- Sweden

- /

- Communications

- /

- OM:ERIC B

Ericsson (OM:ERIC B) Swings to Profit on SEK18.6bn One-Off, Reinforcing Dividend Sustainability Doubts

Reviewed by Simply Wall St

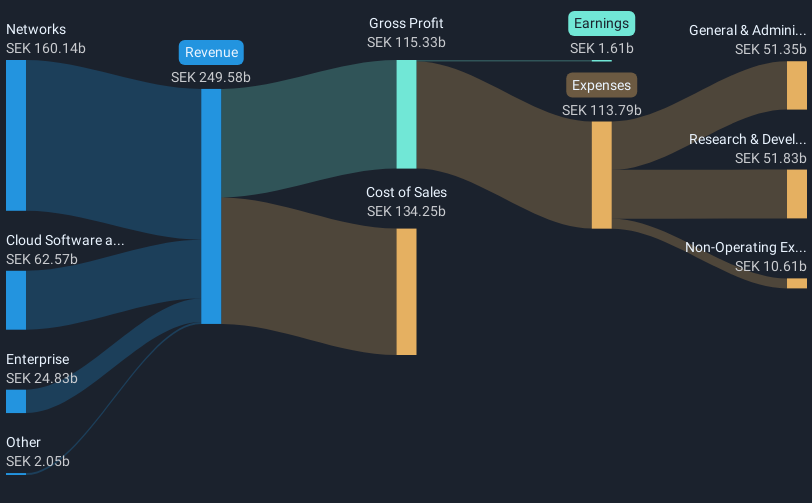

Telefonaktiebolaget LM Ericsson (OM:ERIC B) swung to profitability on the back of a hefty non-recurring gain of SEK18.6 billion over the last twelve months through September 30, 2025. However, the headline number masks deeper trends. Over the past five years, Ericsson’s earnings have fallen sharply, dropping by 29.2% per year. Management expects a further 11.9% earnings decline annually for the next three years. While valuation may look attractive with shares trading at SEK91.94, investors are weighing modest revenue growth projections of just 0.1% per year against material risks to future profitability and dividend sustainability.

See our full analysis for Telefonaktiebolaget LM Ericsson.Next, we’ll look at how these results stack up against the most widely followed narratives for Ericsson, highlighting where the facts align with expectations and where surprises emerge.

See what the community is saying about Telefonaktiebolaget LM Ericsson

Margins Move Despite Shrinking Revenue

- Analysts forecast that profit margins will climb from 7.0% today to 7.5% over the next three years, even as revenue is expected to shrink by 0.5% annually during that time.

- According to the analysts' consensus view, operational efficiency measures and strong product positioning should mitigate slow revenue trends and help sustain margins.

- Expansion of AI-powered telecom applications and ongoing digital transformation across industries are cited as margin tailwinds in the consensus narrative.

- The anticipated margin gains rest on Ericsson's technology leadership and successful cost strategies delivering real-world earnings resilience despite flat sales.

- Surprisingly, this positive margin outlook contrasts the projected revenue decline, and consensus expects gradual improvement even as demand growth remains tepid. 📊 Read the full Telefonaktiebolaget LM Ericsson Consensus Narrative.

Discount to Industry on Key Multiples

- Ericsson trades at a 12.4x price-to-earnings ratio, sitting far below both its peer average (38.1x) and the wider European communications industry (38.7x).

- Consensus narrative notes that Ericsson's below-average valuation could prove attractive if margin improvement materializes, but persistent industry competition and emerging market risks may justify the wide discount.

- Current margin improvements must hold or accelerate, or the company's discount could widen further, validating skeptics' concerns about durability and growth prospects.

- With a modest upside to the analyst consensus price target (current price SEK91.94 vs. target SEK80.56), the room for valuation catch-up appears narrow in the near term.

Dividends Face Durability Test

- EDGAR summary flags the sustainability of current dividends as a top risk due to weak projected earnings and significant reliance on a one-off SEK18.6 billion gain.

- Consensus narrative discusses that legal, regulatory, and ongoing restructuring costs could increasingly force Ericsson to re-examine its dividend payouts.

- Continued earnings inconsistency with substantial non-recurring items raises concerns about the long-term viability of current dividend levels.

- This tension will matter more as net margins come under pressure and as Ericsson faces external headwinds from both regulators and currency fluctuations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Telefonaktiebolaget LM Ericsson on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you spot a different story in the data? Share your perspective and craft your own narrative in just a few minutes: Do it your way

A great starting point for your Telefonaktiebolaget LM Ericsson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Ericsson’s future earnings and dividend stability are under pressure, with margins relying on non-recurring gains and only modest revenue expectations.

If you’re concerned about the sustainability of income, find steadier options with reliable yields among these 2050 dividend stocks with yields > 3% that prioritize consistency and dividend resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefonaktiebolaget LM Ericsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions to communications service providers, enterprises, and the public sector.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives