- Sweden

- /

- Electronic Equipment and Components

- /

- OM:HEXA B

Hexagon (OM:HEXA B) Valuation in Focus After Executive Shakeup and Octave Separation Plans

Reviewed by Kshitija Bhandaru

Hexagon (OM:HEXA B) has announced a wave of executive changes tied to the company’s potential separation of its Octave business. Key leadership figures are slated to transition into new roles, both within Hexagon and the soon-to-be independent Octave team, as the organizational structure evolves. With new faces stepping up in major finance and legal positions, investors are now considering how these shifts might shape Hexagon’s future direction and valuation prospects.

The announcement comes at a time when Hexagon’s share price performance has been more of a slow build than a sprint. Over the past month, the stock has edged up, adding around 4%, while the past quarter has seen a larger gain of 15%. Momentum this year has been positive, though the longer-term picture reveals growth has moderated compared to earlier periods. These executive moves, alongside the upcoming change in Hexagon’s business mix, are adding new layers to the story and could affect how the market views both risk and opportunity ahead.

So after this latest shuffle and a year of measured gains, is Hexagon’s current share price underestimating future growth, or are the markets already baking in all the upside?

Most Popular Narrative: 3.6% Undervalued

According to the most widely followed narrative, Hexagon’s current share price sits below its fair value, reflecting a modest undervaluation based on forward growth prospects and profit expansion.

"Upcoming launches of highly innovative products such as the AEON humanoid robot and the MAESTRO CMM automation platform position Hexagon to capture increased demand from the accelerating digitalization, automation, and robotics adoption across manufacturing and industrial markets. This is likely to drive above-market revenue growth and expand margins as these offerings scale starting in 2026."

Curious how Hexagon’s valuation stacks up against bolder profit expectations? This narrative is driven by projections of rising margins, ambitious product rollouts, and a future profit multiple that is unusually high for the sector. Intrigued to discover the financial assumptions fueling this price target? The numbers could surprise you.

Result: Fair Value of $115.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure or unpredictable currency swings could quickly challenge this view. These factors present real risks that may shift Hexagon’s valuation outlook.

Find out about the key risks to this Hexagon narrative.Another View: Market-Based Lens

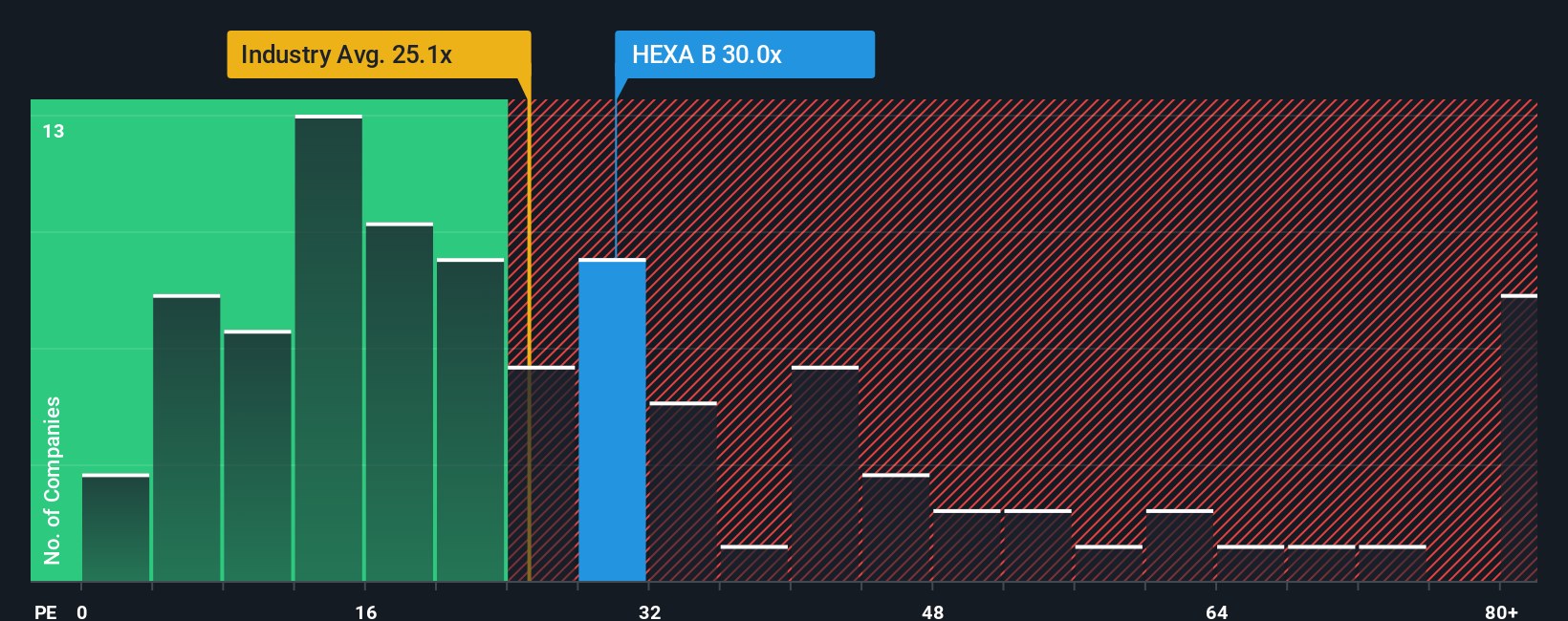

Taking a step back from growth projections, we can also examine Hexagon’s current share price compared to others in its sector. This alternative approach puts it at a premium compared to industry norms, raising the question: is optimism already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Hexagon to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Hexagon Narrative

If you see things differently or want to dig into the figures on your own terms, creating a personalized narrative can be done in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hexagon.

Looking for More Smart Investment Ideas?

You deserve every edge when building your portfolio, so don’t settle for the obvious picks. Use these handpicked investment avenues to spot tomorrow’s winners before the crowd does.

- Target high potential with penny stocks that have strong financial fundamentals by taking a closer look at penny stocks with strong financials.

- Capitalize on groundbreaking progress in artificial intelligence by checking out AI penny stocks shaping the next wave of innovation.

- Maximize potential gains with shares that are undervalued based on robust cash flow metrics through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hexagon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HEXA B

Hexagon

Provides geospatial and industrial enterprise solutions worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives