As we enter January 2025, global markets have shown mixed signals with U.S. consumer confidence declining and major stock indices experiencing moderate gains, while European stocks saw a slight uptick during the holiday-shortened week. Amidst this backdrop of economic uncertainty and fluctuating market performance, dividend stocks can offer investors potential stability and income through regular payouts, making them an attractive consideration for those seeking to navigate these dynamic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

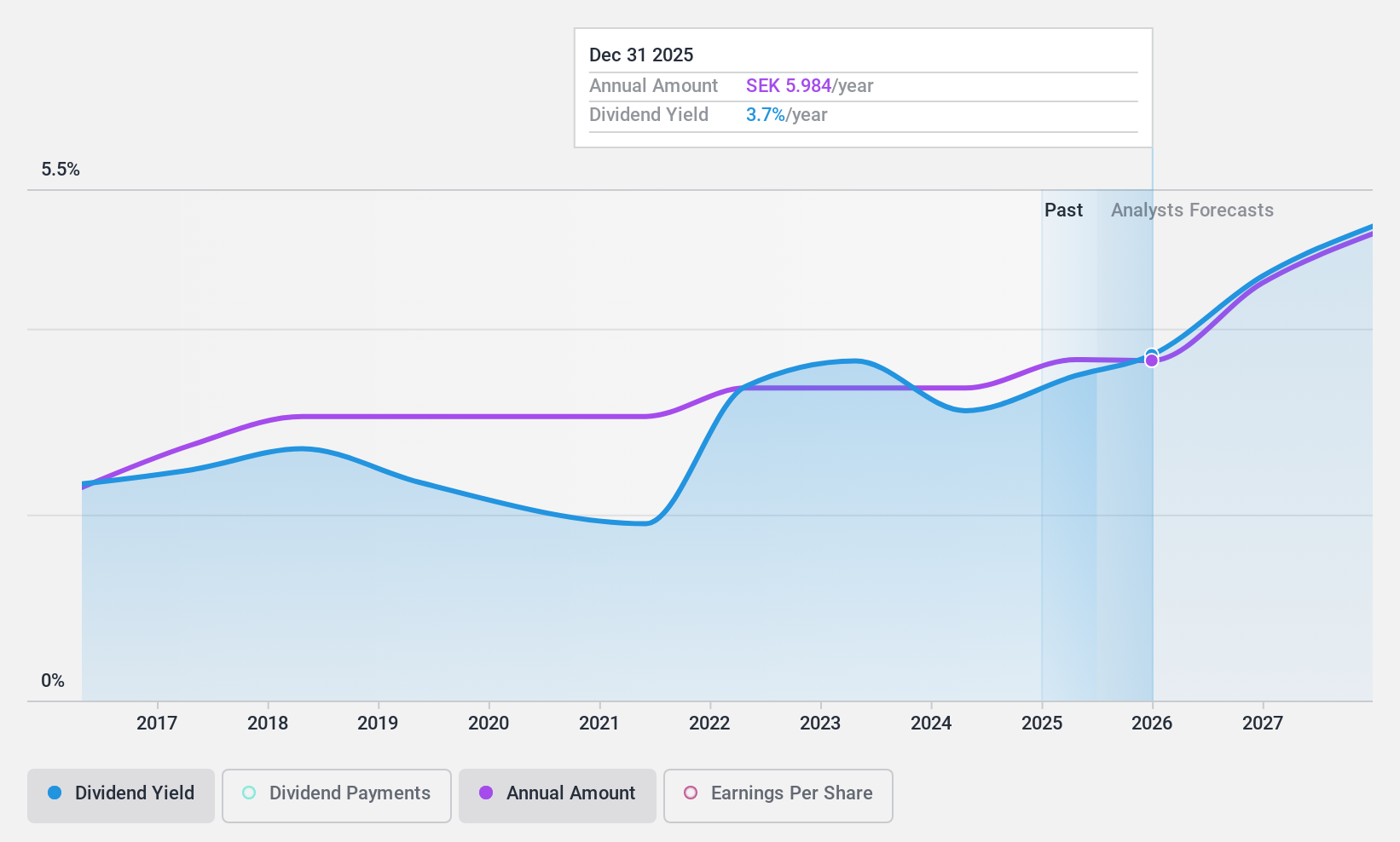

Afry (OM:AFRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Afry AB offers engineering, design, and advisory services across the infrastructure, industry, energy, and digitalization sectors in North and South America, Finland, and Central Europe with a market cap of SEK17.71 billion.

Operations: Afry AB generates its revenue from several segments, including Infrastructure (SEK10.42 billion), Industrial & Digital Solutions (SEK6.85 billion), Process Industries (SEK5.33 billion), Energy (SEK3.77 billion), and Management Consulting (SEK1.69 billion).

Dividend Yield: 3.5%

AFRY's dividend payments, while covered by earnings (52.1% payout ratio) and cash flows (41.4% cash payout ratio), have been volatile over the past decade, indicating an unreliable track record. Trading significantly below its fair value estimate, AFRY offers potential value despite a high debt level and a lower-than-top-tier dividend yield of 3.52%. Recent earnings showed stable net income year-over-year for Q3 2024, with improved nine-month results compared to the previous year.

- Dive into the specifics of Afry here with our thorough dividend report.

- Our valuation report here indicates Afry may be undervalued.

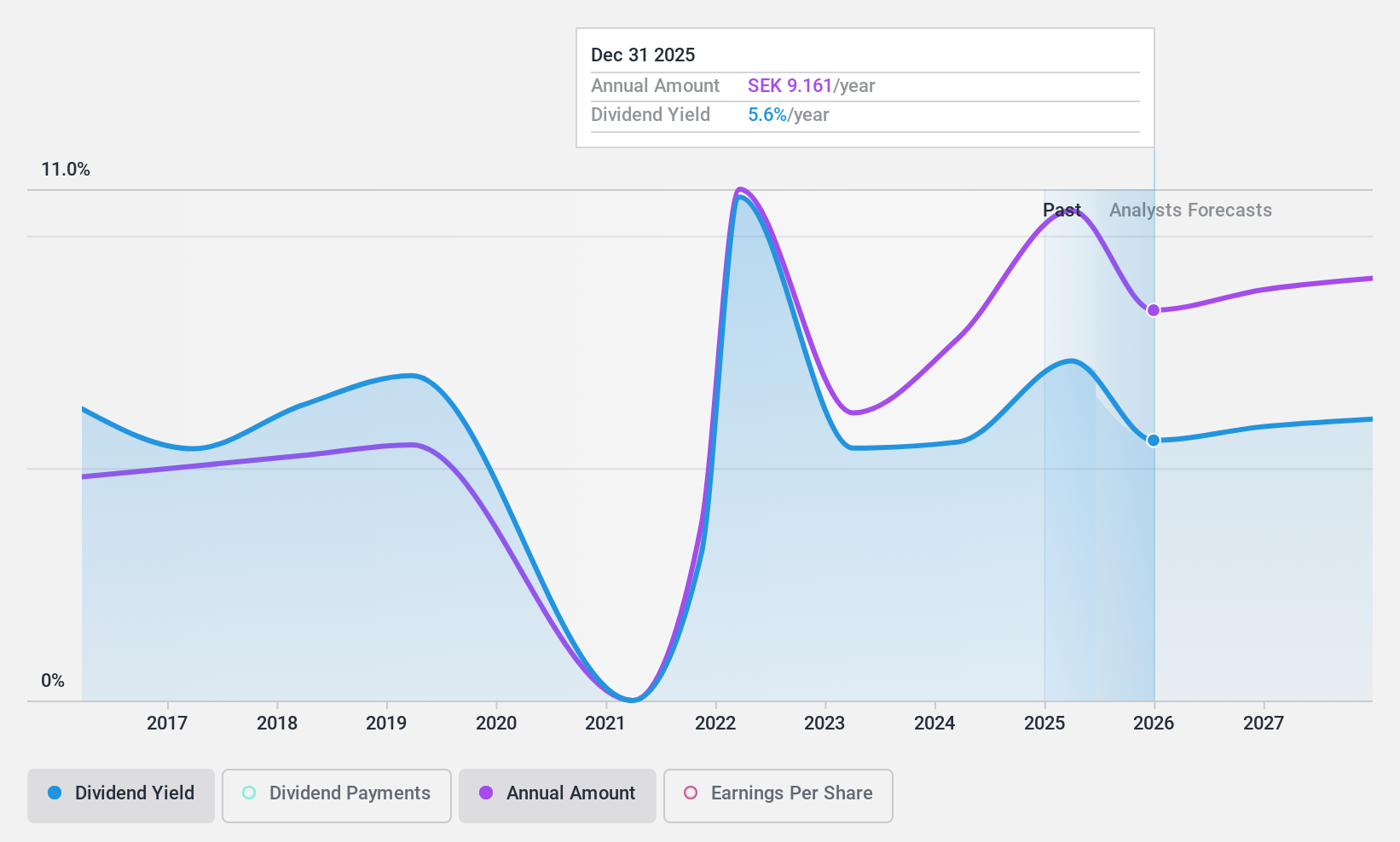

Skandinaviska Enskilda Banken (OM:SEB A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ) offers corporate, retail, investment, and private banking services with a market cap of approximately SEK311.18 billion.

Operations: Skandinaviska Enskilda Banken AB (publ) generates revenue from several segments, including Large Corporates & Financial Institutions (SEK32.00 billion), Corporate & Private Customers excluding Private Wealth Management & Family Office (SEK25.61 billion), Baltic operations (SEK13.46 billion), Private Wealth Management & Family Office (SEK4.63 billion), Life insurance services (SEK3.80 billion), and Asset Management (SEK3.30 billion).

Dividend Yield: 5.6%

Skandinaviska Enskilda Banken's dividend yield is among the top 25% in Sweden, supported by a low payout ratio of 47.7%, indicating current earnings coverage. However, its dividend history has been volatile over the past decade. Earnings are forecast to decline by 7.3% annually over three years, potentially impacting future dividends. Recent board changes and a $500 million fixed-income offering highlight ongoing strategic adjustments amid slightly lower Q3 earnings compared to last year.

- Click here to discover the nuances of Skandinaviska Enskilda Banken with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Skandinaviska Enskilda Banken is trading behind its estimated value.

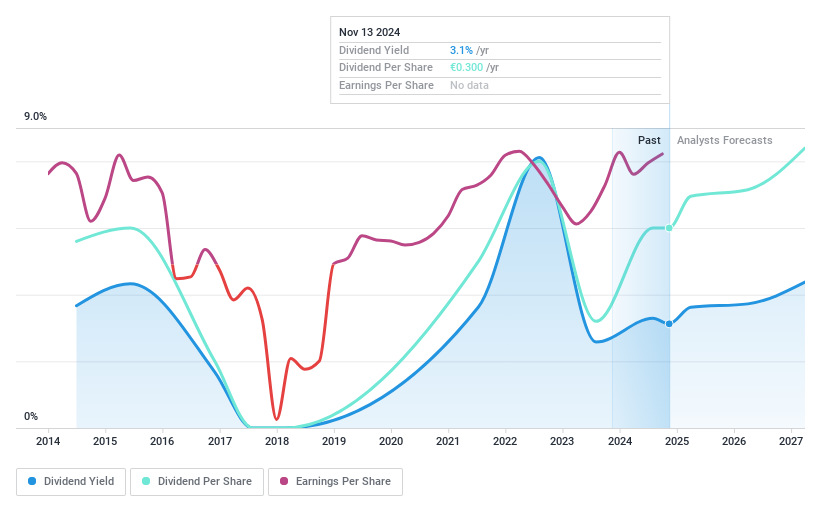

Bastei Lübbe (XTRA:BST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bastei Lübbe AG is a media company that publishes books, audiobooks, e-books, and other digital products in fiction and popular science across Germany, Austria, Luxembourg, and Switzerland with a market cap of €124.74 million.

Operations: Bastei Lübbe AG generates revenue primarily from its Novel Booklets segment, which contributes €7.21 million, and its Book segment (including e-books), which contributes €109.14 million.

Dividend Yield: 3.2%

Bastei Lübbe's dividend payments have grown over the past decade, yet they remain volatile and unreliable. The current payout ratio of 37% suggests dividends are well covered by earnings, though cash flow coverage is tighter at an 80.2% ratio. Despite trading below estimated fair value, its dividend yield of 3.17% is lower than top-tier German payers. Recent earnings show growth with a net income increase to €5.82 million for six months ending September 2024.

- Unlock comprehensive insights into our analysis of Bastei Lübbe stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bastei Lübbe shares in the market.

Make It Happen

- Click here to access our complete index of 1963 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives