As European markets experience a positive shift, buoyed by the easing of U.S.-China trade tensions and strong performances across major indices like the STOXX Europe 600, investors are closely watching high growth tech stocks that could capitalize on this improved sentiment. In such an environment, a good stock often demonstrates robust innovation potential and adaptability to changing market dynamics, positioning itself well for future opportunities in the tech sector.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Elicera Therapeutics | 75.80% | 107.14% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Elliptic Laboratories | 36.34% | 79.05% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Ubisoft Entertainment (ENXTPA:UBI)

Simply Wall St Growth Rating: ★★★★☆☆

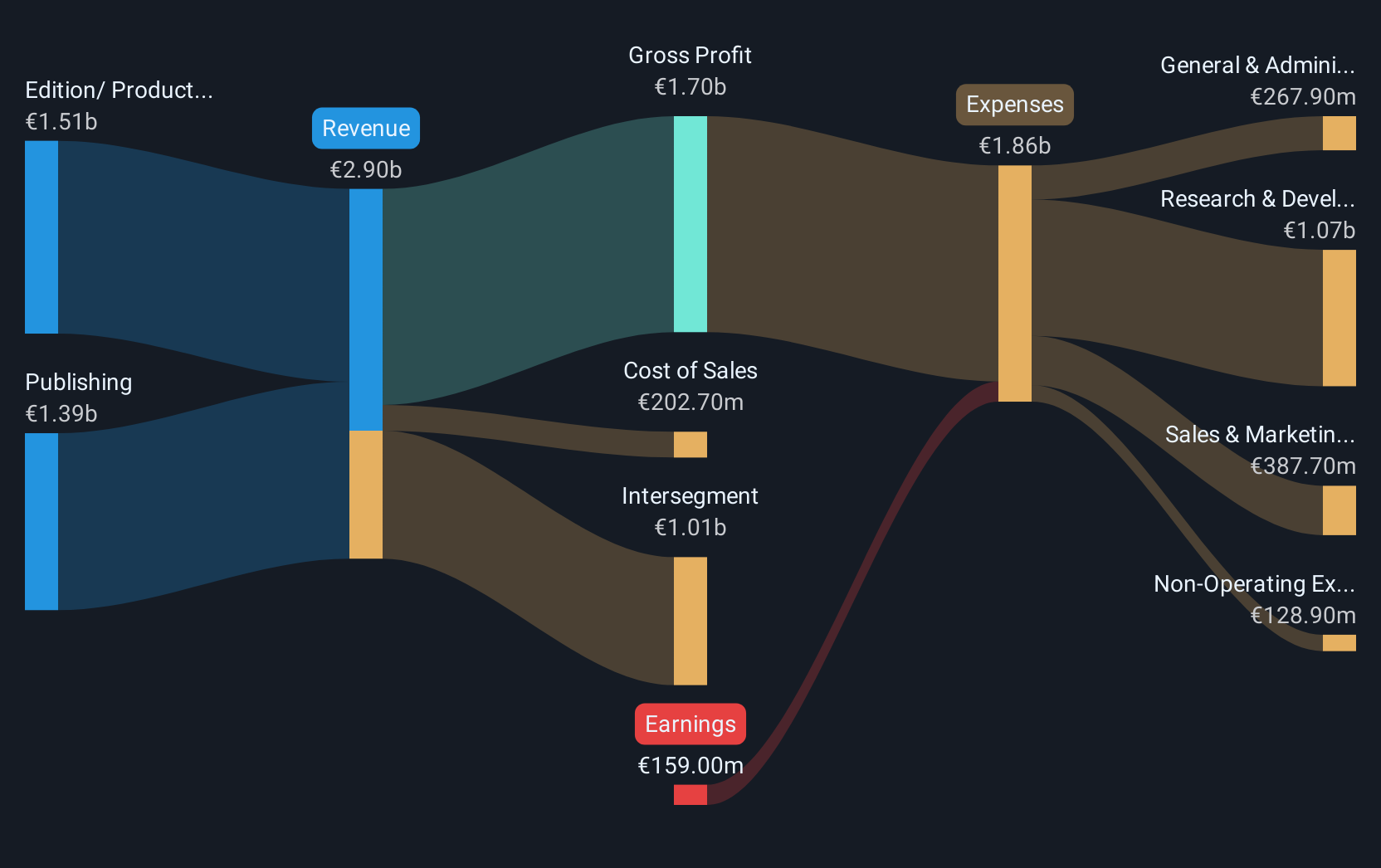

Overview: Ubisoft Entertainment SA is a company that produces, publishes, and distributes video games across various platforms globally, with a market capitalization of approximately €1.30 billion.

Operations: Ubisoft generates revenue through the production, publishing, and distribution of video games for consoles, PC, smartphones, and tablets in both physical and digital formats across Europe, North America, and internationally. The company's market capitalization is approximately €1.30 billion.

Despite a challenging fiscal year where Ubisoft Entertainment reported a significant net loss of €159 million, contrasting starkly with the prior year's net income of €157.8 million, the company is poised for a turnaround. Forecasted to achieve profitability within three years with an impressive annual earnings growth rate of 64.31%, Ubisoft's strategic maneuvers, including its recent partnership with Tencent involving a €1.16 billion investment for a 25% stake in its new subsidiary housing major franchises like Assassin’s Creed and Rainbow Six, signal robust future prospects. This move not only bolsters Ubisoft’s financial position but also enhances its capability to innovate and expand its market reach amidst evolving gaming landscapes.

- Click to explore a detailed breakdown of our findings in Ubisoft Entertainment's health report.

Understand Ubisoft Entertainment's track record by examining our Past report.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★☆☆

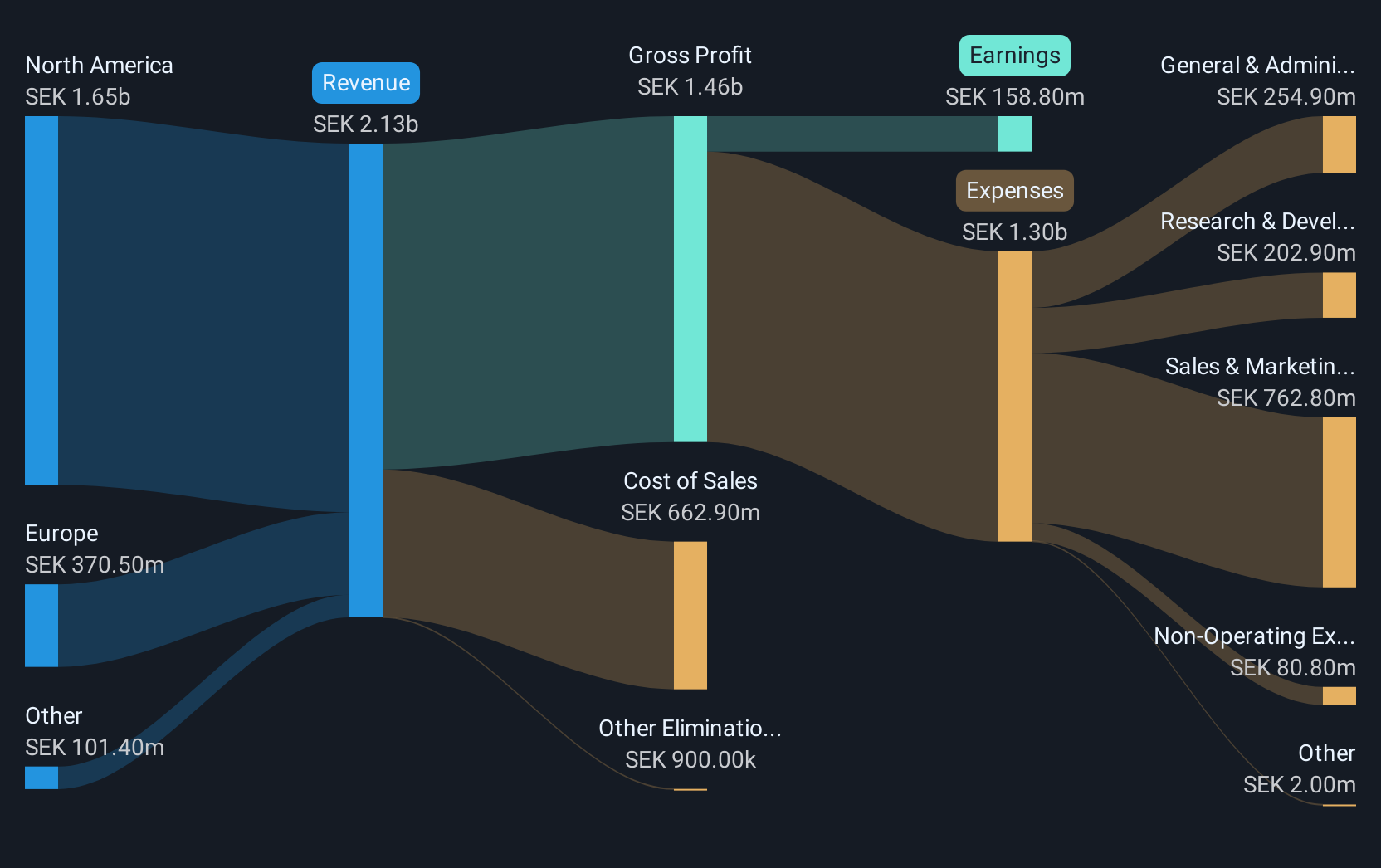

Overview: Dynavox Group AB (publ) specializes in developing and selling assistive technology products for individuals with communication impairments, with a market cap of SEK10.58 billion.

Operations: Dynavox Group AB (publ) generates revenue primarily from its computer hardware segment, amounting to SEK2.13 billion. The company's focus on assistive technology products supports individuals with communication impairments.

Dynavox Group AB has demonstrated a robust financial trajectory, with its first-quarter sales soaring to SEK 581 million from SEK 428 million year-over-year and net income more than doubling to SEK 24 million. This performance is underpinned by a strategic expansion of its credit facilities, increasing by SEK 200 million to fuel acquisitions and organic growth. The firm's recent initiation of a share repurchase program further reflects confidence in its operational stability and future prospects. With an anticipated annual earnings growth of 29.3% outpacing the Swedish tech sector's average, Dynavox stands out for its aggressive growth strategy and market adaptability.

- Click here to discover the nuances of Dynavox Group with our detailed analytical health report.

Examine Dynavox Group's past performance report to understand how it has performed in the past.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★☆☆

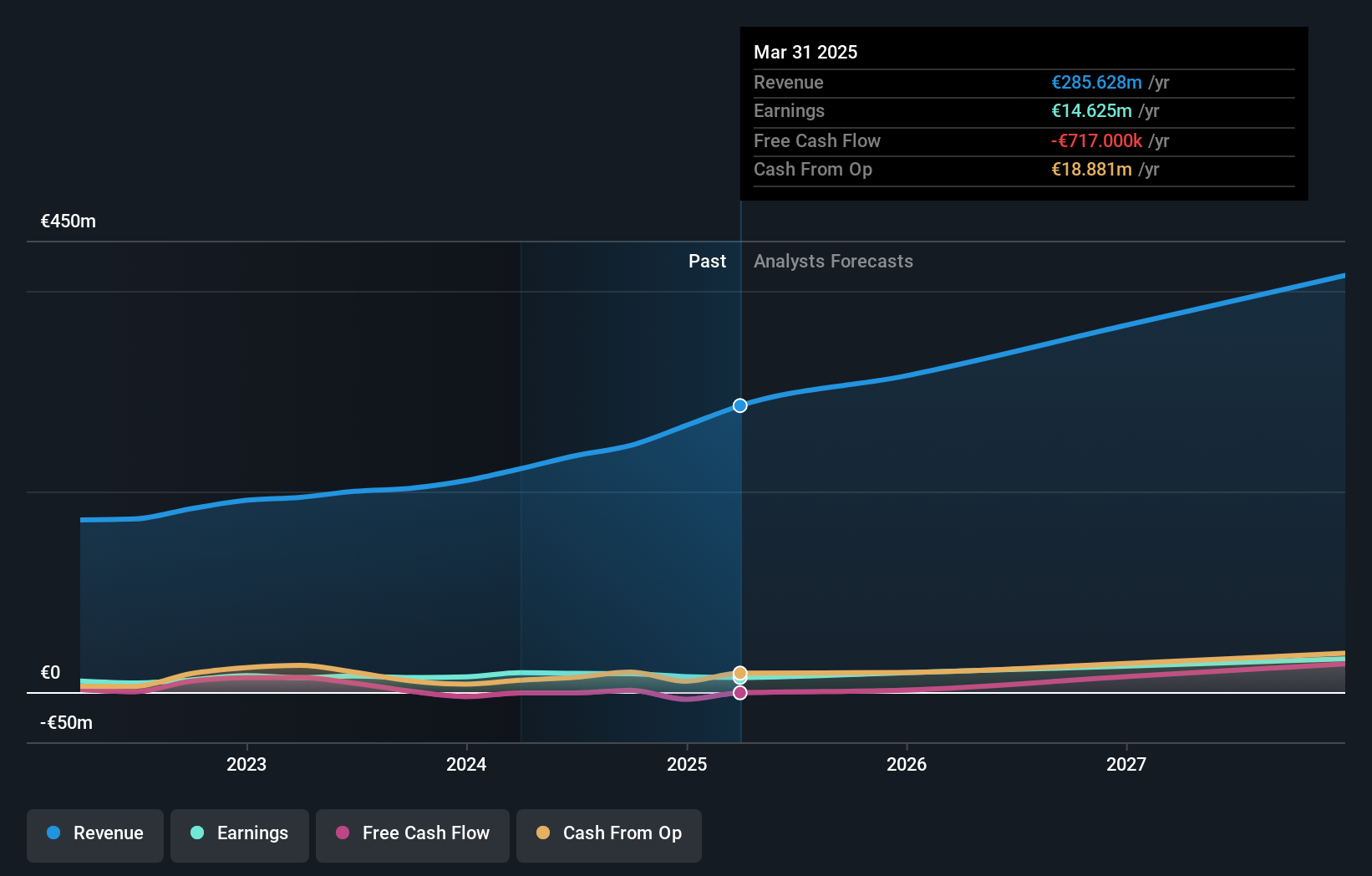

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation on a global scale and has a market cap of €388.13 million.

Operations: Init innovation in traffic systems SE focuses on delivering intelligent transportation system solutions for public transit globally, leveraging its expertise to enhance operational efficiency and passenger experience. The company operates through diverse revenue streams that include software, hardware, and services tailored to the needs of public transport operators.

Init innovation in traffic systems SE showcases resilience and strategic growth in the tech sector, with a notable 14.4% annual revenue increase to €265.67 million, underscoring its expansion amidst challenging market conditions. Despite a slight dip in net income from €2.4 million to €1.56 million in Q1 2025, the company continues to invest heavily in R&D, committing significant resources that reflect its dedication to innovation and market leadership. This approach is further exemplified by their active participation in industry conferences like Kollektivtrafikdagen 2025, signaling ongoing engagement with key industry trends and stakeholders. With earnings projected to grow by an impressive 28.9% annually, Init's strategic initiatives appear well-poised to enhance its competitive edge and foster sustained growth.

Taking Advantage

- Delve into our full catalog of 227 European High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if init innovation in traffic systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IXX

init innovation in traffic systems

Engages in the provision of intelligent transportation systems solutions for public transportation worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)