Swedish Exchange Highlights Husqvarna And 2 Other Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

The Swedish stock market has shown resilience amid global economic shifts, with the pan-European STOXX Europe 600 Index ending the week 1.85% higher following an interest rate cut from the European Central Bank. As investors seek opportunities in this evolving landscape, identifying undervalued stocks becomes crucial for maximizing potential returns. In this context, a good stock is one that demonstrates strong fundamentals and growth potential but is currently trading below its estimated fair value. This article highlights Husqvarna and two other Swedish stocks that fit this criteria, offering insights into their valuation and prospects in today's market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK40.60 | SEK79.91 | 49.2% |

| Husqvarna (OM:HUSQ B) | SEK66.34 | SEK130.49 | 49.2% |

| QleanAir (OM:QAIR) | SEK27.90 | SEK51.85 | 46.2% |

| Lindab International (OM:LIAB) | SEK267.40 | SEK523.24 | 48.9% |

| Litium (OM:LITI) | SEK8.24 | SEK16.42 | 49.8% |

| Nolato (OM:NOLA B) | SEK54.80 | SEK99.04 | 44.7% |

| Tourn International (OM:TOURN) | SEK8.30 | SEK16.50 | 49.7% |

| Mentice (OM:MNTC) | SEK27.40 | SEK50.98 | 46.3% |

| MilDef Group (OM:MILDEF) | SEK86.60 | SEK161.49 | 46.4% |

| BHG Group (OM:BHG) | SEK14.98 | SEK27.09 | 44.7% |

We're going to check out a few of the best picks from our screener tool.

Husqvarna (OM:HUSQ B)

Overview: Husqvarna AB (publ) produces and sells outdoor power products, watering products, and lawn care power equipment, with a market cap of SEK38.02 billion.

Operations: The company's revenue segments are Gardena (SEK12.59 billion), Group Common (SEK157 million), Husqvarna Construction (SEK8.14 billion), and Husqvarna Forest & Garden (SEK28.37 billion).

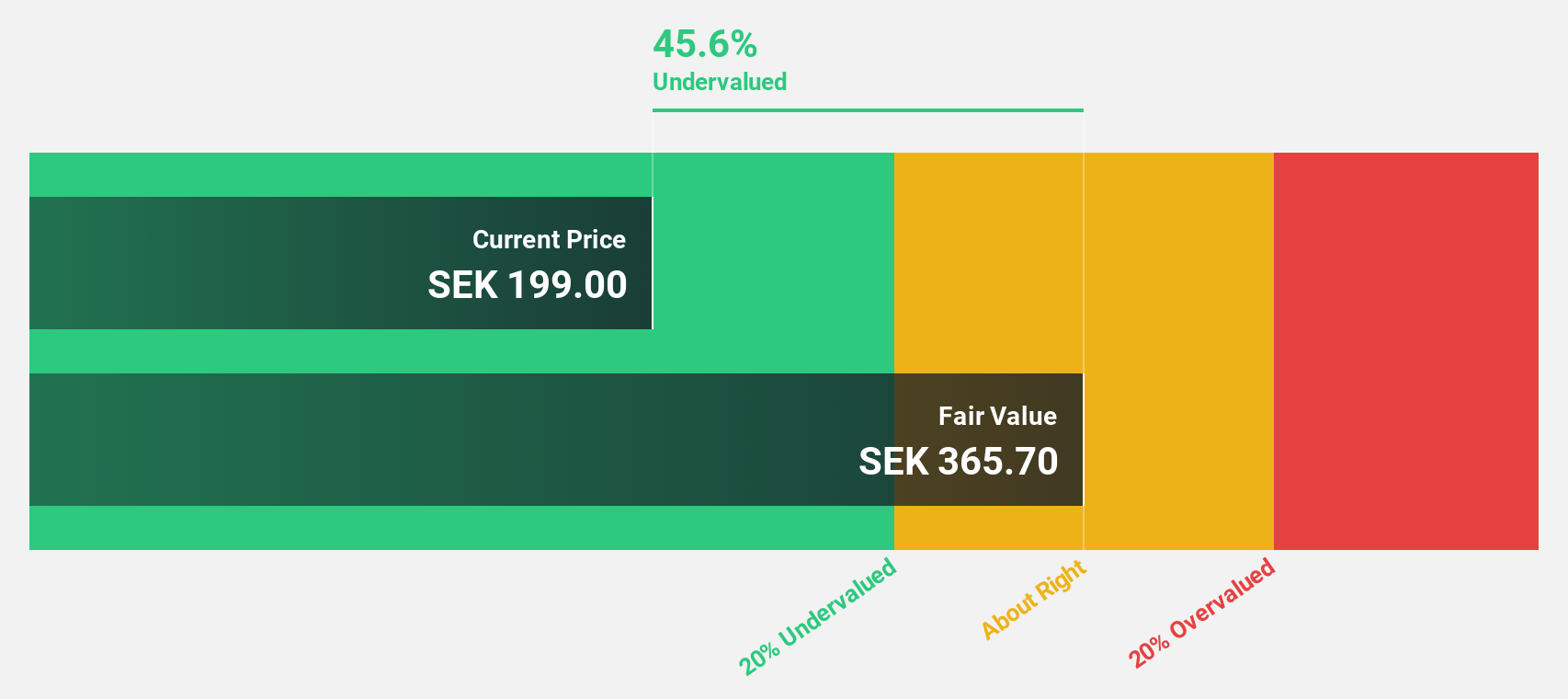

Estimated Discount To Fair Value: 49.2%

Husqvarna is trading at SEK 66.34, significantly below its estimated fair value of SEK 130.49, indicating it may be undervalued based on cash flows. Despite challenging market conditions and expected declines in organic sales for Q3 2024, the company's earnings are forecast to grow by 26% annually over the next three years, outpacing the Swedish market's growth rate. However, Husqvarna faces high debt levels and its dividend coverage remains weak.

- Our expertly prepared growth report on Husqvarna implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Husqvarna with our comprehensive financial health report here.

Lindab International (OM:LIAB)

Overview: Lindab International AB (publ) manufactures and sells ventilation system products and solutions in Europe, with a market cap of SEK20.55 billion.

Operations: Lindab International AB (publ) generates revenue from two main segments: Profile Systems, which contributes SEK3.28 billion, and Ventilation Systems, which provides SEK9.95 billion.

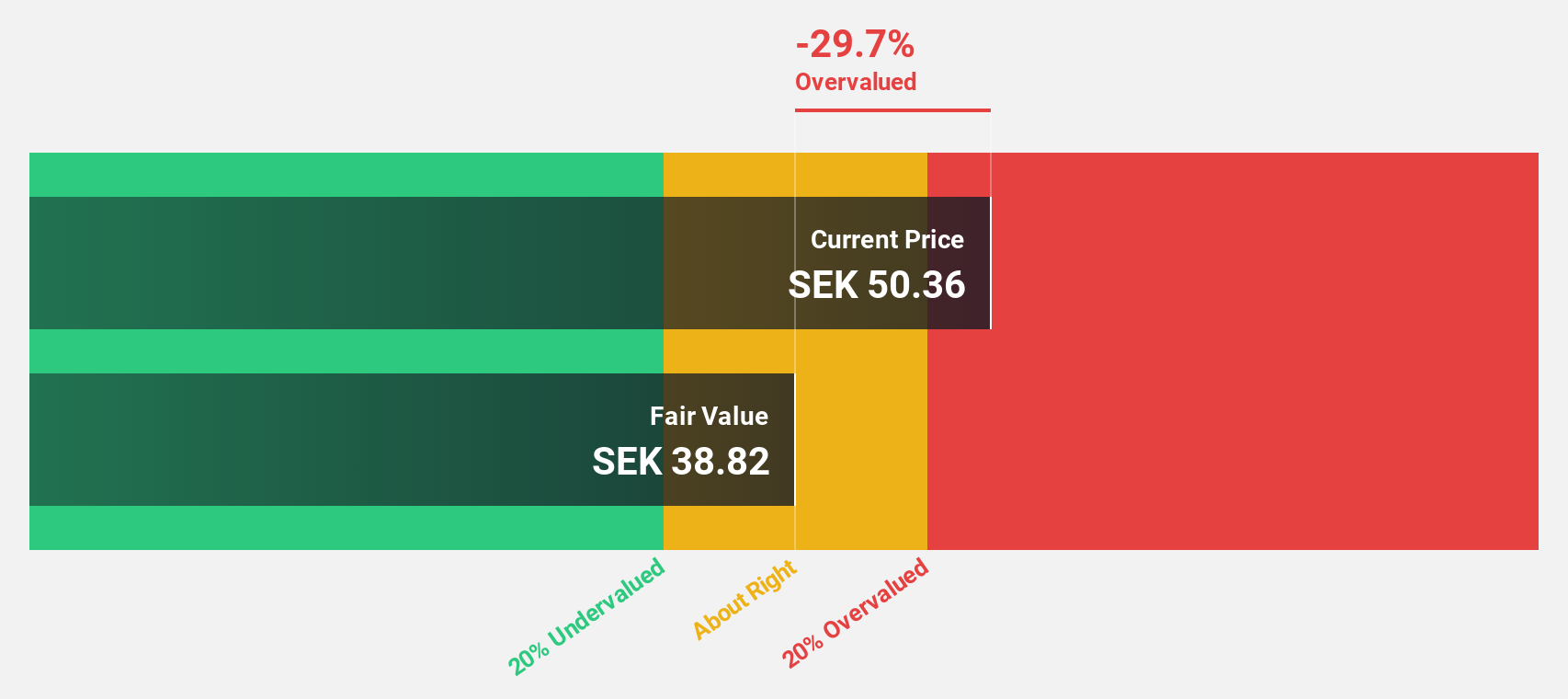

Estimated Discount To Fair Value: 48.9%

Lindab International is trading at SEK 267.4, significantly below its estimated fair value of SEK 523.24, suggesting substantial undervaluation based on cash flows. Despite a slight decline in net income for Q2 2024 compared to the previous year, earnings are forecast to grow by 25.82% annually over the next three years, outpacing both revenue growth and market expectations. However, Lindab's return on equity is projected to remain low at 14.8%, and it has an unstable dividend track record.

- Our growth report here indicates Lindab International may be poised for an improving outlook.

- Take a closer look at Lindab International's balance sheet health here in our report.

Lime Technologies (OM:LIME)

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of SEK4.32 billion.

Operations: The company generates SEK631.84 million from selling and implementing CRM systems.

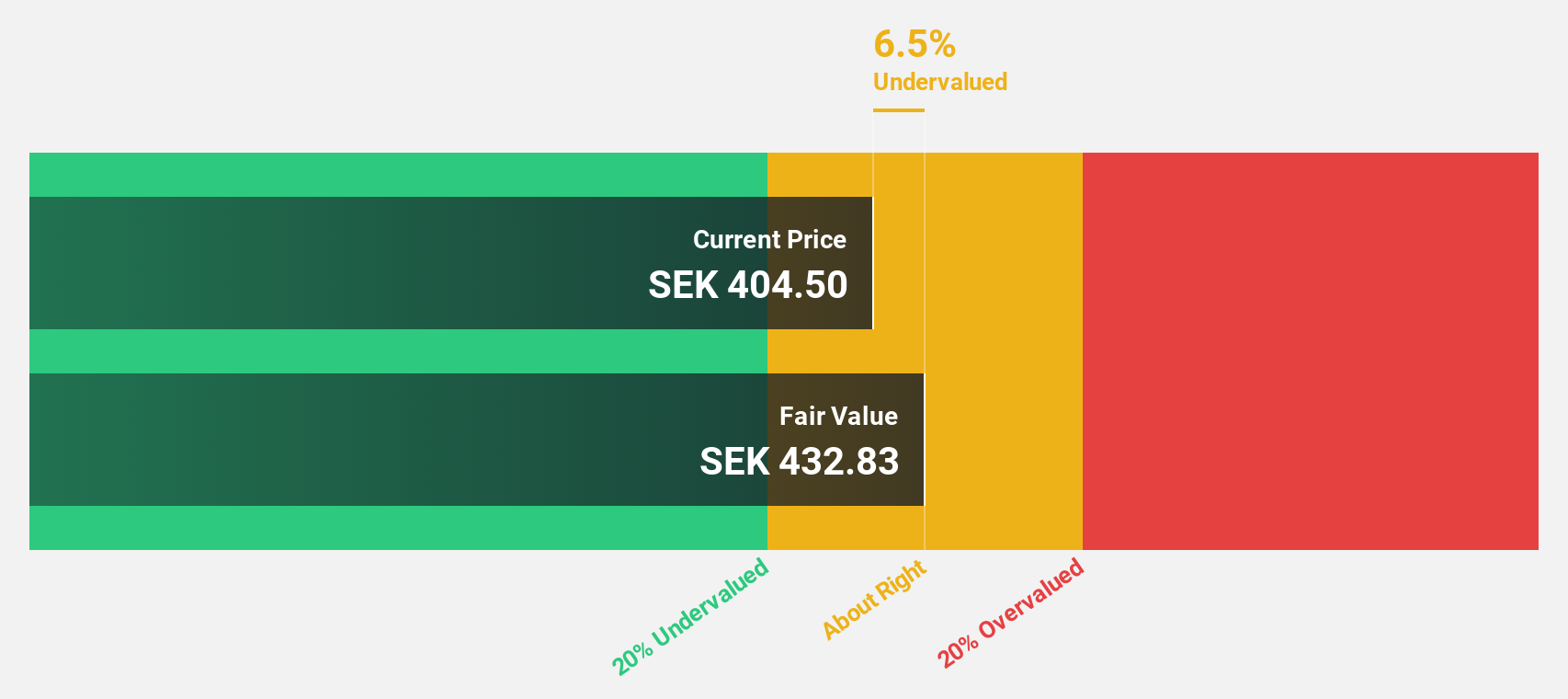

Estimated Discount To Fair Value: 31%

Lime Technologies, trading at SEK 325.5, is significantly undervalued with an estimated fair value of SEK 471.73. Despite a high level of debt, Lime's earnings are forecast to grow at 22.7% annually over the next three years, outpacing the Swedish market's growth rate of 15.3%. Recent Q2 results show revenue growth to SEK 174.71 million from SEK 144.98 million year-over-year, though net income remained relatively flat at around SEK 20 million.

- The growth report we've compiled suggests that Lime Technologies' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Lime Technologies stock in this financial health report.

Key Takeaways

- Click through to start exploring the rest of the 36 Undervalued Swedish Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIAB

Lindab International

Manufactures and sells products and solutions for ventilation systems in Europe.

Undervalued with excellent balance sheet and pays a dividend.