We can readily understand why investors are attracted to unprofitable companies. By way of example, ZignSec (STO:ZIGN) has seen its share price rise 233% over the last year, delighting many shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky ZignSec's cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for ZignSec

Does ZignSec Have A Long Cash Runway?

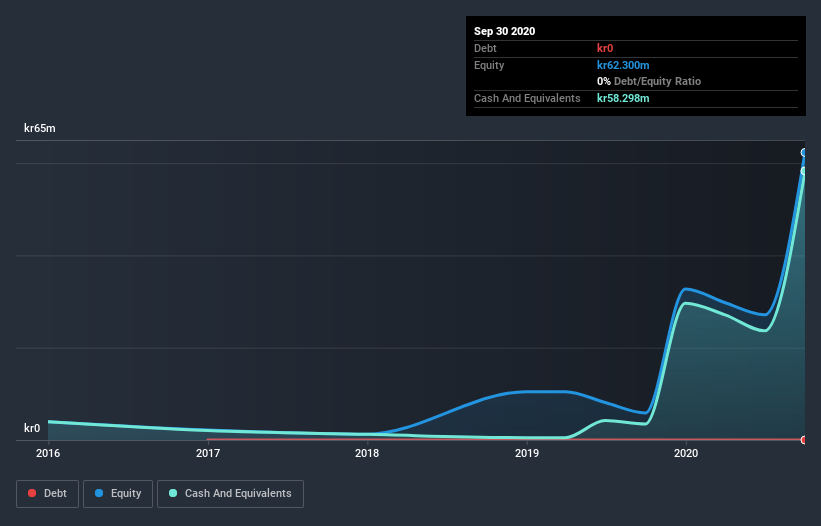

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In September 2020, ZignSec had kr58m in cash, and was debt-free. Importantly, its cash burn was kr16m over the trailing twelve months. That means it had a cash runway of about 3.7 years as of September 2020. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

How Is ZignSec's Cash Burn Changing Over Time?

In our view, ZignSec doesn't yet produce significant amounts of operating revenue, since it reported just kr12m in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. During the last twelve months, its cash burn actually ramped up 86%. While this spending increase is no doubt intended to drive growth, if the trend continues the company's cash runway will shrink very quickly. In reality, this article only makes a short study of the company's growth data. This graph of historic revenue growth shows how ZignSec is building its business over time.

How Hard Would It Be For ZignSec To Raise More Cash For Growth?

While ZignSec does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

ZignSec has a market capitalisation of kr471m and burnt through kr16m last year, which is 3.4% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is ZignSec's Cash Burn Situation?

As you can probably tell by now, we're not too worried about ZignSec's cash burn. For example, we think its cash runway suggests that the company is on a good path. While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. On another note, ZignSec has 5 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading ZignSec or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ZignSec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:ZIGN

ZignSec

Provides Software as a Service platform with digital real time solutions for customers due diligence and identity verification worldwide.

Excellent balance sheet low.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion