Firefly (STO:FIRE) Might Be Having Difficulty Using Its Capital Effectively

To find a multi-bagger stock, what are the underlying trends we should look for in a business? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Having said that, while the ROCE is currently high for Firefly (STO:FIRE), we aren't jumping out of our chairs because returns are decreasing.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Firefly is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.25 = kr37m ÷ (kr247m - kr100m) (Based on the trailing twelve months to March 2023).

Therefore, Firefly has an ROCE of 25%. That's a fantastic return and not only that, it outpaces the average of 16% earned by companies in a similar industry.

See our latest analysis for Firefly

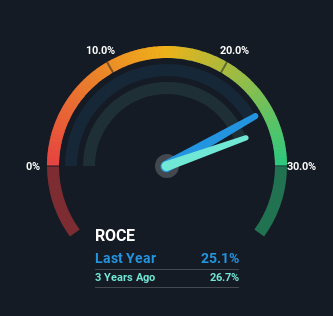

Historical performance is a great place to start when researching a stock so above you can see the gauge for Firefly's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Firefly, check out these free graphs here.

What Does the ROCE Trend For Firefly Tell Us?

In terms of Firefly's historical ROCE movements, the trend isn't fantastic. While it's comforting that the ROCE is high, five years ago it was 33%. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. If these investments prove successful, this can bode very well for long term stock performance.

On a side note, Firefly's current liabilities are still rather high at 41% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

In Conclusion...

In summary, despite lower returns in the short term, we're encouraged to see that Firefly is reinvesting for growth and has higher sales as a result. And long term investors must be optimistic going forward because the stock has returned a huge 186% to shareholders in the last five years. So should these growth trends continue, we'd be optimistic on the stock going forward.

On a final note, we've found 2 warning signs for Firefly that we think you should be aware of.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FIRE

Firefly

Develops and sells industrial fire prevention and protection systems for the process industry worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion