Exploring Three Prominent High Growth Tech Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, with the S&P 500 and Nasdaq Composite marking significant gains despite a year-end slump, investors are keenly observing high-growth sectors like technology for potential opportunities. In this context, identifying promising tech stocks involves considering factors such as innovation potential, market adaptability, and financial resilience to withstand fluctuating economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

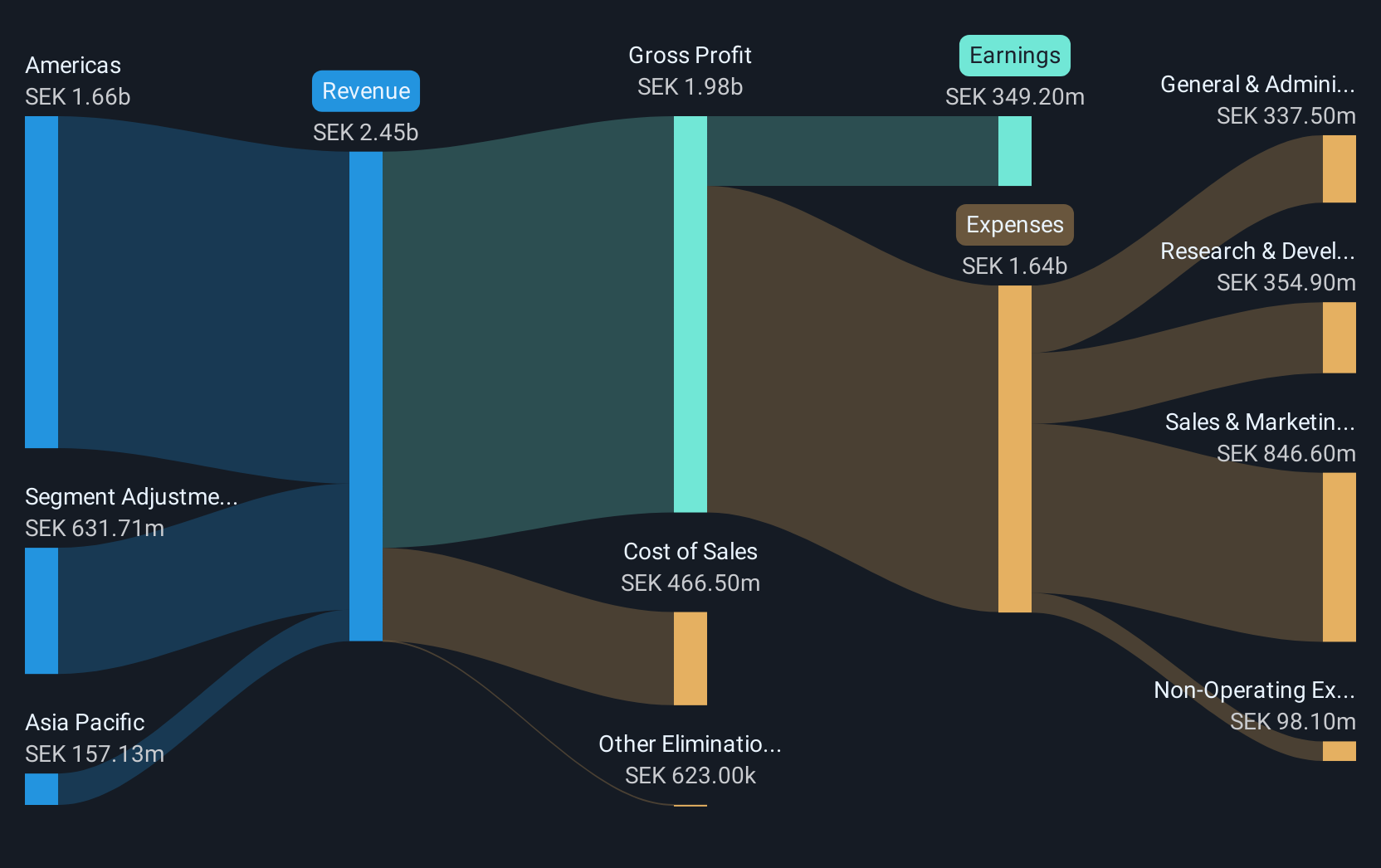

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market capitalization of SEK19.85 billion.

Operations: With a revenue of SEK 2.28 billion from its Security Software & Services segment, Yubico AB focuses on providing authentication solutions.

Yubico, a leader in cybersecurity solutions, has shown remarkable financial and operational growth. In the past year, its earnings surged by 109.7%, significantly outpacing the software industry's average of 40.1%. This trend is expected to continue with an annual earnings growth forecast at 28.8%, well above Sweden's market average of 14.6%. Additionally, Yubico's revenue is projected to grow at 21.2% annually, dwarfing the Swedish market forecast of just 1.2%. The company recently enhanced its product offerings with the launch of Yubico Enrollment Suite for Microsoft users, aimed at bolstering cyber resilience through phishing-resistant multi-factor authentication (MFA). This move aligns with Microsoft’s Secure Future Initiative and positions Yubico favorably within the expanding domain of secure digital identity verification technologies.

- Delve into the full analysis health report here for a deeper understanding of Yubico.

Gain insights into Yubico's historical performance by reviewing our past performance report.

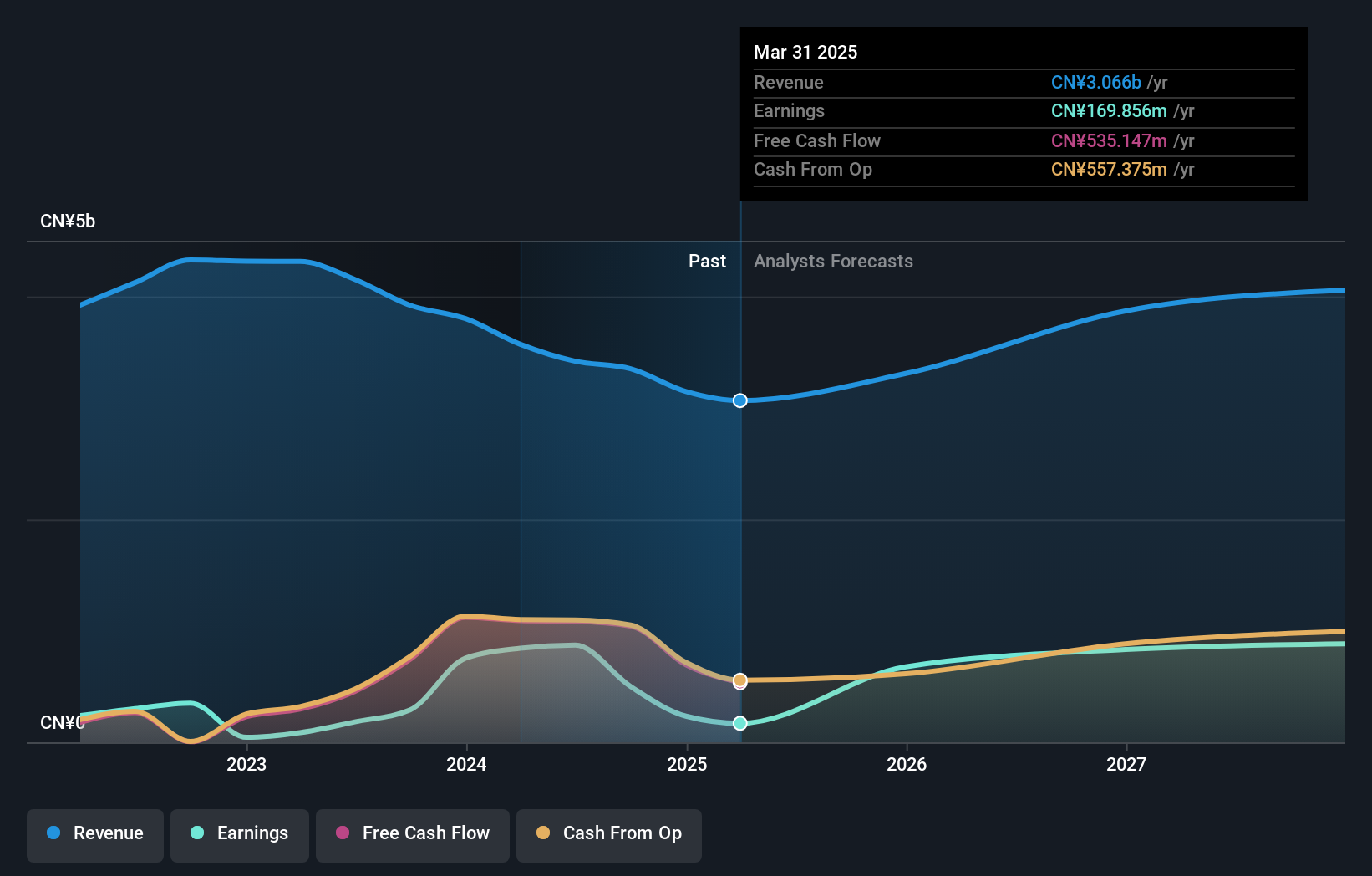

XGD (SZSE:300130)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: XGD Inc. is engaged in the research, development, manufacturing, sale, and servicing of payment terminals both in China and internationally, with a market capitalization of CN¥11.14 billion.

Operations: XGD Inc. focuses on the research, development, manufacturing, and sale of payment terminals across domestic and international markets. The company generates revenue primarily from its payment terminal products and related services.

XGD Inc. has demonstrated a robust pattern of growth, with its earnings forecast to increase by 34% annually, significantly outstripping the Chinese market's average of 25%. This performance is underpinned by substantial investments in R&D, which have risen consistently, reflecting the company's commitment to innovation and staying ahead in competitive tech landscapes. Recently, XGD confirmed a dividend payout following an extraordinary general meeting, underscoring its financial health and commitment to shareholder returns. The firm's ability to maintain revenue growth at 14.5% per year—faster than the broader CN market rate of 13.5%—coupled with a recent dip in net income highlights both the opportunities and challenges it faces within the dynamic tech sector.

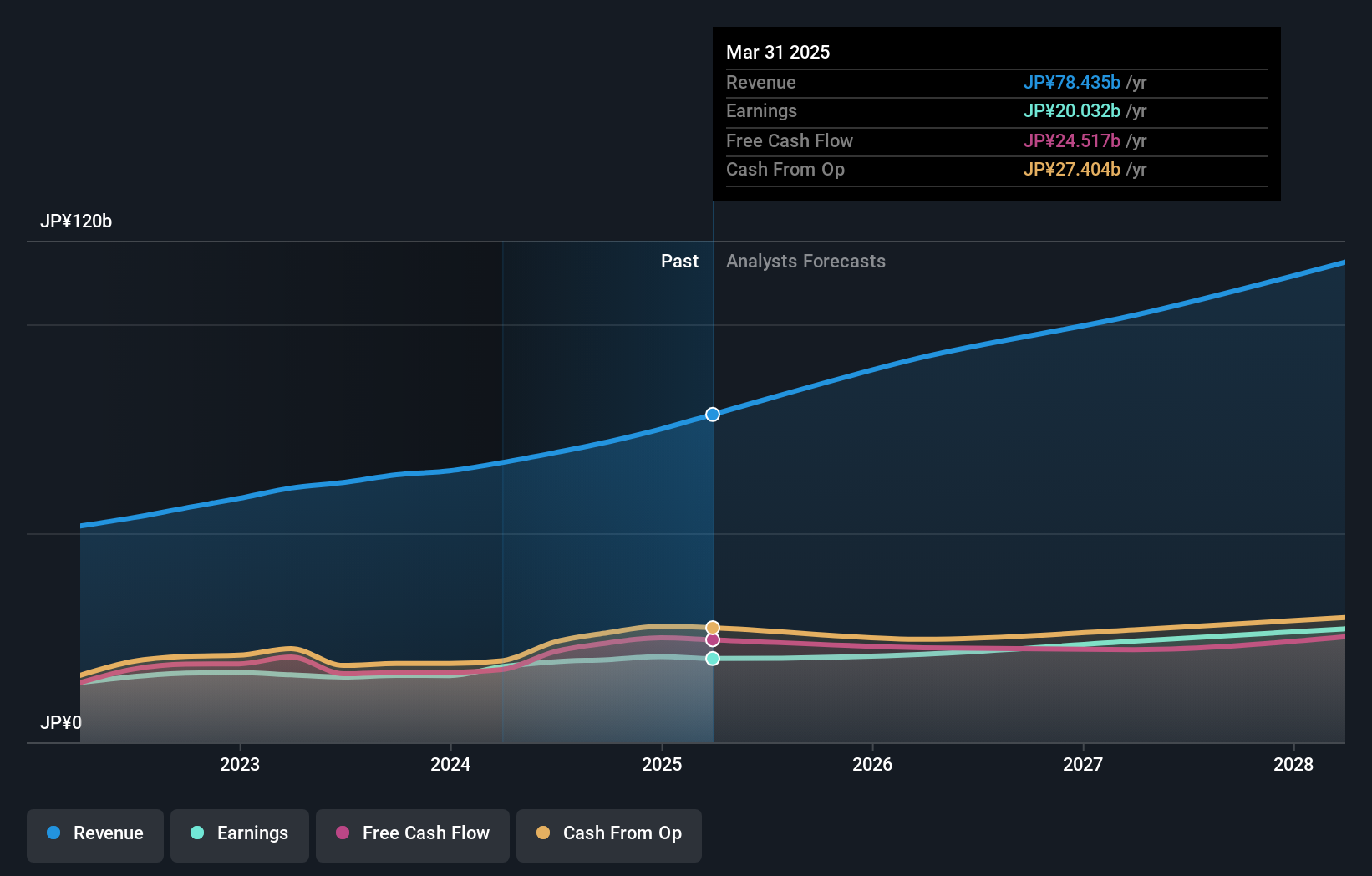

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc. operates in Japan offering purchase support and restaurant review services through its subsidiaries, with a market capitalization of ¥457.95 billion.

Operations: Kakaku.com, Inc. generates revenue primarily through its purchase support and restaurant review services in Japan. The company operates with a market capitalization of ¥457.95 billion, focusing on enhancing consumer experiences across these segments.

Kakaku.com, with its revenue and earnings growing at 9.2% and 10% annually, respectively, outpaces the Japanese market's averages of 4.2% and 7.8%. This growth is supported by a strategic focus on sectors like online price comparison services that cater to an increasingly digital consumer base. The company also emphasizes innovation through R&D investments, which have been crucial in maintaining its competitive edge within the tech landscape. Despite these strengths, it's essential to consider the broader industry challenges that could impact future performance. Kakaku.com continues to adapt to market demands while navigating these potential obstacles effectively.

- Click here and access our complete health analysis report to understand the dynamics of Kakaku.com.

Review our historical performance report to gain insights into Kakaku.com's's past performance.

Seize The Opportunity

- Discover the full array of 1263 High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion