- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

European Value Stocks: 3 Companies Estimated Below Intrinsic Worth

Reviewed by Simply Wall St

Amid a recent improvement in sentiment following the de-escalation of trade tensions between the U.S. and China, European markets have seen a positive uptick, with key indices like Germany's DAX and France's CAC 40 showing gains. In this environment of cautious optimism, identifying stocks that are potentially undervalued can be particularly appealing for investors seeking opportunities; these stocks may offer intrinsic value not fully recognized by current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €52.75 | €105.29 | 49.9% |

| Airbus (ENXTPA:AIR) | €161.84 | €322.14 | 49.8% |

| adidas (XTRA:ADS) | €220.70 | €439.05 | 49.7% |

| Lectra (ENXTPA:LSS) | €23.75 | €47.40 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK214.00 | SEK417.39 | 48.7% |

| Boreo Oyj (HLSE:BOREO) | €15.65 | €30.99 | 49.5% |

| Lumibird (ENXTPA:LBIRD) | €11.90 | €23.51 | 49.4% |

| Claranova (ENXTPA:CLA) | €2.82 | €5.47 | 48.4% |

| BHG Group (OM:BHG) | SEK27.20 | SEK53.71 | 49.4% |

| HBX Group International (BME:HBX) | €9.90 | €19.37 | 48.9% |

Let's explore several standout options from the results in the screener.

Bittium Oyj (HLSE:BITTI)

Overview: Bittium Oyj is a company that offers communications and connectivity solutions, healthcare technology products and services, as well as biosignal measuring and monitoring across Finland, Germany, and the United States with a market cap of €243.08 million.

Operations: The company's revenue segments include €29.80 million from medical, €51.60 million from defense and security, and €14.32 million from engineering services.

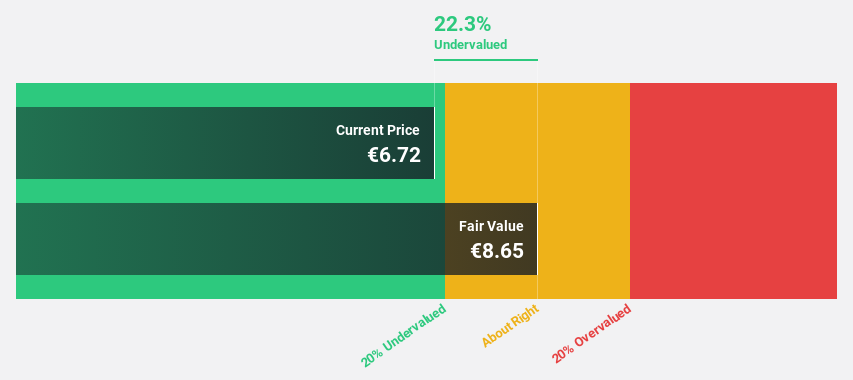

Estimated Discount To Fair Value: 21.4%

Bittium Oyj is trading at €6.85, significantly below its estimated fair value of €8.71, indicating potential undervaluation based on cash flows. Despite recent share price volatility, the company projects strong earnings growth of 20.45% annually over the next three years, outpacing the Finnish market's growth rate. However, revenue growth is expected to be moderate at 10.2% annually and return on equity remains forecasted low at 9.5%. Recent dividend approval and stable guidance further support its financial outlook.

- Our growth report here indicates Bittium Oyj may be poised for an improving outlook.

- Navigate through the intricacies of Bittium Oyj with our comprehensive financial health report here.

Yubico (OM:YUBICO)

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK13.12 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment information for Yubico AB. Therefore, I am unable to summarize the company's revenue segments in a sentence.

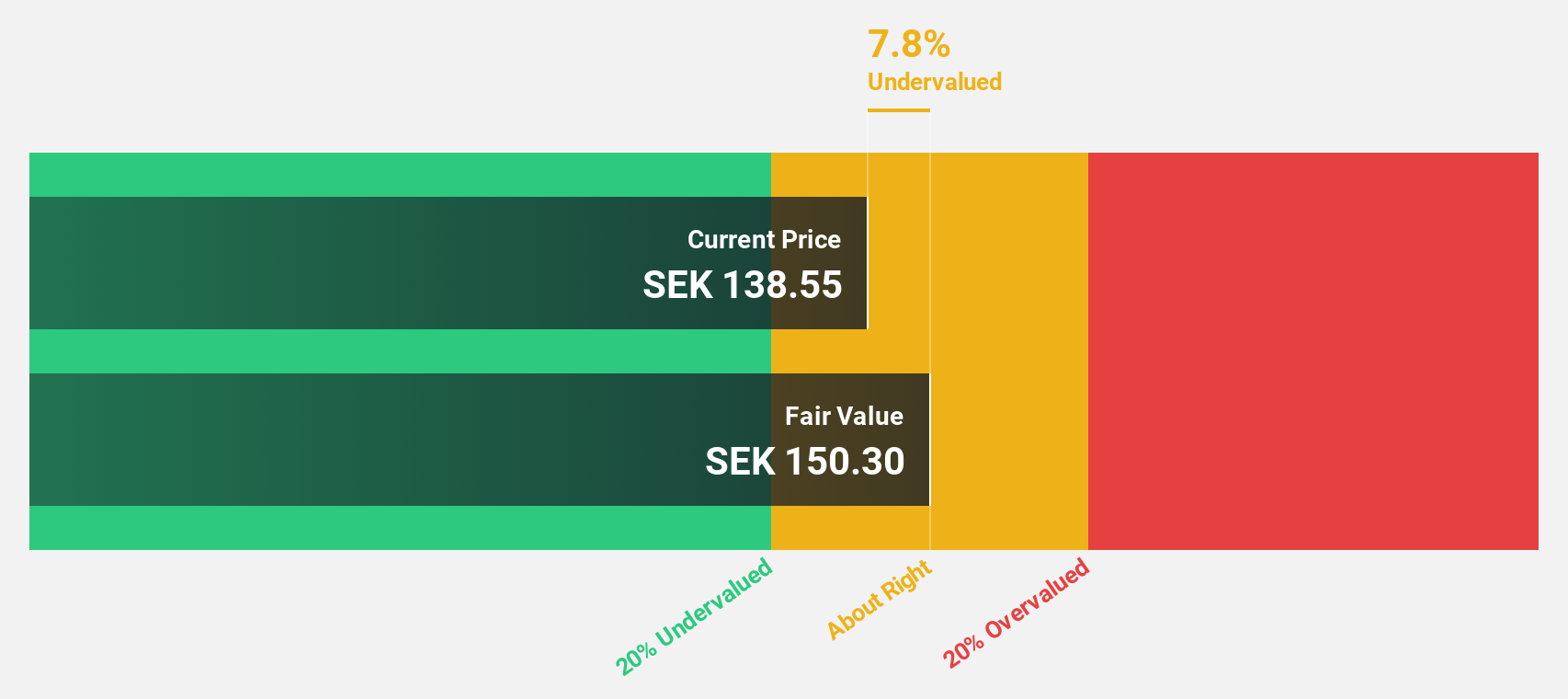

Estimated Discount To Fair Value: 11.4%

Yubico, trading at SEK 152.05, is undervalued with an estimated fair value of SEK 171.64. Despite a recent dip in net income to SEK 51.3 million from SEK 73.8 million last year, Yubico's revenue growth forecast exceeds the Swedish market average significantly at over 20% annually. The company's strategic expansion of YubiKey services across the EU and globally enhances its market position and could drive future cash flow improvements amidst strong analyst consensus on price appreciation potential.

- Insights from our recent growth report point to a promising forecast for Yubico's business outlook.

- Click to explore a detailed breakdown of our findings in Yubico's balance sheet health report.

mobilezone holding ag (SWX:MOZN)

Overview: Mobilezone holding ag, along with its subsidiaries, offers mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland, with a market cap of CHF523.95 million.

Operations: The company's revenue segments consist of CHF731.96 million from Germany and CHF275.76 million from Switzerland.

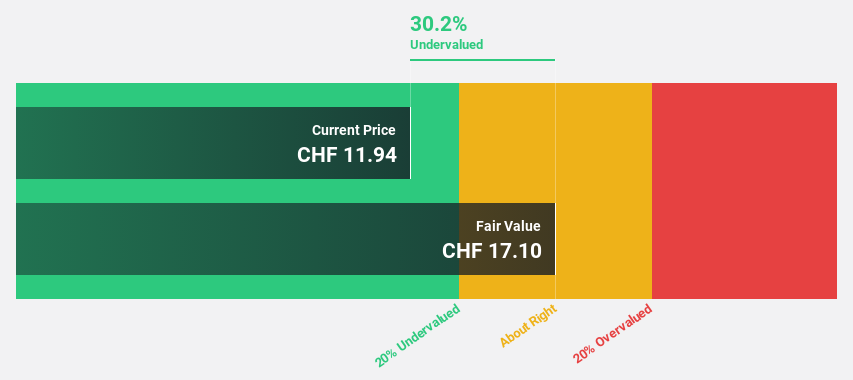

Estimated Discount To Fair Value: 29.1%

Mobilezone holding ag, trading at CHF 12.14, is significantly undervalued with a fair value estimate of CHF 17.12. Despite a decline in net income to CHF 16.98 million from the previous year's CHF 48.09 million and lower profit margins, earnings are forecast to grow over 20% annually, outpacing the Swiss market average of 10.7%. However, high debt levels and negative shareholder equity pose risks to financial stability despite strong projected earnings growth.

- Upon reviewing our latest growth report, mobilezone holding ag's projected financial performance appears quite optimistic.

- Click here to discover the nuances of mobilezone holding ag with our detailed financial health report.

Turning Ideas Into Actions

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 183 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland.

Established dividend payer moderate.

Similar Companies

Market Insights

Community Narratives