- China

- /

- Electrical

- /

- SZSE:001301

3 Growth Companies With High Insider Ownership Growing Earnings Up To 41%

Reviewed by Simply Wall St

In the current global market landscape, investor sentiment has been swayed by cautious commentary from the Federal Reserve and looming political uncertainties, leading to a decline in U.S. stocks despite some recovery towards the week's end. Amidst these fluctuations, growth companies with high insider ownership can present intriguing opportunities, as such ownership often signals confidence in a company's potential to navigate challenging economic conditions while pursuing robust earnings growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK22.04 billion.

Operations: The company generates revenue from its Wireless Communications Equipment segment, amounting to SEK3.01 billion.

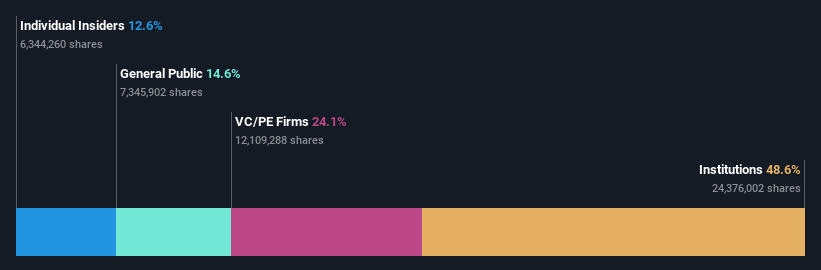

Insider Ownership: 12.6%

Earnings Growth Forecast: 42% p.a.

HMS Networks is experiencing significant earnings growth, projected at 42% annually, outpacing the Swedish market. Despite a recent decline in profit margins and past shareholder dilution, insider buying activity suggests confidence in its future. The company is reorganizing into three divisions to enhance growth and efficiency following strategic acquisitions. This restructuring aims for SEK 40 million annual savings starting January 2025 but incurs SEK 25 million in costs impacting Q4 2024 results.

- Click here to discover the nuances of HMS Networks with our detailed analytical future growth report.

- Our expertly prepared valuation report HMS Networks implies its share price may be too high.

Shijiazhuang Shangtai Technology (SZSE:001301)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shijiazhuang Shangtai Technology Co., Ltd. operates in the technology sector and has a market cap of approximately CN¥17.74 billion.

Operations: Shijiazhuang Shangtai Technology Co., Ltd. has revenue segments totaling CN¥17.74 billion.

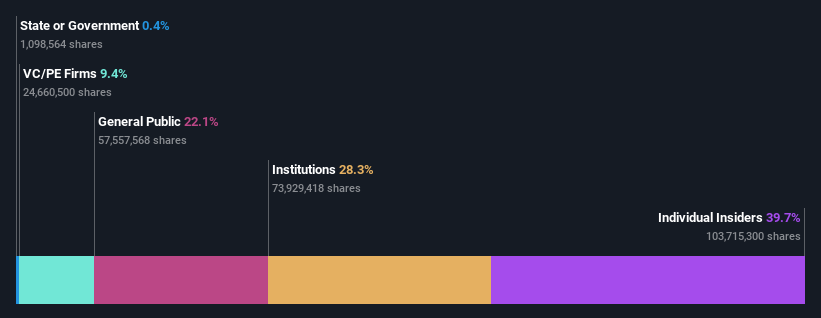

Insider Ownership: 39.8%

Earnings Growth Forecast: 21.1% p.a.

Shijiazhuang Shangtai Technology is experiencing robust revenue growth, projected at 23% annually, surpassing the Chinese market average. The company's recent CNY 100 million share repurchase program reflects strategic use of funds for employee incentives. Despite a lower-than-market earnings growth forecast of 21.1%, it trades at a favorable price-to-earnings ratio compared to peers. Recent earnings showed modest improvements with net income rising to CNY 577.82 million for the first nine months of 2024.

- Dive into the specifics of Shijiazhuang Shangtai Technology here with our thorough growth forecast report.

- Our valuation report here indicates Shijiazhuang Shangtai Technology may be undervalued.

Cre8 Direct (NingBo) (SZSE:300703)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cre8 Direct (NingBo) Co., Ltd. designs, develops, produces, and sells paper-based products with a market cap of CN¥3.09 billion.

Operations: The company's revenue from paper and paper products is CN¥1.74 billion.

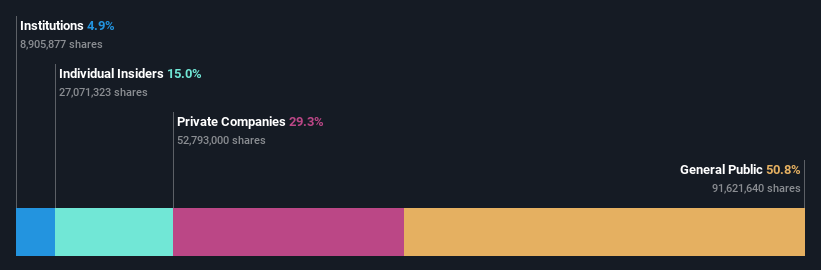

Insider Ownership: 15%

Earnings Growth Forecast: 34.6% p.a.

Cre8 Direct (NingBo) is experiencing strong revenue growth, with a forecast of 27% annually, outpacing the Chinese market. Despite high earnings growth expectations of 34.6%, recent results show net income declining to CNY 59.69 million for the first nine months of 2024, compared to CNY 66.66 million a year ago. The company's share price has been highly volatile recently, and its dividend yield is not well covered by free cash flows.

- Click to explore a detailed breakdown of our findings in Cre8 Direct (NingBo)'s earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Cre8 Direct (NingBo) shares in the market.

Taking Advantage

- Embark on your investment journey to our 1513 Fast Growing Companies With High Insider Ownership selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001301

Shijiazhuang Shangtai Technology

Shijiazhuang Shangtai Technology Co., Ltd.

Good value with reasonable growth potential.

Market Insights

Community Narratives