- Belgium

- /

- Electrical

- /

- ENXTBR:ENRGY

Top European Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As European markets experience a lift from easing trade tensions and optimism over potential U.S. interest rate cuts, the pan-European STOXX Europe 600 Index has seen notable gains. In this environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the company best and may offer resilience amid shifting economic conditions.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 94% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 66.8% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 39.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 63.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Here we highlight a subset of our preferred stocks from the screener.

Trifork Group (CPSE:TRIFOR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trifork Group AG is an information technology and business services provider operating in Switzerland, Denmark, the United Kingdom, the Netherlands, the United States, and internationally with a market cap of DKK1.82 billion.

Operations: Trifork Group AG generates revenue through its information technology and business services across multiple regions, including Switzerland, Denmark, the United Kingdom, the Netherlands, and the United States.

Insider Ownership: 27.8%

Trifork Group, a European tech company, is trading below its estimated fair value and is expected to see significant earnings growth of 23.9% annually, outpacing the Danish market. Despite recent financial results showing a net loss in Q2 2025 due to large one-off items, Trifork's strategic initiatives like the HiBeam launch in the U.S. and involvement in Switzerland's DigiSante program highlight its potential for future expansion. The company's insider ownership aligns with its growth trajectory, although recent insider trading activity is minimal.

- Delve into the full analysis future growth report here for a deeper understanding of Trifork Group.

- In light of our recent valuation report, it seems possible that Trifork Group is trading behind its estimated value.

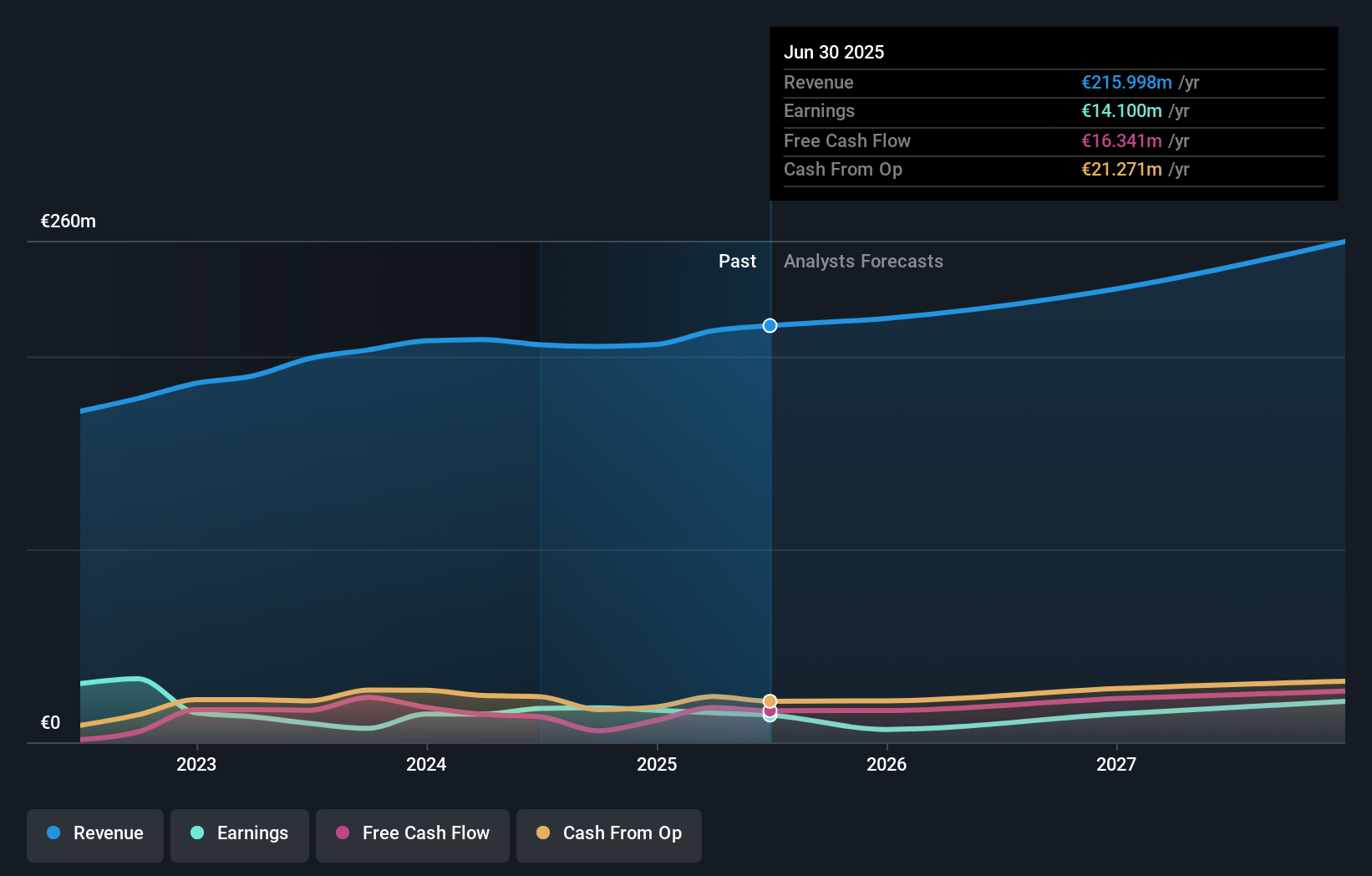

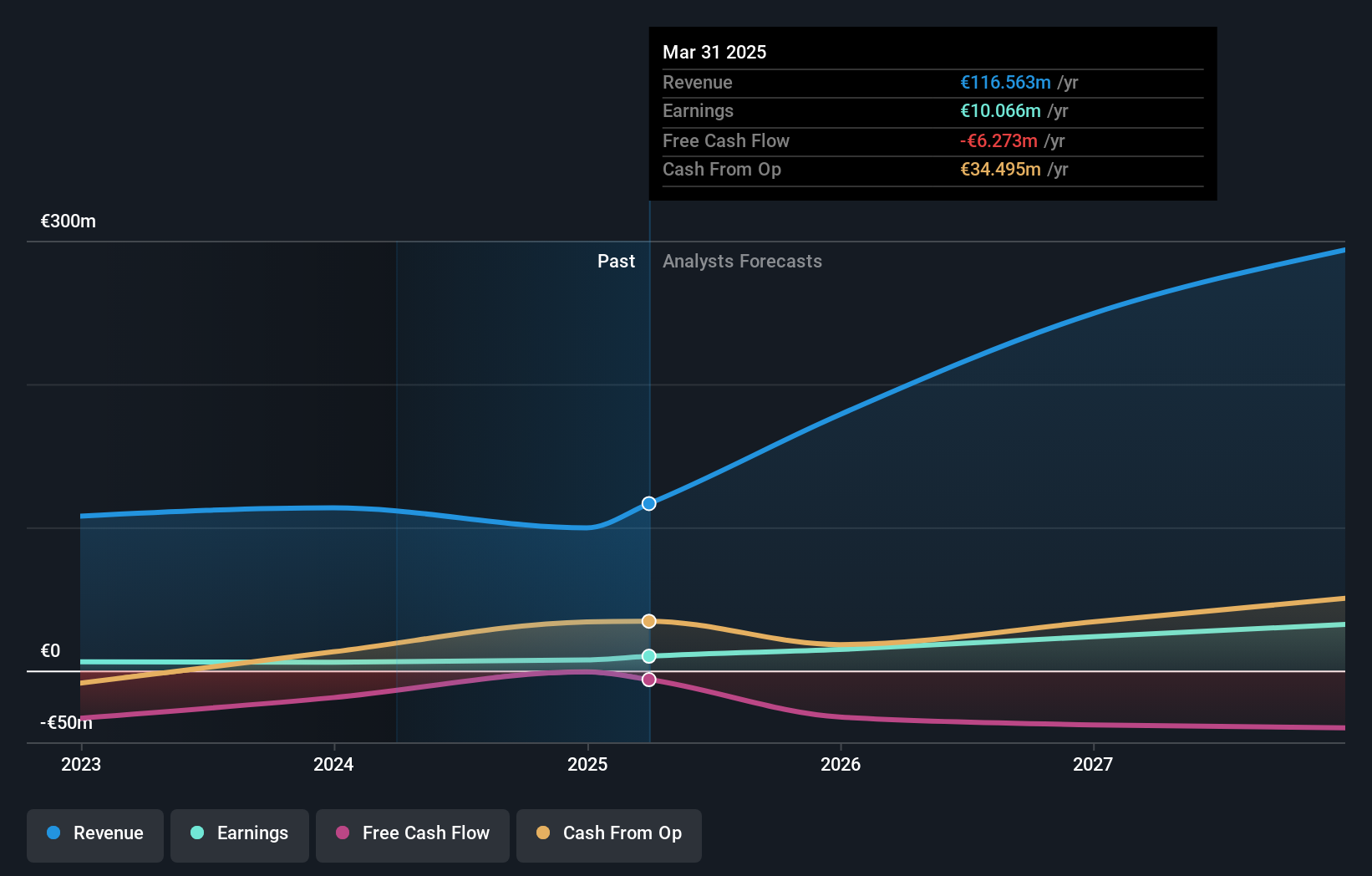

EnergyVision (ENXTBR:ENRGY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EnergyVision NV is a Belgian company offering solar energy and mobility-as-a-service solutions to corporate and residential clients, with a market cap of €725 million.

Operations: The company's revenue segments include €75.84 million from EPC Activity, €16.25 million from Asset-Based Energy, €5.07 million from Asset-Based Mobility, and €23.49 million from Non-Asset-Based Energy solutions.

Insider Ownership: 10.1%

EnergyVision's recent IPO raised €42.26 million, reflecting strong market interest. The company secured a significant concession from NMBS to install and operate public charging stations, aligning with its goal to expand charging points in Belgium from 2,500 to 10,000. Despite high debt levels, EnergyVision's revenue and earnings are forecasted to grow significantly faster than the Belgian market at 20.4% and 42% annually respectively, although its future Return on Equity is projected at a modest 12.4%.

- Navigate through the intricacies of EnergyVision with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of EnergyVision shares in the market.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanza AB (publ) offers manufacturing solutions and has a market capitalization of approximately SEK5.23 billion.

Operations: The company's revenue segments include Main Markets at SEK3.11 billion, Other Markets at SEK2.16 billion, and Business Development and Services at SEK32 million.

Insider Ownership: 34.5%

Hanza's recent earnings report showed strong growth, with sales rising to SEK 1.52 billion and net income reaching SEK 52 million for Q2 2025. The company's earnings are projected to grow significantly at 34.7% annually, outpacing the Swedish market. However, revenue growth is expected at a slower pace of 13% per year. Insider trading activity indicates more shares bought than sold recently, despite significant insider selling in the past quarter.

- Get an in-depth perspective on Hanza's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Hanza is priced lower than what may be justified by its financials.

Key Takeaways

- Click here to access our complete index of 212 Fast Growing European Companies With High Insider Ownership.

- Contemplating Other Strategies? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EnergyVision might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ENRGY

EnergyVision

Operates as a B2B and B2C provider of solar energy and mobility-as-a-service solutions for both corporate and residential clients in Belgium.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives