- Sweden

- /

- Industrials

- /

- OM:VOLO

European Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

As European markets enjoy a positive momentum, with the pan-European STOXX Europe 600 Index rising by 3.44% amidst easing tariff concerns, investors are keenly observing growth companies that exhibit strong insider ownership as potential opportunities. In such an environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company in its future prospects and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| OrganoClick (OM:ORGC) | 33.7% | 66.8% |

Let's explore several standout options from the results in the screener.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

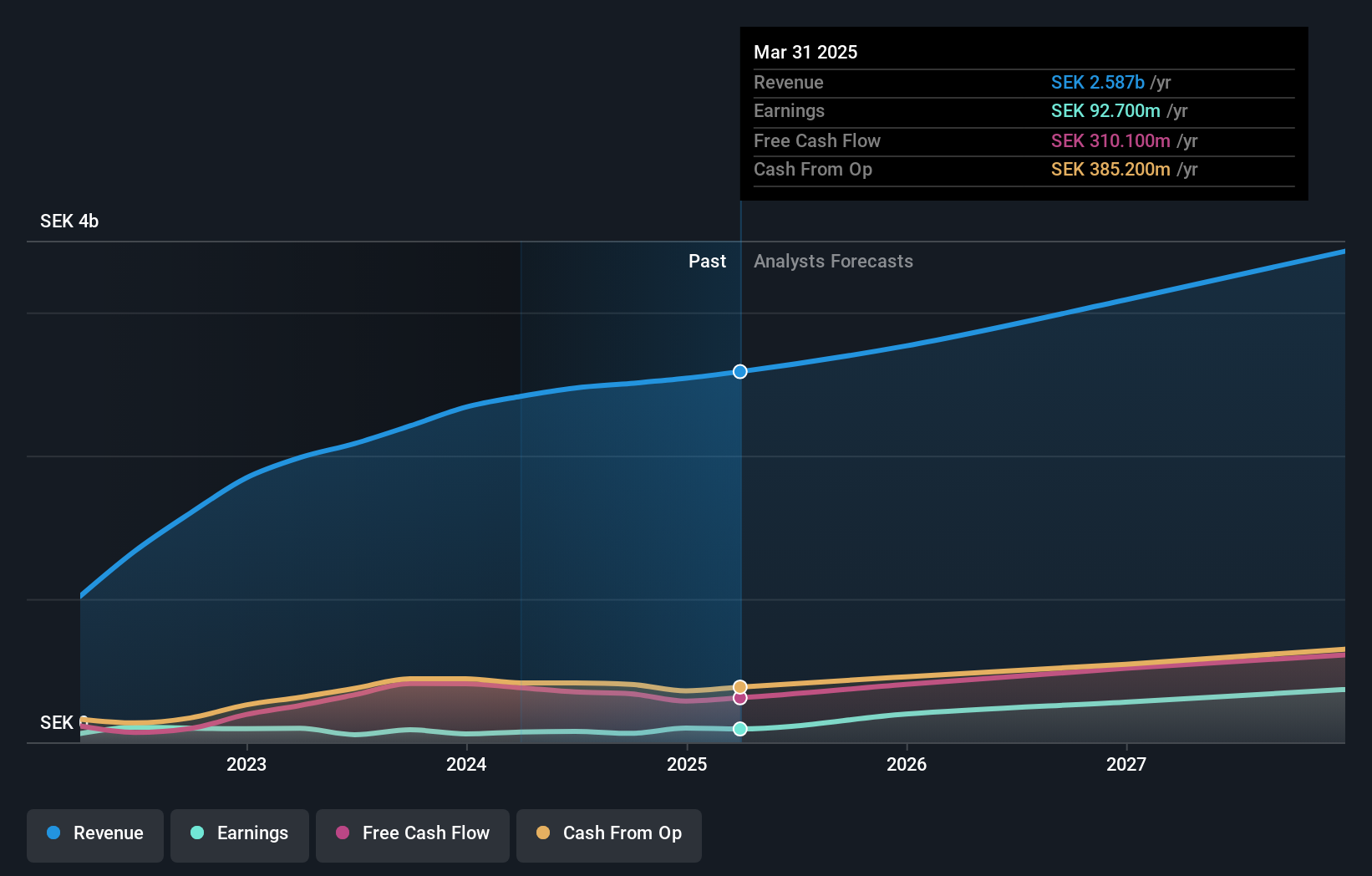

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of approximately SEK5.31 billion.

Operations: The company generates revenue of SEK706.44 million from selling and implementing CRM software systems.

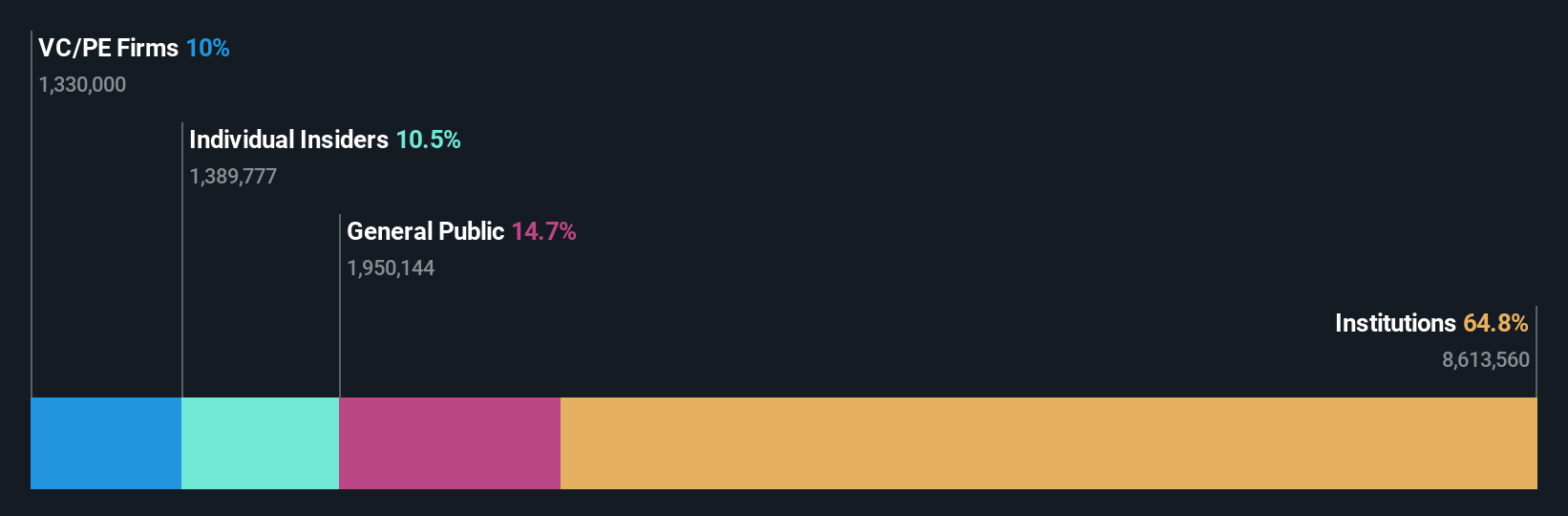

Insider Ownership: 10.5%

Lime Technologies shows promising growth potential, with revenue forecasted to grow at 12% annually, outpacing the Swedish market. Earnings are expected to increase significantly at 21.7% per year, surpassing market averages. The company reported strong Q1 results with SEK 188.73 million in revenue and SEK 28.09 million in net income. Insider ownership remains stable without substantial recent insider trading activity, while board changes include Anna Jennehov's election as a director, enhancing governance expertise.

- Click here to discover the nuances of Lime Technologies with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Lime Technologies' current price could be inflated.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedencare AB (publ) develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses in North America, Europe, and internationally with a market cap of SEK6.21 billion.

Operations: The company's revenue segments include SEK522.20 million from Europe, SEK701 million from Production, and SEK1.59 billion from North America.

Insider Ownership: 23.5%

Swedencare's revenue is projected to grow at 10.8% annually, exceeding the Swedish market rate, while earnings are expected to rise significantly by 43.9% per year. Recent Q1 results showed sales of SEK 641.1 million and net income of SEK 23.9 million, a decrease from the previous year. Insider transactions indicate more buying than selling in recent months, suggesting confidence in future prospects despite lower forecasted return on equity (4.1%).

- Click to explore a detailed breakdown of our findings in Swedencare's earnings growth report.

- According our valuation report, there's an indication that Swedencare's share price might be on the expensive side.

Volati (OM:VOLO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Volati AB (publ) is a private equity firm that focuses on growth capital, buyouts, and add-on acquisitions in mature and middle-market companies, with a market cap of SEK94.34 billion.

Operations: Volati AB (publ) generates revenue through its specialization in growth capital, buyouts, and add-on acquisitions targeting mature and middle-market companies.

Insider Ownership: 28.9%

Volati's earnings are projected to grow significantly at 33.4% annually, outpacing the Swedish market's growth rate. Recent Q1 results showed increased sales of SEK 2 billion and net income of SEK 26 million, reflecting operational progress. The company trades well below its estimated fair value, indicating potential undervaluation despite a high debt level. No significant insider trading activity was reported recently, but robust future earnings growth suggests strong internal confidence in its trajectory.

- Take a closer look at Volati's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Volati is priced lower than what may be justified by its financials.

Taking Advantage

- Click here to access our complete index of 212 Fast Growing European Companies With High Insider Ownership.

- Seeking Other Investments? Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLO

Volati

A private equity firm specializing in growth capital, buyouts, add on acquisitions in mature and middle market companies.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives