The European market recently faced a downturn, with the pan-European STOXX Europe 600 Index snapping five weeks of gains amid heightened tariff threats from the U.S., which have contributed to economic uncertainties and a contraction in eurozone business activity. In this challenging environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to shifting trade dynamics, as these factors can help mitigate broader market volatility.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| CD Projekt | 33.21% | 37.39% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

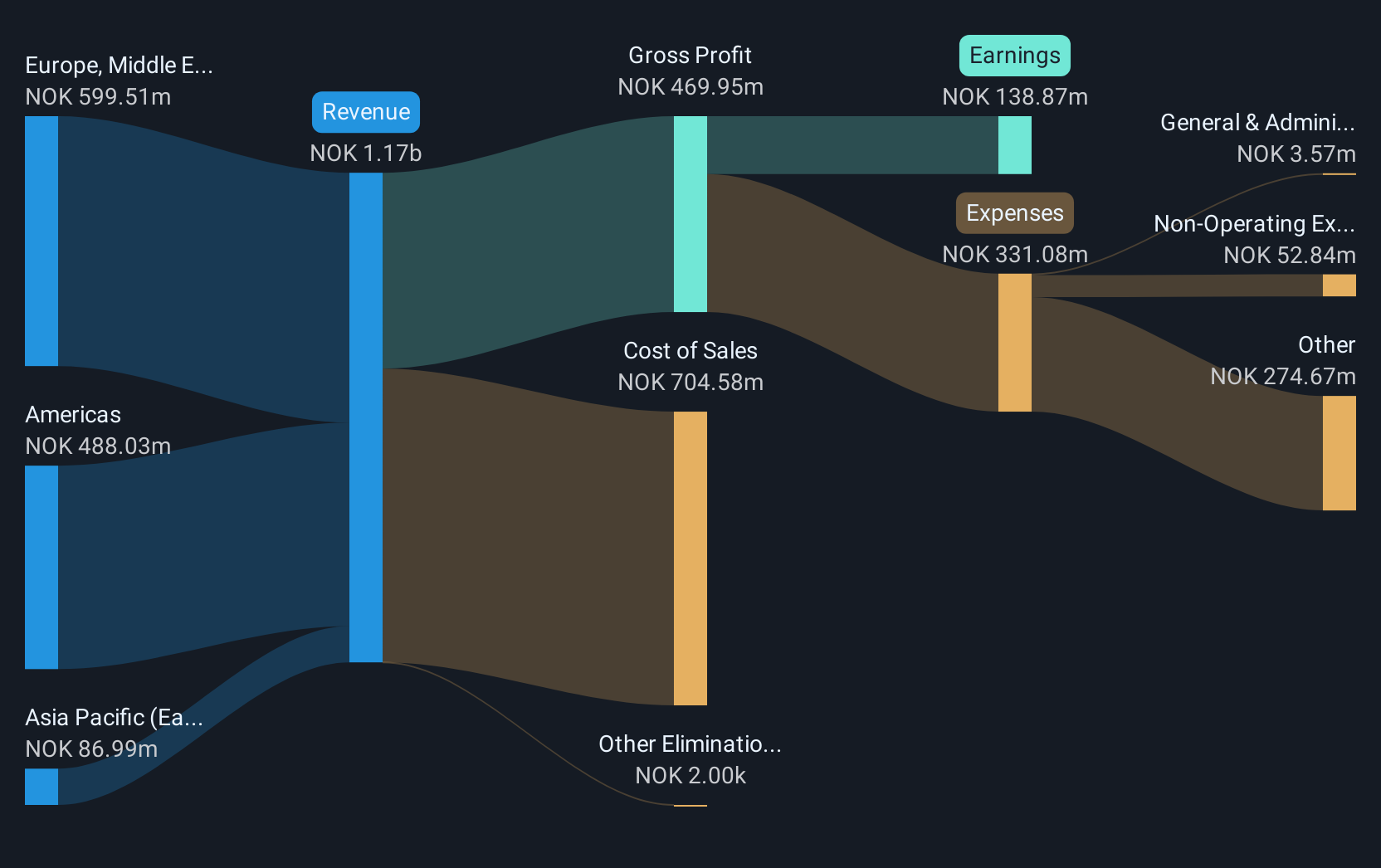

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of NOK5.98 billion.

Operations: Pexip generates revenue primarily through the sale of collaboration services, amounting to NOK1.17 billion. The company focuses on providing comprehensive video conferencing solutions across multiple regions globally.

Pexip Holding has demonstrated robust financial growth, with a notable increase in quarterly sales from NOK 291.98 million to NOK 347.95 million and a rise in net income from NOK 45.41 million to NOK 66.37 million year-over-year. This performance is complemented by strategic expansions, such as enhancing its partnership with Google, which now includes Pexip Connect for Google Meet hardware—allowing seamless integration with other major meeting platforms like Microsoft Teams and Zoom. These moves not only broaden Pexip's market reach but also solidify its position in the competitive tech landscape by catering to diverse corporate needs for video conferencing solutions, reflecting a keen understanding of evolving enterprise requirements.

Knowit (OM:KNOW)

Simply Wall St Growth Rating: ★★★★☆☆

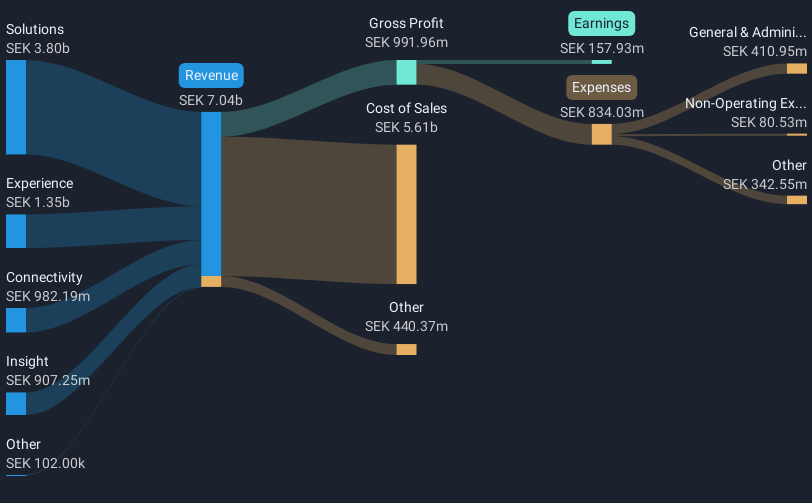

Overview: Knowit AB (publ) is a consultancy company with a market capitalization of SEK3.63 billion.

Operations: The consultancy firm generates revenue primarily from its Solutions segment, contributing SEK3.48 billion, followed by the Experience and Insight segments with SEK1.13 billion and SEK0.85 billion, respectively. The Connectivity segment adds SEK0.81 billion to the revenue stream.

Despite a challenging year with a 58.5% dip in earnings, Knowit remains poised for recovery, underpinned by an ambitious R&D strategy that aligns with its long-term growth objectives in the tech sector. The company's recent board reshuffle and strategic partnerships, like the one with TET Digital for cloud services over potentially ten years, underscore its commitment to innovation and market adaptation. With earnings forecasted to surge by 31% annually—outpacing the Swedish market's 15.9%—and revenue growth projected at 5.2%, slightly above Sweden's 4.2%, Knowit is strategically positioning itself to leverage emerging tech trends effectively. This approach not only enhances its service offerings but also strengthens client relationships in sectors critical for future expansions such as digital mobility solutions.

- Navigate through the intricacies of Knowit with our comprehensive health report here.

Gain insights into Knowit's historical performance by reviewing our past performance report.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★☆☆

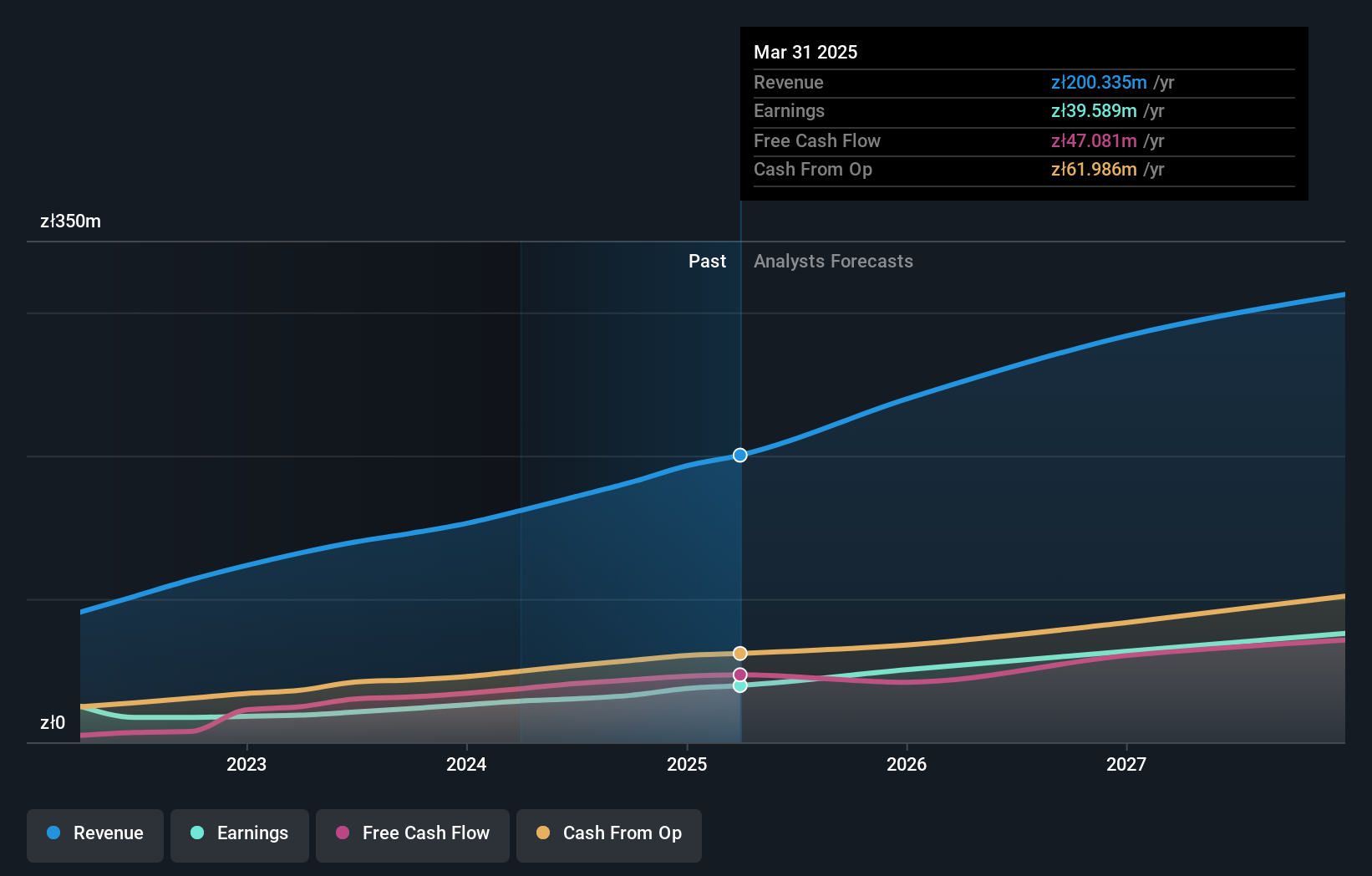

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland, with a market capitalization of PLN1.36 billion.

Operations: Shoper SA generates revenue through its Software as a Service solutions tailored for the e-commerce sector in Poland. The company's financials reflect a focus on scalable digital services, contributing to its market presence.

Shoper S.A. is charting a robust path in the European tech landscape, evidenced by its recent financial performance and strategic activities. In Q1 2025, the company saw its revenue jump to PLN 51.73 million from PLN 44.19 million in the previous year, alongside a net income increase to PLN 9.84 million from PLN 7.76 million, reflecting a consistent upward trajectory in profitability with earnings per share also rising. This growth is complemented by an annual dividend increase to PLN 1.03 per share, signaling strong cash flow and shareholder value enhancement. With revenue forecasted to grow at an annual rate of 13.9%, surpassing Poland's market average of 4.8%, Shoper is not only outpacing local competitors but also embedding itself deeply within the high-growth echelons of the European software industry.

- Click to explore a detailed breakdown of our findings in Shoper's health report.

Review our historical performance report to gain insights into Shoper's's past performance.

Seize The Opportunity

- Navigate through the entire inventory of 226 European High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knowit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KNOW

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives