- Netherlands

- /

- Hospitality

- /

- ENXTAM:TKWY

European Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As European markets navigate the turbulence caused by higher-than-expected U.S. trade tariffs, major indices like the STOXX Europe 600 have experienced significant declines, reflecting broader global economic uncertainties. In such a volatile environment, growth companies with high insider ownership can be particularly appealing as their strong internal confidence might signal resilience and potential for long-term value creation amidst market challenges.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Elicera Therapeutics (OM:ELIC) | 28.3% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Lokotech Group (OB:LOKO) | 13.9% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| CD Projekt (WSE:CDR) | 29.7% | 36.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Circus (XTRA:CA1) | 26% | 51.4% |

We'll examine a selection from our screener results.

Just Eat Takeaway.com (ENXTAM:TKWY)

Simply Wall St Growth Rating: ★★★★☆☆

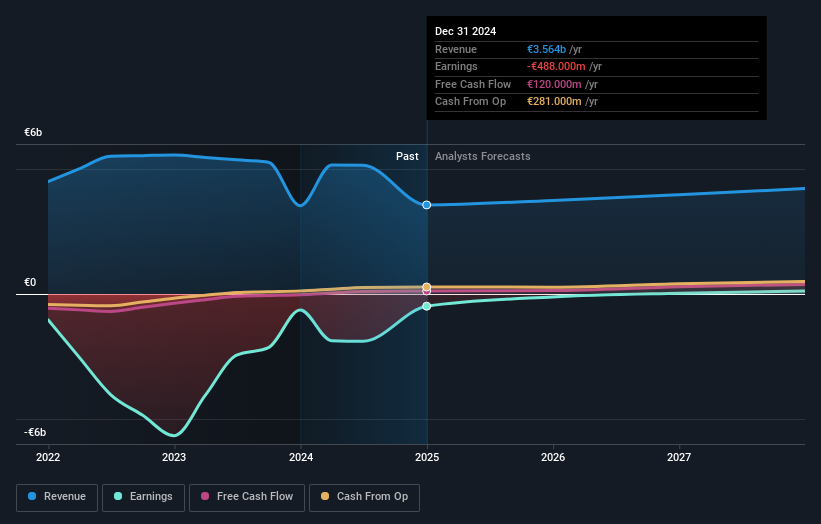

Overview: Just Eat Takeaway.com N.V. is a global online food delivery company with a market cap of approximately €3.72 billion.

Operations: The company's revenue segments are comprised of North America (€437 million), UK and Ireland (€1.39 billion), Northern Europe (€1.37 billion), and Southern Europe & Australia (€372 million).

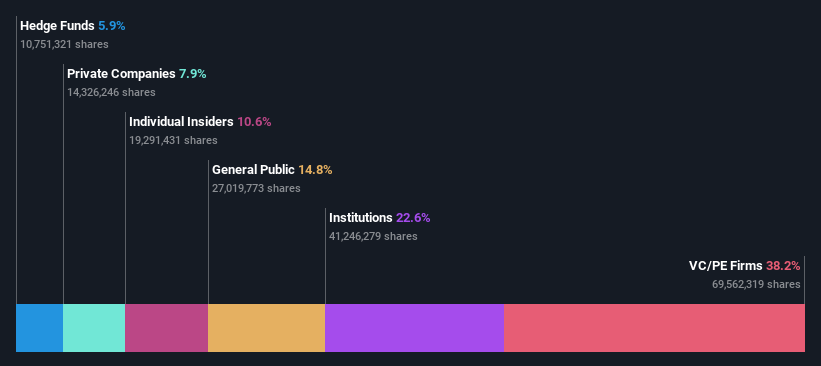

Insider Ownership: 13.2%

Just Eat Takeaway.com is navigating a pivotal phase with Prosus's proposed acquisition, valuing the company at approximately €4.1 billion, and aiming to delist from Euronext Amsterdam. Despite its forecasted revenue growth of 9.2% per year, which surpasses the Dutch market average, its share price remains volatile. While the company is expected to become profitable within three years, insider ownership details are unclear amidst substantial buybacks totaling €146.97 million recently completed.

- Dive into the specifics of Just Eat Takeaway.com here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Just Eat Takeaway.com shares in the market.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

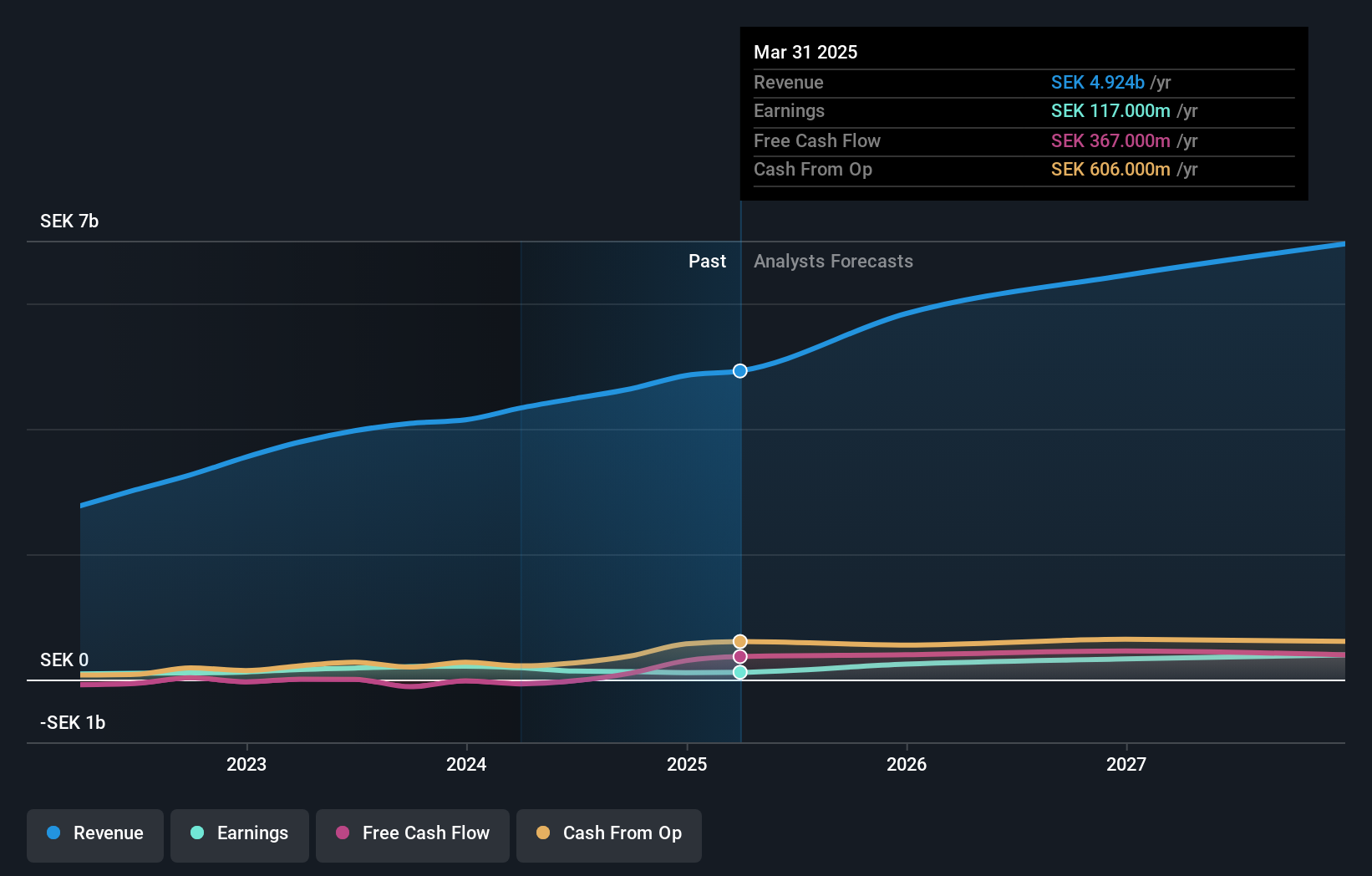

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK2.97 billion.

Operations: The company's revenue is derived from Main Markets at SEK2.86 billion, Other Markets at SEK1.97 billion, and Business Development and Services at SEK14 million.

Insider Ownership: 34.8%

Hanza AB, with significant insider ownership, has faced recent challenges, including a dividend decrease to SEK 0.80 per share and declining net income of SEK 111 million for 2024. Despite this, the company's earnings are forecasted to grow at a robust 26.7% annually, outpacing the Swedish market's growth rate of 9.3%. Trading below its estimated fair value by 24.4%, analysts anticipate a potential stock price increase of 32.4%.

- Take a closer look at Hanza's potential here in our earnings growth report.

- According our valuation report, there's an indication that Hanza's share price might be on the cheaper side.

Norva24 Group (OM:NORVA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Norva24 Group AB (Publ) operates in Northern Europe, offering underground infrastructure maintenance services, with a market cap of SEK6.54 billion.

Operations: The company generates revenue from its Waste Management segment, amounting to NOK3.63 billion.

Insider Ownership: 10.5%

Norva24 Group, with substantial insider ownership, is experiencing mixed financial performance. Despite a forecasted earnings growth of 20.7% annually, outpacing the Swedish market's 9.3%, its profit margins have declined from last year. The company's recent M&A activity includes an acquisition offer by Apax Partners for SEK 6.6 billion. Norva24 trades at a significant discount to its estimated fair value but faces volatility and lower-than-expected revenue growth projections of 6.2% annually.

- Delve into the full analysis future growth report here for a deeper understanding of Norva24 Group.

- Our valuation report here indicates Norva24 Group may be overvalued.

Taking Advantage

- Click here to access our complete index of 229 Fast Growing European Companies With High Insider Ownership.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Just Eat Takeaway.com, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:TKWY

Just Eat Takeaway.com

Operates as an online food delivery company worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives