- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3023

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets experience mixed signals with moderate gains in major U.S. indices and fluctuating consumer confidence, investors are increasingly turning their attention to dividend stocks for potential stability and income. In light of these market dynamics, selecting dividend stocks that demonstrate strong fundamentals and a consistent payout history can be a strategic approach to navigating the current economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.45% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.48% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

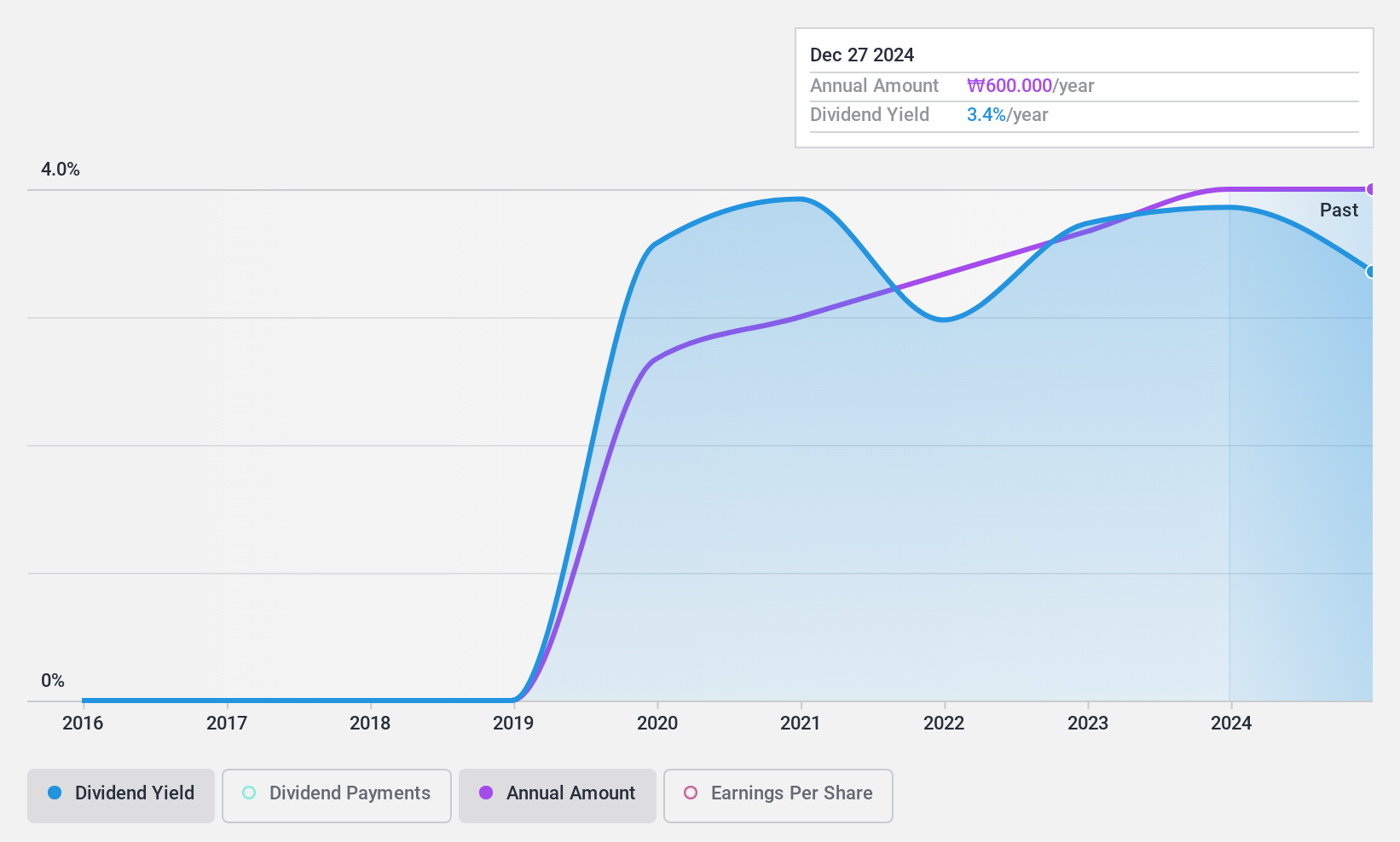

HANYANG ENGLtd (KOSDAQ:A045100)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanyang ENG Co., Ltd specializes in constructing semiconductor facilities both in South Korea and internationally, with a market cap of ₩277.34 billion.

Operations: Hanyang ENG Co., Ltd generates revenue from its System Division, amounting to ₩162.82 million, and its Engineering Business Department, which contributes ₩1.04 billion.

Dividend Yield: 3.5%

HANYANG ENG Ltd. demonstrates a stable and growing dividend profile, with payments increasing over the past decade and showing little volatility. Its dividends are well-covered by earnings, given its low payout ratio of 11.6%, and supported by cash flows with a cash payout ratio of 26.1%. Despite trading at a significant discount to estimated fair value, its dividend yield of 3.54% is below the top quartile in the Korean market but remains reliable for investors seeking steady income.

- Get an in-depth perspective on HANYANG ENGLtd's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, HANYANG ENGLtd's share price might be too pessimistic.

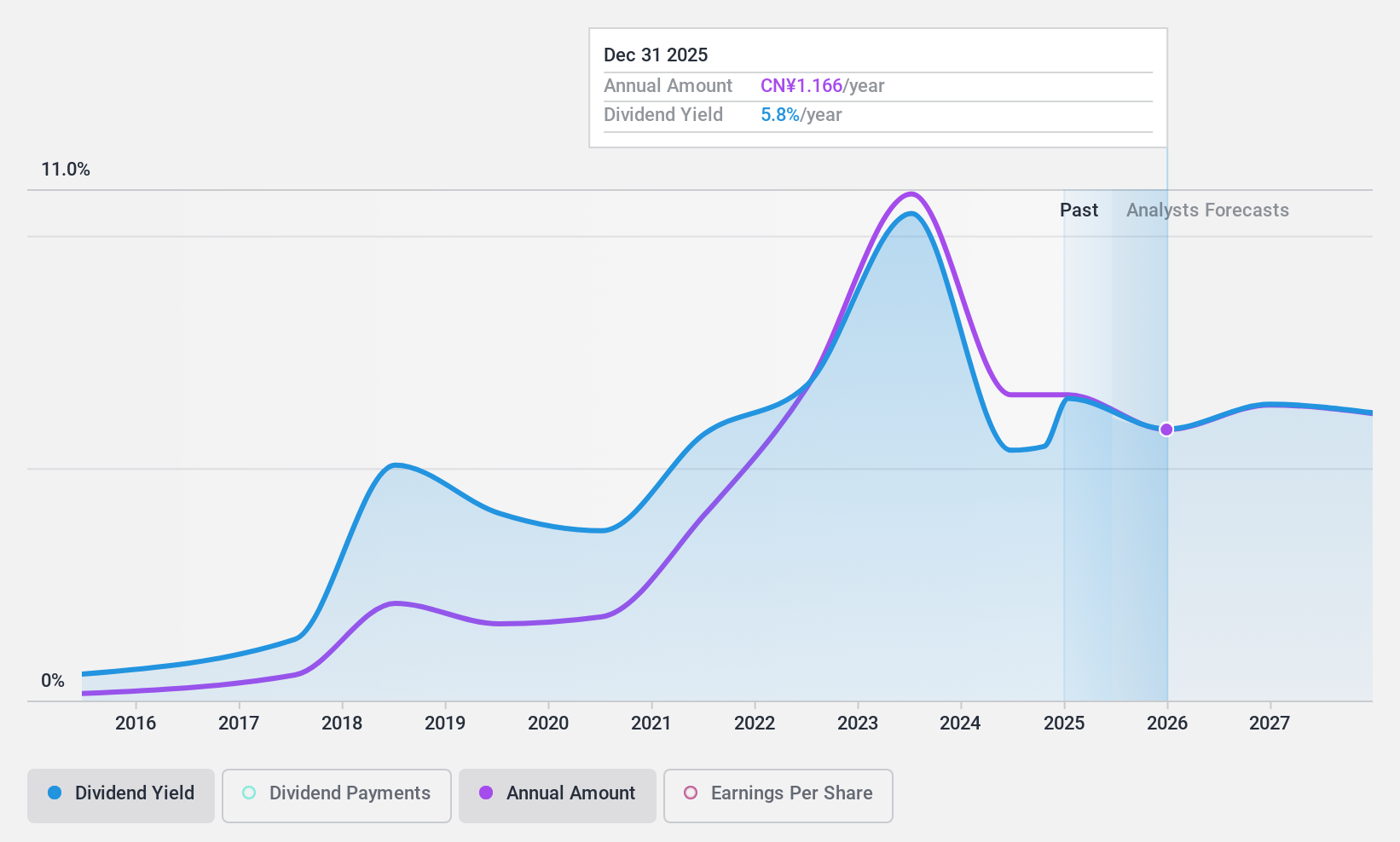

Shaanxi Coal Industry (SHSE:601225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shaanxi Coal Industry Company Limited, with a market cap of CN¥224.15 billion, engages in the mining, production, washing, processing, and sale of coal both in China and internationally.

Operations: Shaanxi Coal Industry Company Limited generates revenue primarily from its coal mining, production, washing, processing, and sales activities within China and on an international scale.

Dividend Yield: 5.6%

Shaanxi Coal Industry's dividend yield of 5.59% ranks in the top 25% of CN market payers, supported by a payout ratio of 65.9% and a cash payout ratio of 41.3%. Despite an unstable and volatile dividend history, recent earnings show coverage is sustainable. The company trades at a significant discount to its estimated fair value, though recent earnings slightly decreased with sales at CNY 125.43 billion and net income at CNY 15.94 billion for nine months ending September 2024.

- Unlock comprehensive insights into our analysis of Shaanxi Coal Industry stock in this dividend report.

- Our expertly prepared valuation report Shaanxi Coal Industry implies its share price may be lower than expected.

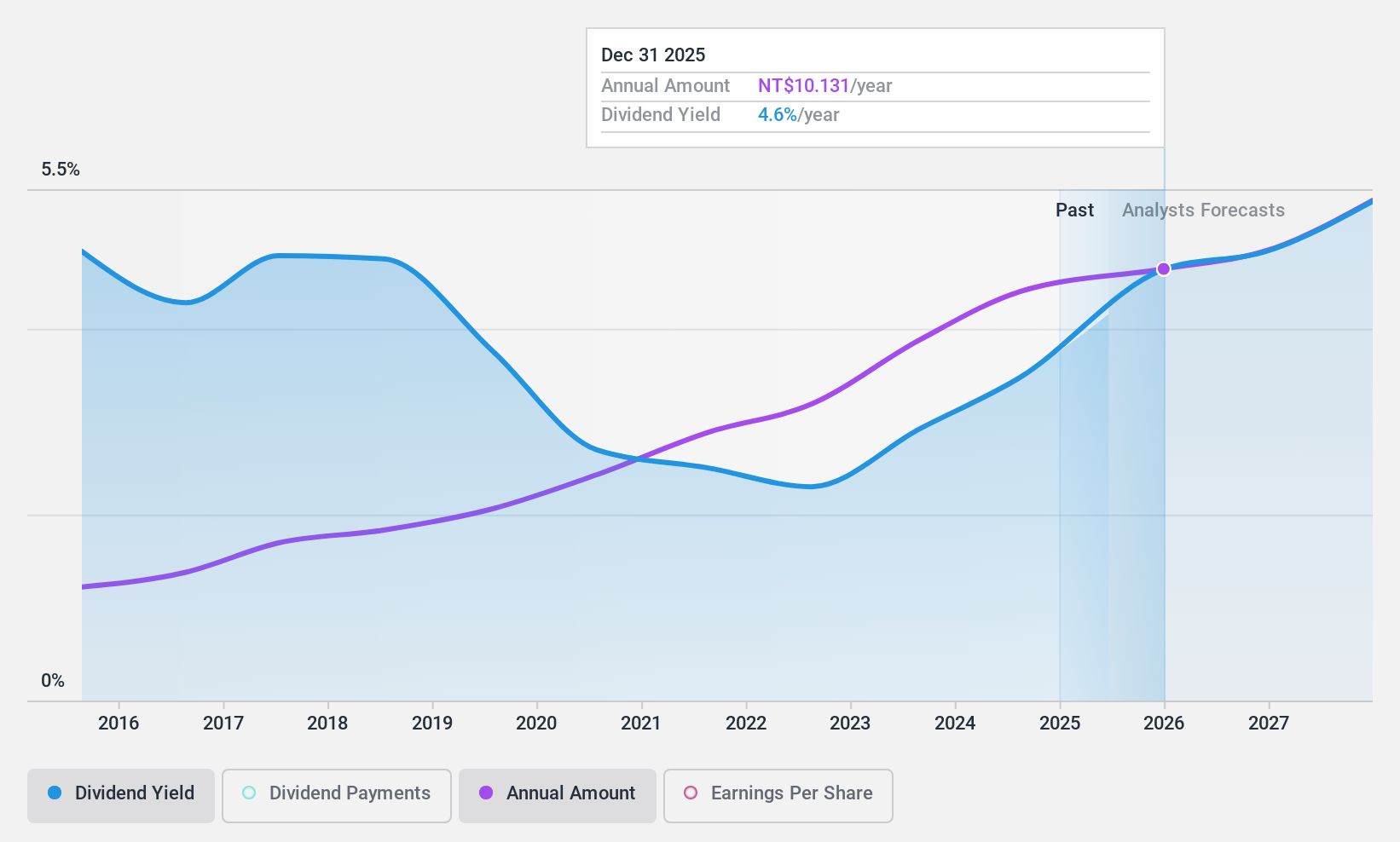

SINBON Electronics (TWSE:3023)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SINBON Electronics Co., Ltd. manufactures and sells computer peripherals, connectors, wires, and other parts across Mainland China, Hong Kong, the United States, Taiwan, and internationally with a market cap of NT$61.58 billion.

Operations: SINBON Electronics Co., Ltd.'s revenue is primarily derived from Industrial Applications (NT$10.25 billion), Green Energy (NT$9.99 billion), Communication (NT$7.57 billion), Automotive and Aerospace (NT$5.21 billion), and Healthcare (NT$2.92 billion) segments.

Dividend Yield: 3.6%

SINBON Electronics offers a stable dividend history with consistent growth over the past decade, though its current yield of 3.56% falls short of Taiwan's top dividend payers. The payout ratio of 67.8% suggests dividends are covered by earnings, yet the high cash payout ratio indicates potential vulnerability in coverage by free cash flow. Recent financials show modest sales growth to TWD 8.43 billion for Q3 2024, with net income rising slightly to TWD 949.09 million year-over-year.

- Take a closer look at SINBON Electronics' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that SINBON Electronics is trading beyond its estimated value.

Summing It All Up

- Discover the full array of 1963 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3023

SINBON Electronics

Manufactures and sells computer peripherals, connectors, wires, and other parts in Mainland China, Hong Kong, the United States, Taiwan, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion