Networks' past performance report to understand how it has performed in the past.

Summing It All Up

- Investigate our full lineup of 231 European High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hemnet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HEM

High growth potential with solid track record.

Market Insights

Community Narratives