Market Participants Recognise Clavister Holding AB (publ.)'s (STO:CLAV) Revenues Pushing Shares 28% Higher

Despite an already strong run, Clavister Holding AB (publ.) (STO:CLAV) shares have been powering on, with a gain of 28% in the last thirty days. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 58% share price drop in the last twelve months.

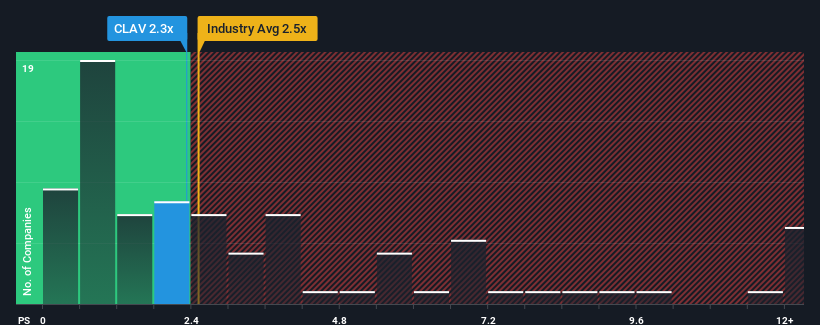

Although its price has surged higher, there still wouldn't be many who think Clavister Holding AB (publ.)'s price-to-sales (or "P/S") ratio of 2.3x is worth a mention when the median P/S in Sweden's Software industry is similar at about 2.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Clavister Holding AB (publ.)

How Has Clavister Holding AB (publ.) Performed Recently?

Clavister Holding AB (publ.)'s revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clavister Holding AB (publ.).Is There Some Revenue Growth Forecasted For Clavister Holding AB (publ.)?

In order to justify its P/S ratio, Clavister Holding AB (publ.) would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Pleasingly, revenue has also lifted 39% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 19% over the next year. Meanwhile, the rest of the industry is forecast to expand by 18%, which is not materially different.

In light of this, it's understandable that Clavister Holding AB (publ.)'s P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Clavister Holding AB (publ.) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Clavister Holding AB (publ.)'s P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Software industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Clavister Holding AB (publ.) (2 are concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CLAV

Clavister Holding AB (publ.)

Develops, produces, and sells cybersecurity solutions in Sweden, rest of Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026