- Sweden

- /

- Electronic Equipment and Components

- /

- NGM:OURLIV

OurLiving Full Year 2024 Earnings: kr0.11 loss per share (vs kr0.31 loss in FY 2023)

OurLiving (NGM:OURLIV) Full Year 2024 Results

Key Financial Results

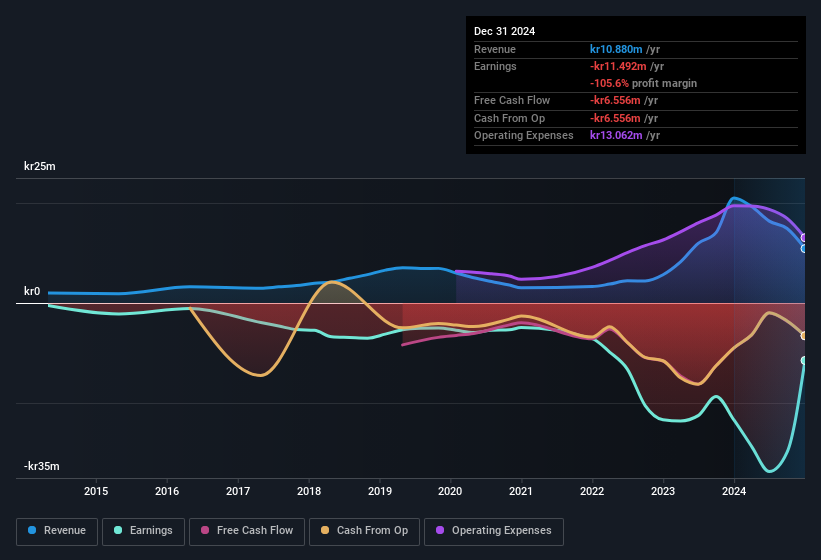

- Revenue: kr10.9m (down 48% from FY 2023).

- Net loss: kr11.5m (loss narrowed by 51% from FY 2023).

- kr0.11 loss per share (improved from kr0.31 loss in FY 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

OurLiving shares are up 9.5% from a week ago.

Risk Analysis

You still need to take note of risks, for example - OurLiving has 5 warning signs (and 4 which shouldn't be ignored) we think you should know about.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:OURLIV

OurLiving

Operates as a software company, provides turnkey SaaS services for the digitization of construction, management, and housing in Sweden.

Moderate and slightly overvalued.

Market Insights

Community Narratives