As global markets react to the recent U.S. election results and a Federal Reserve rate cut, major benchmarks like the S&P 500 have surged to record highs, driven by investor optimism over potential economic growth and tax reforms. Amidst this backdrop of market volatility and shifting economic policies, dividend stocks continue to offer investors a measure of stability through regular income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.04% | ★★★★★★ |

| Globeride (TSE:7990) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.87% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Tong Yang Life Insurance (KOSE:A082640)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Life Insurance Co., Ltd. operates in the life insurance sector in South Korea, with a market capitalization of approximately ₩868.62 billion.

Operations: Tong Yang Life Insurance Co., Ltd. generates its revenue primarily from the life and health insurance segment, amounting to approximately ₩2.94 billion.

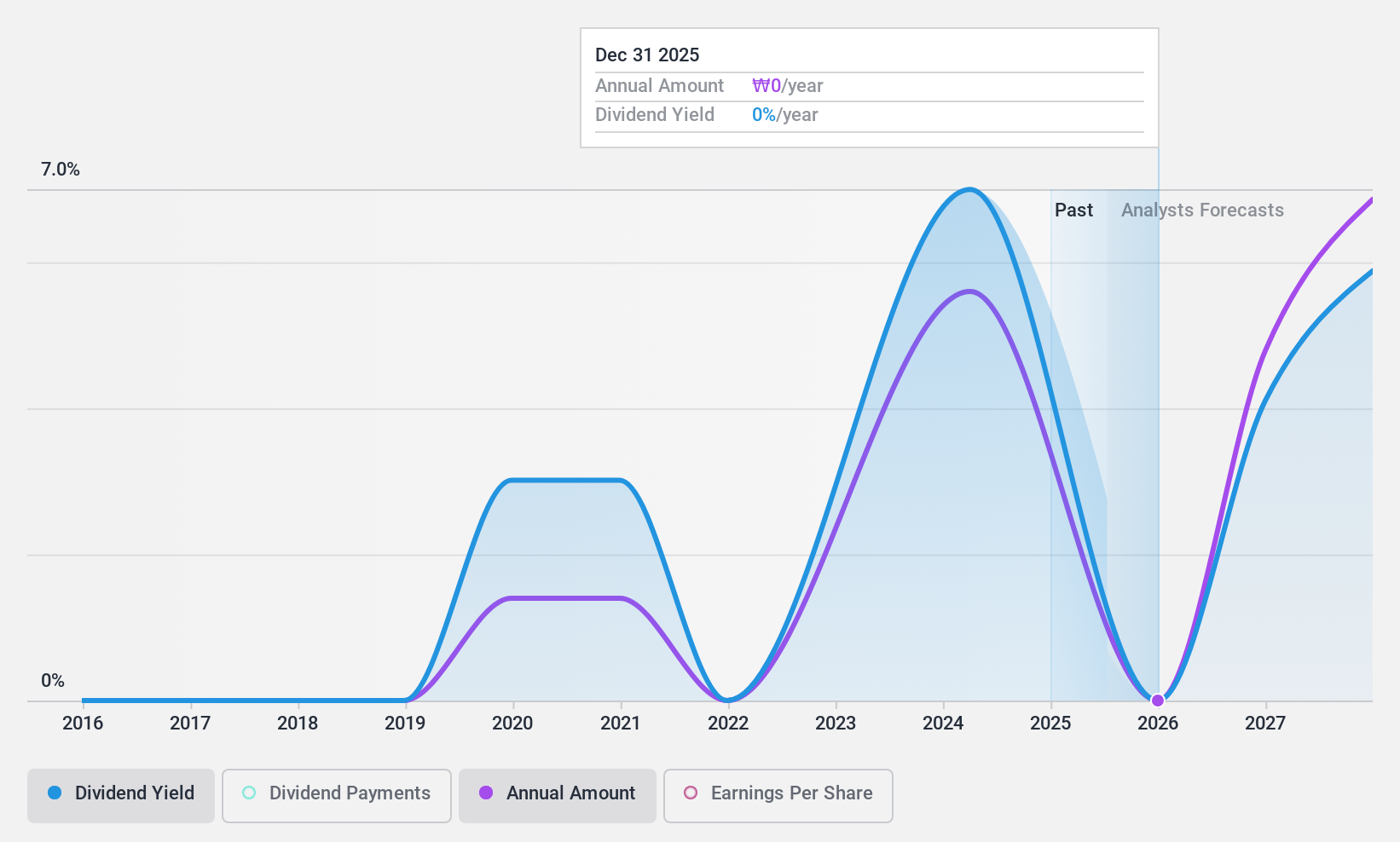

Dividend Yield: 6.7%

Tong Yang Life Insurance offers a compelling dividend profile with a low payout ratio of 24.7%, ensuring dividends are well covered by earnings and cash flows, reflected in a cash payout ratio of 5.7%. Recent earnings growth has been significant, with net income for Q2 2024 at KRW 85.68 billion compared to KRW 37.18 billion the previous year. The acquisition by Woori Financial Group for KRW 1.3 trillion could influence future dividend policies.

- Navigate through the intricacies of Tong Yang Life Insurance with our comprehensive dividend report here.

- Our expertly prepared valuation report Tong Yang Life Insurance implies its share price may be lower than expected.

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Softronic AB (publ) offers IT and management services mainly in Sweden, with a market capitalization of approximately SEK13 billion.

Operations: Softronic AB (publ) generates revenue from its Computer Services segment, totaling SEK848.52 million.

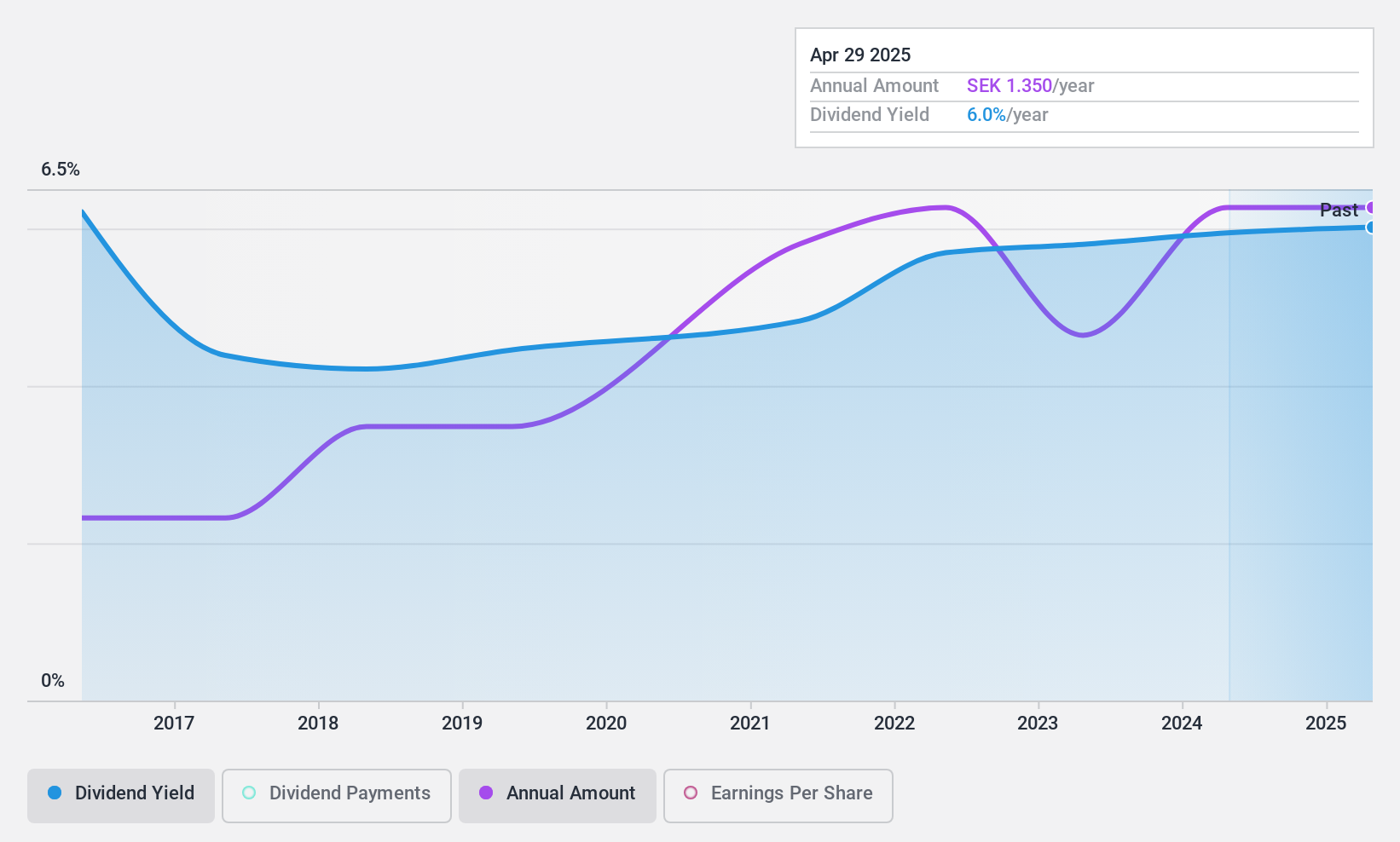

Dividend Yield: 5.5%

Softronic's dividend profile shows mixed stability, with past volatility and unreliability over the last decade. However, dividends are covered by earnings (82.9% payout ratio) and cash flows (60.9% cash payout ratio), suggesting sustainability. The dividend yield of 5.47% ranks in the top quartile of Swedish payers, and recent earnings growth supports this position—Q3 2024 saw net income rise to SEK 25.6 million from SEK 23 million year-on-year, indicating improved financial health.

- Get an in-depth perspective on Softronic's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Softronic's current price could be quite moderate.

Mitsubishi Shokuhin (TSE:7451)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Shokuhin Co., Ltd. is involved in the wholesale distribution of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries both in Japan and internationally, with a market cap of ¥210.59 billion.

Operations: Mitsubishi Shokuhin Co., Ltd.'s revenue segments include processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries.

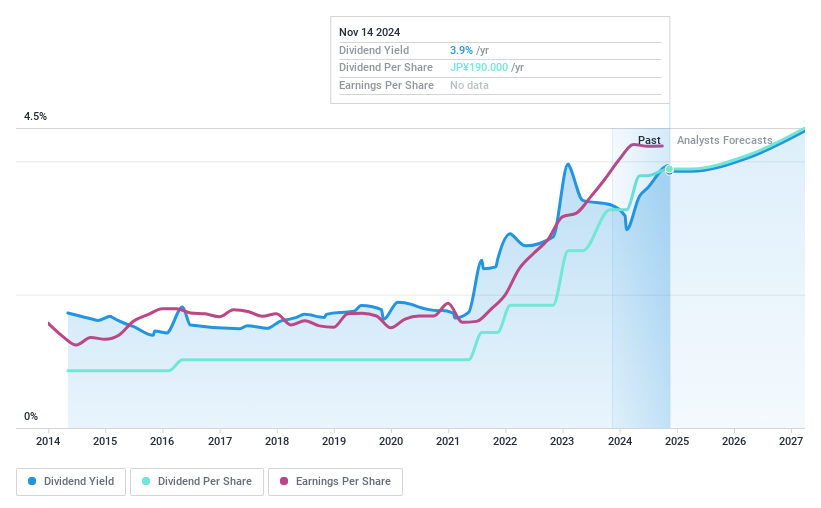

Dividend Yield: 3.9%

Mitsubishi Shokuhin has consistently increased dividends over the past decade, with recent hikes from JPY 80.00 to JPY 90.00 per share and a forecast of JPY 95.00 for year-end. Despite a top-tier dividend yield of 3.85% in Japan, dividends aren't covered by free cash flow but are supported by a low payout ratio of 32.9%. The company projects net sales of ¥2.13 trillion and earnings per share of ¥525.32 for FY2025.

- Unlock comprehensive insights into our analysis of Mitsubishi Shokuhin stock in this dividend report.

- In light of our recent valuation report, it seems possible that Mitsubishi Shokuhin is trading behind its estimated value.

Key Takeaways

- Gain an insight into the universe of 1939 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SOF B

Outstanding track record with flawless balance sheet and pays a dividend.