Fortnox And 2 Other Swedish Stocks That Could Be Undervalued

Reviewed by Simply Wall St

As global markets continue to navigate economic uncertainties, the Swedish stock market has shown resilience with potential opportunities for discerning investors. In this article, we explore three Swedish stocks that could be undervalued, starting with Fortnox. Identifying undervalued stocks often involves looking at companies with strong fundamentals and growth potential that may not yet be fully appreciated by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK40.70 | SEK80.17 | 49.2% |

| QleanAir (OM:QAIR) | SEK26.90 | SEK51.75 | 48% |

| Stille (OM:STIL) | SEK222.00 | SEK443.00 | 49.9% |

| Paradox Interactive (OM:PDX) | SEK139.40 | SEK259.10 | 46.2% |

| Dometic Group (OM:DOM) | SEK68.95 | SEK132.34 | 47.9% |

| Nolato (OM:NOLA B) | SEK53.70 | SEK99.09 | 45.8% |

| Flexion Mobile (OM:FLEXM) | SEK9.28 | SEK17.57 | 47.2% |

| Tourn International (OM:TOURN) | SEK8.38 | SEK16.47 | 49.1% |

| Humble Group (OM:HUMBLE) | SEK9.815 | SEK18.71 | 47.5% |

| Nordisk Bergteknik (OM:NORB B) | SEK18.80 | SEK36.88 | 49% |

Let's uncover some gems from our specialized screener.

Fortnox (OM:FNOX)

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK35.11 billion.

Operations: The company's revenue segments include Businesses (SEK378 million), Marketplaces (SEK160 million), Core Products (SEK734 million), Accounting Firms (SEK352 million), and Financial Services (SEK249 million).

Estimated Discount To Fair Value: 26.6%

Fortnox is trading at SEK 57.56, significantly below its estimated fair value of SEK 78.46, indicating it may be undervalued based on cash flows. Earnings are forecast to grow by 22.6% annually over the next three years, outpacing the Swedish market's growth rate of 16.1%. Recent earnings reports show strong performance with Q2 sales at SEK 515 million and net income rising to SEK 164 million from SEK 127 million a year ago.

- The analysis detailed in our Fortnox growth report hints at robust future financial performance.

- Take a closer look at Fortnox's balance sheet health here in our report.

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market cap of SEK20.45 billion.

Operations: The company's revenue segments are Medtech (€111.91 million), Diagnostics (€20.63 million), Specialty Pharma (€158.39 million), and Veterinary Services (€53.95 million).

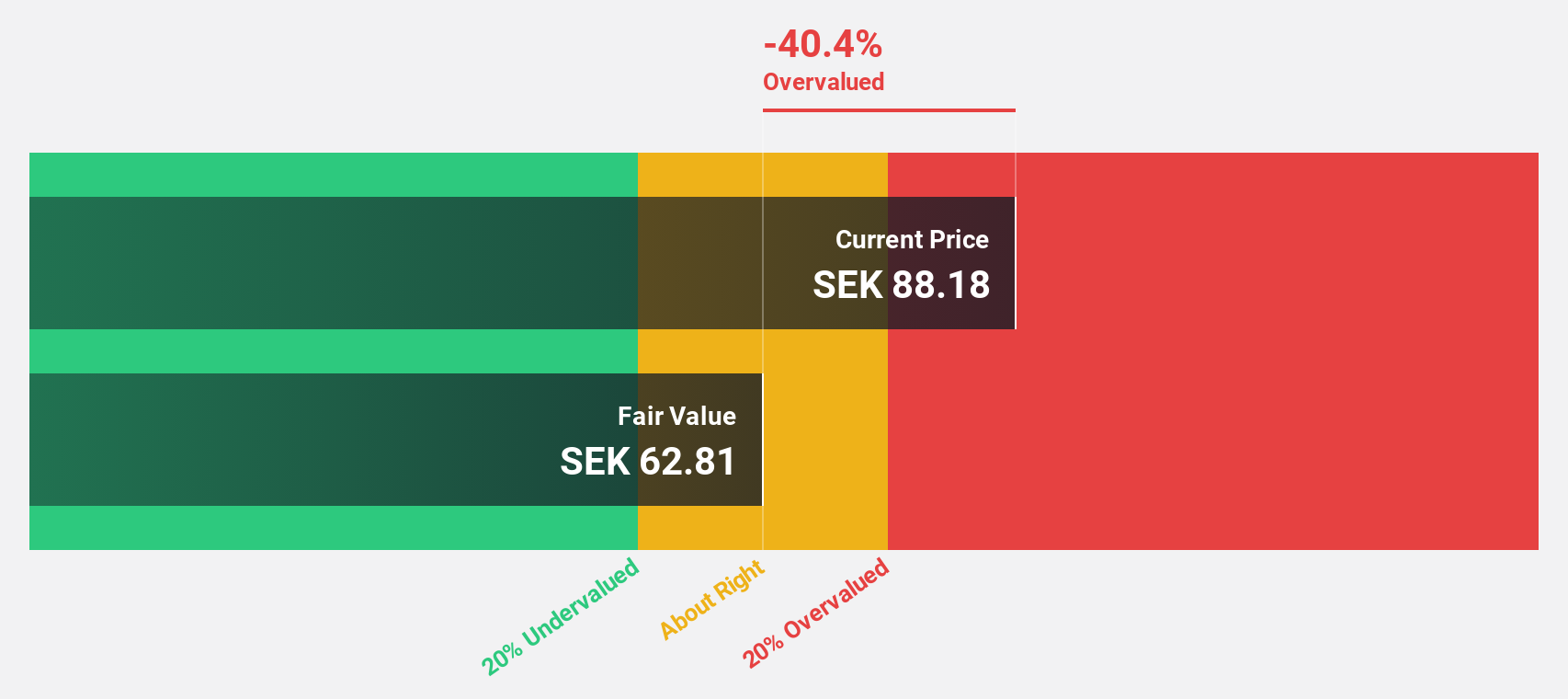

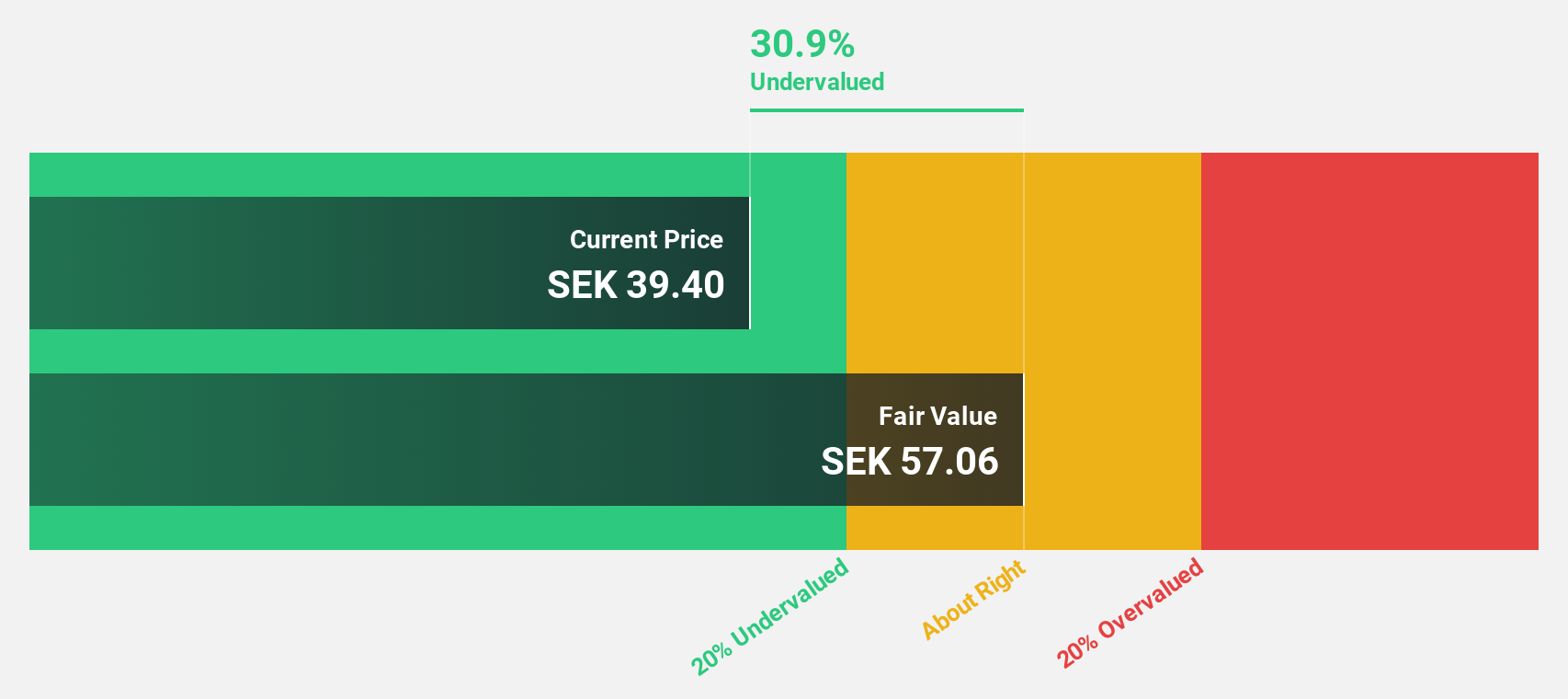

Estimated Discount To Fair Value: 36.5%

Vimian Group, trading at SEK 39.15, is significantly undervalued based on cash flows with an estimated fair value of SEK 61.64. Despite recent shareholder dilution, the company's earnings are forecast to grow by 62.9% annually over the next three years, far outpacing the Swedish market's growth rate of 16.1%. Recent Q2 results show sales increased to EUR 90.99 million from EUR 81.31 million a year ago, with net income rising to EUR 4.87 million from EUR 2.99 million last year.

- The growth report we've compiled suggests that Vimian Group's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Vimian Group.

Yubico (OM:YUBICO)

Overview: Yubico AB provides authentication solutions for computers, networks, and online services with a market cap of SEK25.66 billion.

Operations: Yubico AB's revenue from Security Software & Services amounts to SEK2.09 billion.

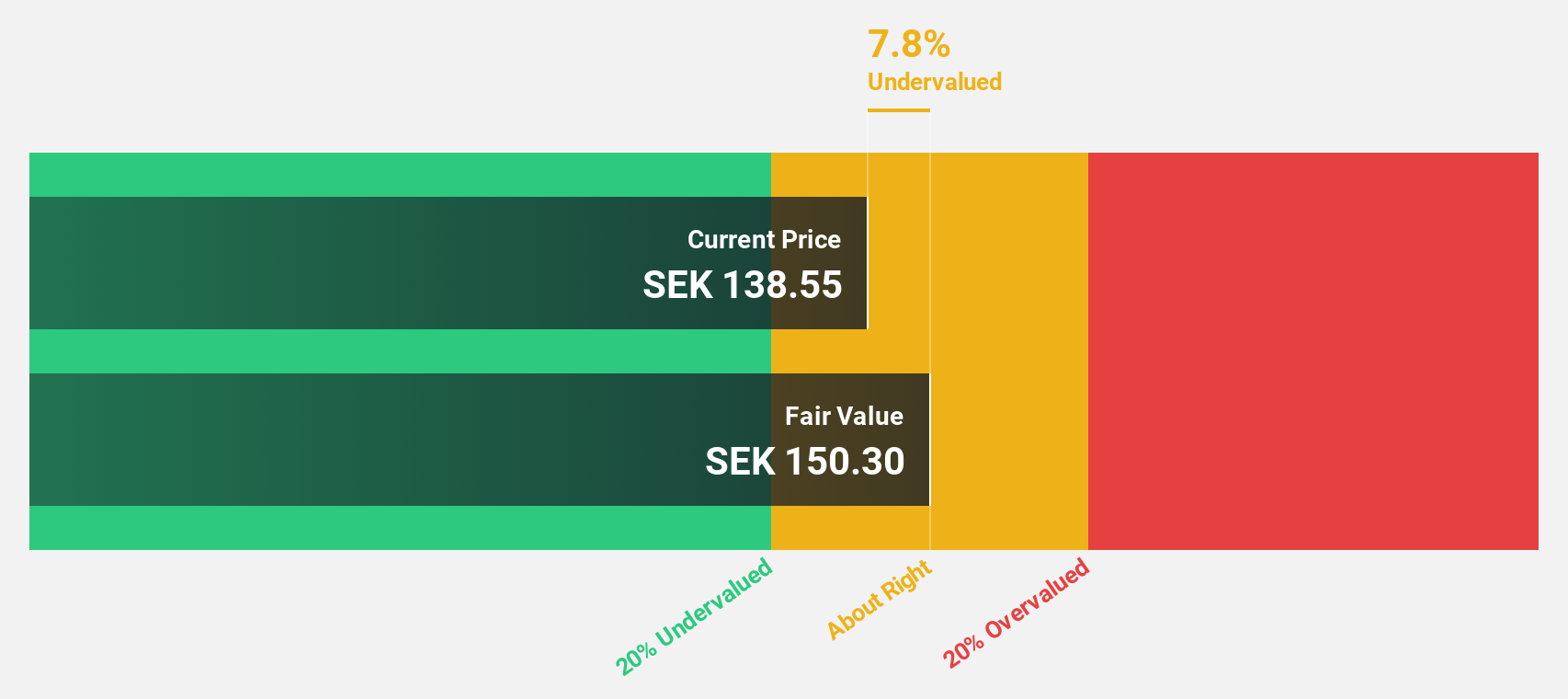

Estimated Discount To Fair Value: 10.7%

Yubico (SEK298) is trading 10.7% below its estimated fair value of SEK333.73, indicating it may be undervalued based on cash flows. Despite recent shareholder dilution, Yubico's earnings are forecast to grow significantly at 43.69% annually over the next three years, outpacing the Swedish market's growth rate of 16.1%. Recent revenue grew by 21.2%, although profit margins declined from 17.8% to 9.3%. The company recently partnered with Straxis for a secure web browsing application for the U.S. Air Force.

- Our earnings growth report unveils the potential for significant increases in Yubico's future results.

- Dive into the specifics of Yubico here with our thorough financial health report.

Next Steps

- Delve into our full catalog of 43 Undervalued Swedish Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives