Do You Know What Micro Systemation AB (publ)'s (STO:MSAB B) P/E Ratio Means?

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll look at Micro Systemation AB (publ)'s (STO:MSAB B) P/E ratio and reflect on what it tells us about the company's share price. Based on the last twelve months, Micro Systemation's P/E ratio is 37.93. That means that at current prices, buyers pay SEK37.93 for every SEK1 in trailing yearly profits.

Check out our latest analysis for Micro Systemation

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Micro Systemation:

P/E of 37.93 = SEK57 ÷ SEK1.5 (Based on the year to December 2018.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each SEK1 of company earnings. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Growth Rates Impact P/E Ratios

Companies that shrink earnings per share quickly will rapidly decrease the 'E' in the equation. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

Micro Systemation shrunk earnings per share by 48% over the last year. But EPS is up 27% over the last 5 years. And over the longer term (3 years) earnings per share have decreased 1.6% annually. This growth rate might warrant a low P/E ratio.

How Does Micro Systemation's P/E Ratio Compare To Its Peers?

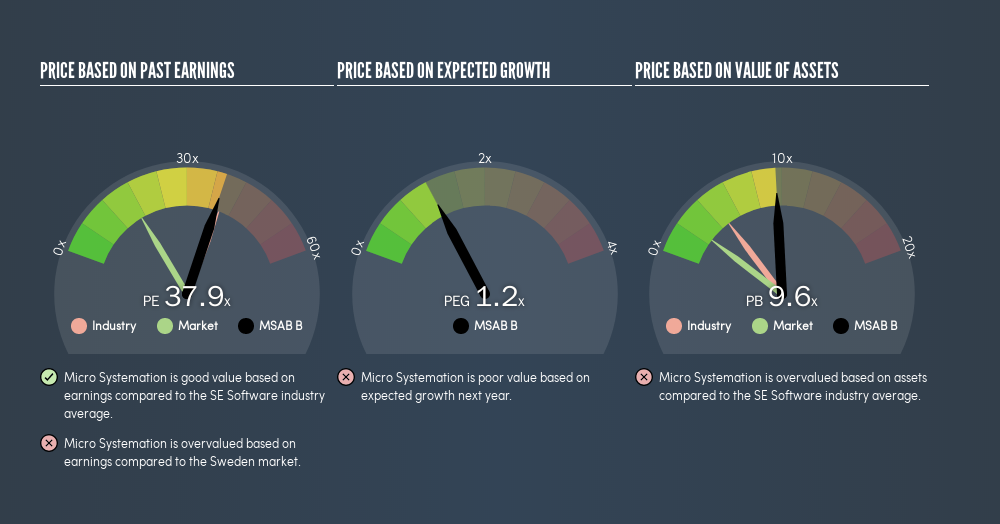

The P/E ratio essentially measures market expectations of a company. The image below shows that Micro Systemation has a P/E ratio that is roughly in line with the software industry average (38.2).

That indicates that the market expects Micro Systemation will perform roughly in line with other companies in its industry. If the company has better than average prospects, then the market might be underestimating it. Checking factors such as the tenure of the board and management could help you form your own view on if that will happen.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Micro Systemation's Balance Sheet

The extra options and safety that comes with Micro Systemation's kr99m net cash position means that it deserves a higher P/E than it would if it had a lot of net debt.

The Bottom Line On Micro Systemation's P/E Ratio

Micro Systemation trades on a P/E ratio of 37.9, which is above the SE market average of 17.1. The recent drop in earnings per share would make some investors cautious, but the net cash position means the company has time to improve: and the high P/E suggests the market thinks it will.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' So this freereport on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than Micro Systemation. If you want a selection of possible winners, check out this freelist of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OM:MSAB B

Micro Systemation

Provides forensic technology for mobile device examination and analysis in Sweden and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives