Could Truecaller’s (OM:TRUE B) AI Push Mark a Turning Point in Its B2B Revenue Ambitions?

Reviewed by Sasha Jovanovic

- In early October 2025, Truecaller unveiled adVantage, an AI-powered recommendation engine designed to personalize and optimize business messaging and advertising across its platform using real-time, anonymized behavioral data. During its pilot phase, adVantage achieved very large open rate increases in business messaging and drove improved click-through rates and measurable results for sectors including automotive, fintech, edtech, and e-commerce.

- By drawing on daily insights from over 200 million users, adVantage aims to improve engagement for brands while maintaining privacy standards for consumers, positioning Truecaller's B2B offerings as increasingly central to its business model.

- We'll examine how the launch of adVantage could accelerate Truecaller's shift toward higher-margin, AI-driven business services and recurring revenue streams.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Truecaller Investment Narrative Recap

To invest in Truecaller, you need confidence in its ability to shift from reliance on third-party ad networks toward higher-margin, AI-powered services that grow recurring revenue streams. The recent adVantage launch could be transformative, as early evidence of sharp uplift in business messaging engagement directly addresses the most immediate growth catalyst; however, the company's sensitivity to third-party advertising market fluctuations and foreign exchange movements, especially with heavy Indian exposure, remains the biggest risk and has not been fundamentally altered by this announcement.

Among recent updates, the launch of Secure Calls in June 2025, focused on business identity verification and anti-spoofing, stands out as especially relevant. Both Secure Calls and adVantage underscore Truecaller's ambitions to drive value in enterprise communications and highlight how investments in AI-powered solutions can support the ongoing transition toward stable, recurring B2B revenue streams.

Yet, in contrast, investors should be mindful that even significant tech innovations like adVantage may not fully shield overall earnings from macro-driven volatility in third-party ad demand…

Read the full narrative on Truecaller (it's free!)

Truecaller's narrative projects SEK3.5 billion revenue and SEK1.1 billion earnings by 2028. This requires 20.2% yearly revenue growth and an earnings increase of SEK612 million from the current SEK488 million.

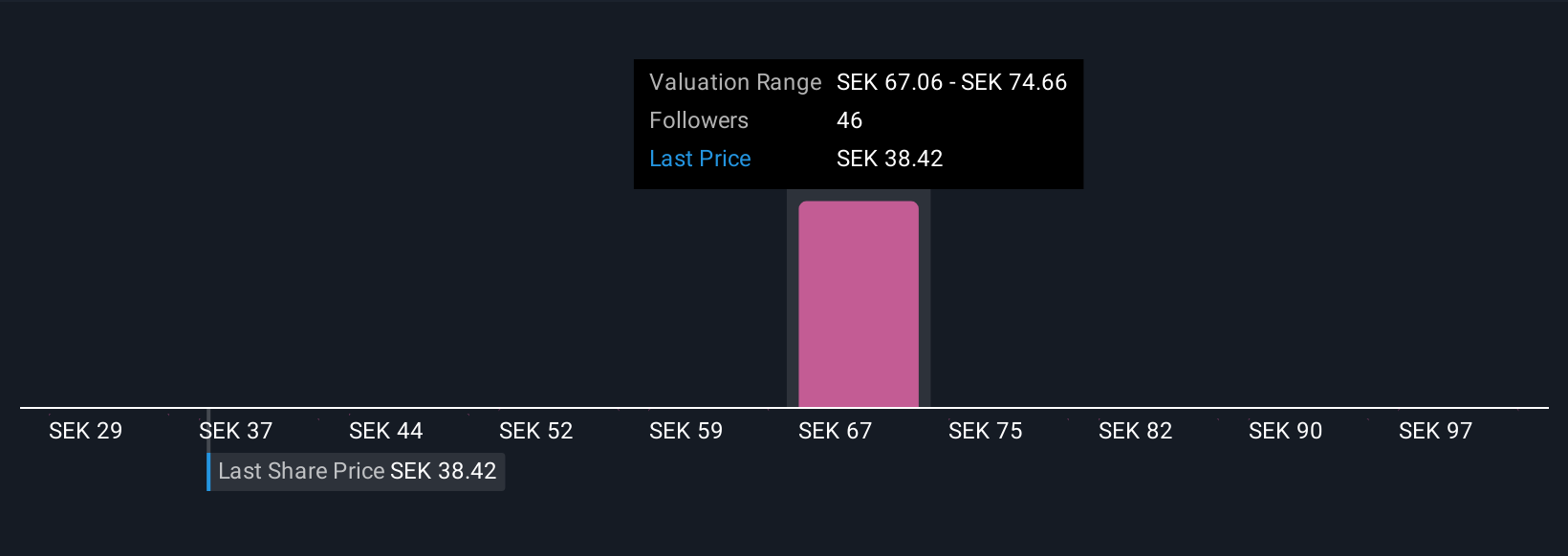

Uncover how Truecaller's forecasts yield a SEK74.17 fair value, a 89% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Truecaller span SEK 29.06 to SEK 105.06, reflecting 14 distinct Simply Wall St Community perspectives. While many focus on the upside from Truecaller’s expanding AI offerings, the business remains exposed to volatility in third-party programmatic ad demand, influencing confidence in future earnings growth.

Explore 14 other fair value estimates on Truecaller - why the stock might be worth over 2x more than the current price!

Build Your Own Truecaller Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Truecaller research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Truecaller research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Truecaller's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives