- Sweden

- /

- Retail Distributors

- /

- OM:ZZ B

Undiscovered Gems Three Promising Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate the end of 2024, with major indices showing moderate gains despite a dip in consumer confidence and manufacturing activity, investors are keenly watching for opportunities that may arise from these fluctuations. In this climate, identifying promising stocks involves looking for companies with solid fundamentals and growth potential that can withstand broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

RVRC Holding (OM:RVRC)

Simply Wall St Value Rating: ★★★★★★

Overview: RVRC Holding AB (publ) operates in the e-commerce outdoor clothing sector across Germany, Sweden, Finland, and internationally with a market capitalization of approximately SEK4.64 billion.

Operations: RVRC Holding generates revenue primarily from its retail apparel segment, amounting to SEK1.85 billion. The company's financial performance is highlighted by a focus on this core revenue stream within the e-commerce outdoor clothing market.

RVRC Holding, a small player in the specialty retail sector, stands out with its debt-free status and high-quality earnings. Over the past year, earnings grew by 17.1%, surpassing industry averages and showcasing robust performance. The company reported a net income of SEK 46 million for Q1 2024, down from SEK 53 million last year, while sales increased to SEK 350 million from SEK 342 million. Trading at an attractive valuation—62.3% below estimated fair value—RVRC continues to offer good relative value compared to peers. With free cash flow positive and no debt burden, future prospects seem promising.

- Unlock comprehensive insights into our analysis of RVRC Holding stock in this health report.

Gain insights into RVRC Holding's historical performance by reviewing our past performance report.

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products in Sweden and internationally, with a market capitalization of SEK3.03 billion.

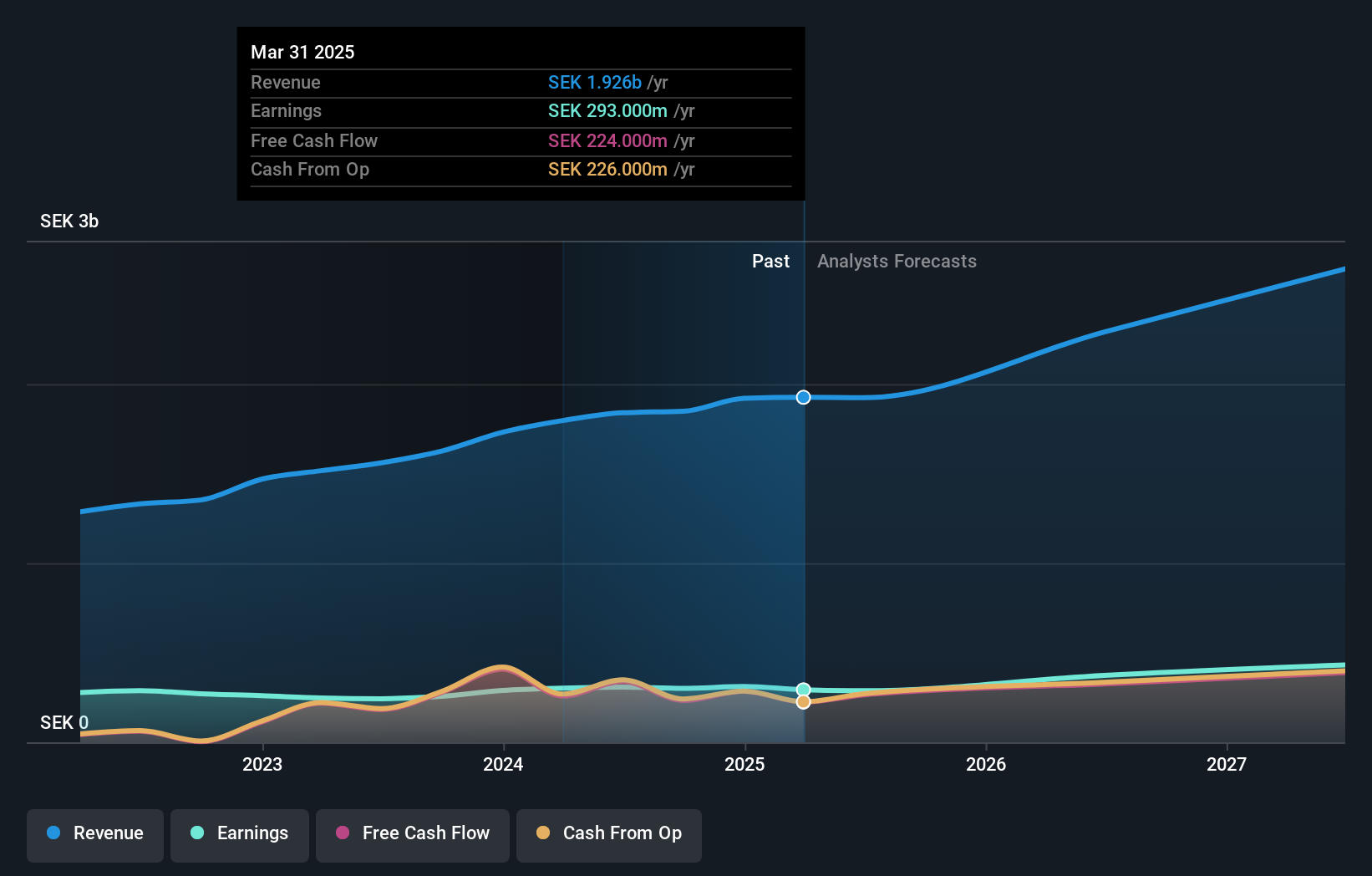

Operations: Zinzino generates revenue primarily from its Zinzino (Incl. VMA Life) segment, which accounts for SEK1.92 billion, while the Faun segment contributes SEK177.37 million.

Zinzino, a nimble player in the wellness sector, is making waves with its strategic expansion into the Canary Islands. This move aligns with their goal of reaching 1 million customers by 2025. Recent financials reveal third-quarter sales at SEK 505 million, up from SEK 417 million last year, though net income dipped to SEK 42 million from SEK 53 million. Despite this, annual revenue surged to SEK 1.86 billion from SEK 1.53 billion previously. Zinzino's innovative digital approach and focus on direct selling are likely driving these impressive numbers as they continue their global growth trajectory.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Value Rating: ★★★★★★

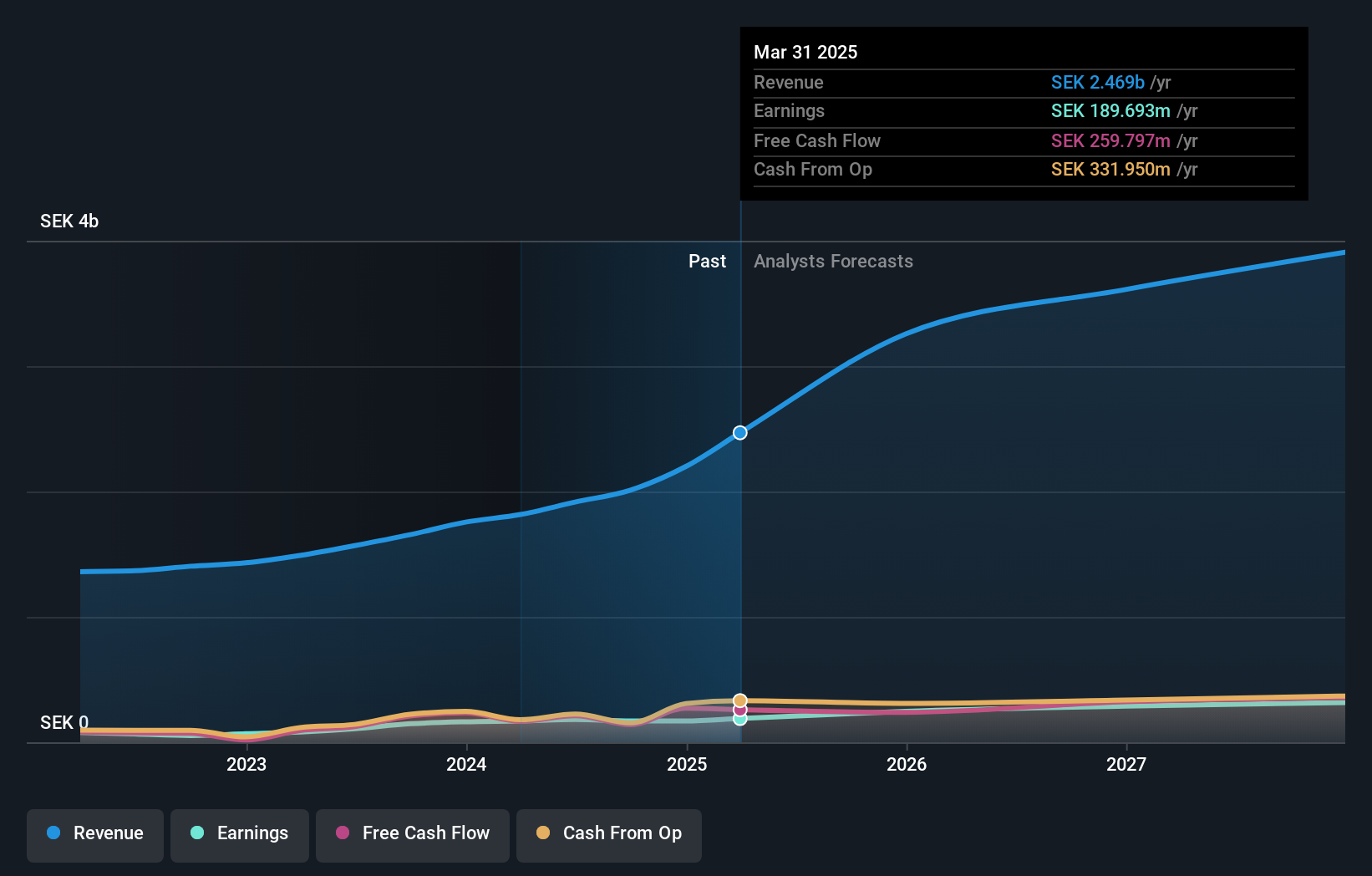

Overview: Mensch und Maschine Software SE specializes in providing CAD/CAM/CAE, product data management, and building information modeling/management solutions both in Germany and internationally, with a market cap of approximately €907.42 million.

Operations: M+M generates revenue primarily through its Software segment (€107.95 million) and Digitization segment (€242.22 million).

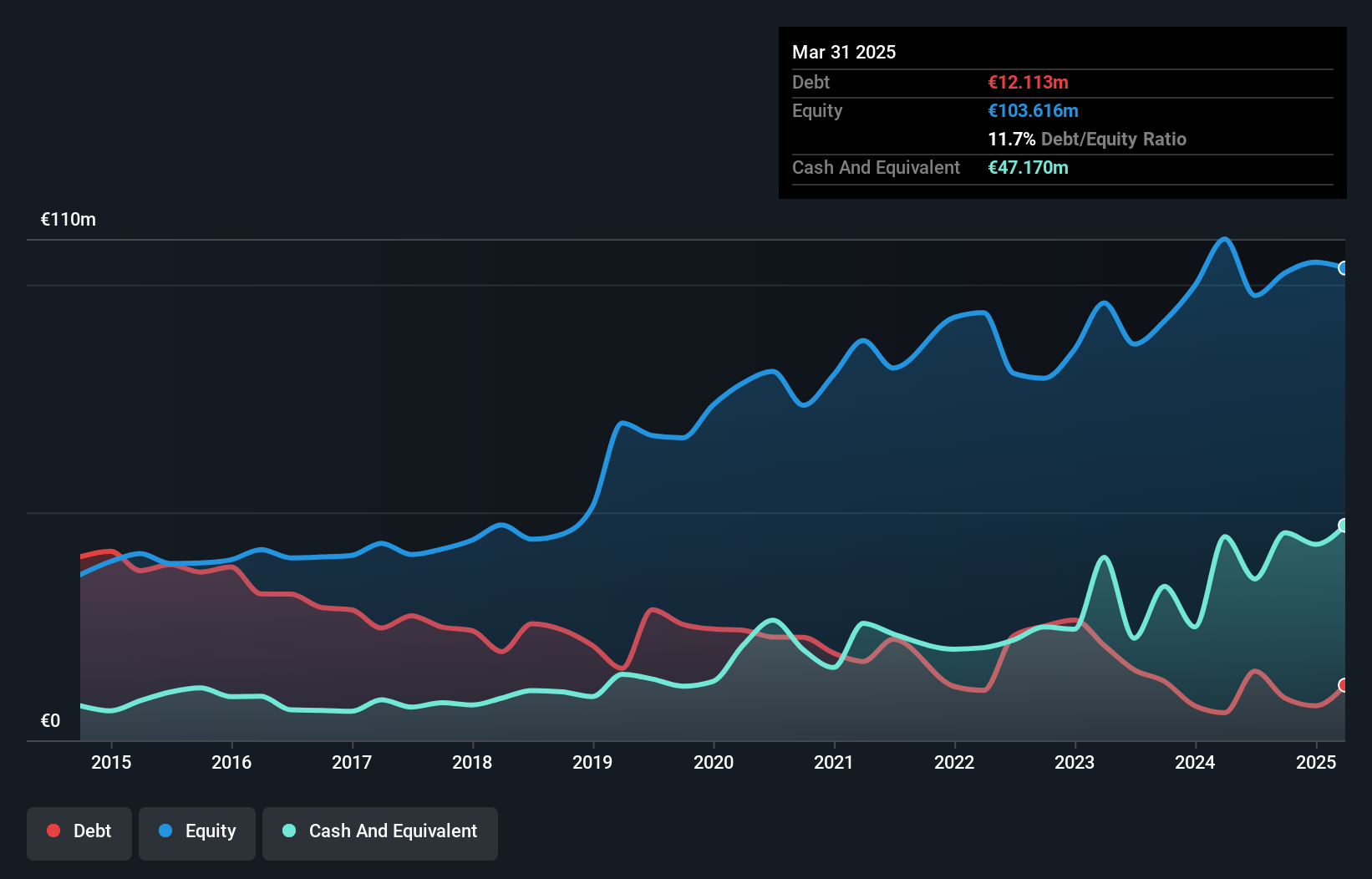

Mensch und Maschine Software, a notable player in the software sector, has demonstrated robust financial health with its cash exceeding total debt and an impressive EBIT covering interest payments 328 times over. The company has reduced its debt to equity ratio from 38.4% to just 9% over five years, reflecting prudent financial management. Recent earnings show significant growth; Q3 sales reached €94.11 million compared to €67.84 million last year, while net income increased to €6.43 million from €4.89 million previously. Trading at nearly half of its estimated fair value, it offers potential for value-seeking investors within the industry context.

Where To Now?

- Investigate our full lineup of 4647 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zinzino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ZZ B

Zinzino

A direct sales company, provides dietary supplements and skincare products in Sweden and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)