- Sweden

- /

- Electronic Equipment and Components

- /

- OM:HEXA B

We Ran A Stock Scan For Earnings Growth And Hexagon (STO:HEXA B) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Hexagon (STO:HEXA B), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Hexagon

How Fast Is Hexagon Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Over the last three years, Hexagon has grown EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

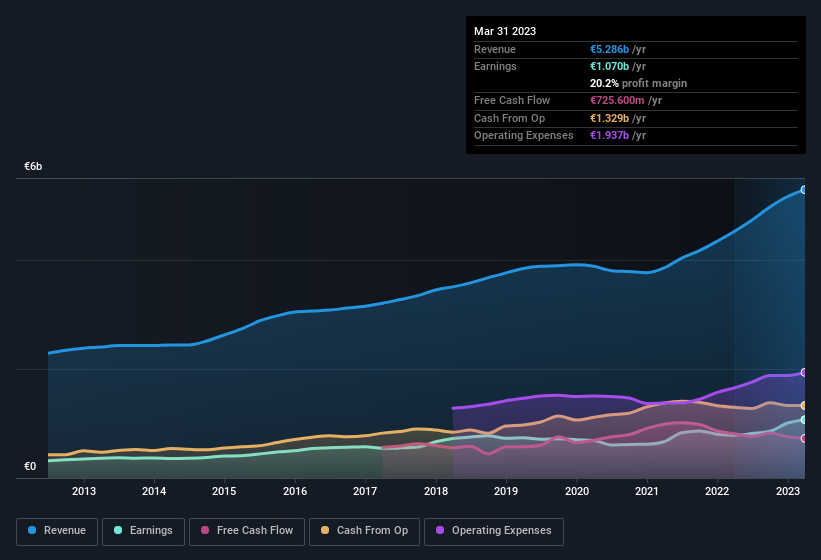

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Hexagon maintained stable EBIT margins over the last year, all while growing revenue 17% to €5.3b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Hexagon's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Hexagon Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that Hexagon insiders spent a staggering €57m on acquiring shares in just one year, without single share being sold in the meantime. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the Independent Director, Brett Watson, who made the biggest single acquisition, paying kr50m for shares at about kr135 each.

Along with the insider buying, another encouraging sign for Hexagon is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth €1.2b. While that is a lot of skin in the game, we note this holding only totals to 0.3% of the business, which is a result of the company being so large. This should still be a great incentive for management to maximise shareholder value.

Does Hexagon Deserve A Spot On Your Watchlist?

One important encouraging feature of Hexagon is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Now, you could try to make up your mind on Hexagon by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Hexagon is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hexagon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HEXA B

Hexagon

Provides geospatial and industrial enterprise solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.