- Canada

- /

- Residential REITs

- /

- TSX:MHC.UN

Global Market's Top 3 Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

In recent weeks, global markets have experienced notable shifts, with small-cap stocks leading the charge as the Russell 2000 Index advanced by 5.52%, outperforming their large-cap counterparts. Amidst this backdrop of dovish Federal Reserve signals and a mixed economic landscape, identifying promising small-cap opportunities requires careful consideration of market dynamics and insider actions that may suggest potential value.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.2x | 0.7x | 43.94% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 38.24% | ★★★★★☆ |

| Eastnine | 11.7x | 7.4x | 48.91% | ★★★★★☆ |

| Centurion | 3.7x | 3.1x | -55.95% | ★★★★☆☆ |

| Chinasoft International | 21.7x | 0.7x | -1205.56% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.53% | ★★★★☆☆ |

| Gooch & Housego | 43.7x | 1.0x | 26.58% | ★★★☆☆☆ |

| Kendrion | 28.9x | 0.7x | 42.73% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.5x | 0.4x | -426.52% | ★★★☆☆☆ |

| PSC | 10.1x | 0.4x | 18.08% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

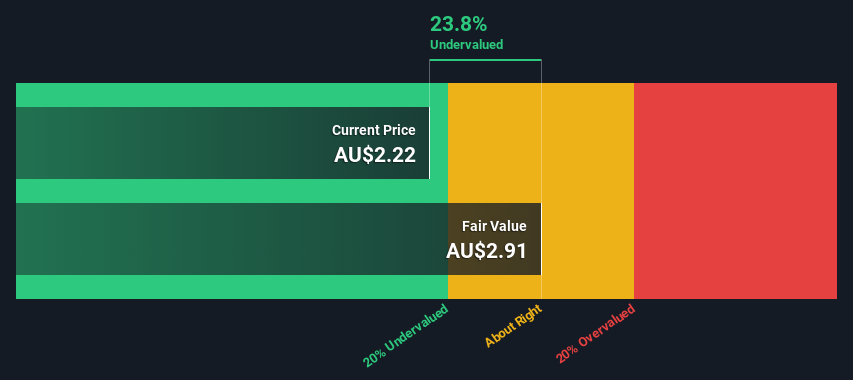

Region Group (ASX:RGN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Region Group operates in the real estate sector, focusing on convenience-based retail properties, with a market capitalization of A$3.45 billion.

Operations: Region Group's revenue primarily comes from its convenience-based retail properties, with the latest reported revenue at A$384.8 million. The company's gross profit margin has shown fluctuations, most recently recorded at 62.97%. Operating expenses have varied over time but were last noted at A$25.3 million, while non-operating expenses have also impacted net income significantly in recent periods.

PE: 13.0x

Region Group, a small company with high-quality earnings, shows potential as an undervalued investment. Despite relying solely on external borrowing for funding, their financial position remains solid with manageable debt levels. Earnings are projected to grow at 4% annually. Insider confidence is evident through recent share purchases by executives between January and March 2025. The company's focus on growth and strategic management could enhance its appeal in the evolving market landscape.

- Unlock comprehensive insights into our analysis of Region Group stock in this valuation report.

Evaluate Region Group's historical performance by accessing our past performance report.

Yubico (OM:YUBICO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Yubico specializes in security software and services, focusing on providing authentication solutions, with a market capitalization of SEK 11.25 billion.

Operations: Yubico generates revenue primarily from its Security Software & Services segment. Over recent periods, the company has seen a notable increase in gross profit margin, reaching 81.57% by the end of 2024 and maintaining above 80% through to late 2025. Operating expenses are largely driven by sales and marketing, research and development, and general administrative costs.

PE: 29.7x

Yubico, a cybersecurity firm known for its YubiKeys, recently expanded retail availability to 350 Best Buy stores in the US, enhancing accessibility and security awareness. Despite a volatile share price and reliance on external borrowing, insider confidence is evident with Mattias Danielsson purchasing 260,000 shares worth SEK 35.37 million between September and November 2025. Although Q3 sales declined to SEK 547.5 million from last year's SEK 589.9 million, the company's strategic partnerships and product innovations signal potential growth opportunities amidst evolving cyber threats.

- Navigate through the intricacies of Yubico with our comprehensive valuation report here.

Assess Yubico's past performance with our detailed historical performance reports.

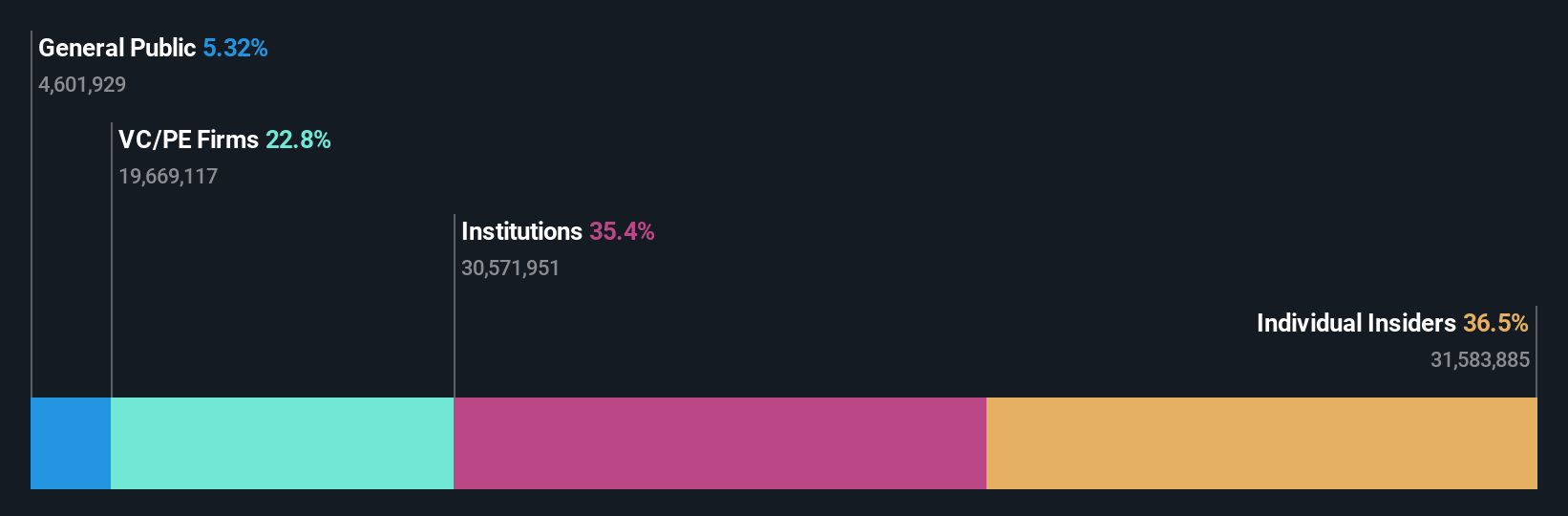

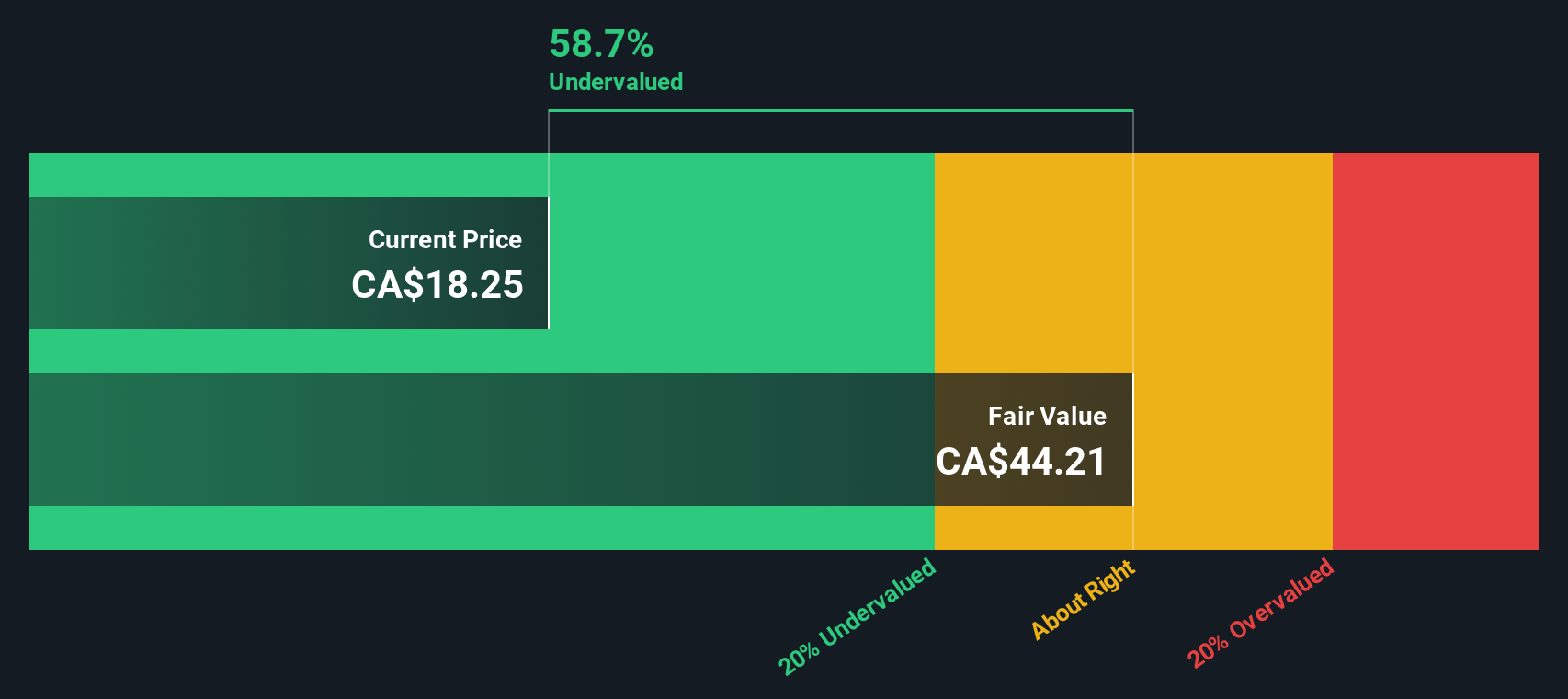

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flagship Communities Real Estate Investment Trust operates as a real estate investment trust focused on residential properties, with a market capitalization of approximately $0.52 billion.

Operations: Flagship Communities Real Estate Investment Trust generates revenue primarily from its residential real estate segment, with recent figures showing $99.69 million. The company's cost structure includes a cost of goods sold (COGS) of $33.70 million and operating expenses totaling $12.66 million as of the latest period reported. It has achieved a gross profit margin of 66.19%, indicating efficient management of its direct costs relative to revenue generation.

PE: 3.7x

Flagship Communities Real Estate Investment Trust, a smaller player in the real estate sector, recently expanded its footprint with acquisitions in Indiana and Ohio for US$79 million. These moves align with its strategy to revitalize underperforming communities by boosting occupancy and expanding lots. Despite earnings forecasts indicating a decline of 47.3% annually over the next three years, insider confidence remains evident through share purchases. The REIT also declared an increased monthly dividend of US$0.0545 per unit starting November 2025, reflecting steady cash flow management amid external borrowing reliance for funding growth initiatives.

Make It Happen

- Discover the full array of 139 Undervalued Global Small Caps With Insider Buying right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MHC.UN

Flagship Communities Real Estate Investment Trust

An unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust dated August 12, 2020 (as subsequently amended and restated, the “Declaration of Trust”) under the laws of the Province of Ontario.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026