Exploring 3 Undervalued Small Caps With Recent Insider Activity

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and key indices like the S&P 600 for small-cap stocks experiencing moderate fluctuations, investors are keenly observing how these dynamics impact smaller companies. In this environment, identifying promising small-cap stocks often involves looking at those with strong fundamentals and recent insider activity, which can signal potential confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 15.3x | 1.3x | 41.60% | ★★★★★☆ |

| Paradeep Phosphates | 25.6x | 0.8x | 25.90% | ★★★★★☆ |

| Maharashtra Seamless | 11.4x | 2.0x | 27.88% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.58% | ★★★★★☆ |

| ABG Sundal Collier Holding | 12.7x | 2.1x | 39.95% | ★★★★☆☆ |

| Avia Avian | 15.2x | 3.5x | 18.32% | ★★★★☆☆ |

| Kambi Group | 17.0x | 1.5x | 38.28% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.3x | -578.25% | ★★★☆☆☆ |

| Digital Mediatama Maxima | NA | 1.3x | 10.05% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

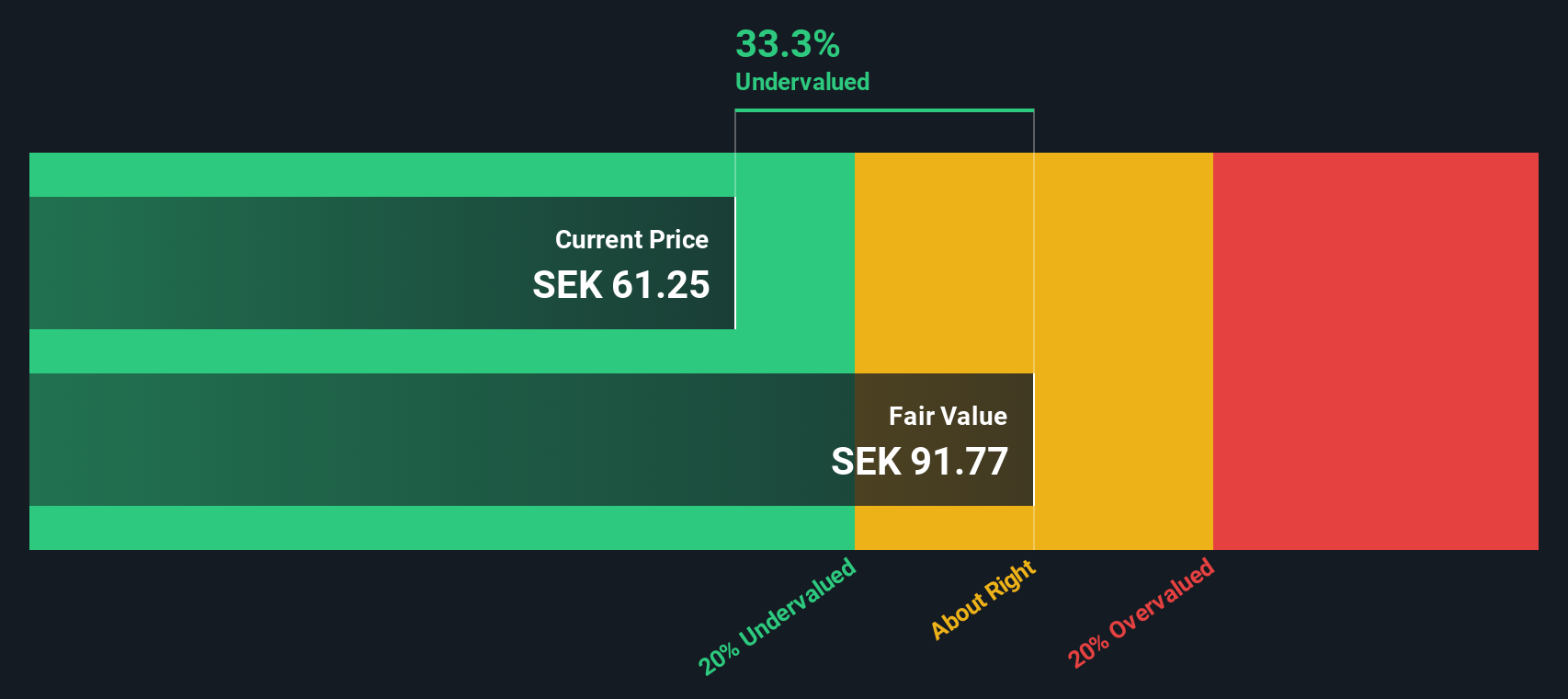

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a communications software company that specializes in caller identification, spam blocking, and messaging services, with a market capitalization of SEK 17.93 billion.

Operations: The company generates revenue primarily from its communications software segment, with a recent gross profit margin of 76.18%. Operating expenses are significant, with general and administrative expenses accounting for a substantial portion.

PE: 36.3x

Truecaller, a communication verification and fraud prevention leader, recently saw insider confidence with Nami Zarringhalam purchasing 22,832 shares for approximately SEK 986,114 in December 2024. This small company is poised for growth with earnings expected to rise by over 23% annually. Despite relying entirely on external borrowing for funding, Truecaller's strategic partnerships with companies like Nawy and Commercial International Bank enhance its market presence. Recent leadership changes include appointing Rishit Jhunjhunwala as Group CEO from January 2025, signaling a focus on innovation and expansion in India.

- Unlock comprehensive insights into our analysis of Truecaller stock in this valuation report.

Explore historical data to track Truecaller's performance over time in our Past section.

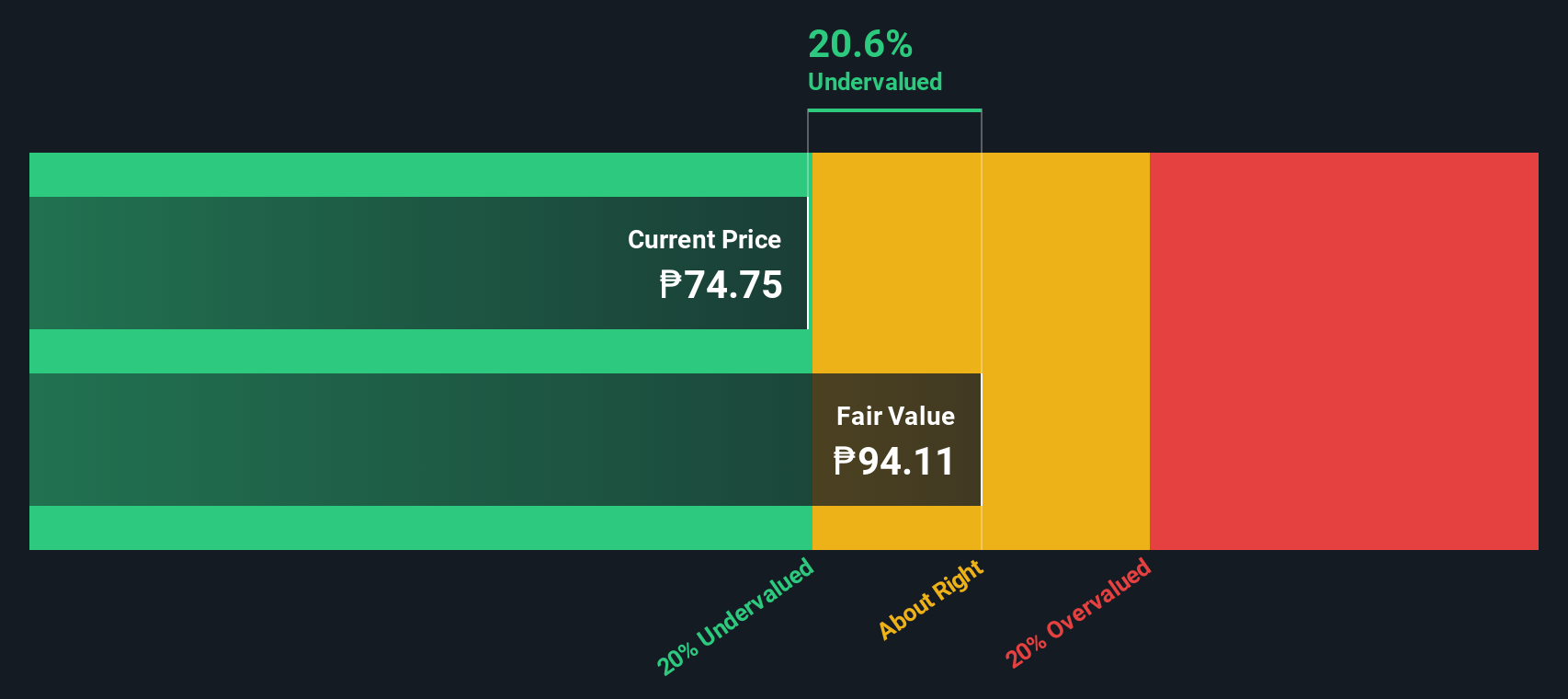

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia United Bank provides a range of financial services including branch banking, consumer banking, commercial banking, and treasury operations with a market capitalization of ₱40.23 billion.

Operations: Asia United Bank generates revenue primarily through Branch Banking and Commercial Banking, with significant contributions from Treasury activities. The company's gross profit margin has consistently remained above 98%, highlighting efficient cost management relative to its revenue. Operating expenses are largely driven by general and administrative expenses, which have shown a steady increase over the periods observed.

PE: 4.4x

Asia United Bank's recent financial performance highlights its potential as a promising investment in the smaller company category. Their third-quarter net income rose to PHP 3,346 million from PHP 1,951 million year-on-year, indicating strong earnings growth. Despite having a high bad loans ratio at 2%, insider confidence is evident with Manuel Gomez purchasing over 15,000 shares valued at approximately PHP 890,310 in November 2024. This insider activity suggests optimism about future prospects despite current challenges.

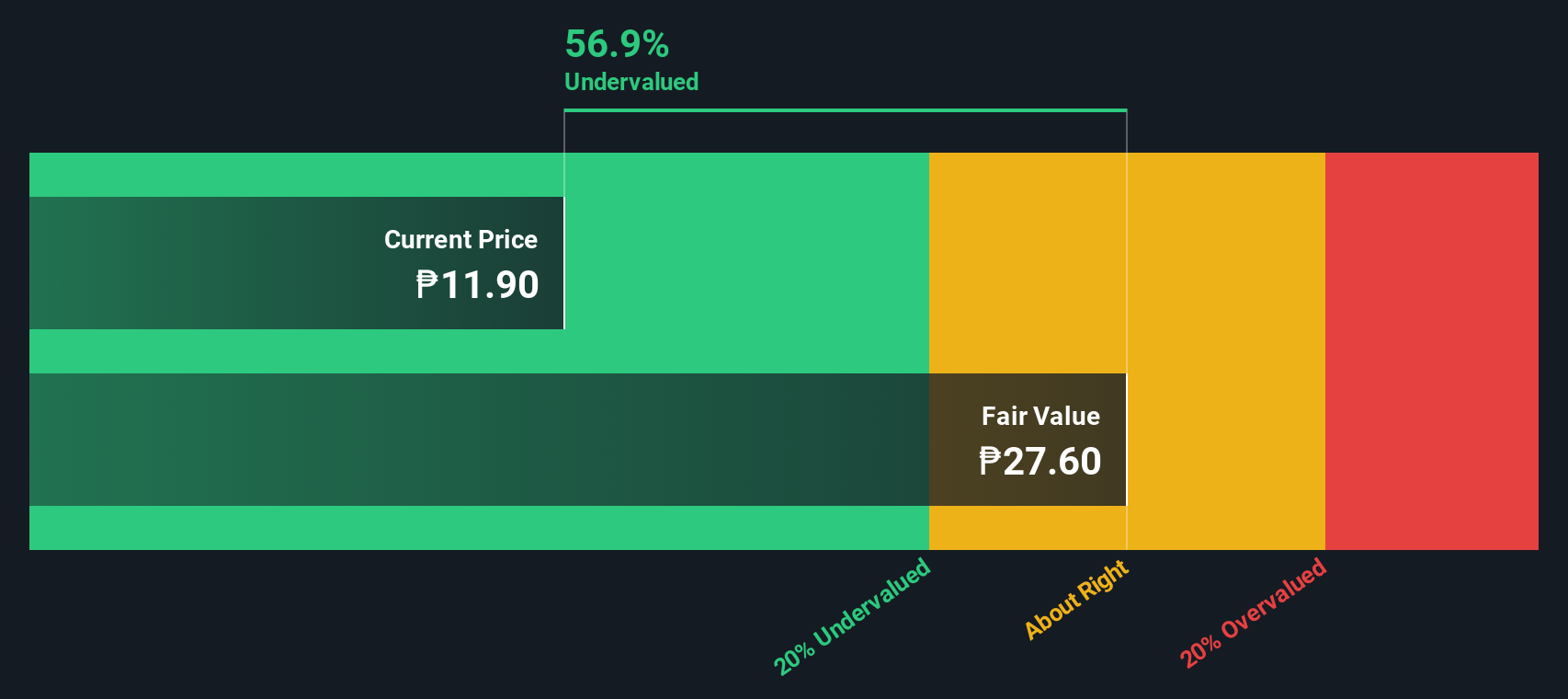

Pryce (PSE:PPC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pryce is a company engaged in the distribution of liquefied petroleum and industrial gases, real estate development, and pharmaceutical products with a market capitalization of ₱7.43 billion.

Operations: Pryce generates significant revenue primarily from its Liquefied Petroleum and Industrial Gases segment, contributing ₱19.88 billion. The company has seen a notable trend in gross profit margin, which reached 30.18% as of June 2024, indicating an improvement over previous periods. Operating expenses are a major cost component, with sales and marketing expenses being substantial within this category.

PE: 7.2x

Pryce's recent financial performance highlights its potential as an undervalued stock. For the third quarter of 2024, the company reported a significant increase in net income to PHP 831.73 million from PHP 692.28 million year-over-year, with revenue also rising to PHP 5,462.64 million from PHP 4,414.4 million. Insider confidence is evident with their President purchasing additional shares worth over PHP 104,000 in late 2024, reflecting belief in the company's future prospects despite reliance on external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of Pryce.

Examine Pryce's past performance report to understand how it has performed in the past.

Where To Now?

- Delve into our full catalog of 180 Undervalued Small Caps With Insider Buying here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives