As global markets show signs of recovery with U.S. indexes nearing record highs and broad-based gains, investors are keenly observing the impact of geopolitical tensions and economic policies on market dynamics. In this environment, growth companies with high insider ownership often draw attention as they suggest a strong alignment of interests between management and shareholders, potentially offering resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Solstad Offshore (OB:SOFF)

Simply Wall St Growth Rating: ★★★★★☆

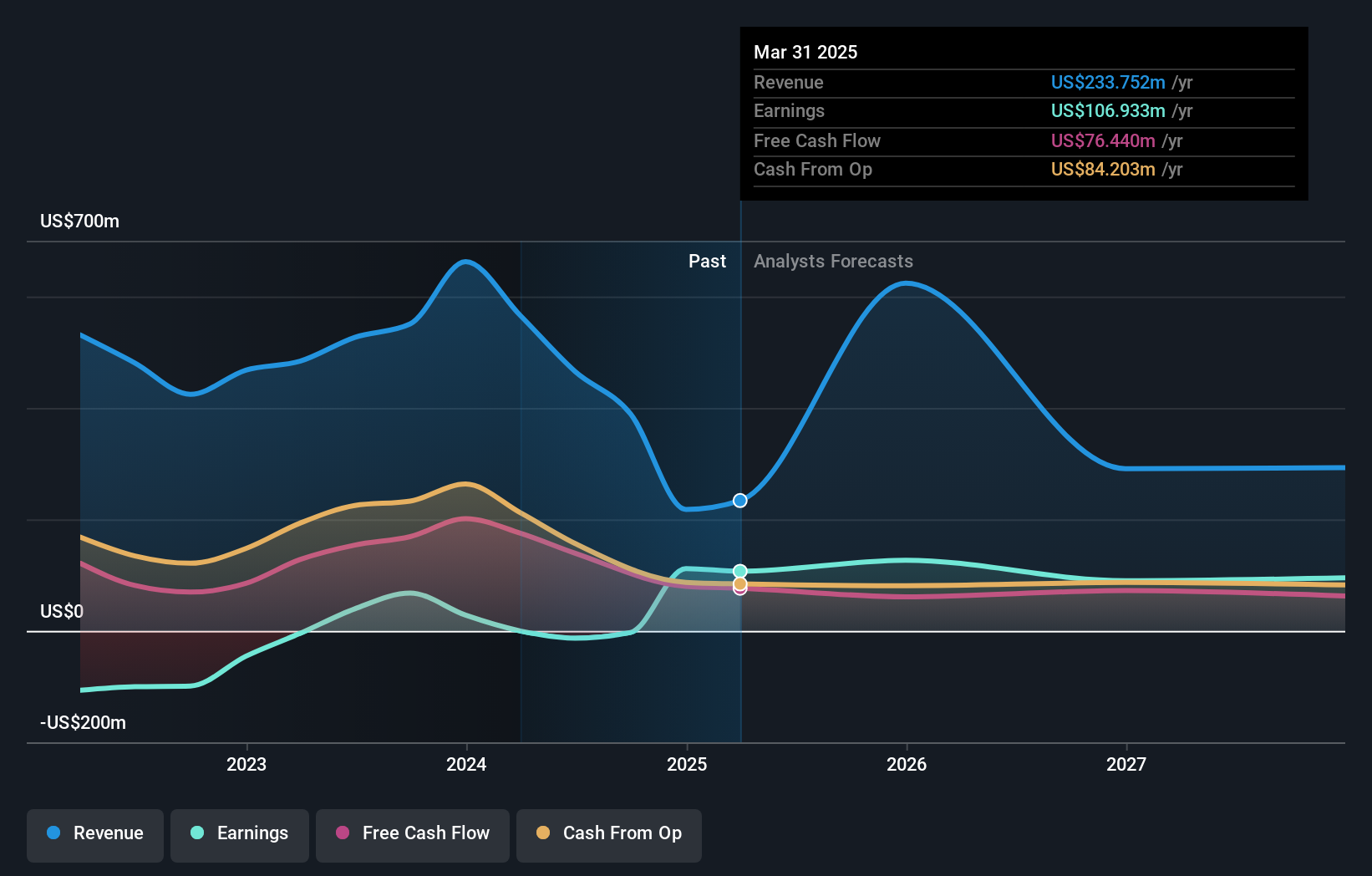

Overview: Solstad Offshore ASA provides offshore service vessels and maritime services to the offshore energy industry, with a market cap of NOK3.92 billion.

Operations: Revenue Segments (in millions of NOK): Platform Supply Vessels: 1,200; Anchor Handling Tug Supply Vessels: 1,500; Subsea Construction Vessels: 2,300. Solstad Offshore ASA generates revenue through its operations of platform supply vessels, anchor handling tug supply vessels, and subsea construction vessels.

Insider Ownership: 16.7%

Return On Equity Forecast: N/A (2027 estimate)

Solstad Offshore is experiencing significant growth, with revenue expected to increase by 28% annually, outpacing the Norwegian market. The company is forecasted to become profitable within three years and has secured multiple new contracts totaling approximately US$113 million, enhancing its future earnings potential. Despite past shareholder dilution and a highly volatile share price, Solstad trades at a significant discount to estimated fair value and offers strong relative value compared to peers.

- Delve into the full analysis future growth report here for a deeper understanding of Solstad Offshore.

- Our comprehensive valuation report raises the possibility that Solstad Offshore is priced lower than what may be justified by its financials.

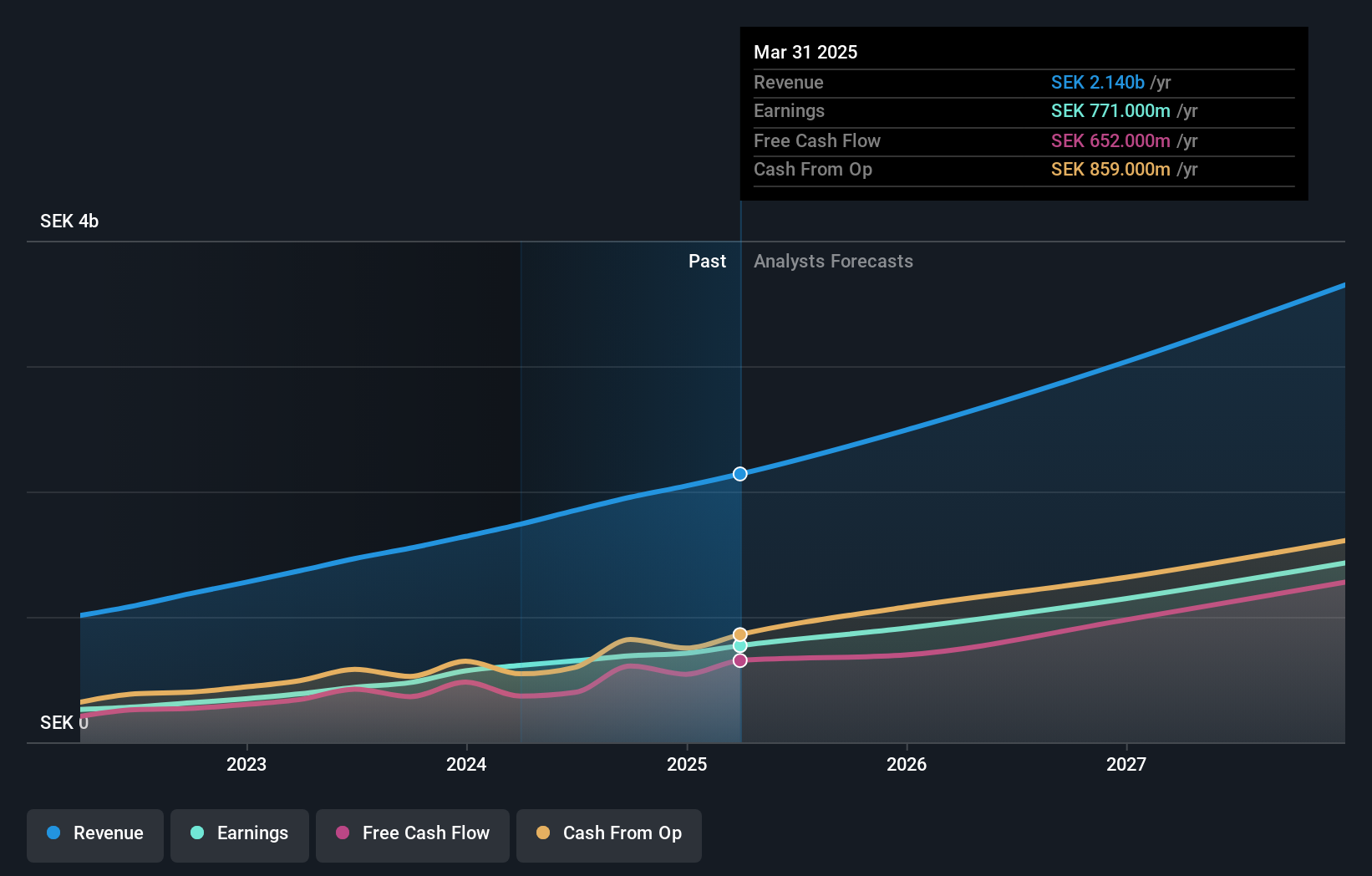

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK41.23 billion.

Operations: The company's revenue segments include Core Products at SEK768 million, Businesses at SEK397 million, Accounting Firms at SEK376 million, Financial Services at SEK267 million, and Marketplaces at SEK173 million.

Insider Ownership: 19.1%

Return On Equity Forecast: 32% (2027 estimate)

Fortnox is experiencing solid growth, with earnings forecasted to grow significantly at 22.5% annually, surpassing the Swedish market's growth rate. Despite revenue growth being slightly below 20%, it remains above the market average. Recent earnings reports show strong performance, with Q3 revenue reaching SEK 530 million and net income rising to SEK 189 million. Insider activity has seen more buying than selling recently, aligning with its trading at a discount to estimated fair value.

- Unlock comprehensive insights into our analysis of Fortnox stock in this growth report.

- Our valuation report here indicates Fortnox may be overvalued.

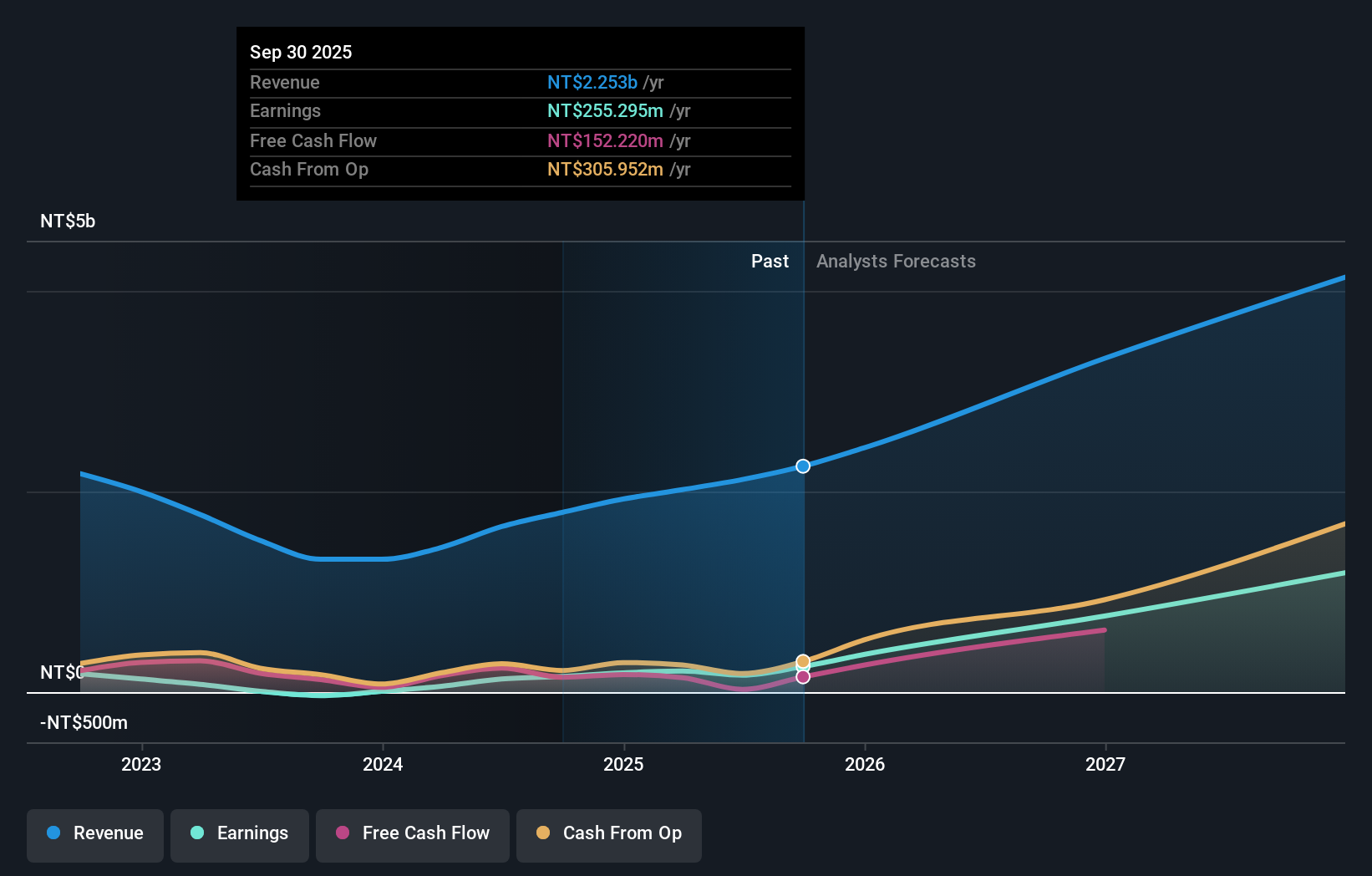

Nan Juen International (TPEX:6584)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nan Juen International Co., Ltd. focuses on the research, development, manufacture, and trading of steel ball guide rails in Taiwan with a market cap of NT$12.76 billion.

Operations: The company's revenue primarily comes from the manufacture and sales of steel ball slide rails, amounting to NT$1.79 billion.

Insider Ownership: 19.7%

Return On Equity Forecast: N/A (2027 estimate)

Nan Juen International has demonstrated robust growth, with Q3 sales rising to TWD 488.9 million and net income increasing significantly to TWD 43.51 million from the previous year. The company has become profitable this year, and its earnings are forecasted to grow over 100% annually, outpacing the TW market's growth rate. Revenue is also expected to expand rapidly at nearly 40% per year, although the share price remains highly volatile.

- Take a closer look at Nan Juen International's potential here in our earnings growth report.

- According our valuation report, there's an indication that Nan Juen International's share price might be on the cheaper side.

Seize The Opportunity

- Investigate our full lineup of 1530 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nan Juen International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6584

Nan Juen International

Engages in the research and development, manufacture, and trading of steel ball guide rails in Taiwan.

High growth potential and fair value.