3 European Growth Companies With Up To 36% Insider Ownership

Reviewed by Simply Wall St

As the European market navigates a mixed landscape with slight fluctuations in major indices and potential policy shifts by the European Central Bank, investors are keenly observing growth opportunities within the region. In this context, stocks with significant insider ownership often signal strong confidence from those intimately familiar with company operations, making them an intriguing focus for those seeking to understand potential growth trajectories amidst current economic conditions.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Skolon (OM:SKOLON) | 38.3% | 126.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

Paratus Energy Services (OB:PLSV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Paratus Energy Services Ltd. operates through its subsidiaries to provide drilling services with a fleet of jack-up rigs in Mexico, and has a market cap of NOK7.10 billion.

Operations: The company's revenue segments include $166.70 million from Fontis and $233.90 million from Seagems.

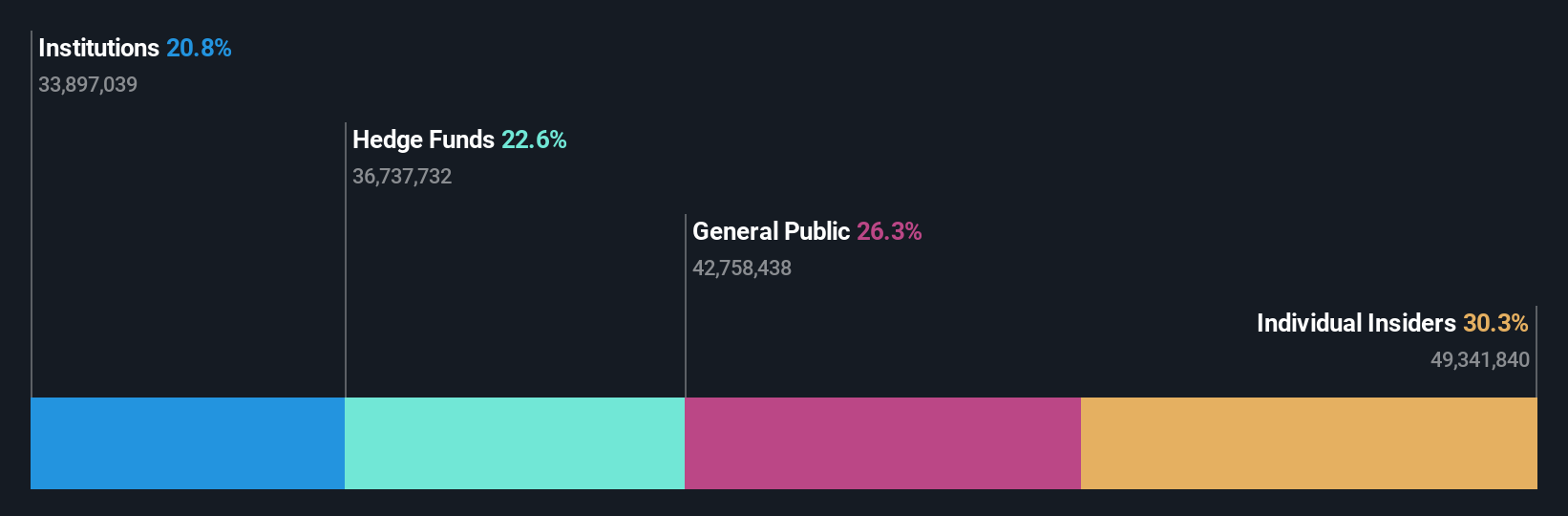

Insider Ownership: 30.3%

Paratus Energy Services demonstrates strong growth potential with earnings increasing by 92.6% over the past year and forecasted to grow annually at 21.88%, outpacing the Norwegian market's expected growth. Despite trading at a significant discount to its estimated fair value, concerns arise from its unsustainable dividend yield of 20.5% and interest payments not being well covered by earnings. Recent financial maneuvers include a successful tender offer funded by proceeds from an asset sale, reducing debt obligations slightly.

- Click here and access our complete growth analysis report to understand the dynamics of Paratus Energy Services.

- Our expertly prepared valuation report Paratus Energy Services implies its share price may be lower than expected.

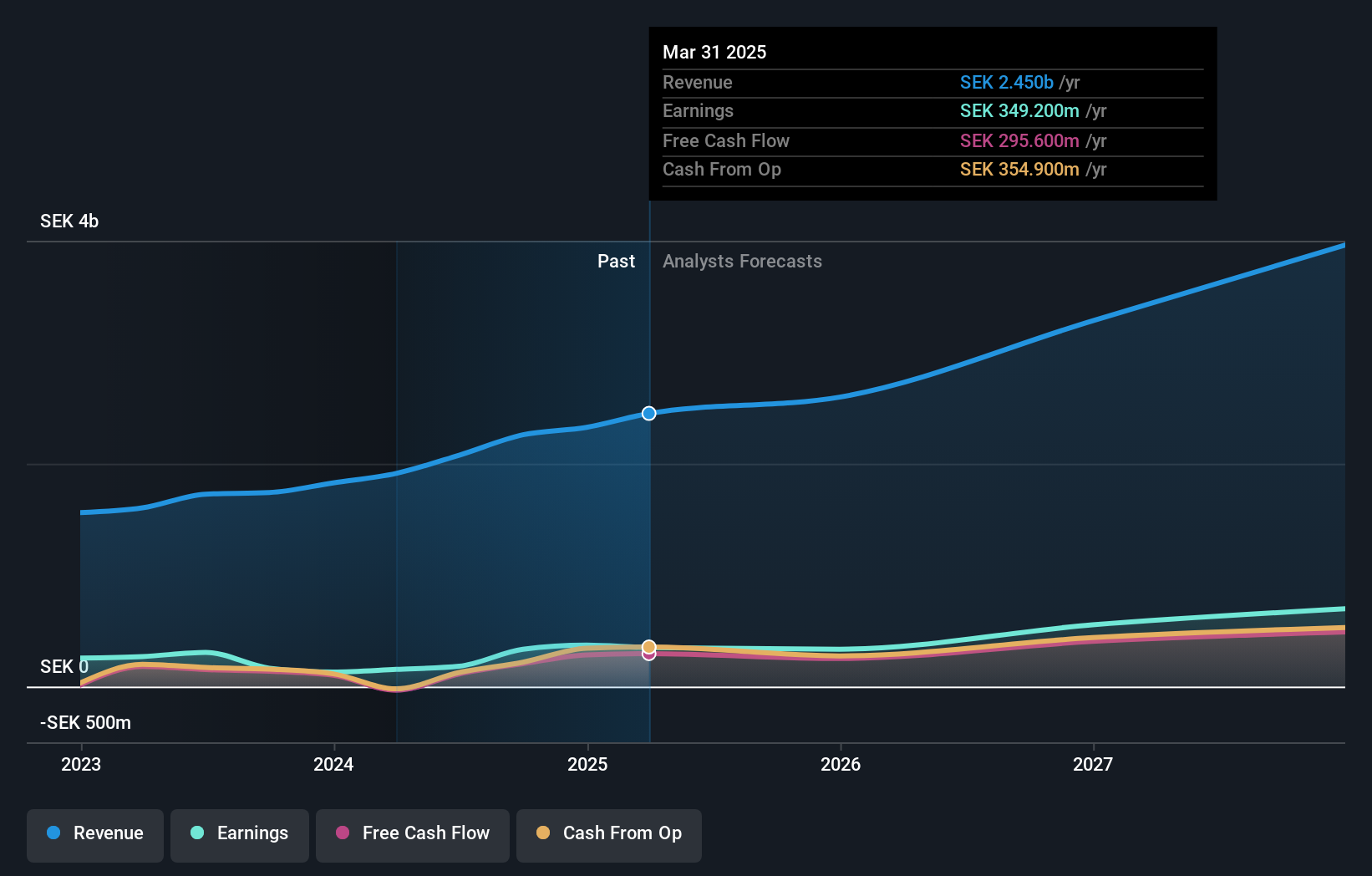

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yubico AB provides authentication solutions for computers, networks, and online services with a market cap of SEK6.63 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, which generated SEK2.29 billion.

Insider Ownership: 36.7%

Yubico's growth trajectory is underscored by a forecasted 37% annual earnings increase, outpacing the Swedish market. Despite a slight revenue dip in recent quarters, insider confidence remains high with substantial share purchases and no significant sales. The company's strategic partnerships, such as with Dashlane for passwordless security solutions, bolster its market position. Recent leadership changes aim to leverage cybersecurity expertise for continued innovation amidst volatile share prices and moderate revenue growth expectations.

- Delve into the full analysis future growth report here for a deeper understanding of Yubico.

- The analysis detailed in our Yubico valuation report hints at an deflated share price compared to its estimated value.

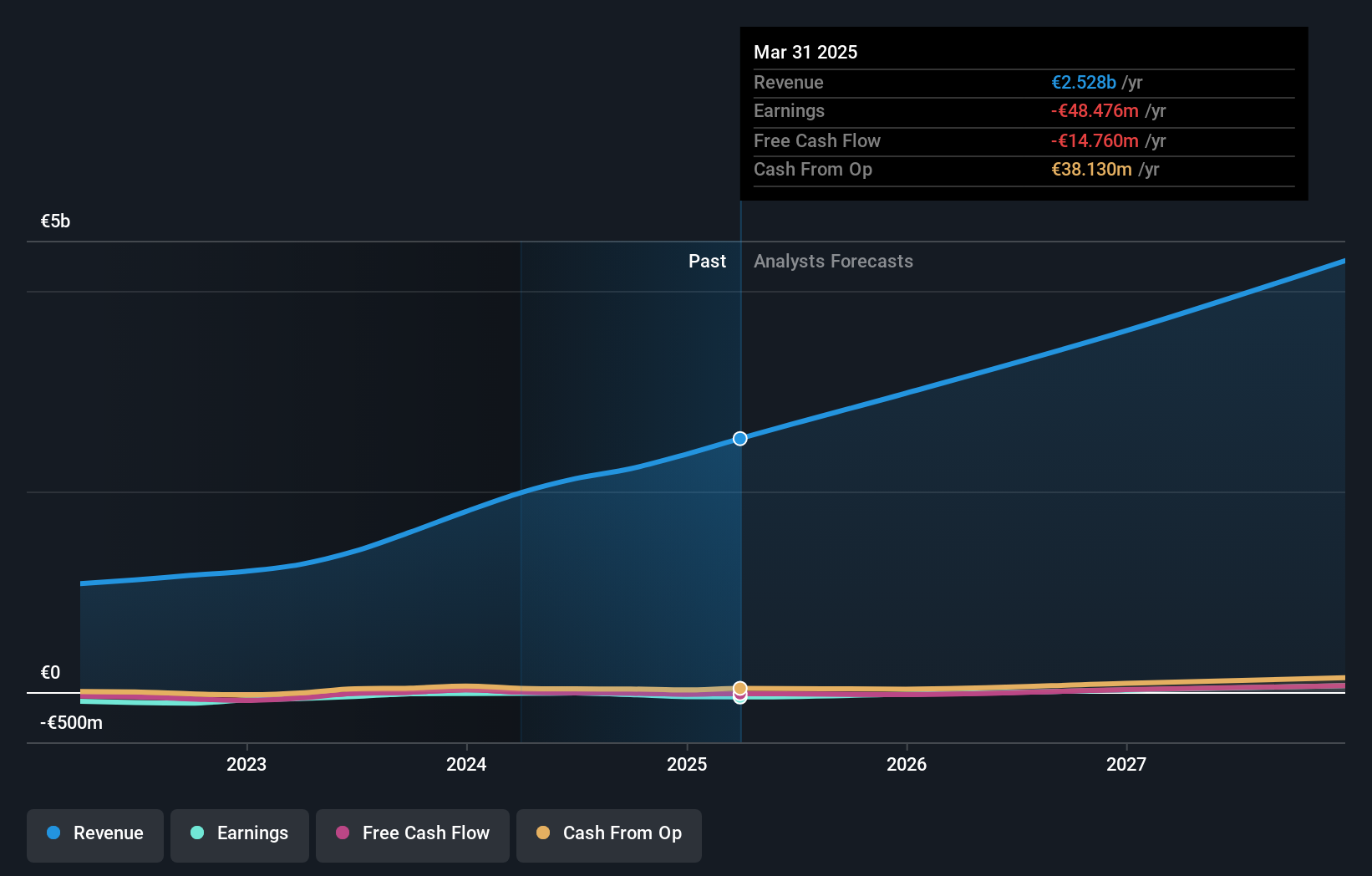

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €1.33 billion.

Operations: The company's revenue segments comprise €2.30 billion from the DACH region and €519 million from its international operations.

Insider Ownership: 13.5%

Redcare Pharmacy's growth is highlighted by a forecasted 61.29% annual earnings increase, surpassing the German market's average. The recent appointment of Hendrik Krampe as CFO, with his extensive e-commerce experience from Amazon and eBay, aligns with the company's strategy to enhance scalability and profitability. Despite reporting a net loss of €8.71 million for nine months ending September 2025, sales rose to €2.15 billion from €1.70 billion year-on-year, reflecting robust revenue growth momentum.

- Unlock comprehensive insights into our analysis of Redcare Pharmacy stock in this growth report.

- According our valuation report, there's an indication that Redcare Pharmacy's share price might be on the expensive side.

Where To Now?

- Unlock our comprehensive list of 210 Fast Growing European Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion